1. Main points

- The adoption rates of basic ICT technologies (such as use of computers and access to the internet) are near saturation, but we find less prevalent use of more sophisticated technologies for e-commerce and business organisation among businesses.

- Within our derived e-commerce intensity indicator – consisting of website sales, EDI sales and e-purchases – we find a significant productivity premium for engaging in e-purchases of around 10%; it is the intensity with which businesses use website sales and EDI sales (as a share of turnover) that is correlated with productivity.

- A large share (24%) of businesses in our sample do not use electronic tools to manage processes within their organisations (enterprise resource planning) or relationships with customers (customer relationship management), or to exchange information with suppliers (supply chain management), but of those that do, customer relationship management and enterprise resource planning are the most common.

- The use of any combination of enterprise resource planning, customer relationship management and supply chain management technologies in our measures are associated with a productivity premium of around 25%.

- Most businesses (64%) in our sample use all three ICT resourcing strategies – direct employment, outsourcing and providing ICT training to employees – to meet their ICT support requirements; all three activities appear to be associated with a productivity premium, but businesses in the services industries only experience a premium when using a combination of these methods.

2. Introduction

The role of information and communication technology (ICT) as a driver of productivity has been a matter of much debate. The importance of this debate in the UK is accentuated by the weakness of productivity growth which, despite the rapid pace of technological advancements in recent years, has grown more slowly in the decade since the economic downturn than in any other period since the Second World War Two1.

ICT is considered an enabler, with a range of potential productivity benefits for businesses through efficiencies in organising business activities and more flexible and remote working arrangements. It can also provide access to new products and markets, more timely and automated supply chain arrangements, as well as supporting better customer relationship management. It may also strengthen businesses capacity to innovate. This article sets out to examine recent trends in the adoption of ICT, as well as the intensity of use of these technologies.

We create three ICT intensity indicators for:

- e-commerce – website sales, electronic data interchange (EDI) sales and e-purchases

- business organisation – the use of software for customer relationship management, supply chain management and enterprise resource planning

- ICT resourcing – hiring ICT specialists, outsourcing ICT services and/or providing employees with ICT training

These intensity indicators explore:

- the prevalence of single and multiple use of these technologies among firms (extensive measure of ICT intensity)

- whether there is an association between productivity and the use of one or more of these technologies

- the marginal productivity benefit of each level of intensity over others

We find high adoption rates for basic ICT technologies – use of computers, having internet access, fixed broadband and a website – as these have become mainstream. However, within our linked E-commerce Annual Business Survey dataset, we find on average a notable share of firms with no ICT activity in relation to business organisation (24%) and e-commerce (17%). Our regression analysis2 shows that engaging in e-purchases and the combination of e-purchases and electronic data interchange (EDI) sales have stronger correlation with productivity.

Our results show variations in productivity impacts of these ICT indicators across production and services industries. We find relatively strong productivity relationships between our e-commerce and business organisation indicators and productivity in the services industry, but less so for production. Conversely, we find stronger productivity relationships among more ICT resource intensity categories in the production industry, relative to services. We also find positive productivity gains for engaging in multiple business organisation activities over single activities, but these are not so clear cut for the e-commerce and ICT resource intensities.

While none of these results are causal – in particular, they cannot say whether more productivity businesses are more likely to undertake these activities, or whether these activities induce higher productivity – they suggest that commonly held notions about the productivity benefits of ICT can be identified in our data, and provide a platform for further work.

The rest of this article is organised as follows:

- Section 3 presents a review of the literature

- Section 4 discusses our data sources

- Section 5 covers the limitations of this analysis

- Sections 6 and 7 outline the results of our analysis

- Section 8 sets out our conclusions from the analysis

Notes for: Introduction

This analysis uses a linked E-commerce Survey and Annual Business Survey dataset, which is limited to the scope of industries sampled on the E-commerce Survey and skewed toward larger businesses, which are more routinely sampled on both surveys.

3. ICT and productivity

It is widely accepted that productivity is a main driver of economic and welfare growth in an economy in the long-term. Since Robert Solow’s remark in 1987, that “you could see computers everywhere but in the productivity statistics”, a large body of research has documented the impact of information and communication technology (ICT) on productivity. Some parallels could be drawn between the period for which Solow made his remark – the 1970s slowdown of productivity in the US, at a time of rapid adoption of computers – and the current productivity puzzle – a decade of low productivity growth during a period of rapid technological advancements.

Early studies1 on the impact of ICT were at the macroeconomic or industry level, using a growth accounting framework (Oulton, 2001). More recently, the availability of firm-level data has allowed researchers to analyse the impact of the heterogeneity in levels of investment and productivity within and between firms (Battisti and others, 2009). The literature includes studies on the mechanisms through which ICT delivers positive outcomes to businesses (Comin and Mestieri, 2013). Using a linked dataset comprising the Annual Business Inquiry (ABI), the E-commerce Survey and the Community Innovation Survey, Clayton and Criscuolo (2002) separate businesses into four categories based on their use of ICT – that is, non-users, some presence, passive users and active users. They find higher innovation activity among active users, compared with non-users. They also find a higher share of skilled workers – with degree or equivalent qualifications – among active users, which they associate with other firm outcomes such as higher innovation, firm growth and higher productivity.

Using cross-sectional data from the 2002 E-commerce Survey, Goodridge and Clayton (2004) explored the prevalence of e-business processes and found greater use of electronic business processes among larger than smaller firms on average, and a higher share of larger firms with electronic business processes. Looking at productivity levels across firms with various e-business links, he found on average higher levels of productivity among firms with any link to e-business processes – however, this was not a conditional analysis.

Farooqui (2005) extended this analysis by exploring conditional impacts of ICT intensities – measured as investment per employee or a labour share in the case of use of computer and access to the internet. He found the strongest gains from IT investment in the services industry, while in manufacturing, younger firms had stronger productivity gains from IT investment than older firms. He also found a relationship between investment on telecommunication and productivity.

We build on these studies and other similar work, and set out to examine recent trends in the adoption of ICT, and the intensity of the use of these technologies. We create three extensive measures of ICT intensity for e-commerce, business organisation and ICT resourcing, to explore:

- the intensity of use of these technologies

- whether there is an association between productivity and the use of one or more of these technologies,

- the marginal productivity benefit of each level of intensity over others

Notes for: ICT and productivity

- See Draca and others (2006) for a review of ICT research.

4. Data sources

In this study, we used data from three primary sources – the E-commerce Survey, the Annual Business Survey (ABS) and the Inter-Departmental Business Register (IDBR). The E-commerce Survey measures the adoption and use of existing and emerging information and communication technologies (ICT) and e-commerce activity, by UK businesses. The survey samples over 7,000 businesses annually and covers most industries except those in:

- agriculture, forestry and fishing

- mining and quarrying

- veterinary activities

- public administration and defence

- social security

- education

- health and social work

- arts, entertainment and recreation

- other service activities except repair of computers

For our descriptive analysis, we mainly use data from the November 2017 e-commerce and ICT activity release, which covers ICT activities up to 2016. We restricted our analysis to firms with employment of 10 or more, as these are the most consistent within the e-commerce dataset.

For our conditional analysis on the relationship between ICT use and productivity, we use a linked E-commerce and Annual Business Survey (ABS) dataset for the period 2008 to 2016. The ABS is the main structural business survey conducted by Office for National Statistics (ONS)1 and provides the financial data on turnover, intermediate purchases and “approximate gross value added” (aGVA) for calculating labour productivity. It surveys around 65,000 firms on an annual basis from the production, construction, distribution and services industries, representing approximately two-thirds of the UK economy2. Reflecting the coverage of this survey, our regression analysis covers firms in Great Britain.

Our measure of labour productivity (GVA per worker) was calculated as aGVA at basic prices over employment. This measure differs from the ONS headline labour productivity measure, which is on a GVA per hour worked basis. Aggregate GVA from the ABS is referred to as aGVA to differentiate from the national accounts measure, of which aGVA is a component. The difference between aGVA and the national accounts measure of GVA is discussed in A comparison between ABS and National Accounts measures of value added. All data in this article are based on the Standard Industrial Classification 2007: SIC 2007 of business activities.

The business-specific measure of labour input that we used in this analysis was employment – which includes both employees and working proprietors – and was obtained from the Inter-Departmental Business Register (IDBR) at the time of sample selection of the ABS. Employment information from the IDBR is derived from a number of different sources (including the Business Register Employment Survey (BRES), HM Revenue and Customs (HMRC) records and some imputation) and some of the employment information – especially for small businesses – may be several years old. Despite this limitation, the IDBR is at present the most comprehensive source of employment information for analysis at the enterprise level (reporting unit).

Notes for data sources

The ABS is conducted by ONS for businesses in Great Britain and separately by the Department of Finance Northern Ireland for businesses in Northern Ireland.

The ABS covers the non-financial business economy, which excludes financial services and the public sector.

5. Quality and methodology

Our linked E-commerce Annual Business Survey (ABS) dataset consists of approximately 2,500 businesses in each year. As discussed in Section 4, the E-commerce Survey has a narrower industry coverage than the ABS. Consequently, our linked data are skewed towards larger businesses, which are routinely sampled on both surveys. The results we present in both the descriptive and regression analyses relate to firms with at least 10 people in employment, and our conditional analyses are unweighted1.

Our analysis explores correlations between ICT use and productivity but does not establish the direction of causality. Indeed, more productive businesses could also be more likely to adopt and use ICT, and conversely for less productive firms. Our analysis also omits some variables such as on innovation and management practices, which are known to have a strong correlation with productivity. As such, our results may be picking up some of these effects.

It is worth noting that questions on the E-commerce Survey are sometimes rotated, resulting in breaks in the time series for some of our variables of interest. We used all available data for our variables of interest within the period 2008 to 2016 and include time dummies in our regressions.

Notes for: Quality and methodology

- See Table 14 in Annex 1 for a size description of our linked E-commerce-ABS dataset.

6. ICT adoption

6.1 Use of basic technologies

In this section, we use data that pertain to the E-commerce Survey. Over the past decades, computers have become cheaper, smaller, more powerful, with faster processing speeds, and an ever-increasing range of capabilities, making them a ubiquitous part of domestic and business life. It is therefore no surprise that the adoption of what we refer to as “basic ICT technologies” – which includes the use of computers, access to the internet, use of a fixed broadband connection and having a website – have almost reached full-saturation within the business community. Over our period of interest, more than 9 in 10 businesses are users of these basic technologies, with the exception of having a website, where we observe a marked increase – of around 10 percentage points – in adoption rates to 84% in the period to 2016 (Figure 1).

Figure 1: Trends in the adoption of basic ICT technologies among UK firms, 2008 to 2016

Source: Office for National Statistics

Notes:

- The data in this chart pertain to firms in the E-commerce Survey with employment of at least 10 in the United Kingdom.

Download this chart Figure 1: Trends in the adoption of basic ICT technologies among UK firms, 2008 to 2016

Image .csv .xls6.2 Use of other technologies

In recent years, there are notable advancements in the capabilities and offerings of smaller, smarter, internet-enabled mobile devices such as smartphones, tablets, notebooks and laptops, supporting more flexible working arrangements. Since 2009 when our records began, the share of firms using a mobile broadband connection via a portable device has increased from less than 4 in 10 firms to almost 7 in 10 firms in 2015 (Figure 2).

Along with these portable mobile technologies, the use of social media such as Twitter, Instagram and Facebook for business purposes is becoming mainstream. The share of businesses using social media has increased markedly from just over 4 in 10 firms in 2012 to more than 6 in 10 in 2016. Similarly, we observe an increase in the share of firms adopting cloud computing technology1 from around one-quarter of businesses in 2013 to over one-third (35%) in 2015.

Figure 2: Trends in the adoption of other ICT technologies by UK businesses, 2009 to 2016

Source: Office for National Statistics

Notes:

- Data for cloud computing are only available in 2013 and 2015.

- Cloud computing relates to services used over the internet to access software, computing power or storage capacity and are often delivered remotely.

- Social media is defined as websites and applications that enable users to create and share content or participate in social networking, this question was added to the survey in 2012.

- Mobile connection is defined as the use of a portable device connected to the internet used for business purposes.

- The data in this chart pertain to firms in the E-commerce Survey with employment of at least 10 in the United Kingdom.

Download this chart Figure 2: Trends in the adoption of other ICT technologies by UK businesses, 2009 to 2016

Image .csv .xls6.3 Access to high speed broadband

Alongside the ICT technologies discussed previously, the availability of faster internet may support the efficient use of these technologies and widen the range of potential applications. Ofcom defines broadband services in Connected Nations 2016 (PDF, 3.8MB) as standard if download speeds are between 10 and 30 Megabytes per second (Mbps), superfast for download speeds of 30Mbps or more, and ultrafast when download speeds are at least 300Mbps. In the period to 2016, we observe a steady increase in the share of businesses with access to super- and ultra-fast broadband services, with around 42% of businesses having access to speeds of 30Mbps or more (Figure 3).

However, using Eurostat data to explore our standing internationally, we find the UK and Germany rank joint 16 out of 28 EU countries, on the share of firms with access to broadband speeds of 30Mbps or more (Figure 4). Within this segment, the UK is only behind six others on the share of firms with access to broadband speeds of 30Mbps but less than 100Mbps. With 14%, the UK ranks joint 18th (with Austria and Poland) on the share of firms with access to internet speeds of 100Mbps or more, with Denmark (42%), Sweden (39%) and Portugal and Finland (32% each) at the top of the scale. Note that access to super- and ultra-fast broadband services relies on availability, and that these data relate to maximum contractual download speeds, which may differ from the actual service received.

Figure 3: Share of UK firms by maximum contractual internet speed, 2010 to 2016

Source: Office for National Statistics

Notes:

- The data in this chart pertain to firms in the E-commerce Survey with employment of at least 10 in the United Kingdom.

Download this chart Figure 3: Share of UK firms by maximum contractual internet speed, 2010 to 2016

Image .csv .xls

Figure 4: Share of businesses with super- and ultra-fast broadband for the EU28 group of countries, 2016

Source: Eurostat

Notes:

- The chart refers to the percentage of firms with maximum contractual internet speed of 30 to 100Mbps and 100Mbps or more.

Download this chart Figure 4: Share of businesses with super- and ultra-fast broadband for the EU28 group of countries, 2016

Image .csv .xls6.4 Trends in e-commerce activities

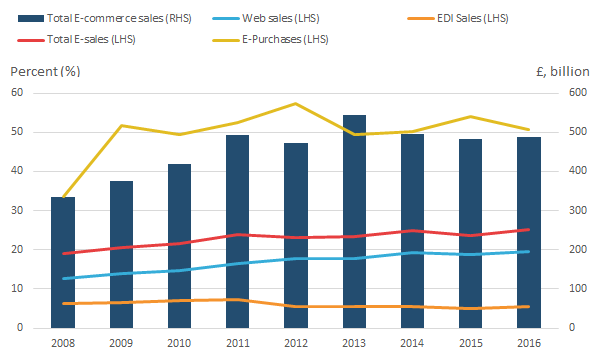

Technology is considered an enabler, with potential to transform the organisation of business activity, streamline production processes, reduce transaction costs, improve relationships between suppliers and customers (and conversely), and open access to new products and markets. However, the E-commerce Survey shows that a relatively small proportion of businesses engage in e-sales, at 25% in 2016 (Figure 5) – this includes website sales and sales via electronic data interchange (EDI)2. This represents a modest growth from 19% in 2008. Over this period, the share of firms with EDI sales declines, while those receiving orders through their websites or “apps” increases, albeit at a modest pace. Similarly, the share of firms engaged in e-purchase has on average remained relatively stable since 2009.

The total value of e-sales in 2016 (£488 billion) is also broadly similar to the value in 2011. With e-sales accounting for 18% of total UK turnover in 2016, the UK ranks just outside of the top 10 (out of 28) EU countries, with Ireland, the Czech Republic and Belgium having more than 30% of total turnover from e-commerce (Figure 6).

Figure 5: Trends in e-commerce activity among UK businesses, 2008 to 2016

Source: Office for National Statistics

Notes:

- The data in this chart pertain to firms in the E-commerce Survey with employment of 10 or more in the UK.

- Total e-commerce sales is the value of sales from website and EDI sales in £, billion and is on the right-hand axis.

- Total e-sales is the share of businesses conducting website sales and EDI sales and is on the left-hand axis.

Download this image Figure 5: Trends in e-commerce activity among UK businesses, 2008 to 2016

.png (19.2 kB) .xls (36.4 kB)

Figure 6: Share of total turnover from e-sales for the EU28 group of countries, 2016

Source: Eurostat

Download this chart Figure 6: Share of total turnover from e-sales for the EU28 group of countries, 2016

Image .csv .xlsNotes for: ICT adoption

Cloud computing relates to services used over the internet to access software, computing power or storage capacity and are often delivered remotely.

Electronic data interchange (EDI) refers to a set of standards for structuring information that is to be electronically exchanged between businesses or other organisations. The standards describe formats that emulate documents, such as purchase orders or invoices; define messages and their contents, but not the method of exchanging the messages themselves. An example of EDI is EDIFACT (Electronic Data Interchange For Administration Commerce and Transport standards).

7. ICT intensity indicators

Using our linked E-commerce Annual Business Survey (ABS) dataset and a similar methodology used by Eurostat (2012)1, we develop three information and communication technologies (ICT) intensity indicators, which are extensive measures of ICT use, relating the number of related activities or processes that a firm reports. These indicators include e-commerce, business organisation and ICT resource intensity indicators. For each of these indicators, we classify a firm as:

- non active when they use none of the three technologies within each group

- low intensity if they use only one technology

- high intensity when they use more than one technology

We aim to examine trends in these intensities over time, and to explore conditional relationships between the different levels of intensities and productivity.

7.1 E-commerce intensity

The first of our ICT intensity indicators relates to the number of linkages businesses have with e-commerce technologies, comprising website sales (web-sales), electronic data interchange (EDI) sales, and e-purchases. E-commerce activities can impact productivity through a variety of channels including wider access to consumer markets increasing sales and turnover, while access to broader producer markets can support purchases of inputs at competitive rates, lowering costs. We derive eight intensity categories as follows:

Non-active

- Firm has no e-commerce activity

Low intensity

- Firm engages in web-sales only

- Firm engages in e-purchases only

- Firm engages in EDI sales only

High intensity

- Firm engages in web-sales, EDI sales and e-purchases

- Firm engages in web-sales and e-purchases only

- Firm engages in web-sales and EDI sales only

- Firm engages in EDI sales and e-purchases only

In Table 1, we present descriptive statistics for e-commerce intensity, averaged across the period 2009 to 2016. For the entire sample of firms, we find an almost equal share of firms with low (42%) and high e-commerce intensity, with less than one-fifth of firms having no e-commerce activity2. Around one-third (34%) of businesses engage in e-purchases, increasing to just under three-quarters (73%) if accounting for those engaging in e-purchases and other e-commerce activities.

We observe variations in the concentration of businesses across the e-commerce categories, between the production and services industries. While e-purchases users are more prevalent in both groups, EDI sales is more popular than web-sales in production than services and conversely for web-sales. Among high-intensity users, we find a higher concentration of production firms engaging in EDI sales and e-purchases (19%), compared with 5% for services firms; and a higher concentration of services firms engaging in web-sales and e-purchases (21%), compared with 7% in production. This is likely to reflect the differences in these industries, with production firms having a greater focus on providing inputs – through EDI sales – while services firms show more focus on expanding their customer base – through web-sales. We also find a relatively higher share of non-active users in production (20%) than services (15%).

Table 1: Descriptive analysis of e-commerce intensity, Great Britain, average, 2009 to 2016

| E-commerce ABS sample | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| E-Commerce | Web-sales | EDI sales | E-purchases | Web-sales and EDI sales | Web-sales and E-purchases | EDI sales and E-purchases | All | None | |||

| Turnover (£,m) | 215 | 193 | 231 | 344 | 624 | 426 | 725 | 155 | |||

| GVA (£,m) | 71 | 50 | 82 | 82 | 164 | 94 | 193 | 43 | |||

| GVA/worker (£,000) | 79 | 73 | 77 | 64 | 61 | 77 | 77 | 70 | |||

| Employment | 1,349 | 730 | 1,539 | 1,106 | 4,270 | 1,285 | 2,899 | 744 | |||

| Observations | 820 | 925 | 7,305 | 371 | 3,347 | 2,345 | 2,824 | 3,631 | |||

| Share of firms (%) | 4 | 4 | 34 | 2 | 16 | 11 | 13 | 17 | |||

| Production industry | |||||||||||

| E-Commerce | Web-sales | EDI sales | E-purchases | Web-sales and EDI sales | Web-sales and E-purchases | EDI sales and E-purchases | All | None | |||

| Turnover (£,m) | 117 | 204 | 224 | 423 | 422 | 387 | 842 | 112 | |||

| GVA (£,m) | 33 | 54 | 68 | 125 | 131 | 95 | 185 | 32 | |||

| GVA/worker (£,000) | 70 | 65 | 94 | 58 | 96 | 72 | 82 | 68 | |||

| Employment | 333 | 760 | 727 | 858 | 1,120 | 1,151 | 1,649 | 409 | |||

| Observations | 199 | 677 | 2,784 | 165 | 568 | 1,643 | 882 | 1,697 | |||

| Share of firms (%) | 2 | 8 | 32 | 2 | 7 | 19 | 10 | 20 | ` | ||

| Services industry | |||||||||||

| E-Commerce | Web-sales | EDI sales | E-purchases | Web-sales and EDI sales | Web-sales and E-purchases | EDI sales and E-purchases | All | None | |||

| Turnover (£,m) | 247 | 162 | 236 | 281 | 666 | 517 | 672 | 193 | |||

| GVA (£,m) | 83 | 41 | 91 | 47 | 171 | 94 | 196 | 52 | |||

| GVA/worker (£,000) | 81 | 95 | 66 | 69 | 54 | 89 | 75 | 71 | |||

| Employment | 1,674 | 648 | 2,040 | 1,304 | 4,914 | 1,597 | 3,467 | 1,038 | |||

| Observations | 621 | 248 | 4,521 | 206 | 2,779 | 702 | 1,942 | 1,934 | |||

| Share of firms (%) | 5 | 2 | 35 | 2 | 21 | 5 | 15 | 15 | |||

| Source: Office for National Statistics | |||||||||||

| Notes: | |||||||||||

| 1. Data relates to firms in our linked E-commerce ABS dataset. | |||||||||||

| 2. Numbers presented in the table are averages across the years 2009 to 2016. The share of firms in each category in each year is presented in Table 15 in the annex to this paper. | |||||||||||

| 3. Percentages may not add to 100% due to rounding. | |||||||||||

Download this table Table 1: Descriptive analysis of e-commerce intensity, Great Britain, average, 2009 to 2016

.xls (40.4 kB)7.2 Business organisation intensity

Our second ICT intensity indicator explores firms’ use of electronic platforms and software to manage their business processes. This includes the use of software or applications for enterprise resource planning (ERP), customer relationship management (CRM) and supply chain management (SCM)3. These resources can among others deliver productivity gains through efficient information sharing within the organisation, better product planning through customer interaction, targeted customer marketing, as well as reduced transaction costs through efficient supply chain arrangements such as automated ordering and just in time production.

As with the e-commerce intensity indicator, we derive eight categories of business organisation intensity as follows:

Non-active

- Firm has no automated business organisation activity

Low intensity

- Firm engages in ERP only

- Firm engages in CRM only

- Firm engages in SCM only

High intensity

- Firm engages in ERP, CRM and SCM

- Firm engages in ERP and CRM only

- Firm engages in ERP and SCM only

- Firm engages in CRM and SCM only

In Table 2, we find a relatively larger share of firms that do not deploy these tools (24%), compared with the e-commerce indicator (17%) (Table 1)4. The share of non-active firms is marginally higher in the services (25%) than in the production industries (22%). We find a higher share of firms in the high intensity categories, at 48%, compared with 28% in low intensity categories. This suggests that firms that engage in business organisation technologies are more likely to be high-intensity users – with 20% of firms using all three technologies.

Between the broad industry groups, we find higher use of ERP in production than services, and conversely, higher use of CRM in services than in production. In general, we find a higher share of high-intensive firms in production (51%) than services (47%), and in the most intensive category, both industry groups are equal.

Table 2: Descriptive analysis of business organisation intensity, Great Britain, average, 2008, 2009, 2011, 2013, 2014 and 2016

| E-commerce ABS sample | ||||||||

|---|---|---|---|---|---|---|---|---|

| ERP | CRM | SCM | ERM and CRM | ERM and SCM | CRM and SCM | All | None | |

| Turnover (£,m) | 330 | 189 | 228 | 283 | 363 | 427 | 795 | 140 |

| GVA (£,m) | 62 | 63 | 57 | 104 | 96 | 111 | 216 | 35 |

| GVA/worker (£,000) | 97 | 67 | 56 | 78 | 77 | 75 | 81 | 65 |

| Employment | 1,034 | 1,330 | 1,498 | 1,535 | 1,845 | 2,346 | 3,968 | 935 |

| Observations | 1,701 | 2,144 | 695 | 2,407 | 1,294 | 926 | 3,203 | 3,830 |

| Share of firms (%) | 11 | 13 | 4 | 15 | 8 | 6 | 20 | 24 |

| Production industry | ||||||||

| ERP | CRM | SCM | ERM and CRM | ERM and SCM | CRM and SCM | All | None | |

| Turnover (£,m) | 203 | 284 | 153 | 282 | 283 | 537 | 608 | 117 |

| GVA (£,m) | 58 | 63 | 40 | 72 | 75 | 99 | 169 | 28 |

| GVA/worker (£,000) | 75 | 75 | 61 | 73 | 77 | 88 | 89 | 83 |

| Employment | 698 | 565 | 539 | 810 | 985 | 999 | 1,590 | 325 |

| Observations | 1,037 | 421 | 255 | 1,022 | 820 | 137 | 1,271 | 1,418 |

| Share of firms (%) | 16 | 7 | 4 | 16 | 13 | 2 | 20 | 22 |

| Services industry | ||||||||

| ERP | CRM | SCM | ERM and CRM | ERM and SCM | CRM and SCM | All | None | |

| Turnover (£,m) | 529 | 165 | 271 | 283 | 500 | 408 | 917 | 154 |

| GVA (£,m) | 70 | 64 | 66 | 128 | 132 | 113 | 247 | 40 |

| GVA/worker (£,000) | 131 | 65 | 53 | 82 | 77 | 73 | 76 | 55 |

| Employment | 1,557 | 1,517 | 2,054 | 2,071 | 3,332 | 2,579 | 5,532 | 1,293 |

| Observations | 664 | 1,723 | 440 | 1,385 | 474 | 789 | 1,932 | 2,412 |

| Share of firms (%) | 7 | 18 | 4 | 14 | 5 | 8 | 20 | 25 |

| Source: Office for National Statistics | ||||||||

| Notes: | ||||||||

| 1. Data relates to firms in our linked E-commerce ABS dataset. | ||||||||

| 2. Numbers presented in the table are averages across the years 2008, 2009, 2011, 2013, 2014 and 2016. The share of firms in each category in each year is presented in Table 15 in the annex to this paper. | ||||||||

| 3. Percentages may not add to 100% due to rounding. | ||||||||

Download this table Table 2: Descriptive analysis of business organisation intensity, Great Britain, average, 2008, 2009, 2011, 2013, 2014 and 2016

.xls (39.9 kB)7.3 ICT resource intensity

Our third ICT intensity indicator aims to capture how firms resource ICT services. This includes three resourcing strategies consisting of whether the firm hires ICT or IT specialists, outsources ICT services to external service providers5 and/or provides ICT training to employees. This intensity indicator is more exploratory and examines which ICT support strategy has the strongest association with productivity. We derive eight categories of ICT resource intensity as follows:

Non-active

- No ICT resource activity

Low intensity

- Provides ICT training to employees only

- Outsources ICT services only

- Employs ICT specialists only

High intensity

- Employs ICT specialists, outsources ICT services and provides ICT training to employees

- Outsources ICT services and provides ICT training to employees

- Employs ICT specialists and provides ICT training to employees

- Employs ICT specialists and outsources ICT services

Only 2% of businesses in our linked sample are non-active in terms of resourcing ICT support. This corresponds to the share of firms with no computers (Figure 1). We find consistent trends in ICT resource intensity between firms in the production and services industries. In general, most firms (84%) are high-intensity users, with almost two-thirds (64%) engaging in all three resourcing activities concurrently. Outsourcing (only) is the second most common strategy, followed by those who hire specialists and provide ICT training combined.

Table 3: Descriptive analysis of ICT resource intensity, Great Britain, average, 2011 to 2016

| E-commerce ABS sample | ||||||||

|---|---|---|---|---|---|---|---|---|

| Employs ICT Specialist | Outsources | Trains employees | Employs and outsources | Employs and trains employees | Outsources and trains employees | All | None | |

| Turnover (£,m) | 80 | 42 | 291 | 125 | 579 | 140 | 482 | 379 |

| GVA (£,m) | 30 | 14 | 38 | 31 | 149 | 41 | 145 | 20 |

| GVA/worker (£,000) | 66 | 56 | 63 | 55 | 169 | 72 | 82 | 46 |

| Employment | 590 | 508 | 907 | 875 | 1,943 | 942 | 2,528 | 851 |

| Observations | 123 | 1,727 | 112 | 1,310 | 679 | 838 | 8,835 | 289 |

| Share of firms (%) | 1 | 12 | 1 | 9 | 5 | 6 | 64 | 2 |

| Production industry | ||||||||

| Employs ICT Specialist | Outsources | Trains employees | Employs and outsources | Employs and trains employees | Outsources and trains employees | All | None | |

| Turnover (£,m) | 80 | 34 | 364 | 97 | 429 | 135 | 437 | 35 |

| GVA (£,m) | 23 | 11 | 42 | 23 | 120 | 31 | 118 | 10 |

| GVA/worker (£,000) | 63 | 59 | 68 | 59 | 93 | 79 | 91 | 48 |

| Employment | 381 | 181 | 507 | 446 | 1,262 | 411 | 1,119 | 212 |

| Observations | 54 | 752 | 59 | 548 | 289 | 365 | 3,305 | 94 |

| Share of firms (%) | 1 | 14 | 1 | 10 | 5 | 7 | 60 | 2 |

| Services industry | ||||||||

| Employs ICT Specialist | Outsources | Trains employees | Employs and outsources | Employs and trains employees | Outsources and trains employees | All | None | |

| Turnover (£,m) | 79 | 48 | 209 | 145 | 691 | 144 | 509 | 545 |

| GVA (£,m) | 36 | 17 | 33 | 36 | 171 | 48 | 161 | 25 |

| GVA/worker (£,000) | 69 | 54 | 56 | 51 | 226 | 67 | 77 | 45 |

| Employment | 754 | 761 | 1,351 | 1,183 | 2,448 | 1,351 | 3,370 | 1,160 |

| Observations | 69 | 975 | 53 | 762 | 390 | 473 | 5,530 | 195 |

| Share of firms (%) | 1 | 12 | 1 | 9 | 5 | 6 | 65 | 2 |

| Source: Office for National Statistics | ||||||||

| Notes: | ||||||||

| 1. Data relates to firms in our linked E-commerce ABS dataset. | ||||||||

| 2. Numbers presented in the table are averages across the years 2011 to 2016. The share of firms in each category in each year is presented in Table 15 in the annex to this paper. | ||||||||

| 3. Percentages may not add to 100% due to rounding. | ||||||||

Download this table Table 3: Descriptive analysis of ICT resource intensity, Great Britain, average, 2011 to 2016

.xls (40.4 kB)7.4 E-commerce intensity and productivity

We explore the relationship between labour productivity and our extensive measures of e-commerce intensity, controlling for a range of firm characteristics including firm size (logarithm of employment), industry, foreign ownership, as well as time and location fixed effects. The linked E-commerce-ABS dataset covers firms with employment of 10 or more and is limited to the scope of industries covered by the E-commerce Survey. The data are also skewed towards large businesses who are more routinely sampled in both surveys (see Table 14 in Annex 1). We therefore suggest caution in interpreting these results. We also control for the share of total turnover accounted for by web-sales and EDI sales – intensive measures of ICT use.

Our results show positive and significant relationships between labour productivity and EDI sales, as well as with e-purchases, but not with web-sales (columns 1 to 3 of Table 4). However, when we control for the intensive measures of web-sales and EDI sales use, EDI sales lose significance and we find positive and significant correlations with these intensive measures; a 1.0% increase in the share of turnover through web-sales is correlated with a 0.2% increase in productivity. Meanwhile, a 1.0% increase in the share of turnover through EDI sales is correlated with a 0.1% increase in productivity. This suggests that it is the intensive use of these technologies that is correlated with productivity gains.

In column 5, we introduce the extensive e-commerce indicators as regressors; we find positive and significant impacts for all intensity categories except for web-sales, EDI sales and the two combined. In our most detailed specification (column 6), we also control for the maximum contractual internet speed of businesses. We find that firms in the e-purchases category remain significantly associated with productivity: businesses that use these systems are on average 10% more productive than the reference group. Those with the combination of EDI sales and e-purchases are on average 8% more productive, although this effect is measured less precisely. We also find significantly higher levels of productivity among firms with access to higher internet speeds, as well as with the intensiveness of use of web-sales and EDI sales.

Table 4: Multivariate analysis of e-commerce intensity, Great Britain, 2009 to 2016

| Dependent variable: Log(GVA/Worker) | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Web-sales | 0.020 | -0.031* | ||||

| (0.01) | (0.02) | |||||

| EDI sales | 0.076*** | 0.023 | ||||

| (0.02) | (0.02) | |||||

| E-purchases | 0.112*** | 0.103*** | ||||

| (0.01) | (0.02) | |||||

| Web sales (%) | 0.002*** | 0.002*** | 0.002** | |||

| (0.00) | (0.00) | (0.00) | ||||

| EDI sales (%) | 0.001*** | 0.001*** | 0.001*** | |||

| (0.00) | (0.00) | (0.00) | ||||

| Web-sales only | 0.005 | -0.009 | ||||

| (0.04) | (0.04) | |||||

| EDI sales only | 0.053 | 0.051 | ||||

| (0.04) | (0.04) | |||||

| E-purchases only | 0.131*** | 0.100*** | ||||

| (0.02) | (0.02) | |||||

| Web-sales and EDI sales | 0.046 | 0.016 | ||||

| (0.05) | (0.05) | |||||

| Web-sales and e-purchases | 0.070** | 0.029 | ||||

| (0.03) | (0.03) | |||||

| EDI sales and e-purchases | 0.110*** | 0.082* | ||||

| (0.03) | (0.03) | |||||

| All | 0.112*** | 0.057 | ||||

| (0.03) | (0.03) | |||||

| <2Mbps | 0.118 | |||||

| (0.06) | ||||||

| 2Mbps> and <10Mbps | 0.155** | |||||

| (0.05) | ||||||

| 10Mbps> and <30Mbps | 0.209*** | |||||

| (0.05) | ||||||

| 30Mbps> and <100Mbps | 0.333*** | |||||

| (0.05) | ||||||

| 100Mbps+ | 0.487*** | |||||

| (0.05) | ||||||

| Log(employment) | 0.016** | 0.011* | 0.009 | 0.004 | 0.004 | -0.025*** |

| (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | |

| Foreign ownership dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Location dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.269 | 0.271 | 0.271 | 0.274 | 0.274 | 0.290 |

| Observations | 23086 | 20848 | 23086 | 20848 | 20848 | 18288 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01. | ||||||

| 2. A constant is included in all regressions, and all results are unweighted. We use robust standard errors. | ||||||

| 3. Time period covers 2009 to 2016. | ||||||

| 4. Data relates to firms in our linked E-commerce ABS dataset. | ||||||

| 5. Where indicated, we used industry dummies at the 2-digit level, based on the 2007 Standard Industry Classification. | ||||||

Download this table Table 4: Multivariate analysis of e-commerce intensity, Great Britain, 2009 to 2016

.xls (33.3 kB)In Table 5, we present a pairwise comparison of the coefficients of the e-commerce indicators from column 6 of Table 4. This shows the coefficient of one ICT system compared with the baseline of another, and aims to measure the marginal productivity impacts between them. Reading the table across a row, a positive number means a higher marginal productivity for the ICT item on the left column relative to the top row, and the reverse for a negative value. Although these relationships are not causal, they provide an indication of the relative productivity premium of each e-commerce intensity over another.

Starting with the bottom row, the signs on the coefficients show that firms with no e-commerce activity are less productive than those in all other categories, except for web-sales. However, when we consider the statistical significance of these coefficients, the results suggest that it is the businesses that engage in e-purchases, EDI sales, and all three e-commerce technologies in combination that have a strong association with productivity.

Within the low intensity categories, we find a significant productivity premium for engaging in e-purchases over web-sales (column 1), but not between the other low-intensity categories. We also find marginal effects for e-purchases relative to all high-intensity categories (column 3), except for e-purchases and EDI sales combined. For the high-intensity categories, we find a significant productivity premium for engaging in e-purchases and EDI sales over web-sales and e-purchases combined.

In general, the results suggest that for those with no activity, there are productivity benefits for adopting e-purchases, and additionally EDI sales, and all three e-commerce technologies in combination. Whilst for those with some intensity, we find the strongest marginal effects among firms with e-purchases and e-purchases in combination with EDI sales.

Table 5: Pairwise comparison of e-commerce intensity coefficients, Great Britain, 2009 to 2016

| Web-sales only | EDI sales only | E-purchases only | Web-sales and EDI sales | Web-sales and e-purchases | E-purchase and EDI sales | All | |

|---|---|---|---|---|---|---|---|

| EDI sales only | 0.06 | ||||||

| (0.047) | |||||||

| E-purchases only | 0.109*** | 0.05 | |||||

| (0.036) | (0.035) | ||||||

| Web-sales and EDI sales | 0.026 | -0.034 | -0.084* | ||||

| (0.056) | (0.053) | (0.047) | |||||

| Web-sales and e-purchases | 0.038 | -0.022 | -0.071*** | 0.012 | |||

| (0.037) | (0.038) | (0.021) | (0.048) | ||||

| E-purchases and EDI sales | 0.091** | 0.031 | -0.018 | 0.066 | 0.053* | ||

| (0.043) | (0.033) | (0.028) | (0.048) | (0.031) | |||

| All | 0.066* | 0.006 | -0.043* | 0.04 | 0.028 | -0.025 | |

| (0.039) | (0.036) | (0.024) | (0.047) | (0.025) | (0.029) | ||

| None | 0.009 | -0.051 | -0.100*** | -0.016 | -0.029 | -0.082** | -0.057* |

| (0.039) | (0.038) | (0.023) | (0.049) | (0.027) | (0.032) | (0.029) | |

| Source: Office for National Statistics | |||||||

| Notes: | |||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01. | |||||||

| 2. A constant is included in all regressions, and all results are unweighted. We use robust standard errors. | |||||||

| 3. Data relates to firms in our linked E-commerce ABS dataset, and time period covers 2009 to 2016. | |||||||

| 4. We used industry dummies at the 2-digit level, based on the 2007 Standard Industry Classification. | |||||||

Download this table Table 5: Pairwise comparison of e-commerce intensity coefficients, Great Britain, 2009 to 2016

.xls (30.2 kB)In Table 6, we explore industry-specific variations in these relationships, using similar models to columns 5 and 6 of Table 4. In general, we find the intensity of use of web-sales and EDI sales (as a share of turnover) to be positively correlated with productivity, with a higher premium for web-sales intensity (0.3%) for the production industry, and higher premium for EDI sales intensity (0.2%) for the services industry. In the services industry, we find significantly higher productivity effects across all the low- and high-intensity categories, except for web-sales and web-sales and EDI sales combined. In the production industry on the other hand, the only positive and significant effect (at the 10% level) is in the e-purchases activity.

Table 6: Multivariate analysis of e-commerce intensity by broad industry groups, Great Britain, 2009 to 2016

| Dependent variable: Log(GVA/Worker) | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Production | Production | Services | Services | |

| Web sales (%) | 0.003** | 0.003** | 0.002*** | 0.001* |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| EDI sales (%) | 0.001** | 0.001** | 0.002* | 0.002* |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Web-sales only | 0.002 | -0.009 | 0.041 | 0.021 |

| (0.05) | (0.06) | (0.05) | (0.05) | |

| EDI sales only | -0.097* | -0.091* | 0.223** | 0.202* |

| (0.04) | (0.04) | (0.07) | (0.08) | |

| E-purchases only | 0.098*** | 0.058* | 0.153*** | 0.120*** |

| (0.03) | (0.03) | (0.03) | (0.03) | |

| Web-sales and EDI sales | -0.118 | -0.131* | 0.163* | 0.110 |

| (0.06) | (0.07) | (0.07) | (0.07) | |

| Web-sales and e-purchases | -0.005 | -0.020 | 0.134*** | 0.074* |

| (0.04) | (0.05) | (0.03) | (0.04) | |

| EDI sales and e-purchases | -0.056 | -0.068 | 0.265*** | 0.214*** |

| (0.04) | (0.04) | (0.05) | (0.05) | |

| All | -0.042 | -0.075 | 0.204*** | 0.130** |

| (0.04) | (0.04) | (0.04) | (0.04) | |

| Log(employment) | 0.079*** | 0.053*** | -0.036*** | -0.065*** |

| (0.01) | (0.01) | (0.01) | (0.01) | |

| Foreign ownership dummies | Yes | Yes | Yes | Yes |

| Industry dummies | Yes | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes | Yes |

| Internet speed dummies | No | Yes | No | Yes |

| Location dummies | Yes | Yes | Yes | Yes |

| R2 | 0.216 | 0.218 | 0.287 | 0.308 |

| Observations | 8365 | 7334 | 12483 | 10954 |

| Source: Office for National Statistics | ||||

| Notes: | ||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01. | ||||

| 2. A constant is included in all regressions, and all results are unweighted. We use robust standard errors. | ||||

| 3. Data relates to firms in our linked E-commerce ABS dataset, and time period covers 2009 to 2016. | ||||

| 4. Where indicated, we used industry dummies at the 2-digit level, based on the 2007 Standard Industry Classification. | ||||

Download this table Table 6: Multivariate analysis of e-commerce intensity by broad industry groups, Great Britain, 2009 to 2016

.xls (39.4 kB)Table 7 shows variations across firms of different sizes. We find that larger firms are more likely to show an association between e-commerce intensity and productivity. For small firms (10 to 49 employment), we find no relationship between our e-commerce indicators and productivity – including for intensiveness of use of web-sales and EDI sales (as a share of turnover). However, the largest firms with employment of 250 or more, show strong positive relationships across more e-commerce indicators, consistent with the findings for the whole sample presented in Table 4. The results for the small and medium size-bands could reflect their disproportionately low numbers in our linked dataset.

Table 7: Multivariate analysis of e-commerce intensity by size band, Great Britain, 2009 to 2016

| Dependent variable: Log(GVA/Worker) | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| 10 to 49 | 10 to 49 | 50 to 249 | 50 to 249 | 250+ | 250+ | |

| Web-sales (%) | 0.002 | 0.001 | 0.003* | 0.002 | 0.003*** | 0.002*** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| EDI sales (%) | 0.008 | 0.004 | 0.005*** | 0.005*** | 0.001** | 0.001** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| Web-sales only | 0.189 | 0.159 | -0.114 | -0.095 | 0.034 | 0.020 |

| (0.12) | (0.13) | (0.06) | (0.06) | (0.05) | (0.05) | |

| EDI sales only | 0.293 | 0.273 | 0.015 | 0.014 | 0.001 | 0.006 |

| (0.21) | (0.22) | (0.09) | (0.09) | (0.04) | (0.04) | |

| E-purchases only | 0.129 | 0.028 | 0.087* | 0.083 | 0.132*** | 0.102*** |

| (0.09) | (0.09) | (0.04) | (0.04) | (0.03) | (0.03) | |

| Web-sales and EDI sales | 0.086 | 0.097 | 0.014 | 0.042 | 0.030 | -0.013 |

| (0.19) | (0.20) | (0.11) | (0.11) | (0.05) | (0.06) | |

| Web-sales and e-purchases | 0.049 | -0.012 | -0.057 | -0.039 | 0.091** | 0.038 |

| (0.11) | (0.12) | (0.06) | (0.06) | (0.03) | (0.03) | |

| EDI sales and e-purchases | -0.040 | 0.034 | 0.040 | 0.040 | 0.097** | 0.066 |

| (0.25) | (0.28) | (0.08) | (0.08) | (0.04) | (0.04) | |

| All | 0.079 | -0.028 | 0.042 | 0.013 | 0.126*** | 0.065 |

| (0.21) | (0.23) | (0.07) | (0.08) | (0.03) | (0.03) | |

| Log(employment) | 0.080 | 0.049 | 0.085* | 0.061 | -0.003 | -0.036*** |

| (0.08) | (0.08) | (0.04) | (0.04) | (0.01) | (0.01) | |

| Foreign ownership dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Internet speed dummies | No | Yes | No | Yes | No | Yes |

| Location dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.185 | 0.211 | 0.255 | 0.272 | 0.306 | 0.323 |

| Observations | 1133 | 977 | 3456 | 2944 | 16259 | 14367 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01. | ||||||

| 2. A constant is included in all regressions, and all results are unweighted. We use robust standard errors. | ||||||

| 3. Data relates to firms in our linked E-commerce ABS dataset, and time period covers 2009 to 2016. | ||||||

| 4. Where indicated, we used industry dummies at the 2-digit level, based on the 2007 Standard Industry Classification. | ||||||

Download this table Table 7: Multivariate analysis of e-commerce intensity by size band, Great Britain, 2009 to 2016

.xls (40.4 kB)7.5 Business organisation intensity and productivity

We extend the study to our second ICT intensity indicator, which focuses on the use of ICT technologies to manage relationships with customers, suppliers, and across different functions within the firm. We find strong positive relationships between labour productivity and each of these three indicators individually (columns 1 to 4). In column 5, we explore firms that engage in one or a combination of these activities exclusively. Here we find that this correlation holds for all categories and is robust even when controlling for internet speed (column 6). The results show larger impacts for high-intensity indicators compared with low-intensity indicators. Firms with a combination of two or all three business organisation technologies are around 25% more productive than those in the reference group, while those with only one also show higher productivity outcomes, albeit at slightly lower magnitudes.

When we compare the coefficients of these indicators against each other (Table 9), we find that the marginal productivity benefits of having more than one indicator are positive and significant. However, we find no statistical difference between the individual indicators when compared against each other, and likewise for the multi-linked indicators.

Table 8: Multivariate analysis of business organisation intensity, Great Britain, 2008 to 2016

| Dependent variable: Log(GVA/Worker) | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ERP | 0.167*** | 0.126*** | ||||

| (0.01) | (0.02) | |||||

| CRM | 0.130*** | 0.092*** | ||||

| (0.02) | (0.02) | |||||

| SCM | 0.124*** | 0.088*** | ||||

| (0.02) | (0.02) | |||||

| ERP only | 0.204*** | 0.170*** | ||||

| (0.03) | (0.04) | |||||

| CRM only | 0.111*** | 0.109*** | ||||

| (0.03) | (0.03) | |||||

| SCM only | 0.107** | 0.093* | ||||

| (0.04) | (0.04) | |||||

| ERM and CRM | 0.276*** | 0.245*** | ||||

| (0.03) | (0.03) | |||||

| ERM and SCM | 0.286*** | 0.259*** | ||||

| (0.03) | (0.04) | |||||

| CRM and SCM | 0.267*** | 0.264*** | ||||

| (0.04) | (0.04) | |||||

| ERM, CRM and SCM | 0.318*** | 0.247*** | ||||

| (0.03) | (0.03) | |||||

| Log(employment) | -0.004 | 0.003 | 0.002 | -0.016** | -0.019** | -0.046*** |

| (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | |

| Foreign ownership dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Internet speed dummies | No | No | No | No | No | Yes |

| Location dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.275 | 0.268 | 0.267 | 0.272 | 0.274 | 0.289 |

| Observations | 18011 | 15628 | 15628 | 15628 | 15628 | 10830 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01. | ||||||

| 2. A constant is included in all regressions, and all results are unweighted. We use robust standard errors. | ||||||

| 3. Data relates to firms in our linked E-commerce ABS dataset, and time period covers 2008, 2009, 2011, 2013, 2014 and 2016. | ||||||

| 4. Where indicated, we used industry dummies at the 2-digit level, based on the 2007 Standard Industry Classification. | ||||||

Download this table Table 8: Multivariate analysis of business organisation intensity, Great Britain, 2008 to 2016

.xls (39.4 kB)

Table 9: Pairwise comparison of business organisation intensity coefficients, Great Britain, 2008 to 2016

| ERP only | CRM only | SCM only | ERP and CRM | ERP and SCM | CRM and SCM | ERP, CRM and SCM | |

|---|---|---|---|---|---|---|---|

| CRM only | -0.061 | ||||||

| (0.039) | |||||||

| SCM only | -0.077 | -0.016 | |||||

| (0.049) | (0.048) | ||||||

| ERP and CRM | 0.075** | 0.136*** | 0.152*** | ||||

| (0.035) | (0.034) | (0.046) | |||||

| ERP and SCM | 0.089** | 0.150*** | 0.166*** | 0.014 | |||

| (0.040) | (0.041) | (0.050) | (0.036) | ||||

| CRM and SCM | 0.094** | 0.156*** | 0.171*** | 0.020 | 0.006 | ||

| (0.045) | (0.043) | (0.053) | (0.041) | (0.047) | |||

| ERP, CRM and SCM | 0.077** | 0.138*** | 0.154*** | 0.002 | -0.012 | -0.017 | |

| (0.033) | (0.033) | (0.045) | (0.028) | (0.034) | (0.040) | ||

| None | -0.170*** | -0.109*** | -0.093** | -0.245*** | -0.259*** | -0.264*** | -0.247*** |

| (0.035) | (0.033) | (0.045) | (0.030) | (0.037) | (0.041) | (0.030) | |

| Source: Office for National Statistics | |||||||

| Notes: | |||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01. | |||||||

| 2. A constant is included in all regressions, and all results are unweighted. We use robust standard errors. | |||||||

| 3. Data relates to firms in our linked E-commerce ABS dataset, and time period covers 2008, 2009, 2011, 2013, 2014 and 2016. | |||||||

| 4. We used industry dummies at the 2-digit level, based on the 2007 Standard Industry Classification. | |||||||

Download this table Table 9: Pairwise comparison of business organisation intensity coefficients, Great Britain, 2008 to 2016

.xls (37.9 kB)Examining these relationships within the production and services industries, we find that the results discussed previously for the whole sample are driven largely by trends in the services industry (Table 10). Firms in the high-intensity categories in the services industry are on average 30% more productive than those who do not use these tools, but the difference is smaller between these businesses and those in the low-intensity categories. In the production industry, only the joint CRM and SCM indicator is significant at the 10% level for the detailed model in column 3.

Table 10: Multivariate analysis of business organisation intensity, by broad industry groups, Great Britain, 2008 to 2016

| Dependent variable: Log(GVA/Worker) | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Production | Production | Production | Services | Services | Services | |

| ERP | 0.042 | 0.156*** | ||||

| (0.03) | (0.02) | |||||

| CRM | 0.014 | 0.146*** | ||||

| (0.02) | (0.02) | |||||

| SCM | 0.061** | 0.097*** | ||||

| (0.02) | (0.02) | |||||

| ERP only | -0.004 | -0.004 | 0.336*** | 0.260*** | ||

| (0.04) | (0.05) | (0.05) | (0.06) | |||

| CRM only | -0.098 | -0.008 | 0.204*** | 0.179*** | ||

| (0.06) | (0.06) | (0.03) | (0.04) | |||

| SCM only | -0.010 | -0.035 | 0.164*** | 0.158** | ||

| (0.05) | (0.06) | (0.05) | (0.06) | |||

| ERM and CRM | 0.039 | 0.043 | 0.403*** | 0.342*** | ||

| (0.04) | (0.04) | (0.03) | (0.04) | |||

| ERM and SCM | 0.055 | 0.046 | 0.417*** | 0.391*** | ||

| (0.04) | (0.05) | (0.05) | (0.06) | |||

| CRM and SCM | 0.164* | 0.180* | 0.343*** | 0.332*** | ||

| (0.07) | (0.08) | (0.04) | (0.05) | |||

| ERM, CRM and SCM | 0.090* | 0.048 | 0.425*** | 0.340*** | ||

| (0.04) | (0.05) | (0.03) | (0.04) | |||

| Log(employment) | 0.062*** | 0.063*** | 0.035** | -0.056*** | -0.059*** | -0.085*** |

| (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | |

| Foreign ownership dummy | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Internet speed dummy | No | No | Yes | No | No | Yes |

| Location dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.209 | 0.210 | 0.204 | 0.289 | 0.293 | 0.312 |

| Observations | 6185 | 6185 | 4278 | 9443 | 9443 | 6552 |

| Source:Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01. | ||||||

| 2. A constant is included in all regressions, and all results are unweighted. We use robust standard errors. | ||||||

| 3. Data relates to firms in our linked E-commerce ABS dataset, and time period covers 2008, 2009, 2011, 2013, 2014 and 2016. | ||||||

| 4. Where indicated, we used industry dummies at the 2-digit level, based on the 2007 Standard Industry Classification. | ||||||

Download this table Table 10: Multivariate analysis of business organisation intensity, by broad industry groups, Great Britain, 2008 to 2016

.xls (39.9 kB)7.6 ICT resource intensity and productivity

For ICT resource intensity, we find significantly higher levels of productivity among firms that engage in each of the ICT resourcing strategies (columns 1 to 4). In column 6, the only significant productivity effects in the low-intensity groups are for outsourcing ICT activities, while all high-intensity categories show significant effects, with the largest impacts for those that employ and train employees, and those that engage in all three combined.

Comparing the ICT resourcing coefficients against each other (Table 12), in the low-intensity categories, we find no marginal productivity difference among our three measures. In the high-intensity categories, we find marginal productivity effects among firms which use all three resourcing activities, relative to the other categories except those who employ specialists and train employees. We find no significant marginal productivity premium between firms who employ ICT specialists and those who outsource ICT services, while we find significant marginal effects for employing and training over all three low-intensity categories and employing and outsourcing combined. These results suggest productivity benefits for engaging in one or more if in the non-active category, and in most cases in all three compared with two or fewer.

Table 11: Multivariate analysis of ICT resource intensity, Great Britain, 2011 to 2016

| Dependent variable: Log(GVA/Worker) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |||||

| Employs ICT specialists | 0.358*** | 0.232*** | ||||||||

| (0.02) | (0.03) | |||||||||

| Trains employees | 0.335*** | 0.279*** | ||||||||

| (0.02) | (0.02) | |||||||||

| Outsources | 0.138*** | 0.093* | ||||||||

| (0.03) | (0.04) | |||||||||

| Employs ICT specialists only | 0.369* | 0.330 | ||||||||

| (0.17) | (0.17) | |||||||||

| Outsources only | 0.325*** | 0.301** | ||||||||

| (0.09) | (0.09) | |||||||||

| Trains employees only | 0.074 | 0.055 | ||||||||

| (0.19) | (0.19) | |||||||||

| Employs and outsources | 0.477*** | 0.442*** | ||||||||

| (0.09) | (0.09) | |||||||||

| Employs and trains employees | 0.808*** | 0.730*** | ||||||||

| (0.10) | (0.10) | |||||||||

| Outsources and trains employees | 0.530*** | 0.488*** | ||||||||

| (0.10) | (0.09) | |||||||||

| All | 0.776*** | 0.707*** | ||||||||

| (0.09) | (0.09) | |||||||||

| Log(employment) | -0.028*** | -0.004 | 0.016** | -0.046*** | -0.045*** | -0.066*** | ||||

| (0.01) | (0.01) | (0.00) | (0.01) | (0.01) | (0.01) | |||||

| Foreign ownership dummies | Yes | Yes | Yes | Yes | Yes | Yes | ||||

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes | ||||

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes | ||||

| Internet speed dummy | No | No | No | No | No | Yes | ||||

| Location dummies | Yes | Yes | Yes | Yes | Yes | Yes | ||||

| R2 | 0.283 | 0.279 | 0.27 | 0.293 | 0.295 | 0.303 | ||||

| Observations | 13493 | 23086 | 23086 | 13493 | 13493 | 13492 | ||||

| Source: Office for National Statistics | ||||||||||

| Notes: | ||||||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01. | ||||||||||

| 2. A constant is included in all regressions, and all results are unweighted. We use robust standard errors. | ||||||||||

| 3. Data relates to firms in our linked E-commerce ABS dataset, and time period covers 2011 to 2016. | ||||||||||

| 4. Where indicated, we used industry dummies at the 2-digit level, based on the 2007 Standard Industry Classification. | ||||||||||

Download this table Table 11: Multivariate analysis of ICT resource intensity, Great Britain, 2011 to 2016

.xls (41.0 kB)

Table 12: Pairwise comparison of ICT resource intensity coefficients, Great Britain, 2011 to 2016

| Employs ICT specialists only | Outsources only | Trains employees only | Employs and outsources | Employs and trains employees | Outsources and trains employees | All | |

|---|---|---|---|---|---|---|---|

| Outsources only | -0.028 | ||||||

| (0.151) | |||||||

| Trains employees only | -0.275 | -0.247 | |||||

| (0.226) | (0.171) | ||||||

| Employs and outsources | 0.112 | 0.140*** | 0.387** | ||||

| (0.151) | (0.034) | (0.171) | |||||

| Employs and trains employees | 0.401** | 0.429*** | 0.676*** | 0.288*** | |||

| (0.157) | (0.055) | (0.177) | (0.053) | ||||

| Outsources and trains employees | 0.158 | 0.186*** | 0.433** | 0.046 | -0.242*** | ||

| (0.152) | (0.036) | (0.172) | (0.036) | (0.056) | |||

| All | 0.378** | 0.406*** | 0.652*** | 0.265*** | -0.023 | 0.219*** | |

| (0.150) | (0.029) | (0.170) | (0.026) | (0.048) | (0.031) | ||

| Non-active | -0.330* | -0.301*** | -0.055 | -0.442*** | -0.730*** | -0.488*** | -0.707*** |

| (0.174) | (0.093) | (0.192) | (0.094) | (0.103) | (0.094) | (0.092) | |

| Source: Office for National Statistics | |||||||

| Notes: | |||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01. | |||||||

| 2. A constant is included in all regressions, and all results are unweighted. We use robust standard errors. | |||||||

| 3. Data relates to firms in our linked E-commerce ABS dataset, and time period covers 2011 to 2016. | |||||||

| 4. We used industry dummies at the 2-digit level, based on the 2007 Standard Industry Classification. | |||||||

Download this table Table 12: Pairwise comparison of ICT resource intensity coefficients, Great Britain, 2011 to 2016

.xls (38.9 kB)Similar to our earlier findings, we find differences when we examine these relationships by industry. In the production industry, we find significantly higher productivity outcomes for firms in both low and high resource intensity categories, except for training employees only. However, in the services industry, only firms in the high-intensity categories show significant productivity effects.

Table 13: Multivariate analysis of ICT resource intensity by broad industry groups, Great Britain, 2011 to 2016

| Dependent variable: Log(GVA/Worker) | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Production | Production | Production | Services | Services | Services | |

| Employs ICT specialists | 0.094** | 0.310*** | ||||

| (0.03) | (0.04) | |||||

| Trains employees | 0.143*** | 0.358*** | ||||

| (0.03) | (0.03) | |||||

| Outsources | 0.139* | 0.050 | ||||

| (0.06) | (0.06) | |||||

| Employs ICT specialists only | 0.456** | 0.454** | 0.208 | 0.149 | ||

| (0.17) | (0.17) | (0.27) | (0.27) | |||

| Outsources only | 0.401*** | 0.405*** | 0.233 | 0.200 | ||

| (0.12) | (0.11) | (0.13) | (0.13) | |||

| Trains employees only | 0.271 | 0.270 | -0.209 | -0.230 | ||

| (0.21) | (0.21) | (0.30) | (0.30) | |||

| Employs and outsources | 0.405*** | 0.401*** | 0.472*** | 0.418*** | ||

| (0.12) | (0.12) | (0.12) | (0.13) | |||

| Employs and trains employees | 0.494*** | 0.474*** | 0.965*** | 0.850*** | ||

| (0.14) | (0.14) | (0.14) | (0.14) | |||

| Outsources and trains employees | 0.458*** | 0.452*** | 0.526*** | 0.465*** | ||

| (0.12) | (0.12) | (0.13) | (0.13) | |||

| Employs, outsources and trains employees | 0.589*** | 0.573*** | 0.840*** | 0.735*** | ||

| (0.12) | (0.11) | (0.12) | (0.12) | |||

| Log(employment) | 0.024* | 0.025* | 0.012 | -0.080*** | -0.079*** | -0.102*** |

| (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | |

| Foreign ownership dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Internet speed dummy | No | No | Yes | No | No | Yes |

| Location dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.210 | 0.212 | 0.215 | 0.314 | 0.318 | 0.329 |

| Observations | 5320 | 5320 | 5319 | 8173 | 8173 | 8173 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01. | ||||||

| 2. A constant is included in all regressions, and all results are unweighted. We use robust standard errors. | ||||||

| 3. Data relates to firms in our linked E-commerce ABS dataset, and time period covers 2011 to 2016. | ||||||

| 4. Where indicated, we used industry dummies at the 2-digit level, based on the 2007 Standard Industry Classification. | ||||||

Download this table Table 13: Multivariate analysis of ICT resource intensity by broad industry groups, Great Britain, 2011 to 2016

.xls (40.4 kB)Notes for: ICT intensity indicators

For more information, see ESSnet on Linking of Microdata on ICT Usage

This is in contrast to the distribution of firms on the E-commerce Survey population (See Table 15 in Annex 1), where we find a sizable share of firms (4 out of 10) having no e-commerce activity; while the largest share of firms (45%) are low-intensity users, and only 14% are high-intensity users.

Enterprise resource planning (ERP) relates to the use of software to integrate information and processes across several functions within the business, for example, planning, procurement, sales, marketing, finance or human resources; customer relationship management (CRM) relates to the use of software to collect, integrate, process and analyse information relating to customers; and supply chain management (SCM) involves exchanging information with customers and/or suppliers about the availability and delivery of products or services to the final consumer.

While the trend is similar, we find a considerably larger share of firms (59%) have no business organisation activity in 2016, in the whole e-commerce sample (see Table 15 in Annex 1). This difference illustrates the impact of the skew of our linked dataset towards large firms who are more likely to be in one of the high-intensity categories.

This question was included but rotated out after the 2006 E-commerce Survey. As such, we linked in a similar question from the ABS – whether or not the firm reported expenditure on computer-related services.

The linked E-commerce-ABS dataset covers firms with employment of 10 or more and is limited to the scope if industries covered by the E-commerce Survey. The data are also skewed towards large businesses who are more routinely sampled in both surveys (see Table 11 in Annex 1). We therefore suggest caution in interpreting these results.

8. Conclusion

In this article, we set out to explore trends in the adoption of information and communication technologies (ICT) and the intensity of use of these technologies. We find a saturation of adoption of basic ICT technologies, as these are now mainstream and integral to routine business functions. Between 2011 and 2016, we find marginal change in the share of firms engaging in e-sales and e-purchases. We also find little change in the total value of sales through e-channels over the same period.

We examine the use of ICT using intensity indicators for three categories of activities – e-commerce, business organisation and ICT resourcing. Our regression analysis shows that engaging in e-purchases and the combination of e-purchases and EDI sales have stronger correlation with productivity.

Our results show variations in productivity impacts of these ICT indicators across production and services industries. We find relatively strong productivity relationships between our e-commerce and business organisation indicators and productivity in the services industry, but less so for production. Conversely, we find stronger productivity relationships among more ICT resource intensive categories in the production industry, relative to services.

We also find positive productivity gains for engaging in multiple business organisation activities over single activities, but these are not so clear cut for the e-commerce and ICT resource intensities. While none of these results are causal – in particular, they cannot say whether more productivity businesses are more likely to undertake these activities, or whether these activities induce higher productivity – they suggest that commonly held notions about the productivity benefits of ICT can be identified in our data, and provide a platform for further work.

Nôl i'r tabl cynnwys9. References

Battistia G, Canepa A, and Stoneman P (2009), ‘e-Business usage across and within firms in the UK: profitability, externalities and policy’. Research Policy, Volume 38, Issue 1, February 2009, Pages 133 to 143

Clayton T and Criscuolo C (2002), ‘Electronic Commerce and Business Change’, Economic Trends No. 583, June 2002

Clayton T and Goodrigde P (2004), ‘E-business and labour productivity in manufacturing and services’, Economic Trends No. 609, August 2004

Comin D, and Mestieri M (2013), ‘Technology diffusion: measurement, causes and consequences’. NBER Working Paper No. 19052.

Draca M, Sadun R and Van Reenen J (2006), ‘Productivity and ICT: A Review of the Evidence’, CEP Discussion Paper No.749, August 2006

Eurostat (2012), ‘Final Report: ESSnet on Linking of Microdata on ICT Usage, November 2012

Farooqui S (2005), ‘Information and Communication Technology use and productivity’, Economic Trends, No.625, December 2005

Office for National Statistics (2017), ‘UK productivity introduction: July to September 2017’

Oulton N (2001), ‘ICT and productivity growth in the UK’, Bank of England

Nôl i'r tabl cynnwys11. Annex 1

Table 14: Size distribution of firms in linked E-commerce Annual Business Survey (ABS) dataset, Great Britain, 2008 to 2016

| % | |||||||||

| Linked E-commerce-ABS Sample (unweighted) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| 10-49 | 4 | 6 | 6 | 5 | 6 | 5 | 5 | 5 | 6 |

| 50-249 | 23 | 20 | 16 | 15 | 13 | 12 | 13 | 13 | 26 |

| 250+ | 73 | 74 | 78 | 80 | 81 | 82 | 82 | 82 | 68 |

| Total | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

| ABS population (weighted) | |||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| 10-49 | 82 | 82 | 82 | 82 | 83 | 83 | 84 | 83 | 84 |

| 50-249 | 14 | 15 | 15 | 14 | 14 | 14 | 13 | 14 | 13 |

| 250+ | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| Total | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

| Source: Office for National Statistics | |||||||||

| Notes | |||||||||

| 1. Data in the top panel show the unweighted share of firms in our linked E-Commerce ABS dataset by size-band. These data are unweighted. | |||||||||

| 2. Data in the bottom panel shows the weighted share of firms on the ABS population, consistent with the coverage of the E-Commerce Survey. | |||||||||

Download this table Table 14: Size distribution of firms in linked E-commerce Annual Business Survey (ABS) dataset, Great Britain, 2008 to 2016

.xls (29.2 kB)

Table 15: Share of firms by e-commerce intensity indicator, United Kingdom, 2008 to 2016

| % | |||||||||

| E-commerce intensity | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| Web-sales | - | 3.1 | 3.6 | 3.6 | 4.2 | 5.2 | 6 | 5.8 | 6.3 |

| EDI sales | - | 1.3 | 1.9 | 1 | 0.8 | 1.4 | 1.7 | 1.2 | 1.6 |

| E-purchases | - | 39.4 | 37.1 | 38.2 | 42.5 | 36.2 | 36.3 | 40.3 | 37 |

| Web-sales and EDI sales | - | 0.5 | 0.8 | 1.2 | 0.7 | 0.8 | 0.9 | 0.5 | 0.8 |

| Web-sales and e-purchases | - | 7.5 | 8.2 | 9 | 11 | 9.7 | 10.5 | 10.6 | 10.9 |

| EDI sales and e-purchases | - | 1.8 | 2.2 | 2.6 | 2 | 1.5 | 1.7 | 1.8 | 1.6 |

| All | - | 2.9 | 2 | 2.6 | 1.8 | 1.9 | 2 | 1.6 | 1.3 |

| None | - | 43.4 | 44.2 | 41.8 | 36.9 | 43.2 | 40.9 | 38.3 | 40.6 |

| Total | - | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

| Business organisation intensity | |||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| ERP | 1.9 | 2.2 | - | 2.3 | - | 3.2 | 3.9 | - | 4.8 |

| CRM | 10.1 | 10.2 | - | 9.2 | - | 11.3 | 14.8 | - | 15.8 |

| SCM | 1.9 | 2.1 | - | 10.9 | - | 4.8 | 3.1 | - | 3.9 |

| ERM and CRM | 1.9 | 2.2 | - | 3 | - | 4.4 | 7.5 | - | 8.9 |

| ERM and SCM | 0.6 | 0.4 | - | 1.7 | - | 1.1 | 1.4 | - | 1 |

| CRM and SCM | 2.1 | 1.6 | - | 5.1 | - | 3.1 | 3.6 | - | 3 |

| All | 0.8 | 1.1 | - | 2.4 | - | 2.5 | 3.9 | - | 4.1 |

| None | 80.6 | 80.1 | - | 65.3 | - | 69.5 | 61.7 | - | 58.5 |

| Total | 100 | 100 | - | 100 | - | 100 | 100 | - | 100 |

| ICT resource intensity | |||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| Employs and trains employees | - | - | - | 17 | - | 15 | 14 | 15 | 14 |

| Employs ICT specialists only | - | - | - | 13 | - | 9 | 8 | 8 | 8 |

| Trains employees only | - | - | - | 11 | - | 10 | 13 | 13 | 12 |

| No ICT resourcing | - | - | - | 59 | - | 67 | 65 | 63 | 66 |

| Total | - | - | - | 100 | - | 100 | 100 | 100 | 100 |

| Outsourcing (from ABS) | - | - | - | 89 | - | 88 | 89 | 88 | 86 |

| Source: Office for National Statistics | |||||||||

| Notes: | |||||||||

| 1. The data in this chart pertain to firms in the E-commerce Survey with employment of 10 or more in the UK. | |||||||||

| 2. Missing columns relate to periods when data were not collected on the E-commerce Survey. | |||||||||

Download this table Table 15: Share of firms by e-commerce intensity indicator, United Kingdom, 2008 to 2016

.xls (31.7 kB)

Figure 7: Share of UK firms by web-sales and electronic data interchange sales intensity, 2009 to 2016

Source: Office for National Statistics

Notes:

- The data in this chart pertain to firms in the E-commerce Survey with employment of 10 or more in the UK.

- Data presented in the chart are averaged across the period 2009 to 2016.