1. UK productivity flash estimate: January to March 2018

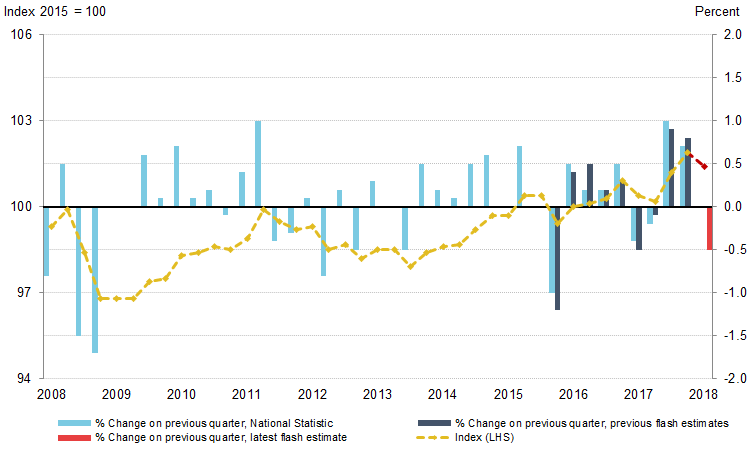

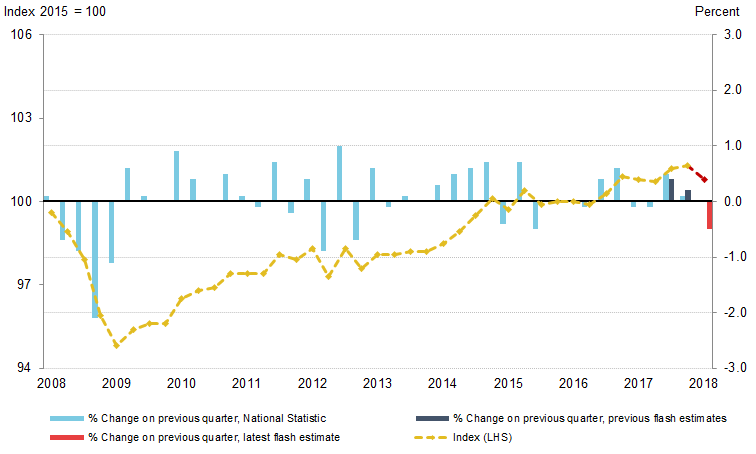

Output per hour – The Office for National Statistics’ (ONS’) main measure of labour productivity – decreased by 0.5% in Quarter 1 (Jan to March) 2018. This follows a 0.7% increase in the previous quarter (Oct to Dec) 2017 (see Figure 1). Output per worker also decreased by 0.5% (see Figure 2).

The fall in Quarter 1 was the result of a 0.1% increase in gross value added (GVA) (using the preliminary gross domestic product (GDP) estimate) accompanied by a 0.6% increase in total hours worked (using the latest Labour Force Survey data).

This flash estimate of UK productivity uses the first available information on output and labour input for the quarter. These data may be revised in subsequent months. In particular, we will publish new estimates of GVA on 25 May 2018. As such, we will release the more detailed Labour productivity bulletin after the third estimate of GDP for the quarter is published, consistent with the quarterly national accounts.

Figure 1: Percentage change on previous quarter and index of output per hour

Seasonally adjusted, Quarter 1 (Jan to Mar) 2008 to Quarter 1 (Jan to Mar) 2018, UK

Source: Office for National Statistics

Download this image Figure 1: Percentage change on previous quarter and index of output per hour

.png (23.3 kB) .xls (26.1 kB)This is the first quarterly fall in output per hour since Quarter 2 (Apr to June) 2017, and is the largest fall since Quarter 4 (Oct to Dec) 2015. Over a longer period, UK productivity growth has been relatively weak – in particular, since the onset of the economic downturn in Quarter 1 (Jan to Mar) 2008 – because of the relative strength of the labour market as compared with GDP.

Figure 2: Percentage change on previous quarter and index of output per worker

Seasonally adjusted, Quarter 1 (Jan to Mar) 2008 to Quarter 1 (Jan to Mar) 2018, UK

Source: Office for National Statistics

Download this image Figure 2: Percentage change on previous quarter and index of output per worker

.png (21.3 kB) .xls (26.1 kB)Both employment – which captures the total number of people in work – and total hours – which captures both changes in employment and working patterns – fell in the course of the economic downturn, but total hours fell further reflecting falls in the average hours of those in employment. However, as GDP fell by a larger proportion in the economic downturn than either hours or employment and has grown slowly by historical standards during the recovery, productivity growth has been subdued since the downturn and has recovered more slowly than following previous downturns.

The reduction in productivity in Quarter 1 2018 was a result of an increase in total hours worked outpacing growth in GVA. The most recent estimate of GDP indicated that the UK economy grew by 0.1% in Quarter 1 2018, which contrasts with an increase of 0.6% in total hours worked and in employment over the same period. Figure 3 shows these relative movements over the post-downturn period. It indicates that in Quarter 1 2018, the economy was around 10.3% larger than the pre-downturn level of output in Quarter 1 2008, while total hours worked and employment were around 8.1% and 9% above their pre-downturn levels respectively.

Figure 3: Index of gross value added (chained volume measure), employment level (aged 16 and over) and total hours worked (weekly)

Seasonally adjusted, Quarter 1 (Jan to Mar) 2008 to Quarter 1 (Jan to Mar) 2018, UK

Source: Office for National Statistics

Download this chart Figure 3: Index of gross value added (chained volume measure), employment level (aged 16 and over) and total hours worked (weekly)

Image .csv .xlsServices GVA grew by 0.3% in Quarter 1 2018, down from 0.4% in the previous quarter. The business services and finance sector continued to be the main driver of GVA growth in the latest quarter, growing by 0.4% over the same period, and contributing 0.14 percentage points to quarterly GDP growth. Of the services industries, telecommunications (0.03 percentage points), engineering activities (0.04 percentage points), and transport, storage and communications (0.05 percentage points) were the main drivers of GDP growth.

Production continued to grow, with a rise of 0.7% in Quarter 1 2018, contributing 0.1 percentage points to GDP growth. This was driven mainly by mining and quarrying, which grew by 3.5%. Following a fall in oil and gas production in Quarter 4 2017 largely driven by a shut down in the Forties pipeline, output recovered in Quarter 1 2018 as the pipeline system returned to normal capacity. Manufacturing growth slowed to 0.2%, which was partially offset by electricity, gas, steam and air conditioning supply growing by 2.3%.

Construction contracted by 3.3%, contributing negative 0.21 percentage points to GDP. There is some evidence of an impact of the bad weather on construction output. However, output fell across all three months of the quarter, not just during the period of bad weather.

Nôl i'r tabl cynnwys2. Data sources

Gross domestic product (GDP) data are from the Gross domestic product, preliminary estimate: January to March 2018 statistical bulletin, published on 27 April 2018.

Labour market data are from the Labour market statistics – May 2018 statistical bulletin, published on 15 May 2018.

Details of the policy governing the release of new data are available from the UK Statistics Authority.

Nôl i'r tabl cynnwys