Cynnwys

- Purpose and overview of this article

- The scope of natural capital accounts for the UK

- Accounting for ecosystem asset extent

- Accounting for ecosystem asset condition

- Physical accounts for ecosystem and abiotic services

- Basic valuation principles in natural capital accounting

- Valuing flows of services

- Valuing ecosystem assets

1. Purpose and overview of this article

In December 2012, the Office for National Statistics (ONS) published a roadmap, Accounting for the value of nature in the UK, which set out a strategy to incorporate natural capital into UK Environmental Accounts by 20201. In 2014, the Department for Environment, Food and Rural Affairs (Defra) and ONS published a first version of an article, which established a number of important approaches to the development of natural capital accounts, and identified a range of issues that needed further work before an accounting principle could be determined. This article (version 2.0) updates that original article. It takes into account the experience gained in developing the first set of accounts and also reflects the progress made by the international community in developing the conceptual framework for ecosystem accounting2.

With this experience behind us, the aims of this article are to:

- refine and revise the principles established in the original article, where possible setting out our position on previously unresolved issues

- offer general guidance on accounting issues, clarifying definitions and distinctions

- identify issues that remain unresolved and note where further research and testing is needed

In some cases the principles are prescriptive (what must or can’t be done). In other cases permissive (that is, identifying approaches that may be done), in order to reflect the evolving nature of natural capital accounting. Taken together, they will enable the accounts to become more transparent, consistent and integrated.

The article is intended as background information for those wanting to understand the concepts and methodology underlying the UK accounts being developed by ONS and Defra. It is also intended as a guide for practitioners more generally working on the compilation of natural capital accounts. This article remains work in progress and we anticipate revising it before 2020 in order to reflect further progress in developing and testing accounting principles and conventions.

Identification and management of relevant data sources, which are crucial to building accounts at national or local level, are not directly in scope of this article, although certain main sources (such as the Land Cover Map) are referred to.

For more information about the ONS and Defra Natural Capital Accounting project and to access all our published work please visit the Natural Capital section of the ONS website. We welcome all those with expertise in any area of future work to contact us at environment.accounts@ons.gov.uk

Department for Environment, Food and Rural Affairs

Download this image Department for Environment, Food and Rural Affairs

.png (9.3 kB)The accounting definition of natural capital

There is no widely agreed definition of natural capital. There is, however, an established definition of environmental assets, which provides a useful starting point as far as the development of natural capital accounts for the UK is concerned. Environmental assets are defined as “the naturally occurring living and non-living components of the Earth, together constituting the biophysical environment, which may provide benefits to humanity”3.

This definition has immediate implications for the nature of the assets that are covered by the accounts. In terms of surface area, the accounts mainly relate to what are termed ecosystems, such as woodland and wetlands. Ecosystems comprise a number of components, such as water, soil and biodiversity, which combine together to provide a range of benefits, such as wild fish and flood protection. The contribution of the ecosystem to these benefits is known as an ecosystem service. Since it is the ecosystem as a whole that provides the services, the accounting system treats the ecosystem as the asset, rather than the constituent parts.

Natural assets also include non-living or abiotic resources such as oil and gas and ground-water. The range and classification of assets is discussed in more detail in Section 3. For this reason we refer to “natural capital accounts” rather than the slightly narrower scope of “ecosystem accounts”.

What are natural capital accounts?

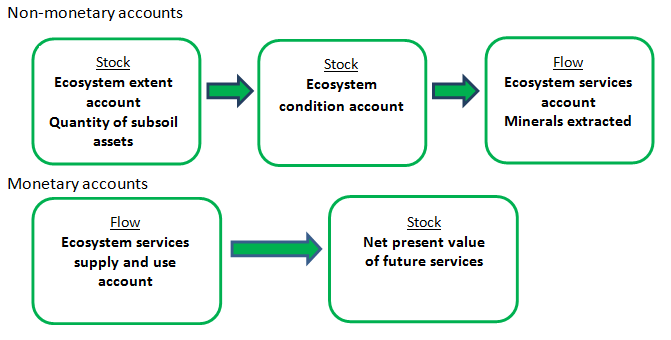

In a national accounting perspective, natural capital accounts are a series of interconnected accounts that provide a structured set of information relating to the stocks of natural capital and flows of services supplied by them. Accounts are of 2 kinds:

- physical accounts – classify and record measures of extent, condition and annual service flow

- monetary accounts – assign a monetary valuation to selected services on an annual basis and record an overall valuation of the natural asset’s ability to generate future flows of services.

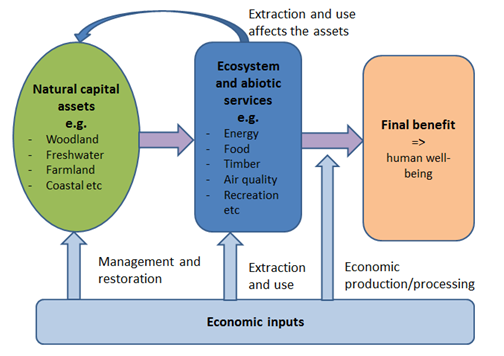

The other main distinction is between asset accounts and service accounts. Figure 1.1 summarises in simple terms how accounting is based on a rigorous distinction between the asset or stock (left hand side) that generates a flow or service (net of human and other economic inputs); this service may then be further processed in some way before its final use or consumption. Further explanation of these distinctions is provided in the rest of this article.

Progress in implementing the UK Natural Capital Accounts (NCA) Roadmap was reviewed in 2015. Work to date has focused on 3 areas:

- aggregated estimates of the value of natural capital in the UK

- scoping and development of initial broad habitat accounts (for example, woodland, farmland, freshwaters, coastal and marine)

- cross-cutting accounts for assets (for example, land use, land cover, carbon) and certain services (for example, air pollutant absorption, recreation)

The set of accounts are developed to be conceptually consistent with the System of National Accounts, in order to facilitate comparison and potential integration with accounting data for the wider economy. Further detail on the scope of natural capital accounts and definitions is provided in Section 2.

Figure 1.1: The links between assets, services and final benefits

Source: Department for Environment, Food and Rural Affairs (Defra), Office for National Statistics

Download this image Figure 1.1: The links between assets, services and final benefits

.png (65.4 kB)Why do we need natural capital accounts?

Gross domestic product (GDP) tells us only part of our economic story. It hides and excludes services provided by natural capital, and it focuses only on flows of income and output, not stocks of capital, including natural capital, that underpin them. The development of natural capital accounts has been flagged by the Natural Capital Committee and the UK National Ecosystem Assessment as a fundamental activity that is necessary if natural capital is to be mainstreamed in decision-making. It sends a strong signal to businesses and local decision-makers of the importance of monitoring and valuing natural assets. More specifically, a well-developed national set of natural capital accounts can:

- monitor losses and gains in our natural capital over time

- identify priority areas for investment and inform resourcing and management decisions

- highlight links with economic activity and pressures on natural capital

At the same time, there has been strong international momentum to develop natural capital accounts. The UN System of Environmental-Economic Accounting is the main source of technical guidance and sharing of experiences. The World Bank’s wealth accounting WAVES project is looking to implement ecosystem accounting in a range of partner countries. In 2010 at Nagoya, 193 countries agreed to a strategic target to incorporate the values of biodiversity into national accounting and reporting systems by 2020 (subsequently referred to in the Sustainable Development Goals).

Note on the text

The article is divided into 3 parts:

- scope and overview of natural capital accounts: Sections 1 to 2

- physical accounts: Sections 3 to 5

- monetary accounts: Sections 6 to 8

Within each section the rationale and issues are described in relatively brief terms. Principles are numbered and included in the text. References to the UN System of Environmental–Economic Accounting (SEEA) guidance on Experimental Ecosystem Accounts4 (SEEA EEA) and other references are given where appropriate, although it is important to note that this is not definitive as thinking and guidance continue to develop through discussion and testing.

The SEEA EEA provides a comprehensive glossary of terms, and we adopt the same definitions unless otherwise indicated.

Acknowledgements

This article draws upon experience from various workstreams of the ONS and Defra Natural Capital Accounting Roadmap work programme since the first Principles paper was published in August 2015. This includes various discussion papers and conferences relating to environmental valuation and accounting. It also draws upon a wide range of experience within the wider international community, including the draft Technical Recommendations for Experimental Ecosystems Accounting circulated by the United Nations Statistical Division and discussions with a number of experts. We would particularly like to acknowledge the work of Carl Obst, Bram Edens, Michael Vardon, Lars Hein, Giles Atkinson (LSE), Per Arild Garnasjordet (Norway Statistical Office), Jan-Erik Petersen (EEA) and Anton Steurer (Eurostat).

Notes for: Purpose and overview of this article

The roadmap and related documents on natural capital accounting can be found on the National Archives website.

As noted later in this section, “ecosystem accounting” is a slightly narrower concept than “natural capital accounting” because the latter also includes abiotic assets (such as minerals and sub-soil assets). We refer, however, in various places to “ecosystem accounting”, because this is the most novel and challenging aspect of natural capital accounting, and is it the focus of specific UN guidance and the broad habitat accounts of the roadmap. The full scope of the roadmap, however, is to develop natural capital accounts.

Paragraph 2.17, System of Environmental –Economic Accounting (SEEA) 2012 Central Framework.

System of Environmental-Economic Accounting 2012, Volume II – Experimental Ecosystem Accounting. References in this article to “SEEA” refer to SEEA Experimental Ecosystem Accounting unless otherwise stated.

2. The scope of natural capital accounts for the UK

Defining the UK’s natural capital: ecosystems and abiotic assets

As noted in Section 1, natural capital relates to the environmental assets that may provide benefits to humanity. The UK Natural Capital Accounts cover those environmental assets that lie within the territory of the UK. In terms of surface area, this can be taken as the land area of the UK, together with the UK’s Exclusive Economic Zone (EEZ1). The spaces above (the “air space” or “atmosphere”) and below (relating to subsoil assets) the UK’s surface area are also included within this framework.

The UK’s surface area holds the most important assets, mainly in the form of ecosystems such as woodland and wetlands. For convenience, we also include groundwater within this category of assets. The inclusion of air space means that the atmosphere above the UK’s land and sea surfaces is also included as a natural asset, albeit not separately identified as an ecosystem in itself. And the inclusion of the space below the surface means that abiotic subsoil assets such as oil and gas resources (together with any surface mineral deposits) are counted within scope.

This categorisation of ecosystem assets used in the UK Natural Capital Accounts differs in relatively minor ways from the framework set out within the System of Environmental–Economic Accounting (SEEA) Central Framework classification of environmental assets2 and the metrics proposed by the Natural Capital Committee (NCC)3. This is because the focus is on the extent and state of the ecosystem as a whole, rather than for selected components such as land, soil or biodiversity. This is a critical aspect of natural capital accounting. It means that the ecosystem asset can be linked to the basket of services provided by the ecosystem, which is not possible if individual components such as soil are accounted for on their own.

This is not to say that these components are completely excluded from the accounting structure, as they are important indicators of the capacity to deliver services (see Section 4 on accounting for condition). It does mean, however, that no attempt is made within the accounts to put values directly on such components; rather, natural capital values are assessed by reference to the current and expected future service flows. This approach is explained in more detail in Section 6.

It follows that (with the exception of renewable groundwater), surface and subsoil mineral and other abiotic assets are not treated as giving rise to ecosystem services. This approach reinforces a helpful distinction between renewable and non-renewable natural resources. It does mean, however, that minerals and abiotic subsoil assets are viewed as part of the UK’s natural capital but not as part of the ecosystem accounts, although we recognise that the process of exploration and extraction of these resources will have impacts upon different ecosystems.

Groundwater is a special case, because it is maintained by the functioning of surface ecosystems and because the service provided – freshwater – is not always distinguished from the service of freshwater provision from surface water sources.

Two main types of accounts: stocks and flows

The essential distinction to bear in mind when developing natural capital accounts is the distinction between stocks and flows.

The ecosystems and mineral resources are the assets that are recorded in the “stock” account. These accounts are designed to give additional detail on the state of those assets, and in practice they may be separated into 2 accounts, covering the extent or volume of the asset and its condition or quality. For some assets (such as water resources) the exact quantity of the stock at a point in time (for example, 31 December) may not be particularly meaningful and it may be recorded as the average volume over a period of time. However, in general the stock account will parallel the concept of a balance sheet and record assets at the start and end of the calendar year.

In contrast, the services that are provided by natural assets are regarded as “flows”, in the same way that the services from the economy to final users are recorded as the sum of the flows over a certain time period (normally a year). As with services provided by the economy, this may not involve any physical transfer of materials.

Both stock (asset) accounts and flow (services) accounts may be recorded in either monetary or physical terms.

There is a clear sequence to these basic types of accounts, in that the volume or extent of the natural assets, combined with information on the physical state and condition of the assets, can be seen as representing the asset base from which the flows of ecosystem services are provided. Once monetary values are put on these flows, it is possible to put values on the assets as well. Figure 2.1 (which is drawn from SEEA EEA draft Technical Guidance Figure 2.2), summarises this sequence.

Figure 2.1: The sequence of accounts

Source: Department for Environment, Food and Rural Affairs (Defra), Office for National Statistics (ONS)

Download this image Figure 2.1: The sequence of accounts

.png (15.5 kB)Relationship of the natural capital accounts to other UK Environmental Accounts

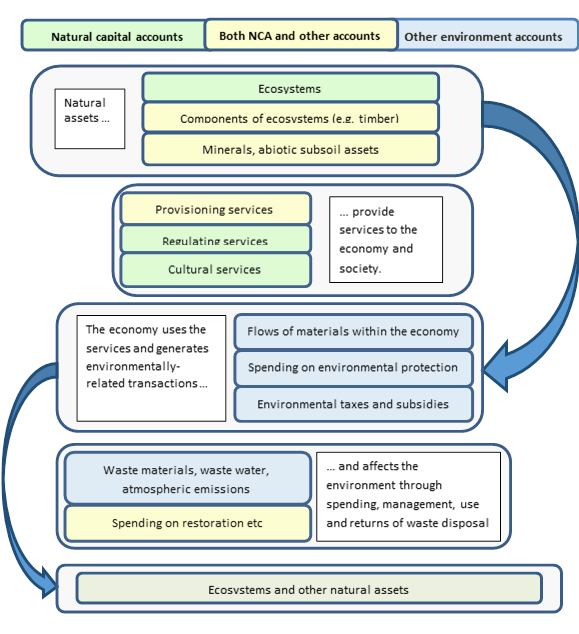

The SEEA Central Framework sets out a range of other accounts, which are relevant to natural capital accounting, such as energy use and water use accounts, as well as atmospheric emissions and effluent accounts. Many of these accounts are already regularly produced by the Office for National Statistics (ONS) within the environmental accounts publication. The main distinction between these accounts and natural capital accounts is that the former focus on the pressures generated by economic activity, whereas the latter focus on the services provided by natural capital.

For many natural resources, such as oil and gas, these are simply two sides of the same coin: the supply of services from natural capital equals the use of such services by economic activities. For emissions and other residuals, however, a strong distinction is made between the pressures on the environment from economic activity (such as emissions of pollutants recorded in the air emissions accounts), and the services received from natural capital (such as the amounts of pollutants absorbed by vegetation recorded in the ecosystem accounts). Figure 2.2 summarises the relationship between these different types of accounts.

As Figure 2.2 indicates, as well as overlaps between the two, there are important linkages between the natural capital accounts and other types of environmental accounts, especially for flows of atmospheric emissions, effluent and waste back to the environment, and spending on the environment. For example, the use made of ecosystem services by the agricultural sector revealed in the natural capital accounts can be linked to the emissions and effluent generated by the economic activities of that sector.

Cross-cutting and thematic accounts

Developing the natural capital accounts in the UK has to date focused on the assets and services relating to particular broad habitats. This has worked well, but it has become increasingly clear that i) certain services such as recreation and flood protection are commonly provided by a number of habitats; and ii) certain indicators of condition (such as soil carbon content) are relevant to more than one type of asset. Ensuring consistency between different habitat accounts and enabling an overview of different features of natural capital in the UK can best be achieved by developing what are known as thematic4 or cross-cutting asset and service accounts.

The concept of cross-cutting service accounts, as distinct from cross-cutting asset accounts, is relatively new. In effect they are summaries of the flow of particular ecosystem services that can be disaggregated (at the very least) by broad habitat and ideally by some of the other characteristics of ecosystems (such as type of woodland).

There should be a similar consistency between cross-cutting asset accounts and the accounts of extent and condition for the range of ecosystem assets. In particular, the entries in the cross-cutting land cover and land use accounts for a particular habitat type should match those in the relevant ecosystem account. However, such cross-cutting accounts can be expanded to cover the subject matter more comprehensively, for example, by reporting on stocks of carbon in sub-soil energy resources. Looking at particular elements of the natural world in this way can give important insights into the nature of the interactions between stocks and flows.

Figure 2.2: Relationship of natural capital accounts to wider environmental accounts

Source: Department for Environment, Food and Rural Affairs (Defra), Office for National Statistics

Download this image Figure 2.2: Relationship of natural capital accounts to wider environmental accounts

.png (104.6 kB)Aggregate natural capital estimates

In November 2016, ONS published updated estimates of UK Natural Capital - monetary estimates, which provide an overview of the value of measurable components of natural capital. The emphasis in these estimates is on UK level monetary values rather than a fully integrated account of all the relevant physical and monetary stocks and flows. The estimates have been significantly revised, as more robust methodologies and data sources have been established.

Whilst the experience of developing the individual “broad habitat” accounts has informed the high level estimates, there is a need to ensure complete consistency in methodology between the two. This confirms our intention to ensure that:

The aggregate accounts should be based on, and consistent with, the underlying ecosystem accounts for different broad habitats. (Principle 2.1)

Relationship of the natural capital accounts to the main national accounts

Both the natural capital accounts and other UK Environmental Accounts are seen as extensions to the main national accounts, within the framework of the UN System of National Accounts (SNA). This means that where appropriate the concepts and methodologies used in the natural capital accounts should align with those used in the main part of the SNA. This may be particularly challenging as far as valuation is concerned (see Section 6). It also leads to some overlap between the use of natural resources by the economy recorded in the natural capital accounts, and the supply of certain economic goods and services recorded in the main SNA. These goods and services are described in the SEEA EEA as “SNA benefits”. They mainly relate to the natural materials that are extracted and supplied to users elsewhere in the economy. Although they are potentially of interest in their own right, to date the focus of the UK accounts has been on the identification of all services from UK natural capital, whether or not they are already recorded to some degree within the framework of the SNA.

There is a similar potential overlap with the asset accounts of the SNA, in that certain natural resources, such as proven oil and gas reserves, are treated as economic assets but will also be included within the natural capital accounts. The extent of these overlaps is an area of further work.

Within the main national accounts, suppliers and users of economic goods and services are identified as different sectors of the economy, such as businesses, government and households. This classification is maintained within the UK Natural Capital Accounts and gives rise to important linkages between the economic activities of different sectors recorded in the main national accounts, and the use of services provided by natural capital. The links are established through the development of ecosystem services supply and use tables, as discussed in Section 5.

National, subnational and corporate accounts

These guidelines and principles are mainly intended for use in the development of national level natural capital accounts. It is recognised, however, that accounts for subnational areas5 such as countries, regions, county councils, river basin districts, catchment areas and national parks will be useful for policy purposes. An example is the pilot ecosystem accounts developed for 3 national parks and one Area of Outstanding Natural Beauty in England. In principle:

The national level accounts should be consistent with these more spatially disaggregated accounts. (Principle 2.2)

In practice, it may not be possible either to disaggregate the national level accounts systematically to these areas or to scale up subnational accounts to the national level. This is an area of further research. It makes sense to pilot and test accounting approaches further at a subnational level where there may be greater data availability and potential applications, such as in the government’s Pioneer projects.

This guidance has not, however, been developed specifically with applications of corporate accounting in mind. The Natural Capital Committee has set out a methodology for developing corporate natural capital accounts, which bears many similarities to the principles here. Although there will be much in common, national accounts have their own concepts and conventions that may not have a precise equivalent in corporate accounts. On the other hand, corporate natural capital accounts will explicitly include financial costs and expenditure associated with the natural assets being accounted for. In this way, organisations can better assess and report the value for money of their activities within a specific estate, in the form of a balance sheet comprising assets and liabilities. Cost accounting is less feasible at national level, although this is a subject of further research.

A related initiative to natural capital accounting is the Natural Capital Protocol, launched in July 2016 by the international Natural Capital Coalition. The Protocol is a framework designed to help generate “credible and actionable information for business managers to inform decisions”. Natural capital accounting approaches can inform various stages of the Protocol, and in particular can enable monitoring of decisions taken as a result of applying the Protocol.

Frequency of accounts

A major use of natural capital accounts is in the trends that they reveal over time – through changes in physical quantities and monetary values – quite apart from the specific values recorded for a given year. Ideally we would propose to maintain annual accounts (though for water the hydrological year is different and quarterly or seasonal accounts are likely to be more useful). However, changes in assets are often not significant on an annual basis and sources of data such as the National Forest Inventory are unlikely to be able to support such frequent accounts. One solution is to produce annual accounts, updating those elements that can readily be updated, but with the option of reporting change by reference to a baseline determined by the more comprehensive but intermittent data source. This is an issue that is likely to be guided by the availability of data: sufficient annual data may simply not be available, although even then there may be process advantages to be gained by setting up production systems on an annual cycle. Annual accounts should be the aim for natural capital flows. Asset accounts which are unlikely to change significantly can be updated less frequently. (Principle 2.3)

Uncertainty

Broadly 3 types of uncertainty affect natural capital accounting estimates:

- underlying data quality, uncertainties and gaps

- methodological uncertainties and ambiguities

- statistical uncertainties

This principles article can help to iron some of the methodological uncertainties, and, based on the SEEA, establish relevant accounting conventions.

Uncertainty in an accounting context can be difficult to measure (SEEA-EEA Section 2.5.5), as accounts traditionally present an integrated “single best picture” of point estimates, which are balanced with other accounts; ranges do not allow this. However, many of the procedures and descriptions of quality used in the SNA are relevant to ecosystems accounting and provide a useful starting point for assessment of data quality and fitness for purpose6. More broadly, it should be understood that the significance of data and methodological uncertainties will be relative to the level and purpose of the accounts. Changes in, or differences between, accounting estimates may be more robust than the absolute levels.

For high-level ecosystem accounting a degree of uncertainty is acceptable where the main purpose is to estimate orders of magnitude and track trends over time. (Principle 2.4)

We accept that in many areas we will only have a partial coverage of ecosystem services or total economic value. In the experimental phase at least, the reasons for uncertainty of estimates will be varied. In time, it may be preferable to adopt specific conventions to communicate confidence levels in a consistent summary way instead of, or in addition to, textual descriptions.

For each account we will provide a transparent assessment of confidence levels in the estimates, the major gaps in service coverage, the potential for over or understatements and other uncertainties. This will help to communicate the degree of uncertainty effectively and transparently. (Principle 2.5)

The extent and frequency of revisions provide the main indicator of robustness. In this experimental phase, we expect significant revisions, particularly to the monetary estimates (Sections 6 to 8), as methodologies are tested and evaluated. In particular, we expect revisions to the monetary accounts to arise from a number of sources:

- additions arising from new estimates for additional services

- implementing latest guidance emerging international discussions on ecosystem accounting

- revised projections of future service flows based on new data or revised outturn data

- revised principles regarding asset calculation (for example, on asset life, discounting)

- revised assumptions regarding the unit values of service flows

As accounts are updated we will indicate the major revisions and the reasons for them. (Principle 2.6)

Notes for: The scope of natural capital accounts for the UK

The UK’s Exclusive Economic Zone is the area around the UK over which we have special rights regarding the exploration and use of marine resources. It includes parts of the North Sea and Irish Sea and extends out beyond the islet of Rockall in the North Atlantic Ocean.

SEEA Central Framework Section 5.2.2

See SEEA EEA draft Technical Recommendations December 2015. The 2020 Roadmap uses the term “cross-cutting” – as used in Section 1 of this article.

These areas are known in the SEEA as Ecosystem Accounting Units (EAUs), see SEEA EEA Section 2.3.4.

See Vardon M. Recognising and managing uncertainty in national and environmental accounting. Issue paper 2.1, Valuation for Accounting Seminar (London 2013)

3. Accounting for ecosystem asset extent

Classification of ecosystem assets

Ecosystem asset accounts describe the extent and condition of the different land cover or habitats. They enable decision-makers to understand the state of each asset and how it is changing over time. The information on the extent and condition of each asset can also be linked with information on land use, landscape type, land ownership, protected area status and land management practices, in order to provide a richer understanding of the drivers of change and the prospects for longer-term sustainability. Because land use and other characteristics have such a strong influence on the nature of the services provided by the ecosystem assets, it may in due course be desirable to incorporate some of these characteristics into the classification used to define each ecosystem type.

However, the starting point for any classification of ecosystem types is the Land Cover Map (LCM). In the absence of an up-to-date LCM for the UK, the initial accounts that we developed were dependent upon a variety of other sources including information on land use from the Agricultural Census and the National Forest Inventory. It should now be possible to base the UK accounts around the new LCM for 20151 produced by the Centre for Ecology and Hydrology (CEH). It follows that the information on the extent of different land uses used in the initial accounts will need to be integrated with the LCM estimates so that the accounts are both comprehensive and non-overlapping.

The land cover types used in the Land Cover Map, and how they relate to the broad habitat classes used in the initial UK Natural Capital Accounts to date, are set out in Table 3.1. With the advent of a new series of LCMs, it should also now be possible to account systematically for a wider range of different habitats (column 2). The final column of Table 3.1 shows the more detailed habitats, which to date (January 2017) have been separately identified within the UK’s initial Natural Capital Accounts, albeit not fully integrated into the accounting structure.

In future the UK ecosystem extent accounts should systematically reflect the full range of 23 Land Cover classes from the Land Cover Map. (Principle 3.1)

Further work is needed to determine the extent to which other characteristics (such as land management practices) can be used within the classification of ecosystem types. Further work will also be needed to determine the level of aggregation required in order for comprehensive accounts of ecosystem condition and ecosystem services to be compiled.

Although the 23 Land Cover classes set out in Table 3.1 are more detailed than the 8 broad habitats used in the initial accounts, there are still classification issues to be addressed, such as the treatment of inland rock; floodplains; linear features; and woodland or freshwater ecosystems within urban areas. These will all be the subject of further research.

Table 3.1: Mapping of Land Cover Map classes to UK Broad Habitats

| Broad Habitat | LCM habitat class | Sub-classes included | Classes included within the initial UK accounts to date |

| Woodlands | 1 Broadleaved woodland | Deciduous; Recent (<10 yrs); Mixed; Scrub | Broadleaved Woodland; Coniferous Woodland |

| 2 Coniferous woodland | Conifer; Larch; Recent (<10 yrs); Evergreen; Felled | ||

| Enclosed farmland | 3 Arable and horticulture | Arable bare; Arable unknown; Unknown non-cereal; Orchard; Arable barley; Arable wheat; Arable stubble | Arable and horticulture; Improved grassland; Rough grazing; Linear features |

| 4 Improved grassland | Improved grassland; Ley; Hay | ||

| Semi-natural grassland | 5 Rough grassland | Rough / unmanaged grassland | To be determined |

| 6 Neutral grassland | Neutral | ||

| 7 Calcareous grassland | Calcareous | ||

| 8 Acid grassland | Acid; Bracken | ||

| Open water, wetlands, floodplains | 16 Freshwater | Water flooded; water lake; water river | Open water; wetlands; peatland |

| 9 Fen, marsh and swamp | Fen / swamp | ||

| 12 Bog | Bog; Blanket bog, Bog (grass dominated); Bog (heather dominated) | ||

| Mountains, moorlands, heaths | 10 Heather | Heather and dwarf shrub; Burnt heather; Gorse; Dry heath | To be determined |

| 11 Heather grassland | Heather grass | ||

| 13 Montane habitats | Montane habitats | ||

| 14 Inland rock | Inland rock; Despoiled land | ||

| Marine | 15 Salt water | Water sea; Water estuary | All areas of saltwater not included below |

| 19 Littoral rock | Littoral rock; Littoral rock / algae | ||

| 20 Littoral sediment | Littoral mud; Littoral mud / algae; Littoral sand | ||

| Coastal margins | 17 Supra-littoral rock | Supra littoral rocks | Sand dunes; machair; saltmarsh; shingle; sea cliffs; coastal lagoons |

| 18 Supra-littoral sediment | Sand dune; Sand dune with shrubs; Shingle; Shingle vegetated | ||

| 21 Saltmarsh | Saltmarsh; Saltmarsh grazing | ||

| Urban | 22 Urban | Bare; Urban; Urban industrial | To be determined |

| 23 Suburban | Urban suburban | ||

| Source: Office for National Statistics | |||

Download this table Table 3.1: Mapping of Land Cover Map classes to UK Broad Habitats

.xls (30.2 kB)Measurement of individual ecosystem assets

Ecosystem assets2 are the individual areas of a particular land cover class or ecosystem type. When aggregated together across the country, they represent the total extent of that ecosystem type. Each individual area should be contiguous although the proximity to other areas of the same type, or to areas of other ecosystem types, will be important in terms of ecosystem connectivity and general landscape values. The area of all the ecosystem assets in the UK should equal the total area of the UK, although the extent of each ecosystem type will vary over time.

As discussed earlier in this section, for the UK the classification of land cover types used in the Land Cover Maps will form the basis of estimates of ecosystem extent. The LCM will also provide information on the location and extent of each individual ecosystem asset3, in the form of contiguous 25 metre squares4. In deriving the area of the individual ecosystem asset as a whole, it is implicitly assumed that each 25 metre square is entirely made up of that land cover type.

The rich spatial detail expected from the Land Cover Map is seen as an essential element of the natural capital accounts. It will form the basis of subnational accounts, and it can be used in modelling the provision of certain ecosystem services such as air pollutant absorption and flood protection. It also provides the opportunity to report the accounts in the form of maps as well as in the form of accounting tables. However, it is recognised that data for many other parts of the accounts will not be available at such a detailed level, and that estimates of the condition of ecosystem assets or the volume of ecosystem services may only be available at higher levels of spatial resolution and presented in the form of overlays. It follows that comprehensive natural capital accounts for individual ecosystem assets are not expected to be produced as part of the UK accounts.

Delineation between different ecosystem types

The information about the land cover type of individual 25 metre squares has implications for the treatment of rivers and other linear features such as hedgerows and lines of trees. For example, the initial farmland ecosystems account5 records hedgerow length and other linear features in area terms, but this hardly does justice to their importance in delivering particular ecosystem services. Further work on the treatment of linear and point features will be undertaken in the next phase of the roadmap.

The delineation between the marine ecosystem and coastal margins needs particular attention. As discussed in a recent Scoping Study6, the unique features of the coastal land cover types means that all such habitats, including those below the mean high water mark (HWM), which might otherwise have been classified as part of the marine ecosystem, should be recorded as coastal margins. The reason for this is that many of the services that such habitats provide are strongly terrestrial (for example, grazing sheep and wildfowling, in the case of salt marshes). The Scoping Study also noted that for some purposes, such as recreation, it made little sense to distinguish between coastal and marine habitats.

There is a distinction to be made between the habitat or land cover and the underlying ecosystem, which has implications for the way the accounts are compiled. This particularly concerns the recording of degraded peatland, floodplains, semi-natural grassland and habitats within urban areas within the accounts. In practice it may be necessary to develop sub-accounts for these specific ecosystems, which can then be analysed separately or combined with other habitat-based accounts depending upon the issue of interest.

Notes for: Accounting for ecosystem asset extent

Centre for Ecology and Hydrology, Land Cover Map 2015.

Known as Land Cover Ecosystem Units in the SEEA, see SEEA EEA Section 2.3.3

The allocation to a particular ecosystem type could in due course take into account information on topography (such as altitude) or other characteristics (such as land management practices.

These squares are known as Basic Spatial Units in the SEEA, see SEEA EEA Section 2.3.2. The size of the squares will depend, amongst other things, upon the sophistication of the satellite technology.

4. Accounting for ecosystem asset condition

The meaning of ecosystem condition

The main objective of the asset account is to enable us to monitor changes in the stock of our natural capital in terms of its capacity to continue to deliver ecosystem services. The capacity to deliver services can be influenced by 3 main characteristics:

- quantity

- quality

- spatial configuration

Quantity can be assessed by means of the measurement of the extent of each ecosystem asset, as discussed in Section 3, together with key volume such as the quantity of water in rivers and lakes. Measures of spatial configuration such as fragmentation and ecosystem connectivity are challenging to compile and are expected to be the subject of further research. Hence this section focuses on measures of ecosystem quality, as far as it relates to the provision of services. In due course assessments of capacity to deliver services may be more systematically assessed through the separate development of accounts for ecosystem capacity.

Indicators of condition

The System of Environmental–Economic Accounting (SEEA) sets out 5 dimensions of quality for which indicators or metrics could be included within the condition account:

- vegetation

- biodiversity

- soil

- water

- carbon

In practice the demarcation between these dimensions has not been entirely clear (for example, soil carbon is to be shown under soil rather than carbon, and fish species are shown under water rather than biodiversity).

The SEEA dimensions have helped as a framework for the indicators used in the UK’s initial accounts to date, although in practice different indicators within each dimension have been used, depending upon the nature of the ecosystem: for example, the index of farmland birds has been used in the enclosed farmland account, whilst indices of woodland birds were used in the woodland accounts. Although this makes practical sense, it is recognised that it will be difficult to develop summary indicators of condition across different land cover types, let alone across different dimensions1.

More recently, practitioners2 have recognised that there is a distinction to be made between the “more natural” ecosystems such as rivers, ancient woodland and protected high nature value areas, and other more heavily modified landscapes (such as areas of intensive farming and urban parks). For the former, it may be possible to establish a “reference condition” in order to assess the extent to which the current condition is in its untouched or natural state. Indicators of water quality and assessments of the condition of sites of special scientific interest (SSSIs) would fall into this category. It may even be possible to take into account proximity to tipping points or thresholds for these kinds of areas. Another option is to assess the degree to which the ecosystem has moved away from the state in an historic reference year (such as 1970), if this is known. However, for most of the UK, it will be more realistic simply to attempt to measure quality by reference to the condition of the ecosystem at the start and end of the accounting period.

In addition, the capacity to deliver services is affected by other factors such as the volume of water present in lakes and reservoirs, the proximity to areas of population, nature of access for recreational purposes and the degree to which the asset is protected by law. This suggests that:

The following broad dimensions should be considered when compiling condition accounts:

- relevant volume estimates (for example, timber biomass, water quantity or flow, length of linear features)

- biodiversity indicators (for example, abundance indicators, mean species richness)

- soil indicators (for example, carbon content, water content)

- ecological condition indicators (for example, water quality, plant health, invasive species)

- spatial configuration (for example, fragmentation, connectivity)

- access (for example, proximity to areas of population)

- management practices (for example, organic farming, degree of protection) (Principle 4.1)

More work is needed to identify those areas where reference condition indicators could be used and to ensure that the indicators used are consistent as far as possible across ecosystem types.

Environmental thresholds and limits

Using the previous period as the reference condition has limitations in terms of assessing whether any reduction in the quality of the stock is at such a level as to cross environmental thresholds and limits. Incorporating limits and thresholds (which may include concepts of social acceptability) would require an extension to the accounts. Where there are significant gaps in scientific understanding regarding ecosystem functioning (including the possibility of non-linear thresholds), there is limited ability to reflect potential limits and thresholds in prices in the short-term. Physical accounts or assessments are therefore important to complement monetary accounts in understanding thresholds.

We recognize that conceptual work on valuation can often be ahead of empirical understanding of ecosystem processes (for example, pollination) and in general more scientific research is needed to increase overall confidence in the accounts. The question of environmental thresholds in accounts is, however, an unexplored area and general principles for its treatment have yet to be established. The position taken in the SEEA (paragraph 4.35) is that it does not fit well within a model based on assessment of change over successive accounting periods. Further work is required on how to incorporate limits and thresholds into the accounts.

The structure of ecosystem asset (extent and condition) accounts

The basic asset account has a standard format, although the characteristics of the stock of assets described in each account may vary according to the type of asset and the availability of data. A typical account would have the structure of Table 4.1.

Table 4.1: The general structure of the asset account in physical terms3

| Extent of ecosystem (area) | Volume (volume) | Biodiversity (indicator) | Soil (index) | Ecological condition (indicator) | Access (indicator) | Management practice (area) | |

| Examples | Woodland, Freshwater | timber biomass; carbon stock; water quantity | Farmland Birds Index | carbon content, water content | water quality | proximity to areas of population | conservation status, organic farming |

| Opening stock | |||||||

| Additions to stock3 | Net change | Net change | Net change | ||||

| Reductions in stock | |||||||

| Closing stock | |||||||

| Source: Office for National Statistics | |||||||

Download this table Table 4.1: The general structure of the asset account in physical terms^3^

.xls (27.1 kB)Biodiversity accounts

The SEEA follows the Convention on Biological Diversity (CBD) and defines biodiversity at 3 levels:

- genes

- species

- ecosystem (see Assessing different levels of biodiversity within the natural capital accounts)4

Although aspects of biodiversity (for example, wildlife and/or game; or active principles for pharmaceutical products) can be viewed as services, the SEEA takes the view that in general the value of biodiversity will be captured via the value of the ecosystem services that each ecosystem asset produces. Except in very specific circumstances, the value of biodiversity is not evidenced directly, or if valued directly, this is not a value that is in addition to ecosystem values measured via ecosystem services. The SEEA therefore sees biodiversity through the lens of species diversity and primarily as a characteristic of ecosystem assets and an indicator of condition5. The World Conservation Monitoring Centre has published a guide showing how these indicators may form part of and be derived from a broader cross-cutting account of species biodiversity.

Assessing different levels of biodiversity within the natural capital accounts

There is a long-standing discussion in the international community on the connections between biodiversity and ecosystem services. From an ecosystem accounting point of view, because it is possible to account for both ecosystem assets and ecosystem services, it is relatively straightforward to place these 2 areas of measurement in context. The 3 levels of biodiversity are covered in the following ways:

Ecosystem diversity can be assessed via ecosystem extent accounts through measurement of the changing composition of ecosystem types within an area.

Species diversity should be considered as a characteristic of ecosystem assets, with declines in diversity usually reflected in declines in the condition of ecosystem assets. This connection to assets is important as it implies, in accounting terms, that biodiversity can be considered to deteriorate or improve – a feature that cannot apply to services.

Genetic biodiversity is the number of genetic characteristics in the genetic make-up of a species. It is probably highly relevant to the production of ecosystem services, and potential option value, but how best to record it in an ecosystem accounting framework has not yet been considered.

The selection of species within a species diversity account depends upon the analytical focus6. If reporting on the general condition of the ecosystem is the main concern, then the selection should cover those specialist species most strongly associated with that particular habitat. If the concern is with the continuing capacity of the ecosystem to provide services, this list might be further refined to “keystone” species, which are critical to the functioning of the ecosystem.

Species-level indicators can be compiled in more than one way. A draft technical paper for the UN by Hein7 sets out a number of options:

- number of species in specific classes – focusing on (a combination of) specific taxonomic groups; this is not recommended as it does not indicate relative abundance and gives equal weight to each species

- biodiversity indices, for example, Simpson and Shannon indices of species diversity based on species richness and relative abundance;tThis is difficult to interpret and equal weight is given to each species

- mean species abundance; an indicator of mean abundance of original species relative to their abundance in undisturbed ecosystems

- numbers of red-list and/or endemic species; a good indicator of current status but difficult to interpret short-term changes

- populations of keystone species that is, those species that regulate essential ecosystem processes such as nutrient recycling; not clear if keystone species can be identified for all ecosystems

It is also possible to model the expected species biodiversity based on information about the extent and condition of the habitat, although this proposal is a little circular if the resulting indicator of biodiversity is then taken as an indicator of condition.

These options need to be explored further. In the meantime, birds indicators provide a limited but readily available view of changes in biodiversity, although we may need to rebalance our focus in biodiversity monitoring from individual species to ecosystem functioning.

Notes for: Accounting for ecosystem asset condition

SEEA 4.69 acknowledges that aggregation across dimensions will be problematic.

See Saner, M.A. and Bordt, M., Building the consensus: the moral space of earth measurement

The SEEA EEA makes a distinction between an extent account and a condition account, but since they both provide key information about the nature of the asset, it is helpful to combine them together.

The SEEA EEA (Table 4.4) envisages disaggregating the additions/reductions by cause (anthropogenic or not) but in practice the distinction is expected to be extremely problematic.

This focus on capturing biodiversity in stock accounts is consistent with the concerns set out by the Cambridge Conservation Initiative, Biodiversity at the heart of accounting for natural capital: the key to credibility (2016), where the focus is primarily on corporate natural capital accounting.

For a more complete description, see King, S., WCMC presentation to London Group meeting 2016 slide 11.

Hein, L., “Linkages between ecosystem service accounts and ecosystems asset accounts”, Draft version 1, December 2014.

5. Physical accounts for ecosystem and abiotic services

The accounting definition of a service

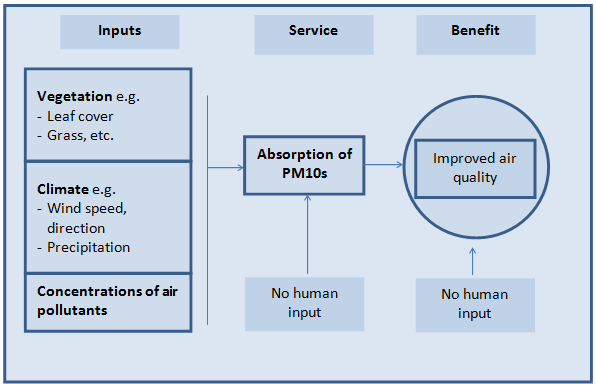

Accounting relies on clear definition and classification of activities in order to avoid double-counting and maintain consistent and comparable estimates between components and over time. The construct of a logic chain as set out in the System of Environmental–Economic Accounting (SEEA) and in various Department for Environment, Food and Rural Affairs (Defra) reports (for example Figure 5.1, drawn from an AECOM report on initial measurement of air pollution absorption services) can assist in this.

In accounting terms, a service is a flow between a supplier of the service and the recipient of the service. The flow of ecosystem services – which may not be a movement in any physical sense – represents a “transaction” between 2 economic entities, with the ecosystem being the supplier and one or more economic actors being the recipient (see also Section 6 on valuation principles).

Figure 5.1: Logic chain model for the ecosystem service of air pollution absorption

Source: Department for Environment, Food and Rural Affairs (Defra), Office for National Statistics (ONS)

Download this image Figure 5.1: Logic chain model for the ecosystem service of air pollution absorption

.png (14.7 kB)The conceptual framework shown in the logic chain model in Figure 5.1 draws a parallel with economic production as far as the distinction between services and benefits is concerned. In the economy, the production of sawn timber is an intermediate or supporting service, and the sale of furniture to the consumer is the final service or benefit. The challenge involved in integrating ecosystems into this model is to identify the contribution of ecosystems to the provision of the initial service, especially (as with agriculture) where the production of the service is heavily dependent upon economic agents (such as farmers) managing the process.

The boundaries that we draw between ecosystem production and economic production in the following sections are to some extent determined by practical considerations of measurement, the intention being to establish some broad conventions on which ecosystem service accounts can be based. Hence it makes sense first to establish what kinds of services we are intending to include within the scope of the accounts and consider where the boundaries are to be drawn in each case.

It is good practice to set out a logic chain in developing accounts for ecosystems services, whilst recognising that the relationships between the inputs used in the model, and the delivery of services, are unlikely to be fully established and should not be interpreted in a deterministic way. (Principle 5.1)

Classification of ecosystem services

The Common International Classification of Ecosystem Services (currently CICES version 4.3)1 sets out a potential standard to be followed. It is based on the well-established split into provisioning, regulating and cultural services2.It is, however, in the process of undergoing some significant revision and for the time being:

CICES should be regarded as a checklist rather than as a standard to be followed in all its detail. (Principle 5.2)

Using CICES as a checklist, Table 5.1 shows the current list of services already included or being considered for inclusion within the UK accounts, together with some suggestions for units of measurement. For completeness, Table 5.1d includes other (non-ecosystem) abiotic services such as those from oil and gas reserves.

Table 5.1 a: List of natural capital provisioning services to be considered in the UK accounts

| Description of service | Notes | |

| Biomass | Cultivated crops including horticulture (tonnes) | For example wheat; can include residues used as animal fodder. |

| Grass (tonnes) | Livestock is excluded as the production of grass fodder is taken as the service. | |

| Wild fish (tonnes) | Aquaculture is treated in the same way as livestock. | |

| Woody biomass (cubic metres) | Production of timber | |

| Wild produce (tonnes) | Nuts, berries, mushrooms, wild animals | |

| Peat (tonnes) | For either horticulture or energy | |

| Water (cubic metres) | Water (cubic metres) | Water abstracted, including groundwater and collected water Naviagation Possibly |

| Energy | Hydropower (joules) | Energy from hydropower |

| Other renewable sources (joules) | Energy from wind, solar, tidal etc. | |

| Source: Office for National Statistics | ||

Download this table Table 5.1 a: List of natural capital provisioning services to be considered in the UK accounts

.xls (19.5 kB)

Table 5.1 b: List of natural capital regulating services to be considered in the UK accounts

| Description of service | Notes | |

| Mediation of wastes and nuisances | Air pollutant absorption by vegetation (tonnes) | Deposition of pollutants on bare soil is excluded |

| Other waste remediation (tonnes/cubic metres) | Solid waste e.g. manure spreading | |

| Liquid waste e.g. effluent deposition/dilution/remediation (may be a supporting service to water provisioning) | ||

| Noise mitigation (decibels) | Shelter belts along motorways | |

| Mediation of visual impacts | Shelter belts around industrial structures | |

| Mediation of flows | Flood protection (cubic metres/ reduced risk of flooding) | Water absorption and attenuation by vegetation |

| Control of sediment | ||

| Provision of storage for excess water | ||

| Maintaining baseline flows for water supply (reduced risk of drought) | Supporting service for water provisioning | |

| Storm protection (reduced risk of damage) | Properties protected by natural sea defences (wetlands, dunes, shelter belts) | |

| Erosion protection (reduced risk of loss of soil) | Mass stabilisation and control of erosion rates | |

| Biophysical Maintenance | Greenhouse gas sequestration (tonnes) | Excludes carbon storage |

| Local climate regulation | Vegetation that enables air circulation | |

| Pollination | Commonly seen as a supporting or intermediate service | |

| Source: Office for National Statistics | ||

Download this table Table 5.1 b: List of natural capital regulating services to be considered in the UK accounts

.xls (28.2 kB)

Table 5.1 c: List of natural capital cultural services to be considered in the UK accounts

| Description of service | Notes | |

| Physical interactions with nature | Setting for outdoor recreation (No. of visits, or time spent at site) | Walking, hiking, climbing, boating. Note that health is generally viewed as a benefit rather than as a service |

| Nature-related tourism (No. of visits, time spent at site) | Bird watching, snorkelling | |

| Amenity (experiential interactions with nature) | Overlaps with recreation; can include an element of option value. | |

| Intellectual interactions with nature | Educational interactions (No. of visits) | School trips |

| Subject matter for scientific research (No. of publications) | Research related to ecosystems | |

| Heritage preservation (cultural archive) | ||

| Ex situ entertainment viewing | Documentaries on UK ecosystems | |

| Sense of place / artistic representations | ||

| Spiritual interactions with nature | Symbolic (emblematic plants, animals etc.) | No obvious measures within the UK |

| Sacred and religious | ||

| Existence and bequest | ||

| Source: Office for National Statistics | ||

Download this table Table 5.1 c: List of natural capital cultural services to be considered in the UK accounts

.xls (27.1 kB)

Table 5.1 d: List of natural capital other abiotic services to be considered in the UK accounts

| Description of service | Notes | |

| Fossil fuels | Oil, gas, coal (calorific values) | Volume extracted ((gross of losses e.g. from flaring, which will also be recorded in other environmental accounts) |

| Other mineral extraction | Sandstone; limestone and dolomite; chalk; igneous rock; salt; sand and gravel; potash (tonnes) | Volume extracted |

| Source: Office for National Statistics | ||

Download this table Table 5.1 d: List of natural capital other abiotic services to be considered in the UK accounts

.xls (26.1 kB)Particular issues in defining certain services

In this section we briefly discuss a number of potential services, which can be a source of confusion in terms of whether they should be included in their own right within a services account.

Agricultural production

The separation of the services provided by the farmland ecosystem from other economic inputs to agricultural production is challenging because of the degree to which the activity of farming manages and interacts with those services, for example, through sowing, irrigation, fertiliser spreading and livestock management. With very intensive arable farming, natural inputs may be limited to the provision of a medium for growing, with nutrients, light and water provided by the farmer, whilst intensive livestock farming may even take place entirely indoors. At the other extreme, livestock may be allowed to roam freely over semi-natural grassland with very limited human intervention. For the time being in these accounts:

We draw the line between the farmland ecosystem and the economy at the point at which vegetable biomass is extracted, therefore livestock is not included as an ecosystem service within the UK Natural Capital Accounts. (Principle 5.3)

This is a pragmatic solution, recognising that it is difficult to measure the separate inputs of nutrients, water and sunlight. It means that livestock growth is not counted as ecosystem production, as otherwise there would be double-counting with the grass and other fodder provided by the ecosystem. It is also consistent with the treatment of timber production as a woodland ecosystem service, and with the boundary between the environment and the economy used in the Material Flows Accounts. It does, however, mean that the accounts fail to distinguish effectively between intensive and less intensive uses of farmland, and further work is needed to bring this distinction into the accounts.

Carrier services and the provision of space for economic activities

Generally speaking, there is little merit in regarding the provision of space for economic activities as a service provided by natural capital, since the nature of the space is a given and cannot readily be altered. An exception could be made for open water and marine habitats, which might be viewed as providing carrier services. Unlike land-based activities, freshwater and potentially marine navigation is dependent upon ecosystems functioning well and can therefore arguably be included within the list of key services provided by those ecosystems.

Waste disposal and remediation

There is a distinction to be made between the passive use of the environment as a space in which to “store” unwanted materials, and the active remediation of those materials through chemical, biological or physical means. The latter service can be included within the accounts, although in some circumstances (such as remediation of effluent) the service can be seen as a supporting service to the provision of clean water.

Carbon storage

Carbon storage is a particular example of the distinction between storage and active remediation discussed in this section. The main ecosystem service relating to unwanted carbon is sequestration through the absorption of carbon into biomass. Indeed, the carbon stored by the ecosystem can be regarded as a liability, which may only be incurred if we allow the carbon to be released. Hence carbon stored in subsoil minerals or in peatland is regarded simply as a stock. Carbon storage – as well as carbon emissions – are, however, separately recorded in the cross-cutting carbon account.

Biodiversity

As discussed in Section 4, biodiversity is generally treated as a condition indicator within the ecosystem asset account. It can also be seen as a supporting service to other services insofar as it is critical to the functioning of the ecosystem as a whole.

Pollination and other intermediate services

In general, the focus of ecosystem accounts is on the final service provided by the ecosystem. However, such an approach risks overlooking important supporting or intermediate services, provided by separate habitats. Examples include the water flow management service provided by upstream habitats, which means that a steady supply of water reaches downstream parts of rivers, and horticultural pollination services provided by insects and birds associated with other habitats.

Pollination and other intermediate services should be recorded within the accounts where possible and valued where appropriate. (Principle 5.4)

Health (mental or physical)

Generally speaking this is regarded as a benefit but not a service: much of the benefit comes from the service of recreation. However, in terms of monetary flows it may be desirable to distinguish between the different benefits, as different methodologies might be needed in order to place values on the service. This is an area of further research.

Recreation and tourism

The ecosystem service of recreation can be regarded as providing benefits to 2 different groups of users: households benefit from the activity of enjoying being in the natural environment; and businesses benefit from the fact that these habitats attract visitors. These benefits are regarded as complementary and can be valued separately (see Section 7).

Alternative classifications of natural capital accounts

There are 2 other ecosystem services classification systems that could be used. The US Environmental Protection Agency (EPA) has developed an alternative classification known as FEGS-CS (Final Ecosystem Goods and Services – Classification System). The system is intended to provide a direct link between environmental classes (habitats or landscape types), ecosystem services and ultimate beneficiaries. The approach adopted is to aim to separate the ecological production function from total economic value, which includes an economic production function.

Because of this multi-dimensional perspective, the resulting system is very detailed – a particular flow of services can come from a number of different ecosystem types and have a number of different beneficiaries. Neither the ecosystem types nor the beneficiaries are categorised according to current UN standards. However, the list of goods and services may also provide a useful checklist for ecosystem accounting in the UK.

As an alternative, the US EPA has also developed a National Ecosystem Services Classification System (NESCS), which addresses some of these issues, in that the system does not prescribe which ecosystems deliver which services to which economic actors and ultimate beneficiaries, and is more consistent with international classification systems. The system identifies 3 types of ecosystem service use with many parallels to the CICES classification: extractive use such as raw materials and support of animal cultivation; in original location use such as waste disposal and recreation; and non-use such as existence and bequest values.

Ecosystem disservices

Ecosystem disservices relate to interactions between the ecosystem and humans that are considered to be bad. Examples are pests and diseases that cause harm to people (for example, asthma caused by pollen), which may result from a combination of ecosystem processes and adverse human management. It may be useful to distinguish them from negative externalities, such as carbon emissions from degraded peatland.

The accounting process does not deal well with either type of “negative value”. For disservices, a parallel can be made with smoking, which has negative consequences although it is only the sale of cigarettes which is recorded in the national accounts. For negative externalities, it is theoretically possible to record at least the relevant physical flows within an accounting structure, and to the extent that such flows are directly anthropogenic, they should already be recorded within the relevant emissions or waste accounts3. More work is needed on the appropriate accounting treatment for flows that are not so clearly anthropogenic in nature.

In conclusion, it would not be appropriate to record either source of “negative value” in the main natural capital accounts:

The natural capital accounts should not take into account the disservices or negative externalities arising from ecosystems functioning. (Principle 5.5)

Other pests and diseases that damage natural assets and cause a loss of service (for example, a virulent tree disease) will in principle be captured within the condition accounts.

Structure of accounts for natural capital goods and services

In line with the main national accounts, the natural capital accounts can include 2 relevant tables on natural capital services. The first (see Table 5.2) describes the different types of services provided by the different ecosystem types within an area, using illustrative numbers. This account is known as the Supply Table. In some cases the units are fairly obvious but in others measurement is a challenge and further work is likely to be needed.

Table 5.2: Supply of natural capital services for an Accounting Area (illustrative)

| Ecosystem type e.g. | Resource type | Total | ||||

| Woodland | Enclosed farmland | Fresh-water | Coastal margins | Oil and gas | ||

| Provisioning | ||||||

| - Woody biomass | 1000 m3 | 1000 m3 | ||||

| - Freshwater fish | 10 kt | 10 kt | ||||

| Regulating | ||||||

| - Air pollution absorption | 10 kt | 15kt | 25 kt | |||

| - Carbon sequestration | ||||||

| Cultural | ||||||

| - Recreation | 200 visits | 100 visits | 600 visits | 1000 visits | 1900 visits | |

| Abiotic flows | ||||||

| - Crude oil | 500 kt | 500 kt | ||||

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. m3 is cubic metres, kt is kilotonnes | ||||||

Download this table Table 5.2: Supply of natural capital services for an Accounting Area (illustrative)

.xls (28.7 kB)This table can be extended to show the economic sector of the owner of the land supplying the service, including whether the land is owned by a non-government organisation (as in the case of many nature reserves). Such an extension might have significant policy uses in terms of the management of important natural habitats.

The second table (see Table 5.3) shows those economic sectors that use or benefit from the services, recognising that the beneficiaries may not be located in the same area as the location of the asset. This table is known as the Use Table. Note that the supply totals and the use totals must be equal so that the accounts balance as in the national accounts.

This table may have important policy uses, for example, if the use of services by households distinguishes between different types or locations of households.

Table 5.3: Use of natural capital services for an Accounting Area (illustrative)

| Economic sector | Total | ||||

| Enterprises e.g. forestry, oil and gas sector | Households | Government | Rest of the world | ||

| Provisioning | |||||

| - Woody biomass | 1000 m3 | 1000 m3 | |||

| - Wild fish | 10 kt | 10 kt | |||

| Regulating | |||||

| - Air pollution absorption | 25 kt | 25 kt | |||

| - Carbon sequestration | 110 kt | 110 kt | |||

| Cultural | |||||

| - Recreation | 1800 visits | 100 visits | 1900 visits | ||

| Abiotic flows | |||||

| - Crude oil | 500 kt | 500 kt | |||

| Source: Office for National Statistics | |||||

| Notes: | |||||

| 1. m3 is cubic metres, kt is kilotonnes | |||||

Download this table Table 5.3: Use of natural capital services for an Accounting Area (illustrative)

.xls (28.7 kB)Notes for: Physical accounts for ecosystem and abiotic services

Common International Classification of Ecosystem Goods and Service (CICES)

Supporting or intermediate services are excluded from the basic accounts as they could otherwise lead to double-counting of benefits; however, we have not ruled out supplementary accounts covering supporting services.

The one exception is “natural flux", such as the gross inflows and outflows of carbon as part of the daily carbon cycle, where it would not make sense to record only the gross inflows in the accounts.

6. Basic valuation principles in natural capital accounting

The scope and limits of monetary valuation

Within the accounting framework, monetary valuation provides a common metric through which services can be aggregated and compared, and comparisons made with the flows and stocks that are already included in the System of National Accounts (SNA). Importantly, the SNA does not seek to capture the total welfare value provided by goods and services, but rather accounts more pragmatically for the values of those services as or if traded (so-called “exchange value” – see below). This makes practical sense. Housing, for example, can be ascribed an exchange value (based on aggregating the market value of all existing houses, or rental services), whereas a total welfare value of housing makes less sense because a civilised society could not do without housing. The same principle can be applied to ecosystem1 goods and services.

Accounting frameworks and methodologies are not intended to capture all or total values for the natural environment. Rather the aim is to expand the production and asset boundaries of the national accounts to include and value an increasing range of services and assets29.(Principle 6.1)

Extending the production boundary of the accounts beyond those with direct market prices is not unique to natural capital (for instance, owner-occupied housing services are included within the SNA) and is generally accepted by the accounting community. Valuation, particularly using standard methods, can only partially address sustainability concerns such as ecosystem degradation.

Monetary accounting depends upon and must be developed in parallel with physical accounting in order to provide an overall view of the status and trends in ecosystem services. (Principle 6.2)

What to value

For the service flow accounts, valuation considers the value of goods and services produced during an accounting period. Valuation of natural capital assets, which provide these services will typically be done through projection of services supplied and used over a defined period and discounted to a present value (see Section 8).

An important distinction is made within the System of Environmental–Economic Accounting (SEEA) guidance on Experimental Ecosystem Accounts (SEEA EEA) (Section 3.2.2 and paragraph 3.32)3 about the difference between capacity and actual use of services. For example, timber in a forest could be valued in terms of the whole forest being harvested for timber (as in the SEEA Central Framework, which focuses upon specific natural resources)4. However, in natural capital accounting it makes sense to value only the flows of timber actually harvested, because of potential trade-offs between various services.

Monetary accounts are based on the concept that a transaction has taken place (or, in the case of asset valuation, a projected flow of transactions) with an identifiable user or beneficiary. (Principle 6.3)

Our approach wherever possible will be to value actual use of services. This principle also applies to expected future use of services to estimate asset values (see Section 8). (Principle 6.4)

This is broadly consistent with general national accounting principles and highlights the fact that many regulating and cultural services provide greater value where there are more people or businesses that make use of the service (for example, woodland near urban areas will have more recreational use than in rural areas) or receive that service locally (for example, local air quality or flood risk alleviation). Following on from the definition of services in Section 5:

Valuation should aim to isolate the contribution of the ecosystem to the service received by users. Therefore valuation should exclude human inputs and produced capital. (Principle 6.5)

This underpins, for example, the concept of resource rent discussed in Section 7.

Consistency with national accounting valuation principles

Valuation enables comparison and integration with the System of National Accounts. On the other hand, this valuation for accounting is not simply economic welfare value as found in environmental economics. To be consistent with SNA, the aim should be “to value the quantity of ecosystem services at market prices that would have occurred if the services had been freely traded and exchanged” (SEEA-EEA 5.20). This is the concept of exchange value, which is based on a feasible transaction between a supplier and a beneficiary, so that the supply value equals the use value5. An important challenge here is that many ecosystem services are not traded in markets and do not have observable exchange values. Exchange values therefore need to be “imputed” that is, indirectly measured or estimated. This is the case with health, education or intermediate financial services in the SNA.

To ensure consistency with the national accounts, our approach wherever possible will be to identify an exchange value for individual ecosystem services, including for non-marketed services. (Principle 6.6)

An exchange value could be observed, deduced or, for non-market goods, imputed (“if a market existed”). This may require innovative, but transparent and intuitive methods to identify or impute prices, including adapting traditional methods of environmental valuation. (Principle 6.7)

Further guidance on individual services is provided in Section 7.