1. Introduction

To calculate public service productivity, we produce estimates of both public service inputs and outputs. Estimates of UK public service inputs include a number of components: labour, intermediate consumption (goods and services) and capital consumed to produce public service output. For example, doctors, nurses and support staff use medical equipment in a hospital to produce healthcare services. Similarly, teachers and assistants use educational material in schools to produce lessons.

To measure the volume of these inputs, components are either observed directly (such as the number of full-time equivalent staff) or indirectly through expenditure adjusted for price effects. An aggregate index of inputs is then produced by weighting together the growth of each component by their respective share in aggregate total public service expenditure.

Historically, estimates of total UK public service inputs have been calculated and broken down by contributions from service areas. From this, we are able to observe how much each individual service area (such as healthcare or education) contributes towards overall input growth in each year. However, the accounting framework can also be rearranged to offer a breakdown of movements in total public service inputs measured by component. This allows us to observe alternatively how much an input component (such as labour or intermediate consumption) contributes to overall growth in total UK public service inputs. This article, therefore, shares further insight into the drivers and trends shown by this alternative breakdown.

As shown in Figure 1, growth of inputs in 2015 was driven by increases in total public service intermediate consumption, contributing 1.1 percentage points, out of 1.3 percentage points of total inputs growth. Labour and consumption of fixed capital both contributed 0.1 percentage point each in 2015.

Figure 1: Contributions to growth of real total public service inputs by component, 1998 to 2015, UK

Source: Office for National Statistics

Notes:

- Individual contributions may not sum to total due to rounding.

Download this chart Figure 1: Contributions to growth of real total public service inputs by component, 1998 to 2015, UK

Image .csv .xlsLooking at the long-run trend, Figure 1 shows that growth, for much of the period, was supported by positive contributions from all components – individual contributions reflecting both the component’s year-on-year growth and its expenditure relative to total public services. However, from the late 2000s onwards, this trend began to deteriorate as year-on-year growth experienced by the individual components began to slow.

In 2011, total public service inputs contracted for the first time since the start of the series. This coincided with spending reductions in many departments as part of the Spending Review 2010, with initially intermediate consumption making up the majority of the inputs experiencing contractions, before in 2012 and 2013 where labour became the only individual input seeing a reduction. Throughout this period (2011 to 2013) consumption of fixed capital remained positive. Between 1998 and 2009 there was an average growth of 3.6%; however, after 2009 total inputs have grown by an average of 0.5% per year.

To further explore this and the drivers behind it, this article will first focus on the total picture, providing an insight into recent changes in total UK public service expenditure and volume as well as drawing insight into the changes in price experienced by UK public services, through their implied deflator. Later sections will then delve further into the individual input components.

Nôl i'r tabl cynnwys2. Key terms

Throughout this article, references will be made to the different components and it is therefore important to establish the meaning of these terms.

Total government expenditure

Also referred to as general government final consumption expenditure, total government expenditure covers transactions on final consumption of goods and services for which the public sector is the ultimate bearer of the expense to provide public services. It is essentially the final expenditure on public services to allow for their provision to the public. As a formula, total government expenditure equals the sum of their output, plus the expenditures on products supplied to households via market producers (that is, social transfers in kind) deducting payments by other units and own-account capital formation.

Service areas

Standardised classifications of government activities for the purpose of the national accounts. They do not necessarily align to government departments. For total public service productivity, we have nine service areas, these are: Healthcare, Education, Public Order and Safety, Defence, Police, Children’s Social Care, Adult Social Care, Social Securities Administration and Other.

Input components

Also referred to as Economic Categories, input components are classifications of transactions relating to inputs used in production and are based on the European System of Accounts 2010 (ESA 2010). In this article, final consumption expenditure, compensation of employees, intermediate consumption, social transfers in kind and consumption of fixed capital will be used.

Labour

This refers to the ESA 2010 transaction of compensation of employees. This is all employees involved in producing output, for example, doctors, nurses, healthcare assistants for health service output, or teachers, teaching assistants, administrative staff for education service output.

Intermediate consumption

This refers to the goods and services consumed as inputs by a process of production. For this article estimates relating to intermediate consumption will also capture the ESA 2010 transaction of social transfers in kind, which are individually consumed goods and services provided by a market producer and paid for by government. This can include the outsourcing of labour from the private sector through contractors.

Consumption of fixed capital

The use of fixed assets that depreciate and will need to be replaced at the end of their lives. These are proxied for by the decline in value of fixed assets owned as a result of normal obsolescence, including wear and tear. This measure also includes terminal and clean-up costs as a fixed asset may need to be decommissioned; the cost of this is included.

Volume

Reflects the quantities of goods and services used in production. They are either observed directly (such as the number of full-time equivalent staff) or indirectly through expenditure adjusted for price effect (deflated).

Deflator or implied price

A measure of price movements over time. These can be either measured directly as a price index or indirectly as the implied ratio of a current and constant price series (taking expenditure and dividing it by volume).

Nôl i'r tabl cynnwys3. Total UK public services

Expenditure

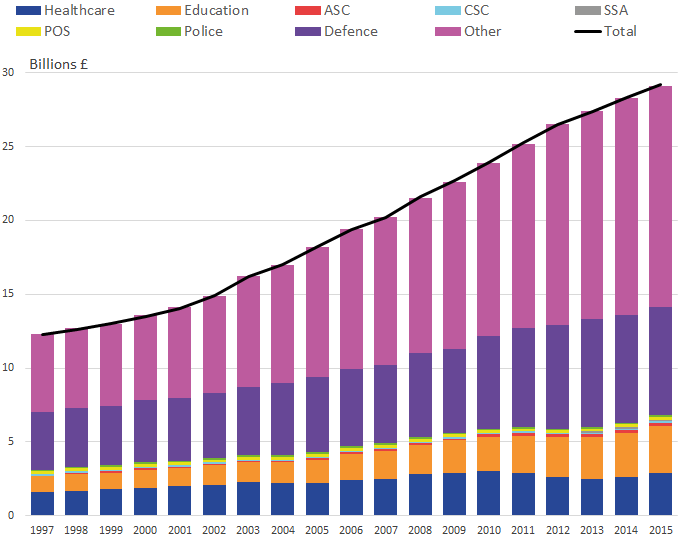

In 2015 expenditure on total UK public service was £363 billion, accounting for around a fifth of UK gross domestic product (GDP) in expenditure terms. This was £3.3 billion more than in 2014 and £212.7 billion more than at the start of the time period in 1997. This is based on data sourced from the ESA Table 11 returns on UK general government annual expenditure. As shown in Figure 2, expenditure has grown consistently throughout the period, although the rate of growth has slowed in more recent periods. While expenditure on total UK public services grew by around 7.0% per year between 1997 and 2008, from 2008 to 2015 it grew by around 2.0% per year.

Figure 2: Total expenditure on public services by component, current price, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

- Sum of individual components may not equal total due to rounding.

Download this chart Figure 2: Total expenditure on public services by component, current price, 1997 to 2015, UK

Image .csv .xlsFigure 2 also splits this expenditure into the respective contributions by different input components. It shows that, while expenditure on each component has increased over this time period, much of the growth slowdown in the later period is accounted for by slower growth in expenditure on labour and, to a lesser extent, expenditure on intermediate consumption.

An increase in expenditure between any two years could reflect a number of scenarios. Firstly, a rise in expenditure could be because more inputs were purchased (for example, more staff). This would reflect a change in volume (volume effect) of the inputs used. Similarly, expenditure may increase as a result of the inputs purchased becoming more expensive (for example, staff pay increased). This reflects a change in price (price effect) of the inputs used. The third, and most likely scenario, is some combination of the two. That is, a change in the amount of inputs bought, together with a change in the price (for example, more staff were employed and both sets of employees saw pay increases or higher wages). It is important to note that a change in price and volume could also be negative.

To understand what is causing the change in a given year, therefore, we can isolate the individual price and volume effects.

Volume effect

The volume series essentially shows the number of inputs used in the production process, to provide the services demanded by the public. A given component can be observed in one of two ways, depending on the suitability of the data available for the purpose:

by direct measurement of the resource used (for example, the number of full-time equivalent employees)

by dividing the current price expenditure by an index that measures price change in the items procured

In line with the recommendations of the Atkinson Review (PDF, 1.08MB), this process is carried out at a sufficiently disaggregated level to take into account the differing mix of inputs and costs experienced, whilst remaining comprehensive and practical. As a result, estimation of the volume is carried out separately for each service area being measured (that is, Education, Health, Police and so on) and for each input component (labour, intermediate consumption and so on).

To produce estimates of total UK public service inputs, estimated growth rates of inputs for individual components are aggregated by their relative share of total government expenditure (expenditure weight).

These weights are important to know as they are used to determine the contribution of each input component’s volume series toward total UK public service inputs. They represent the component’s respective share or weight relative to total public services. This involves weighting and then aggregating the volume of inputs for each component, using the same respective expenditure weights as shown in Figure 3.

The contribution an individual component makes is then dependent on not only the growth in that component, but also its weight relative to total public services. In scenarios where components experience growth at the same rate, a component that accounts for a greater share of total expenditure will then have a greater effect on the overall growth rate for total public services. The breakdown of expenditure weight components, between 1997 and 2015, can be seen in Figure 3.

Figure 3: Total public service expenditure weights by component, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

- Totals for each year may not sum to 100 due to rounding.

Download this chart Figure 3: Total public service expenditure weights by component, 1997 to 2015, UK

Image .csv .xlsIn Figure 3 we can see that labour was the most significant single component of total expenditure. However, despite actual spending growing throughout the period, its overall share has fallen from 55.9% of total expenditure in 1997 to 48.0% in 2015. This is because expenditure for the other input components has grown at a faster rate. To place this in context, the respective share of intermediate consumption has risen from 35.9% in 1997 to 44.0% in 2015. Meanwhile, the share of expenditure associated with consumption of fixed capital has remained fairly constant at 8.2% in 1997 to 7.9% in 2015.

Figure 4 examines the trend for the total inputs and the components, showing total UK public service inputs volume and its components since 1997. Between 1997 and 2015, total UK public service inputs grew by 57.1%, but increasingly diverged from the path of labour inputs due to the volume growth of intermediate consumption and total consumption of fixed capital growing and gaining greater weight.

Of the three components, the volume of public service inputs grew the most in intermediate consumption – by 110.5%. Inputs relating to consumption of fixed capital grew by less, with growth of 65.1% from 1997 to 2015. Public service labour inputs grew the least over the period, growing by 25% in volume terms.

Figure 4: Components of total public service inputs, volume, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

- Individual components are aggregated together by using weighted expenditure growth, which results in some components.

Download this chart Figure 4: Components of total public service inputs, volume, 1997 to 2015, UK

Image .csv .xlsPrice effect

While deflation is carried out at a service area level (using specific deflators and expenditure elements for the different subsectors), the aggregation framework can also be arranged to offer a breakdown of movements in total public service inputs measured by components, in terms of expenditure and volume. By extension, we can observe the implied deflator for these public service input components.

Calculated by dividing the current price expenditure by its associated volume series, these implied deflators reflect the average ratio between expenditure and volume. It should be noted that such measures may be influenced by differences in the coverage of these series. This is due to the volume series for some service areas, most notably healthcare, being based on different data sources to those used in producing expenditure data. While these differences affect the deflator included in this article, these differences in coverage have a minimal effect on the public service productivity measures themselves.

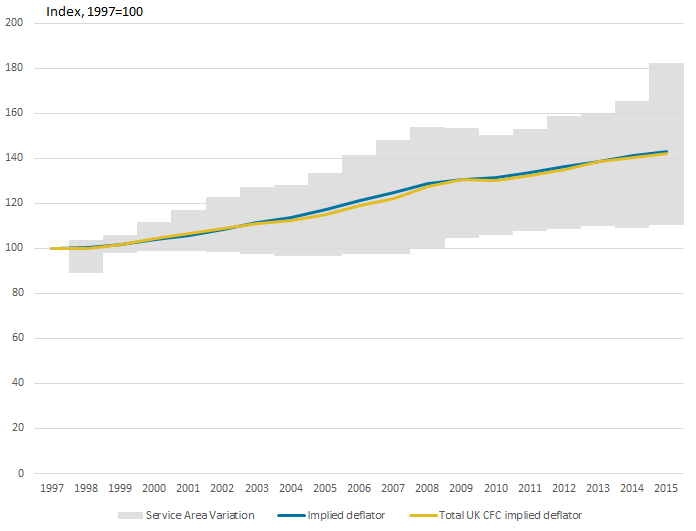

Figure 5 investigates the implied deflators of total UK public service inputs, which are calculated by dividing an expenditure series by its respective volume series, suggesting the general rate of inflation experienced over the period. It shows that average prices increased by 53.6% between 1997 to 2015. This reflects a general upwards movement over the near two decades: only 2015 saw a contraction in general public service input prices.

Figure 5: Comparison of total public service inputs implied deflator, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

- Individual components are aggregated together by using weighted expenditure growth, which results in some components growing faster than the total inputs.

Download this chart Figure 5: Comparison of total public service inputs implied deflator, 1997 to 2015, UK

Image .csv .xlsFigure 5 also shows the implied deflator for each input component. It suggests that, while experiencing relatively similar trends between 1997 and 2015, growth in labour input cost increased at a faster rate (2.8% per year) relative to intermediate consumption (1.9% per year) and consumption of fixed capital (2.0% per year). However, labour input cost growth has slowed in recent years (0.8% per year between 2011 and 2015). Additionally, Figure 5 shows that the contraction in the total UK implied deflator for public service inputs in 2015 reflected a combination of the slower growth in labour than in previous years and relative prices falling for intermediate consumption.

Figure 6 explores this further, showing growth rates for the implied deflators for total UK public service inputs and its components over the last 10 years. It also provides further context, showing a comparison to the Services Producer Price Index (SPPI) gross time series. When compared to the total public service inputs implied price index, it allows us to see how public and private service producers have seen their prices change over time.

SPPI gross has been chosen as a comparison here because of the way in which government expenditure is theoretically considered. An output measure, SPPI gross calculates the price movement of services. For total public service inputs, the government is the bearer of the cost and consumers access the services free of charge. This means that an output measure is comparable with the prices of the total inputs. No profit margin or tax will be added between production and provision of the service so the price will remain the same for public services.

Figure 6: Growth in implied deflator of total public service inputs and components, 2006 to 2015, UK

Source: Office for National Statistics

Notes:

Implied prices are estimates of the price experience not an exact price measure.

Services Producer Price Index (SPPI) gross is being used as a comparison to services in general, not as a direct comparison to public services.

Download this chart Figure 6: Growth in implied deflator of total public service inputs and components, 2006 to 2015, UK

Image .csv .xlsComparing the implied total deflator growth with the SPPI gross, it can be seen that they experience similar movements for most of the time period – a slowing of price growth (Figure 6) – although service producers have seen greater fluctuation in price movements. The main fluctuation can be linked with the economic downturn of 2008 where we see price growth peak at 3.5% then prices decrease by 0.8% in 2009. For public services, we have seen an impact because of the downturn, but it has been much more gradual with the slowing of price growth being less significant. It is likely that this took place because of the way in which public services will still be heavily (if not more) demanded during an economic downturn. The quantity remaining fairly constant will mean prices and costs for the government would not behave in a similar fashion.

In the latest period, the two series diverge again as total public service inputs saw its first price contraction, decreasing by 0.4%. In the same year, the SPPI showed a 0.4% increase. Decomposing the recent fall in the public service implied deflator (Figure 6), however, we can see this was driven by intermediate consumption, with prices falling by 1.8% in 2015. Labour and capital partially offset this price decrease with both components seeing positive growth in prices for the latest year. This would suggest that the difference came about from a specific component, rather than a general price movement.

Summary

Figure 7 brings these effects together, decomposing growth in total UK public service expenditure (shown by the blue line) into the contributions made in each year by the volume and price effects (shown by the blue and yellow bars respectively).

Figure 7: Contributions to growth of total public service inputs expenditure by price and volume growths, 1998 to 2015, UK

Source: Office for National Statistics

Notes:

Individual contributions may not sum to total due to rounding.

Implied price is an estimate of the price experience not an exact price measure.

Download this chart Figure 7: Contributions to growth of total public service inputs expenditure by price and volume growths, 1998 to 2015, UK

Image .csv .xlsFocusing on the earlier part of the period, growth was driven by positive contributions from both volume and price effects. However, after 2008 this trend changes. It is probable that this change is linked to two important events, specifically the economic downturn (which sees an initial price slowing) and then the 2010 spending review (which sees expenditure growth slow).

While prices continued to grow, albeit at a slower rate later in the series, the largest contribution to the recent slowing of total UK public service input expenditure growth is from the volume effect. The public service volume of labour inputs fell from 2011 to 2013. We can see in 2011 and 2013 that growth in public service expenditure was particularly slow, mainly due to negative labour growth and intermediate consumption inputs decreasing in 2011 and remaining constant in 2013.

However, when decomposing growth of total UK public service input in 2015 the price effect acted as a drag on growth in expenditure. This suggests that total UK public services experienced a fall in prices, which as previously shown was caused by intermediate consumption seeing a price fall.

Due to the nature of total inputs being aggregated, much of the variation experienced across input components and service areas will be difficult to identify. Additionally, investigation can be done for the components of total UK public service inputs. The remainder of this article will apply a similar analysis to the separate input components, to provide further insight into the drivers of changes in estimates of total UK public service inputs.

Nôl i'r tabl cynnwys4. Intermediate consumption

As covered in the earlier section, intermediate consumption accounts for all the goods and services used in the production of public service output. This would include such items as bed linen for hospitals, textbooks for schools and fuel for emergency vehicles. Additionally, this input component also captures expenditure on social transfers in kind (STiK). These would consist of individual goods and services provided for free (or at a price that is not economically significant) to households by a third party, paid for by government (for example, provision of prescription medicines, day-care centres and ophthalmic care). Therefore, growth in intermediate consumption is indicative of not only growth in the public service’s direct consumption of goods and services but also the provision by third parties to deliver important public services.

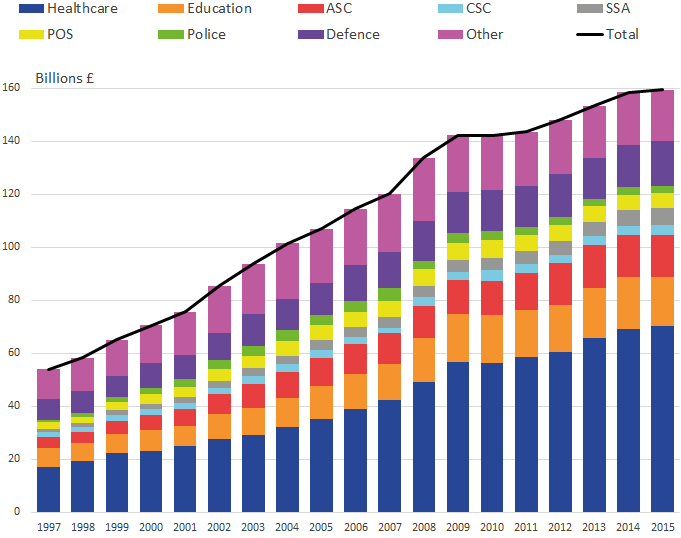

Between 1997 and 2015, as shown in Figure 8a, expenditure on intermediate consumption by UK public services grew by £105.5 billion – equivalent to growth of 195.6% or 6.2% per year – to £159.5 billion in 2015 and accounting for around 44% of total UK public service current expenditure. Figure 8a outlines the expenditure by individual service areas and this is shown in percentage terms in Figure 8b. These have grown or shrunk depending on service area; those areas that have seen a large increase in their expenditure weight will be the main drivers behind growth in total UK public service intermediate consumption expenditure.

Figure 8a: Public service intermediate consumption expenditure by service area, current price, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

Sum of individual components may not equal total due to rounding.

Public order and safety includes courts and probation services, prison service and fire service.

Other refers to other government services, which comprises of services such as economic affairs, recreation, and housing.

POS stands for Public Order and Safety, CSC stands for Children's Social Care, SSA stands for Social Security Administration, ASC stands for Adult Social Care.

Download this image Figure 8a: Public service intermediate consumption expenditure by service area, current price, 1997 to 2015, UK

.png (20.9 kB) .xls (37.4 kB)

Figure 8b: Public service intermediate consumption expenditure weights by service area, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

Totals for each year may not sum to 100 due to rounding.

POS stands for Public Order and Safety, CSC stands for Children's Social Care, SSA stands for Social Security Administration, ASC stands for Adult Social Care.

Other refers to other government services, which includes services such as economic affairs, recreation, and housing.

Download this chart Figure 8b: Public service intermediate consumption expenditure weights by service area, 1997 to 2015, UK

Image .csv .xlsWhile all service areas experienced significant increases in expenditure on intermediate consumption, with the whole expenditure increasing by 195.4%, Healthcare services account for the single largest proportion of intermediate consumption expenditure. As we can see from both Figures 8a and 8b this has been growing over the time period, with healthcare seeing large increases compared with the other service areas, especially from 2006 onwards. Whilst this was occurring, the other service areas also saw expenditure increases but to a lesser extent. As a result of its faster growth, Healthcare’s relative share of total expenditure grew from 31.8% in 1997 to 44.0% in 2015.

We also see that Education (11.7%), Defence (10.7%), Adult Social Care (9.8%) and Other (12.1%) contribute significantly towards total intermediate consumption expenditure.

Again it is possible to break down expenditure growth in a particular component by service area into growth in volume terms and growth of prices. Figure 9 illustrates this, decomposing growth in total UK public service intermediate consumption expenditure (shown by the blue line) into the contributions made in each year by the volume and price effects (shown by the blue and yellow bars respectively).

Figure 9: Contributions to growth of public service intermediate consumption expenditure by price and volume growths, 1998 to 2015, UK

Source: Office for National Statistics

Notes:

Individual contributions may not sum to total due to rounding.

Implied price is an estimate of the price experience not an exact price measure.

Download this chart Figure 9: Contributions to growth of public service intermediate consumption expenditure by price and volume growths, 1998 to 2015, UK

Image .csv .xlsFigure 9 shows three distinct periods of growth for the input component between 1997 and 2015. Between 1998 and 2003, volume acted as the largest contributor to the growth, suggesting that UK public services were spending more on actual intermediate consumption, as a result of using a greater volume of goods and services. In the period that followed (2004 to 2009), we can see that price began to have a greater effect, while growth in volume became more subdued. This would suggest that UK public services continued to purchase a greater volume of goods and services, but the existing level of goods and services became more expensive to purchase.

From 2010 onwards, growth and its drivers were much more varied. Experiencing its first contraction in 2010 (coinciding with the 2010 spending review), growth in public service intermediate consumption expenditure has been subdued in comparison with the earlier period. After 2010, expenditure grew by an average of 2.4% per year compared with 7.7% per year up to and including 2010. This has been driven by much more mixed growth in the volume and price of public service intermediate consumption. In fact, expenditure growth in 2015 slowed to just 0.7%, reflecting that, while a greater volume of inputs were purchased, average implied price fell.

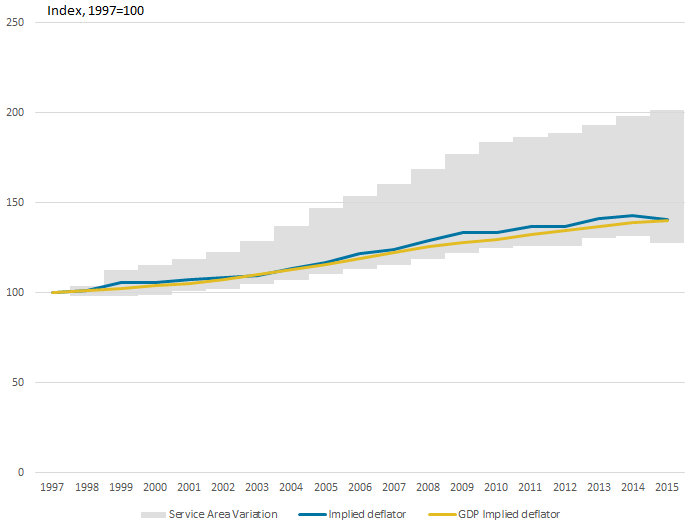

Because of their design, these aggregate metrics present an average experience. Within them we can observe both variation in the effects across the different service areas as well as the individual mix for each service area. As a result, it would be expected that experiences across public services through time, would differ greatly. Figure 10 illustrates this, focusing on the price experience, showing both the average growth in price (black line) and that of the constituent service areas (shaded area).

From Figure 10 we can see that the average implied prices for intermediate consumption grew across the period, albeit slower in recent years. As a result, prices were 40.4% higher in 2015 than in 1997, suggesting that the basket of goods and services used had become more expensive. This compares closely to the GDP implied deflator – a proxy for similar price changes experienced by the whole UK economy – following a broadly similar trend, although with a greater degree of volatility.

Figure 10: Comparison of public service intermediate consumption implied deflator, service area and GDP implied deflator, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

Implied prices are estimates of the price experience not an exact price measure.

Service area variation shows the range in price indices across the services and does not necessarily represent one service area throughout the duration of the time series.

GDP implied deflator is an implied measure of changes in the overall level of prices for the goods and services that make up GDP.

Download this image Figure 10: Comparison of public service intermediate consumption implied deflator, service area and GDP implied deflator, 1997 to 2015, UK

.png (13.1 kB) .xls (35.8 kB)From the shaded area, reflecting the variation in price changes public service areas have experienced with intermediate consumption in a given year, we can see two things. Firstly, while prices have grown across the UK public service, they have varied across services because of the different nature of goods and services each area will purchase. This is shown by the extremes of the shaded area, suggesting that while some service areas’ prices have grown by 101.2% between 1997 and 2015, other service areas have grown by just 27.5% over the same period.

Secondly, we can also see that the total grows along the lower bound suggesting that, despite the variation in price experienced, the majority of spending for intermediate consumption has been in service areas that have seen subdued price growth. This is because the overall price experience will be dictated by those areas with the greatest expenditure weights. In the case of intermediate consumption (and as shown in Figure 8b), this is areas such as Healthcare, Education, Other and Defence.

We now look more at the comparison of public services to general prices implied through gross domestic product (GDP), of which around 80% is made up of services. We can see that public services have seen a faster increase in prices than the whole economy. This could be because GDP includes goods that will naturally increase differently in price to services as well as those services being more varied than those measured by the public services implied deflator.

Nôl i'r tabl cynnwys5. Labour

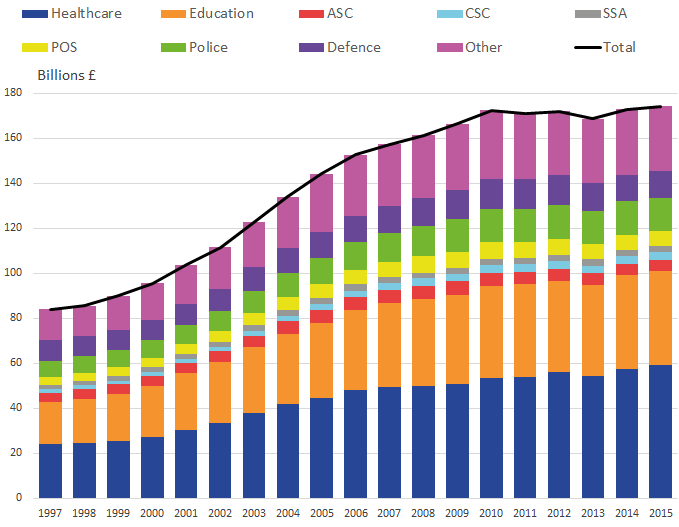

Shown in Figure 11a, expenditure by UK public services on labour inputs has increased by £90.3 billion between 1997 and 2015 – equivalent to 107.4% or 4.1% per year – to £174.3 billion. Also shown by Figure 11a is that expenditure growth is much more evenly shared across the service areas. This is not too surprising given that many of the public services are heavily reliant on labour inputs. An example of this would be education, where teachers and teaching assistants are a core part of teaching and caring for pupils. Adult social care and children's social care would also fall into this category of requiring labour inputs to provide the service.

Figure 11a: Public service labour expenditure by service area, current price, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

Sum of individual components may not equal total due to rounding.

Public order and safety includes courts and probation services, prison service and fire service.

Other refers to other government services, which comprises of services such as economic affairs, recreation, and housing.

POS stands for Public Order and Safety, CSC stands for Children's Social Care, SSA stands for Social Security Administration, ASC stands for Adult Social Care.

Download this image Figure 11a: Public service labour expenditure by service area, current price, 1997 to 2015, UK

.png (20.1 kB) .xls (37.4 kB)

Figure 11b: Public service labour expenditure weights by service area, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

Totals for each year may not sum to 100 due to rounding.

POS stands for Public Order and Safety, CSC stands for Children's Social Care, SSA stands for Social Security Administration, ASC stands for Adult Social Care.

Other refers to other government services, which includes services such as economic affairs, recreation, and housing.

Download this chart Figure 11b: Public service labour expenditure weights by service area, 1997 to 2015, UK

Image .csv .xlsFigure 11b demonstrates where most labour expenditure on public services is being spent. This shows us that healthcare (33.8%) and education (24.1%) make up the largest service areas in expenditure terms in 2015. This is likely to be caused by the coverage these services have across the UK as well as the services lending themselves to requiring labour at all levels of provision. In Healthcare there are doctors, nurses, administrative staff and so on, meaning that covering the whole of the UK in terms of healthcare accessibility requires large numbers of staff to run the service and provide healthcare to patients.

What can be seen is that growth rates have been similar for each service area with little change in the weights over the time period. This, from Figure 11a breaking down the current price expenditure numbers, means that all services have seen expenditure grow and services have increased their labour expenditure at almost the same rate.

When decomposing the annual growth of public service labour expenditure (Figure 12), we can see that growth in the volume of labour has been relatively muted for much of the time series, compared with other input components. Prices, on the other hand, have grown over much of the period.

Figure 12: Contributions to growth of public service labour expenditure by price and volume growths, 1998 to 2015, UK

Source: Office for National Statistics

Notes:

Individual contributions may not sum to total due to rounding.

Implied price is an estimate of the price experience not an exact price measure.

Download this chart Figure 12: Contributions to growth of public service labour expenditure by price and volume growths, 1998 to 2015, UK

Image .csv .xlsSince 2011, the price and volume effects have varied. With growth in volume contracting in three of the last five years, coupled with slower or flat price growth, this has meant that the recent growth in UK public service expenditure on labour has been relatively modest.

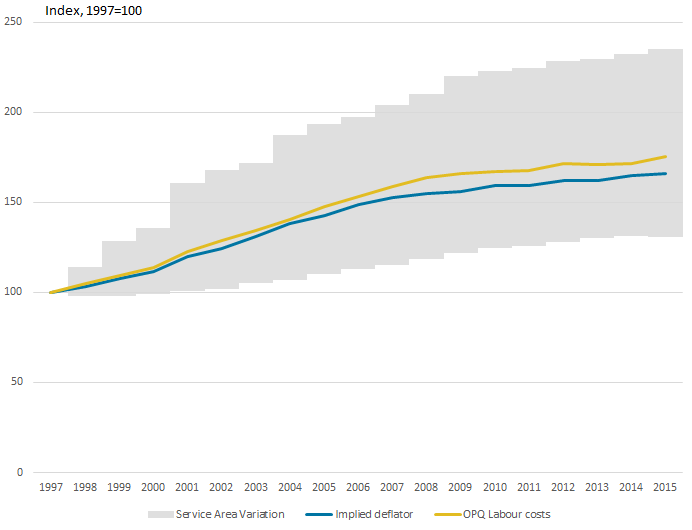

As previously shown, labour saw its implied price grow by around 65.8% – which represented the highest growth of the three components of total inputs. As with intermediate consumption, Figure 13 shows the labour price experience for total public services comparing both against the price range experienced by its constituent service areas and a proxy for the whole economy.

Figure 13: Comparison of public service labour implied deflator, service area and total labour costs in industries OPQ, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

Implied prices are estimates of the price experience not an exact price measure.

Service area variation shows the range in price indices across the services and does not necessarily represent one service area throughout the duration of the time series.

OPQ labour costs are implied from total labour costs divided by number of workers for those industries.

Download this image Figure 13: Comparison of public service labour implied deflator, service area and total labour costs in industries OPQ, 1997 to 2015, UK

.png (15.4 kB) .xls (36.4 kB)In looking at the spread of the implied labour deflators – shown as the shaded area in Figure 13 – it is apparent the price experience has differed between service area. The shaded area shows that some service areas have seen much faster price increases than others. This impact has been minimal in the total picture, however, as we see the price index move in the middle of the minimum and maximum bounds.

Reflecting the growth in the cost of labour in certain comparable industries (using standardised industry classifications) – Public Administration, Defence (O), Education (P), Human Health and Social Work Activities (Q) – the proxy index illustrates a whole economy perspective. Capturing both price growth in the public and private sectors, its growth relative to our implied deflator suggests that prices have been growing at a similar trend, albeit at a slightly stronger rate. This stronger rate of growth suggests that prices experienced by the non-government sector (one of the main, although not only, differences between the two series) have grown quicker.

We see from Figure 13 that whole economy costs of labour have grown by 75.3% over the time period, whereas public services have seen the price of labour increase by 65.8%. This shows that over the period, prices have grown reasonably closely and reflect the fact that the industries measured by the proxy series will have a large crossover with the public services labour measure. As well as this, prices seem to slow in growth from around 2010 onwards, implying that public service labour contributes noticeably towards whole economy total costs of labour for industries OPQ.

Nôl i'r tabl cynnwys6. Consumption of fixed capital

Between 1997 and 2015, expenditure on consumption of fixed capital by UK public services has increased by £16.9 billion – equivalent to 136.5% or 4.9% per year – to £29.2 billion.

Consumption of fixed capital (CFC) is the decline in the value of fixed assets owned as a result of normal wear and tear when providing public services, an example of this would be emergency vehicles used to attend emergency calls. When using those vehicles to provide the emergency service, wear and tear will depreciate the vehicle’s value, that fixed capital will be partly consumed. CFC makes up about 8% of total input expenditure on public services. Another aspect of CFC is the coverage of anticipated terminal costs. This would include decommissioning costs of medical equipment or clean-up costs of landfill sites, for example; therefore service areas that would pick up this decommissioning will see larger levels of expenditure. This is measured using data from the national accounts and is estimated using the perpetual inventory method.

CFC has been aggregated using expenditure weights like with the other input components. From the previous point, Other government service is used to capture all expenditure unaccounted for by traditional service areas, thus the decommissioning of roads and the clean-up of landfill sites would fit under Other. Therefore, the 51.6% expenditure is more a combination of both the fact that most traditional service areas consume little capital in the provision of services, and that the expenditure measure includes these terminal costs that are unlikely to be picked up in traditional service areas.

Figure 14a: Public service consumption of fixed capital expenditure by service area, current price, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

Sum of individual components may not equal total due to rounding.

Public order and safety includes courts and probation services, prison service and fire service.

Other refers to other government services, which comprises of services such as economic affairs, recreation, and housing.

POS stands for Public Order and Safety, CSC stands for Children's Social Care, SSA stands for Social Security Administration, ASC stands for Adult Social Care.

Download this image Figure 14a: Public service consumption of fixed capital expenditure by service area, current price, 1997 to 2015, UK

.png (18.8 kB) .xls (36.9 kB)

Figure 14b: Public service consumption of fixed capital expenditure weights by service area, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

Totals for each year may not sum to 100 due to rounding.

POS stands for Public Order and Safety, CSC stands for Children's Social Care, SSA stands for Social Security Administration, ASC stands for Adult Social Care.

Other refers to other government services, which includes services such as economic affairs, recreation, and housing.

Download this chart Figure 14b: Public service consumption of fixed capital expenditure weights by service area, 1997 to 2015, UK

Image .csv .xlsFrom Figure 14a we can see the increases in expenditure on consumption of fixed capital. While we see service areas increasing their expenditure, the growth in expenditure from Other is much faster than any of the service areas, causing its expenditure weight to increase as seen in Figure 14b. This weight increases from 42.9% to 51.6% in 2015, which means Other government services now contribute the majority of expenditure for total consumption of fixed capital. Service areas that notably contribute are Defence (25%), Healthcare (10%) and Education (10.9%); these make up the large proportion of the remaining expenditure. This ultimately means that movements in these service areas will impact more heavily on the total picture for consumption of fixed capital. These will be seen in the total volume and total price effects respectively for consumption of fixed capital.

To show what the impact of the price and volume effects are for expenditure, Figure 15 shows the contributions to expenditure growth from volume and price growth in consumption of fixed capital. We can see that over the whole series, volume and price growth contribute substantially towards expenditure growth; in 2015, both aspects grew by 1.5%, leading to a growth in consumption of fixed capital expenditure of 3.1%.

Figure 15: Contributions to growth of public service consumption of fixed capital expenditure by price and volume growths, 1998 to 2015, UK

Source: Office for National Statistics

Notes:

Individual contributions may not sum to total due to rounding.

Implied price is an estimate of the price experience not an exact price measure.

Download this chart Figure 15: Contributions to growth of public service consumption of fixed capital expenditure by price and volume growths, 1998 to 2015, UK

Image .csv .xlsFigure 15 also shows that consumption of fixed capital is currently seeing the fastest growth in expenditure of the three input components, with 3.1% growth in 2015. This means that from the total picture where it makes up 8.0% of expenditure, if it continues to be the fastest-growing component, its total expenditure weight will increase further.

This will lead to it having a greater impact on total input movements in volume and price growth. We have also seen that as with the other components, there has been a slowing in expenditure growth in recent years. However, with consumption of fixed capital we have not seen growth in expenditure slowing to such an extent, with the last two years both showing growth of 3.1% compared with labour expenditure growth being 0.8% in 2015 and intermediate consumption expenditure growth being 0.7% in 2015. This could be partly because assets already purchased will continue to depreciate at the previous level of expenditure, while any new equipment purchased will increase expenditure in coming years, as well as the additional price effect.

Similar to that experienced by intermediate consumption, the price for CFC in public services has risen fairly consistently over the time period. Shown in Figure 16, prices have increased by 43.2%. This price growth is essentially where the value of depreciation increases in a given year; this could mean more expensive equipment has been purchased that is now depreciating, or that the method of depreciation evaluation has resulted in more depreciation being attributed to different years. For example, if the same asset depreciates more in year two than in year one, then despite seeing the same usage, the price of depreciation has risen, as well as this the terminal costs aforementioned could be re-evaluated in different years causing a price effect. Other things equal, the implied deflator of CFC will move in line with the price of capital.

Figure 16 also shows a comparison with a total UK CFC implied price index, allowing for a comparison between public services and the total UK economy’s consumption of fixed capital. This proxy measure is similar in its estimation of prices of consumption of fixed capital as it is derived from taking expenditure and dividing that by the chained volume measure of CFC. This measure differs slightly from the public service price measure for capital as it is a different set of industry areas, leading to the impact public services are having on the more broad series being less noticeable when aggregated with other industries. The comparison with total UK consumption of fixed capital, and the way they track each other, offers a good insight into how the different industries have seen very similar capital increases compared with the public services.

Figure 16: Comparison of public service consumption of fixed capital implied deflator, service area and total UK CFC implied deflator, 1997 to 2015, UK

Source: Office for National Statistics

Notes:

Implied prices are estimates of the price experience not an exact price measure.

The maximum and minimum series show the range in price indices across the services and do not necessarily represent one service area throughout the duration of the time series.

The maximum value shows the difference between the maximum index and the minimum index in a given year.

Download this image Figure 16: Comparison of public service consumption of fixed capital implied deflator, service area and total UK CFC implied deflator, 1997 to 2015, UK

.png (15.8 kB) .xls (36.9 kB)Looking at Figure 16 we have been able to see that over the time period, the price of CFC for all public services has increased by 43.2%, while total UK CFC has seen slower growth of 42%. Interestingly from the shaded area, the variation of service areas has been large by 2015 showing that over time, prices have differed a reasonable amount for public services CFC. From the comparison, both series see an average annual growth of 2.0%, showing that throughout the time series they move closely. One noticeable difference is from around 2007 to 2011 where we see total UK CFC overtake the public services in 2009 price for CFC. This is on the back of an average growth of 2.2% for UK CFC compared with a 1.9% average growth for public services, showing that prices for the public services were not increasing at the same rate as the total UK economy, so capital employed by public services has seen slower inflation compared with other industries. This is explained by the use of different fixed assets in production, meaning prices for each will grow at different rates.

Nôl i'r tabl cynnwys