Cynnwys

- Acknowledgements

- Main points

- Introduction

- Literature review

- Data sources

- Data quality and methodology

- Descriptive analysis of linked ABS-FDI dataset

- Foreign ownership and productivity

- Estimating the relationship between FDI and productivity

- Estimating the productivity premium of FDI firms

- Conclusion and next steps

- References

- Links to related statistics

- Annex 1 – Descriptive tables

- Authors

1. Acknowledgements

The authors wish to express their appreciation to Alice Heffernan, Matthew Parkinson, Harriet Weston, Ciaren Taylor, Sami Hamroush, Andrew Jowlet, Yanitsa Petkova, Joanne Sheppard, Ted Dolby and Rebecca Riley for their contributions to this work.

Nôl i'r tabl cynnwys2. Main points

- Between 2012 and 2015, on average, we find that foreign direct investment (FDI) firms are larger than non-FDI firms, and account for around 37% and 20% of annual turnover and employment within our population.

- Our result shows that the productivity of the median FDI firm (£59,000) is around twice that of the non-FDI firm (£28,000); the productivity of the average FDI firm (£172,000) is around three times that of the non-FDI firm (£48,000) in 2015.

- Keeping size, industry, time and region constant, firms with inward FDI were 74% more productive than non-FDI firms; taking other directions of FDI flows into account, we find higher productivity outcomes among firms with outward than inward FDI, with the highest productivity outcomes among firms with both inward and outward FDI flows.

- Our study also finds significant variation in productivity outcomes between FDI and non-FDI firms in the same industry, which are robust to controls for the characteristics of each group; we find significantly higher productivity outcomes among FDI firms in a few relatively capital intensive industries, indicating that the high productivity performance of FDI firms is not homogeneous across industries and may not exist at all in some.

3. Introduction

The link between foreign direct investment (FDI) and productivity is the subject of a large academic literature and holds considerable policy-maker interest. Firms which attract flows of investment from overseas corporations (inwards investment) are widely thought to benefit from increased investment, access to technology and expertise, as well as stronger management and organisational practices, while firms which undertake investment overseas (outwards investment) are thought to benefit from access to larger markets. A considerable proportion of the literature is also devoted to identifying the indirect impact of FDI flows on domestic firms. The literature posits that new FDI in an industry can have an impact on domestic firms in the same industry (horizontal spillovers) or on firms in the supply chain (vertical spillovers), through a wide range of transmission mechanisms. Flows of FDI are consequently thought to have considerable potential to affect firm-level productivity.

This study provides some facts about the nature of UK firms that are involved in FDI and their productivity, building on previous ONS research in this area (ONS 2017). We link firm-level FDI data on immediate foreign ownership to firm-level responses to the Annual Business Survey (ABS) for the 2012 to 2015 period to explore the composition of firms with FDI relationships (which we term FDI firms) in terms of their size and industry. We consider their contributions to turnover and employment and examine the distribution of productivity among FDI and non-FDI firms. Finally, as FDI status is non-random, we examine variations in productivity outcomes by FDI status while controlling for other factors. While our findings cannot be read as causal, this paper broadens our understanding of the dynamics of UK businesses, and therefore contributes to our understanding of the productivity puzzle.

We find that on average only around 1% of the ABS population of businesses is engaged in either inward or outward FDI over this period. However, these firms accounted for around 37% of total turnover and 20% of employment in our population between 2012 and 2015. This study also finds that FDI firms are more likely to be large, with 9% having employment of 250 or more, compared with less than 1% of non-FDI firms. Conversely, 88% of non-FDI firms are micro-firms (employing between one to nine workers), compared with just 45% of FDI firms.

Owing to this, – and other factors – we find the distribution of productivity among FDI firms skewed towards the higher end of the labour productivity distribution. Controlling for size, industry, region and time, we find FDI firms to be more productive than non-FDI firms. We also present some preliminary results which suggest that the productivity premium enjoyed by FDI firms is particularly large in some industries, including Mining and Quarrying, the utilities industries, and Professional, Scientific and Technical Activities. We plan to continue to develop these results in future releases, in particular by looking for evidence of spillovers from FDI investments, and by extending our analysis to examine the link between FDI status and multi-factor productivity (MFP) – which accounts better for the contribution of capital to production at the firm level.

The rest of this paper is organized as follows: Section 4 presents a review of the literature; Section 5 discusses our data sources and Section 6 outlines data quality issues and methodology. Section 7 presents some descriptive statistics; Section 8 examines productivity distributions, while Sections 9 and 10 presents results of our regression analysis. We present the conclusions and next steps in Section 11.

Nôl i'r tabl cynnwys4. Literature review

The relationship between foreign direct investment (FDI) and productivity has been a topic of discussion within a substantial academic literature for many years; with spillovers often cited as the link between the these concepts (Blomström, 1986; Driffield, 2001; Javorcik 2004; Godart and others 2013). Firms engage in FDI by establishing subsidiaries overseas, or by acquiring an ownership stake in an existing foreign company. Dunning (1979) suggests that firms engage in FDI when they possess some “ownership asset” which allows them to compete in foreign markets against established domestic firms. This ownership asset could take the form of access to capital flows for investment, new technology, access to new – including foreign markets, better marketing techniques and management practices. Firms with FDI flows are able to exploit these factors, manifesting in higher levels of productivity (Griffith (2002)).

The size and sign of the impact of FDI on domestic firms is a matter of some debate (Javorcik, 2004). Recent papers examining the UK context have found that the presence of (inward) FDI has a positive relationship with the productivity of domestic firms and raises productivity levels for the host country as a whole. This may reflect domestic firms benefitting from technology transfer and knowledge spillovers, through horizontal or vertical linkages. Horizontal spillovers refer to spillover effects of FDI on domestic firms within the same industry. This type of spillover can occur through imitation – copying technologies used by FDI firms – or labour mobility, involving workers moving from FDI firms to domestic firms and transferring acquired knowledge and skills. The entry of FDI firms into an industry has also been found to increase competition and productivity, by forcing domestic firms to increase their efficiency in order to remain competitive, and/or by forcing unproductive firms to exit the market (Blomström, 1986, Griffith and others 2002).

Spillovers also diffuse across industries through interactions within the supply chain, known as vertical spillovers. Backward or upstream spillovers involve efficiency gains by firms which supply intermediate products to foreign-owned clients. This spillover mechanism could take the form of higher standard of requirements from FDI firms, forcing local producers to implement new technology or improved processes; direct knowledge transfer from foreign clients to domestic suppliers; increased demand for intermediate products enabling domestic suppliers to expend production and benefit from scale economies. Similarly, in the forward or downstream supply chains, domestic firms could benefit from improved intermediate products and services and/or cheaper inputs from FDI firms as suppliers.

Griffith and others (2002) found evidence of positive FDI impact on productivity growth in the UK. Their study found the performance of FDI firms increasing the productivity frontier (best in class), and a correlation between FDI presence within an industry and a closing of the gap between the best in class (frontier firms) and those (especially) at the lower end of the productivity distribution. Similarly, Haskel and others (2002) estimate that a 10% increase in foreign presence within an industry – measured as foreign employment share – is associated with an increase in productivity (total factor productivity) of 0.5%.

This article sets out with more limited ambitions, aiming to build a platform for future research. We aim to use recent data (2012 to 2015) to assess the labour productivity performance of firms with inward, outward and both forms of FDI flows, relative to domestic firms. This provides us with new insight on the productivity performance of UK firms in a period of relatively stagnant productivity growth known as the “productivity puzzle”.

Nôl i'r tabl cynnwys5. Data sources

To examine the productivity outcomes of businesses with and without foreign direct investment (FDI) ties, we used a dataset that linked FDI with the Annual Business Survey (ABS). The FDI dataset is a comprehensive list of institutions in the UK which engage in outward or inward direct investment activities, and forms the sample frame for the quarterly and annual FDI surveys. Enterprises on the FDI dataset either (a) hold at least 10% of the ordinary shares or voting rights in an overseas corporation (outward investment) or (b) have overseas investors who hold at least 10% of their ordinary shares or voting rights (inward investment). The FDI surveys collect consolidated financial information relating direct investment in the UK by enterprises resident abroad (inward FDI) and direct investment abroad by enterprises resident in the UK (outward FDI), including earnings, flows and positions.

The Annual Business Survey (ABS) provides the financial data on turnover, intermediate purchases and “approximate gross value added” (aGVA) for calculating labour productivity in our analysis. The ABS is the main structural business survey conducted by the ONS1. It surveys around 65,000 firms on an annual basis to collect information from firms in the production, construction, distribution and services industries, representing approximately two-thirds of the UK economy2. The analysis presented in this article covers firms in Great Britain and therefore excludes Northern Ireland.

The business-specific measure of labour input that we used in this analysis was employment – including both employees and working proprietors – and was obtained from the Inter-Departmental Business Register (IDBR) at the time of sample selection of the ABS. Employment information from the IDBR is derived from a number of different sources (including the Business Register Employment Survey (BRES), HM Revenue and Customs (HMRC) records and some imputation) and some of the employment information – especially for small businesses – may be several years old. Despite this limitation, the IDBR is at present the most comprehensive source of employment information for analysis at the reporting unit level.

To estimate constant price gross value added (GVA) we used the current price data, which is collected on the ABS and an experimental set of industry deflators. These deflators were derived by allocating national accounts product level deflators to specific industries and weighting them using information on industry-level output shares from the supply and use framework. More information on these experimental deflators is available on our website.

Finally, our measure of labour productivity (GVA per worker) was calculated as aGVA at basic prices over employment. This measure differs from the ONS headline labour productivity measure, which is on a GVA per hour worked basis. Aggregate GVA from the ABS is referred to as aGVA to differentiate from the national accounts measure, of which aGVA is a component. The difference between aGVA and the national accounts measure of GVA is discussed in Ayoubkhani (2014). All data in this article are based on the 2007 Standard Industrial Classification of business activities.

We published an article on Foreign direct investment: trends and analysis, summer 2017 in July. It presented experimental statistics comparing firms with and without FDI links among other analyses. While the methodologies used to link the FDI dataset with the ABS are similar, a few differences exist, owing to different aims of each study. Firstly, in the previous paper, the FDI dataset was linked to the entire ABS population of businesses including reported and estimated data, while for this analysis we linked to the respondent ABS sample in each year, and weighted up to the ABS population. Secondly, the analysis in the FDI release focused on firms with inward FDI investment only, while this analysis utilized information on both inward and outward FDI. Finally, the July article only covered data for 2014, compared with an expanded period – 2012 to 2015 – in this article.

Notes for: Data sources

The ABS is conducted by ONS for businesses in Great Britain and separately by the Department of Finance Northern Ireland for businesses in Northern Ireland.

The ABS covers the non-financial business economy, which excludes financial services.

6. Data quality and methodology

As with any detailed study of this kind, the data sources used place some limitations on our work. The first of these relates to the coverage of the business survey data on which the analysis is based. The Annual Business Survey (ABS) covers the private, non-financial business economy of the UK, with partial coverage of firms in the financial industries. We therefore exclude industries in Section K – financial and insurance activities – from our analysis. The ABS also has no coverage of the public sector, which limits the scope of our analysis but still covers a majority of the economy by employment.

Secondly, the industry deflators used in this analysis will vary in their applicability to specific firms and may be subject to improvements in the future. Conceptually, the appropriate deflator for the output of a given industry is a weighted combination of the price indices of the products produced by that industry. In cases where the goods produced by an industry are homogeneous, or where an industry produces a very limited range of products, this industry level deflator will also be appropriate for firm-level output. However, where firms vary in their mix of production, or where there is considerable product heterogeneity, the deflator we use may be less appropriate for the output of a specific firm. This limitation – and the potential for future revision owing to the ongoing reviews of the national accounts deflators –is common in a majority of other studies in this area (for a discussion on the importance of business-level prices, see Syverson (2011)).

Finally, linking the ABS and the foreign direct investment (FDI) dataset requires some simplifying assumptions, owing to the different reporting structures of the business targeted by the two sources. While the ABS collects information from the enterprise (Reporting Unit) level of a business, the FDI surveys are primarily aimed at the enterprise group which reports collectively for all the enterprises within the group . We therefore linked the two datasets at the enterprise group level and applied FDI markers to all (ABS) enterprises whose apex units (enterprise group) were positively linked to the FDI dataset. One limitation of this linking is that we are unable to account for variations in the level of foreign investment across different enterprises which belong to the same enterprise group.

There are a few other notable differences between the analysis presented in this paper and wider research using the ABS. Much of the research in this area employs the ABS in isolation and as such is constrained to the use of the variables available therein. This means using the ABS’ “ultimate foreign owner” variable to define whether a firm has an FDI relationship. The “ultimate foreign owner” differs from the FDI dataset definition which is on an “immediate foreign owner” basis. This has two implications. Firstly differences may arise where multiple ownership levels exist, and the institution at the apex level is a UK firm . Secondly the “ultimate foreign owner” only relates to inward FDI relationships while the FDI dataset identifies firms with both inward and outward FDI relationships.

Variation between the results presented here and in the previous literature may also arise owing to the level of the business in focus. This study focuses on labour productivity, which does not account for the contribution of capital. This paper also focuses on the enterprise level (reporting unit), while others have conducted their studies at the establishment level (also called plant or local unit). Since financial information is collected on the ABS at the enterprise level, establishment level data is derived through apportionment, based on plant level employment, industry and a range of other factors.

Despite these limitations, the analysis presented in this article shows patterns that are consistent with the literature and with trends observed at the whole economy level.

Nôl i'r tabl cynnwys7. Descriptive analysis of linked ABS-FDI dataset

7.1 Population, turnover and employment

The linked ABS-FDI dataset provides information about firms on the (Annual Business Survey) ABS sample with foreign direct investment (FDI) relationships across two dimensions – inward and outward – with some overlap between the two. Table 1 shows that on average, between 2012 and 2015, around 1% of firms in the ABS population have an FDI relationship, comprising 0.8% with inward FDI, and 0.2% with outward FDI relationships. We also observe a small share of firms with both inward and outward FDI relationships, representing less than 0.1% of firms in the ABS population.

Despite accounting for a relatively small share of firms, our linked dataset shows that firms with an FDI relationship (either inward or outward) account for a disproportionately large share of total annual turnover of around 37%, and around 20% of total employment over the period. Firms with both inward and outward FDI relationships account for an average of around 3% of total turnover and 2% of employment .

Table 1: Basic descriptive statistics of linked ABS-FDI dataset, Great Britain, 2012 to 2015

| Percent | ||||||||||||

| Firms | Turnover | Employment | ||||||||||

| 2012 | 2013 | 2014 | 2015 | 2012 | 2013 | 2014 | 2015 | 2012 | 2013 | 2014 | 2015 | |

| No FDI | 99.1 | 99.0 | 98.9 | 98.9 | 62.2 | 63.8 | 63.2 | 63.6 | 80.1 | 79.8 | 79.4 | 79.3 |

| Inward | 0.8 | 0.8 | 0.8 | 0.8 | 24.9 | 23.7 | 23.2 | 22.8 | 9.8 | 9.9 | 9.8 | 10.0 |

| Outward | 0.1 | 0.2 | 0.2 | 0.3 | 12.9 | 12.5 | 13.6 | 13.6 | 10.1 | 10.3 | 10.8 | 10.7 |

| TOTAL | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Of which both | 0.01 | 0.02 | 0.02 | 0.02 | 2.5 | 2.9 | 3.1 | 2.8 | 1.5 | 1.8 | 2.1 | 2.0 |

| Source: Office for National Statistics | ||||||||||||

| Notes: | ||||||||||||

| 1. Turnover is in current prices | ||||||||||||

| 2. FDI includes firms with either inward or outward FDI relationship | ||||||||||||

| 3. Includes all firms covered by the Annual Business Survey (ABS) excluding section K (Financial and Insurance Activities), weighted to reflect the population of firms. | ||||||||||||

Download this table Table 1: Basic descriptive statistics of linked ABS-FDI dataset, Great Britain, 2012 to 2015

.xls (29.2 kB)7.2 Distribution of firms by employment size groups

As discussed in Section 5.1 the majority of firms in our ABS population have no FDI relationship. Consequently, the size distribution of firms with no FDI affiliation mirrors that of the population as a whole. On average, between 2012 and 2015, the majority of firms with no FDI relationship fall into either the micro (1 to 9 employment) or small (10 to 49 employment) size bands, accounting for 98% of firms between them. Only 1.5% of firms with no FDI have between 50 and 249 employment, and a very small proportion of firms (0.3%) with employment of over 250.

By comparison, firms with FDI are more likely to be large, with almost 1 in 10 having employment of 250 or more, and only 45% being micro-firms (1 to 9 employment). A recent ONS study found micro-firms to be the dominant size group at the bottom 10% of the labour productivity distribution (see Ardanaz-Badia, Anna, Gaganan Awano and Philip Wales, 2017). As such, the size composition of FDI firms suggests the likelihood of these firms to be at the higher end of the productivity distribution (see Section 6). It also suggests that the selection of firms which have an FDI link is far from random.

Table 2: Size distribution of firms in the ABS population by FDI status, Great Britain, 2012 to 2015

| Average (2012-2015) - Percent | |||||||

| Firm Size (by emploment) | |||||||

| 1 to 9 | 10 to 49 | 50 to 249 | 250 to 999 | 1000+ | Total | ||

| Population | 88.0 | 9.9 | 1.7 | 0.3 | 0.1 | 100 | |

| No FDI | 88.5 | 9.7 | 1.5 | 0.2 | 0.1 | 100 | |

| FDI | 45.2 | 29.0 | 16.6 | 6.1 | 3.0 | 100 | |

| Source: Office for National Statistics | |||||||

| Notes: | |||||||

| 1. Table 2 shows the average share of firms in each employment size group and by FDI status over the period 2012 to 2015. | |||||||

| 2. FDI includes firms with either inward or outward FDI relationship | |||||||

| 3. Includes all firms covered by the Annual Business Survey (ABS) excluding section K (Financial and Insurance Activities), weighted to reflect the population of firms. | |||||||

Download this table Table 2: Size distribution of firms in the ABS population by FDI status, Great Britain, 2012 to 2015

.xls (20.0 kB)7.3 Industry distribution of firms, turnover and employment by FDI status

The linked dataset that we have developed here suggests that while there are FDI firms in each high-level industry, their prevalence varies considerably. As the distribution of FDI by industry is fairly stable through time, we focus on the most recent period (2015) and present the distributions for the remaining years in Annex 2. Table 3 shows that there are some FDI firms in each industry, but that the share of industry firms, turnover and employment accounted for by FDI firms varies considerably. The highest share of FDI firms was in the Manufacturing (2.6%), Non-manufacturing production (1.8%) and Distribution, hotels and restaurants industries (1.6%). Construction and Other services industries had the lowest shares of FDI firms at 0.4% and 0.3% respectively.

Despite their relatively small numbers, FDI firms account for a sizeable share of total industry turnover, with the highest shares in Non-manufacturing production (at 73%), Transport storage and communication (at 45%) and Distribution, hotels and restaurants (at 43%), while the least share of around 14% was in Construction. This is consistent with the relatively large size of FDI firms observed in Table 2, and shows a substantial contribution by FDI firms to total industry output.

The distribution of workers also shows a more varied pattern among FDI firms relative to non-FDI firms. Possibly owing to the concentration and global nature of firms in mining and quarrying industries, the share of workers in FDI firms in Non-manufacturing production was on par with non-FDI firms at 50%. Similarly, Distribution, hotels and restaurants, and Transport storage and communication, which are also known to have large global chains have relatively large FDI worker shares, albeit at a lower level than workers in non-FDI firms in the same industries. The share of turnover and workers in Construction and Other services industries are notably low, but higher than their share of firms. A notable observation across the industries, the greater share of FDI turnover than the FDI share of employment (the reverse is true for no FDI), such that turnover per head is greater on average for FDI firms than no FDI firms.

Table 3: Distribution of firms, turnover and employment by industry and FDI status, Great Britain, 2015

| Percent | ||||||

| Firms | Turnover | Employment | ||||

| Industry | No FDI | FDI | No FDI | FDI | No FDI | FDI |

| Non-Manufacturing Production | 98.2 | 1.8 | 27.2 | 72.8 | 50.3 | 49.7 |

| Manufacturing | 97.4 | 2.6 | 61.1 | 38.9 | 72.8 | 27.2 |

| Construction | 99.6 | 0.4 | 86.4 | 13.6 | 91.7 | 8.3 |

| Services: Distribution, hotels and restaurants | 98.4 | 1.6 | 57.4 | 42.6 | 67.9 | 32.1 |

| Services: Transport, storage and communication | 98.8 | 1.2 | 54.7 | 45.3 | 70.1 | 29.9 |

| Services: Business and Real Estate | 99.0 | 1.0 | 73.5 | 26.5 | 82.3 | 17.7 |

| Services: Other | 99.7 | 0.3 | 77.5 | 22.5 | 93.4 | 6.6 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Turnover is in current prices | ||||||

| 2. FDI includes firms with either inward or outward FDI relationship | ||||||

| 3. Includes all firms covered by the Annual Business Survey (ABS) excluding section K (Financial and Insurance Activities), weighted to reflect the population of firms. | ||||||

| 4. Key: | ||||||

| Non-Manufacturing Production equals Section A (Agriculture, Forestry and Fishing), B (Mining and Quarrying), D (Electricity, Gas, Steam and Air Conditioning Supply) and E (Water Supply; Sewerage, Waste Management and Remediation Activities). | ||||||

| Manufacturing equals Section C (Manufacturing). | ||||||

| Construction equals Section F (Construction). | ||||||

| Services: Distribution, hotels and restaurants equals Sections G (Wholesale and Retail Trade; Repair of Motor Vehicles and Motorcycles) and I (Accommodation and Food Service Activities). | ||||||

| Services: Transport, storage, and communication equals Sections H (Transportation and Storage) and J (Information and Communication). | ||||||

| Services: Business and Real Estate equals Sections L (Real Estate Activities), M (Professional, Scientific and Technical Activities) and N (Administrative and Support Service Activities). | ||||||

| Services: Other equals Sections P (Education), Q (Human Health and Social Work Activities), R (Arts, Entertainment and Recreation) and S (Other Service Activities). | ||||||

Download this table Table 3: Distribution of firms, turnover and employment by industry and FDI status, Great Britain, 2015

.xls (30.2 kB)8. Foreign ownership and productivity

8.1 Descriptive statistics

In this section we examine productivity outcomes and distributions for firms with and without foreign direct investment (FDI) by various characteristics. Between 2012 and 2015, we find the level of productivity of the median FDI firm to be at least twice that of the non-FDI firm, while the mean productivity level for the FDI firms was at least three times that of the non-FDI firms (Table 4) . We observe similar ratios when we compare the productivity of the average non-FDI firm with the average productivity of firms with either an inward or outward FDI relationship.

Table 4: Mean and median of real labour productivity by FDI status, Great Britain, 2012 to 2015

| £, 000 per worker per year | |||||||||||||||

| Median | Mean | Of which mean of: | |||||||||||||

| No FDI | FDI | No FDI | FDI | Inward FDI | Outward FDI | ||||||||||

| 2012 | 25.3 | 61.6 | 44.3 | 123.0 | 125.5 | 119.2 | |||||||||

| 2013 | 26.5 | 53.4 | 47.5 | 156.8 | 159.2 | 161.7 | |||||||||

| 2014 | 27.1 | 63.3 | 48.6 | 153.4 | 165.7 | 109.0 | |||||||||

| 2015 | 27.7 | 59.3 | 48.3 | 172.7 | 185.6 | 140.3 | |||||||||

| Source: Office for National Statistics | |||||||||||||||

| Notes: | |||||||||||||||

| 1. Labour productivity is calculated as GVA/employment, in 2015 constant prices. | |||||||||||||||

| 2. FDI includes firms with either inward or outward FDI relationship. In the final two columns, FDI has been split between these different relationships. | |||||||||||||||

| 3. Includes all firms covered by the Annual Business Survey (ABS) excluding section K (Financial and Insurance Activities), weighted to reflect the population of firms. | |||||||||||||||

Download this table Table 4: Mean and median of real labour productivity by FDI status, Great Britain, 2012 to 2015

.xls (29.2 kB)While the time-period covered here is comparatively short, these data suggest that there have been some considerable changes in the distribution of firm-level productivity for FDI firms in particular. While the average level of labour productivity – whether measured on a mean or median basis – has increased for non-FDI firms, the pattern for FDI firms is less clear. Median productivity for FDI firms has fluctuated over the period, but is largely unchanged over these four years. However, mean labour productivity for FDI firms has increased by around 38% over this period. This suggests a marked increase in the output per worker of FDI firms towards the top of the labour productivity distribution (see Table 7, annex 1).

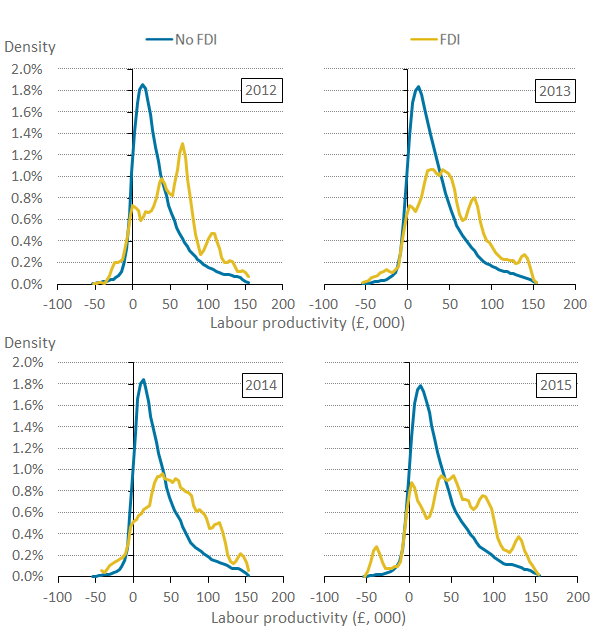

8.2 Distribution of firm-level productivity by FDI status

Figure 1 shows the labour productivity distribution of FDI and non-FDI firms in the ABS population between 2012 and 2015 . The left-hand tail of the distribution shows firms with lower levels of productivity, while the right-hand tail shows firms with higher productivity levels. We observe that the productivity distribution of non-FDI firms is smoother than for FDI firms, with a critical mass around the £10,000 to £20,000 value added per worker per year region. The productivity distribution of FDI firms is much less smooth, reflecting smaller sample sizes, and more dispersed. It also appears to be further to the right than the distribution of labour productivity for domestic firms, indicating a higher share of firms at higher levels of productivity. This is supported by the large difference in productivity of the median firm within the two groups (Table 4). However, this effect is not uniform: there is a notable cluster of low productivity FDI firms at the left-hand tail of the distribution, which may reflect one or a combination of factors such as the difficulty faced by new foreign affiliates in relatively new markets or simply outperformed FDI enterprises.

Figure 1: Labour productivity distribution by FDI status

Great Britain, 2012 to 2015

Source: Office for National Statistics

Notes:

Kernel Density, Bandwidth size = 4.

The sample used is constrained between minus £50,000 and plus £150,000 output per worker.

Labour productivity is calculated as GVA/employment, in 2015 constant prices.

FDI includes firms with either inward or outward FDI relationship.

Firms can have negative levels of value added per worker in specific periods when they report larger values of purchases than their total turnover.

Includes all firms covered by the Annual Business Survey (ABS) excluding section K (Financial and Insurance Activities), weighted to reflect the population of firms.

Download this image Figure 1: Labour productivity distribution by FDI status

.png (36.1 kB) .xls (26.9 kB)In Figure 2, we present the share of firms at each percentile of the productivity distribution, allowing us to highlight the disparity in productivity levels between FDI firms and non-FDI firms. In this visualisation, points above (below) the 45 degree line indicate positions at which there are greater shares of FDI firms at lower (higher) productivity percentiles, compared to the population. The trend for each year is broadly similar, with a larger proportion of FDI firms in higher productivity percentiles than the sample as a whole. Taking the years together around 25% of firms with FDI relationships have output per worker below the median, meaning almost 75% of FDI firms can be considered “above average” in productivity terms. Furthermore, around 30% of firms with and FDI relationship are in the 90th percentile, highlighting the disproportionate share of FDI firms with relatively high productivity levels. As with Figure 1, we observe a notable share of FDI firms in the bottom 10%, above the 45 degree line.

Figure 2: Productivity distribution of FDI firms by percentile of the productivity distribution of all firms

Great Britain, 2012 to 2015

Source: Office for National Statistics

Notes:

Labour productivity is calculated as GVA/employment, in 2015 constant prices.

FDI includes firms with either inward or outward FDI relationship.

Includes all firms covered by the Annual Business Survey (ABS) excluding sections K (Financial and Insurance Activities), weighted to reflect the population of firms

Download this chart Figure 2: Productivity distribution of FDI firms by percentile of the productivity distribution of all firms

Image .csv .xls8.3 Distribution of firm level productivity by FDI status and size

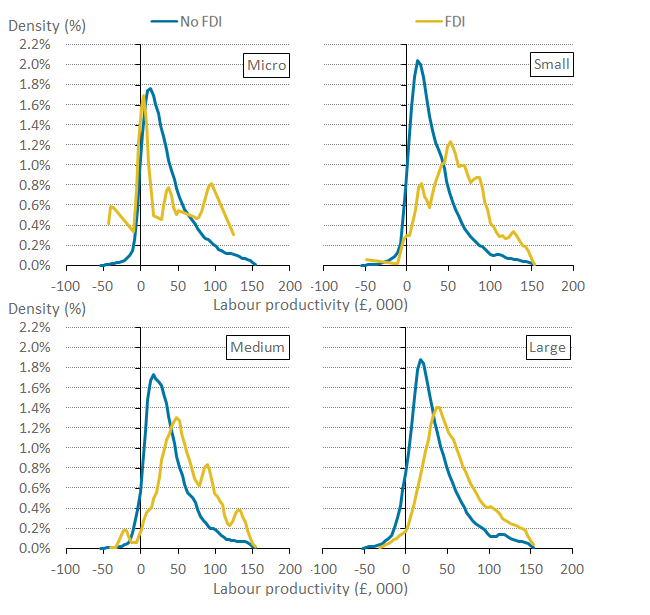

While these differences in labour productivity at FDI and non-FDI firms are striking, they will in part reflect the mix of firms present in each group. This makes it difficult to assess whether it is the presence of FDI that is related to productivity, or whether FDI firms are simply more likely to have characteristics which contribute to high productivity. This section and the following section attempt to decompose this difference, before some conditional analysis is set out in Section 9.

Size is one characteristic which is closely related to labour productivity. Comparing FDI and non-FDI firms of similar sizes allows for a distinction to be made between differences in productivity and differences arising due to the composition of these firms (in terms of employment size). Figure 3 shows the distribution of output per worker for FDI and non-FDI firms for micro-firms (1 to 9 employment – top left-hand panel), small firms (10 to 49 employment – top right-hand panel), medium firms (50 to 249 employment – bottom left-hand panel) and large firms (250 or more employment – bottom right-hand panel) in 2015.

Among larger businesses, these data show a marked rightwards shift in the labour productivity of FDI firms relative to that of non-FDI firms. For larger, medium-sized and – albeit to a lesser extent – small firms, the mass of the labour productivity distribution among FDI firms is located to the right of the equivalent mass for non-FDI firms – indicating that even within firms of similar sizes, those with FDI are more likely to be more productive. The higher share of more productive FDI firms may be a result of a combination of factors discussed in Section 4, including being more capital intensive, have better access to and sharing of international best practice, superior technology, benefits of economies of scale, and better management practices .

This relationship is considerably less clear for the smallest businesses. Among these firms, we observe a higher concentration of low-productivity FDI firms – the left-hand tail of the distributions – which plays a large part in explaining the relatively high concentration of low productivity firms in the FDI population in Figure 1. Further research into this FDI size band, such as their age profiles, may help explain this trend.

Figure 3: Labour productivity distribution for firms with and without an FDI relationship, by size

Great Britain, 2015

Source: Office for National Statistics

Notes:

Kernel Density, Bandwidth size = 4.

The sample used is constrained between minus £50,000 and plus £150,000 output per worker.

Labour productivity is calculated as GVA/employment, in 2015 constant prices.

FDI includes firms with either inward or outward FDI relationship.

Firms can have negative levels of value added per worker in specific periods when they report larger values of purchases than their total turnover.

Includes all firms covered by the Annual Business Survey (ABS) excluding section K (Financial and Insurance Activities), weighted to reflect the population of firms.

Key: Micro equals employment of 1 to 9; Small equals employment of 10 to 49; Medium equals employment of 50 to 249; Large equals employment of 250 and above.

Download this image Figure 3: Labour productivity distribution for firms with and without an FDI relationship, by size

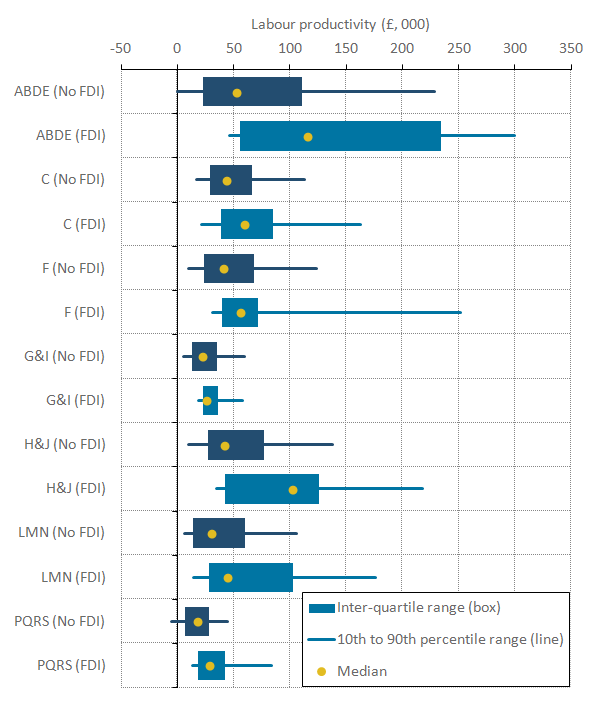

.png (37.8 kB) .xls (75.8 kB)8.4 Distribution of firm level productivity of by industry and FDI status

The industry mix of FDI and non-FDI firms may also play an important role in explaining these labour productivity trends. A previous study (ONS 2016) found notable variation in the distribution of productivity across industries, and if FDI firms are concentrated in some high-productivity industries, this may also affect their average labour productivity. To partially address this, Figure 4 presents summary information on the labour productivity distribution by industry for FDI and non-FDI firms. It shows the productivity of the median firm (the dots), the 10th and 90th percentiles (the lines) and the inter-quartile range (that is, the difference between the 75th and 25th percentiles – the bars) for each industry group in 2015, allowing comparisons of the labour productivity of FDI and non-FDI firms within industries.

Figure 4 highlights several striking features of the performance of FDI and non-FDI firms. Firstly, it is apparent that median labour productivity was higher for FDI firms than for domestic firms in all these high level industries in 2015. This difference was particularly marked in the production industries (ABDE) and Transport, Storage and Communication Services (H and J). Secondly, the gap in productivity between the 10th percentile – the least productive firms – and the 90th percentile – the most productive – varies markedly across industries, but is typically wider for FDI firms. This suggests that while average productivity among FDI firms is higher, they also have a wider dispersion of productivity levels. Finally, all three summary statistics – the median, inter-quartile range and the 10th to 90th percentiles – are shifted to the right for FDI firms relative to non-FDI firms. This suggests that while industry composition may be important in explaining the average performance of FDI firms relative to non-FDI firms, there also appears to be some additional premium associated with FDI status within industry.

Figure 4: Labour productivity distribution by industry and FDI status

Great Britain, 2015

Source: Office for National Statistics

Notes:

Tails (lines) represent the 10th to 90th percentiles, boxes represent the inter-quartile ranges, and dots show medians.

Labour productivity is calculated as GVA/employment, in 2015 constant prices.

FDI includes firms with either inward or outward FDI relationship

Includes all firms covered by the Annual Business Survey (ABS) excluding sections K (Financial and Insurance Activities).

Firms can have negative levels of value added per worker in specific periods when they report larger values of purchases than their total turnover.

Key:

ABDE – Non-manufacturing production: A (Agriculture, Forestry and Fishing), B (Mining and Quarrying), D (Electricity, Gas, Steam and Air Conditioning Supply) and E (Water Supply; Sewerage, Waste Management and Remediation Activities).

C – Manufacturing

F – Construction

G&I – Distribution, Hotels & Restaurants Services: G (Wholesale and Retail Trade; Repair of Motor Vehicles and Motorcycles) and I (Accommodation and Food Service Activities).

H&J – Transport, Storage & Communication Services: H (Transportation and Storage) and J (Information and Communication).

LMN – Business Services & Real Estate: L (Real Estate Activities), M (Professional, Scientific and Technical Activities) and N (Administrative and Support Service Activities).

PQRS – Other Services: P (Education), Q (Human Health and Social Work Activities), R (Arts, Entertainment and Recreation) and S (Other Service Activities).

Download this image Figure 4: Labour productivity distribution by industry and FDI status

.png (22.4 kB) .xlsx (10.6 kB)9. Estimating the relationship between FDI and productivity

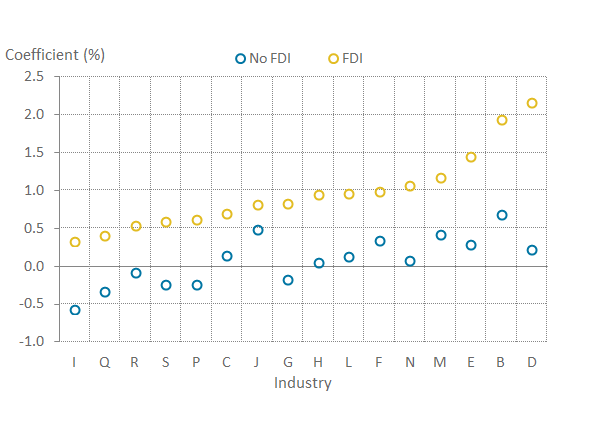

While the preceding sections suggest that foreign direct investment (FDI) firms have higher labour productivity on average than non-FDI firms, these results are likely to reflect a mix of different effects. In particular, as the composition of FDI firms in terms of their industry, size and other characteristics varies from non-FDI firms, it can be difficult to separate an association between FDI status and productivity from the effect of these compositional differences on productivity. In this section, we employ regression analysis to estimate the robustness of the findings in previous sections, examining the link between FDI and productivity while controlling for variations in size, industry, time and region . In our regression models, we use real labour productivity (in log form) as our dependent variable, and categorical variables to control for five size groups (1 to 9, 10 to 49, 50 to 249, 250 to 999 and 1000 plus, in terms of employment), 17 industry groups, the location of businesses (11 regions of Great Britain) and time trends (for the period 2012 to 2015). While our results cannot be read as the causal impact of FDI on labour productivity, they make an attempt to delineate the association between FDI and productivity and that between other firm level characteristics associated with FDI and productivity.

In Table 5 we start with a simple model and add extra independent variables in order to observe their effect on the relationship we establish in the initial model. In our first model (column 1), we find FDI firms to be around 85% more productive than firms with no FDI . In specifications 2 to 5, we sequentially add controls for time, size, industry and region. In our most parsimonious specification, the coefficient on FDI status is slightly smaller but robust when controlled for size, industry, time and regional location of the enterprise (column 5).

In column 6, we use separate dummies for inward, outward and both forms of FDI, and find significant positive coefficients on the FDI marker for all three groups, indicating higher levels of productivity irrespective of the direction of FDI flows. However, we observe larger coefficients for FDI firms who engage in outward than inward FDI, and even larger coefficients for firms with both inward and outward FDI. This indicates higher productivity outcomes for firms with both FDI flows, relative to those with a single direction. These outcomes are robust controlling for size, industry, time and region. Coefficients on these other variables appear broadly consistent with conventional results in the literature. In particular, the coefficients suggest that larger businesses are more productive than smaller firms – although the size of this productivity premium declines somewhat among the largest firms with at least 1,000 employees.

Table 5: Multivariate analysis of labour productivity among FDI and non-FDI firms, Great Britain, 2012 to 2015

| Dependent variable: logarithm of labour productivity | ||||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| FDI | 0.847*** | 0.845*** | 0.823*** | 0.765*** | 0.732*** | |

| (0.04) | (0.04) | (0.05) | (0.05) | (0.05) | ||

| Micro-firms | - | - | - | - | ||

| (.) | (.) | (.) | (.) | |||

| Small firms | -0.034*** | 0.137*** | 0.142*** | 0.142*** | ||

| (0.01) | (0.01) | (0.01) | (0.01) | |||

| Medium firms | 0.140*** | 0.281*** | 0.285*** | 0.283*** | ||

| (0.01) | (0.01) | (0.01) | (0.01) | |||

| Large firms | 0.140*** | 0.267*** | 0.270*** | 0.264*** | ||

| (0.01) | (0.01) | (0.01) | (0.01) | |||

| Very large firms | -0.069*** | 0.079*** | 0.067** | 0.056** | ||

| (0.02) | (0.02) | (0.02) | (0.02) | |||

| No FDI | - | |||||

| (.) | ||||||

| Inward FDI only | 0.741*** | |||||

| (0.05) | ||||||

| Outward FDI only | 0.771*** | |||||

| (0.07) | ||||||

| Inward and Outward | 0.943*** | |||||

| (0.11) | ||||||

| Time dummies | No | Yes | Yes | Yes | Yes | Yes |

| Industry dummies | No | No | No | Yes | Yes | Yes |

| Region dummies | No | No | No | No | Yes | Yes |

| R-squared | 0.004 | 0.004 | 0.005 | 0.061 | 0.066 | 0.066 |

| Observations | 172668 | 172668 | 172668 | 172668 | 172668 | 172668 |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01 | ||||||

| 2. The time period covers 2012 to 2015 | ||||||

| 3. Where indicated, we used 17 industry dummies, based on the 2007 Standard Industry Classification, covering Sections A to S with the exclusion of Sections K (Financial and Insurance Activities) and Section O (Public Administration and Defence). | ||||||

| 4. A constant is included in all regressions, and all results are weighted | ||||||

| 5. Labour productivity is measured as output per worker (GVA/employment) in 2015 constant prices. | ||||||

| 6. FDI includes firms with either inward or outward FDI relationship. In model 6, FDI has been split between these different relationships. | ||||||

Download this table Table 5: Multivariate analysis of labour productivity among FDI and non-FDI firms, Great Britain, 2012 to 2015

.xls (31.2 kB)11. Conclusion and next steps

The link between Foreign Direct Investment (FDI) and productivity is the subject of a large academic literature and holds considerable policy-maker attention. Analyses in this area have previously shown that FDI is associated with stronger industry-level productivity, and studies for the UK have also shown some evidence that flows of inwards FDI can influence the performance of domestic plants through a number of spillover channels. We set out to examine the characteristics and productivity outcomes of FDI firms in our ABS population. In particular, we find that FDI firms have higher labour productivity than non-FDI firms on average. Median labour productivity among FDI firms is twice that among non-FDI firms in 2015, while mean labour productivity among FDI firms is closer to three times higher than non-FDI firms in the same period.

We examine the characteristics of FDI firms and find that they are typically larger than non-FDI firms, and relatively concentrated in the UK’s production industries, although they also account for a relatively large share of employment and turnover in several services industries. The FDI productivity premium is consistent across firms of all sizes with the exception of micro-firms, where we found a cluster of FDI firms at the lower tail of the productivity distribution. We also observe higher median productivity among FDI firms across all industries. Taking the direction of FDI flows into account, we find higher productivity among firms with outward than inward FDI, but the highest productivity outcomes were among firms with both inward and outward FDI links.

As FDI status is non-random, we also present conditional analysis which attempts to identify the link between FDI and productivity while controlling for the other characteristics of the firm. In our conditional analysis, we find statistically significant evidence of higher productivity performance among FDI firms, when controlling for size, industry, time and region. Our study also finds significant variation in productivity outcomes between FDI and non-FDI firms in the same industry which are robust to controls for the characteristics of each group. Here we find significantly higher productivity outcomes among FDI firms in a few relatively capital intensive industries, indicating that the high productivity performance of FDI firms is not homogeneous across industries and may not exist at all in some.

These results take us a step further in understanding of the nature of firm performance at the top end of the productivity distribution in particular. However, they are only a first step, and there are several areas for further analysis. Firstly, we intend to develop this work to examine the relationship between FDI presence and the productivity of domestic firms. Second, we plan to increase the granularity of our analysis to examine – in particular – whether there is more variation at the detailed industry level than presented here. Thirdly, we plan to extend our analysis to consider the impact of FDI status and presence on measures of multi-factor productivity, which can better account for the contribution of capital to output. Finally, further work in this area will involve exploring the relatively low productivity micro-FDI firms, with particular focus on new (greenfield) FDI, and the links between FDI, trade and productivity.

Nôl i'r tabl cynnwys12. References

Ardanaz-Badia, A, Awano, G and Wales, P (2017) “Labour productivity measures from the Annual Business Survey: 2006 to 2015”, Office for National Statistics

Awano, G, Heffernan, A and Robinson, H (2017) “Management practices and productivity among manufacturing businesses in Great Britain: Experimental estimates for 2015”, Office for National Statistics

Ayoubkhani, D (2014) “A comparison between Annual Business Survey and National Accounts of Value Added”, Office for National Statistics

Driffield, N (2001), “The Impact on Domestic Productivity of Inward Investment in the UK”. The Manchester School, Volume 69, Issue 1, 103 to 119, January 2001.

Blomström, M (1986) “Foreign Investment and Productive Efficiency: The Case of Mexico”. The Journal of Industrial Economics, Vol. 35, No. 1 (Sep., 1986), pages 97 to 110.

Driffield, N (2001) “The Impact on Domestic Productivity of Inward Investment in the UK”. The Manchester School, Vol 69, No. 1( January 2001), pages 103 to 119.

Dunning, J H (1979). `Explaining Patterns of International Production: In Defence of the Eclectic Theory', Oxford Bulletin of Economics and Statistics, Vol. 41, No. 4, ppages 269 to 295.

Evans, P, and Welpton, R (2009) “Business Structure Database – The Inter-Departmental Business Register (IDBR) for Research”. Economic & Labour Market Review, Volume 3, No 6, June 2009.

Godart, ON, and Görg, H. (2013) “Suppliers of multinationals and the forced linkage effect: Evidence from firm level data”. Journal of Economic Behavior & Organization 94 (2013), pages 393 to 404.

Griffith, R, Redding, S, and Simpson, H (2002) “Productivity Convergence and Foreign Ownership at the Establishment Level”. The Institute for Fiscal Studies, WP02/22.

Haskel, J, Pereira, S, Slaughter, M (2002), “Does Inward Foreign Direct Investment Boost the Productivity if Domestic Firms?”. NBER Working Parer Series, Working Paper 8724.

Javorcik. BS (2004) “Does Foreign Direct Investment Increase the Productivity of Domestic Firms? In Search of Spillovers Through Backward Linkages”. The American Economic Review, Vol. 94, No 3, (June 2004), pages 605 to 627.

ONS, (2015), Balance of Payments annual geographical data tables, downloaded on 21 September 2017, Office for National Statistics

Syverson, C. (2011) ‘What determines productivity?’ Journal of Economic literature, 49:2, 326 to 365

Nôl i'r tabl cynnwys14. Annex 1 – Descriptive tables

Table 7: Descriptive statistics of real labour productivity by FDI status, Great Britain, 2015

| £, 000 per worker per year | |||||||||||||||

| 10th Percentile | 25th Percentile | Median Percentile | 75th Percentile | 90th Percentile | Standard Deviation | ||||||||||

| Year | No FDI | FDI | No FDI | FDI | No FDI | FDI | No FDI | FDI | No FDI | FDI | No FDI | FDI | |||

| 2012 | 1.3 | 0.0 | 10.7 | 25.9 | 25.3 | 61.6 | 50.7 | 104.1 | 90.6 | 190.5 | 493.1 | 1411.6 | |||

| 2013 | 1.9 | 1.7 | 10.9 | 25.4 | 26.5 | 53.4 | 52.5 | 102.1 | 92.6 | 220.7 | 493.9 | 2098.3 | |||

| 2014 | 2.2 | -1.7 | 11.3 | 28.3 | 27.1 | 63.3 | 54.3 | 115.8 | 96.6 | 196.7 | 505.8 | 2103.4 | |||

| 2015 | 2.6 | -0.8 | 11.9 | 23.3 | 27.7 | 59.3 | 54.8 | 107.8 | 95.5 | 224.3 | 537.6 | 2127.5 | |||

| Source: Office for National Statistics | |||||||||||||||

| Notes: | |||||||||||||||

| 1. Labour productivity is calculated as GVA/employment, in 2015 constant prices. | |||||||||||||||

| 2. FDI includes firms with either inward or outward FDI relationship | |||||||||||||||

| 3. Includes all firms covered by the Annual Business Survey (ABS) excluding section K (Financial and Insurance Activities), weighted to reflect the population of firms. | |||||||||||||||

Download this table Table 7: Descriptive statistics of real labour productivity by FDI status, Great Britain, 2015

.xls (29.2 kB)

Table 8: Industry distribution of firms by FDI status and year, Great Britain, 2012 to 2015

| Percent | ||||||||||||||||||

| No FDI | FDI | |||||||||||||||||

| Industry | 2012 | 2013 | 2014 | 2015 | 2012 | 2013 | 2014 | 2015 | ||||||||||

| Non-Manufacturing Production | 98.8 | 98.6 | 97.2 | 98.2 | 1.2 | 1.4 | 2.8 | 1.8 | ||||||||||

| Manufacturing | 97.2 | 97.2 | 97.3 | 97.4 | 2.8 | 2.8 | 2.7 | 2.6 | ||||||||||

| Construction | 99.9 | 99.7 | 99.7 | 99.6 | 0.1 | 0.3 | 0.3 | 0.4 | ||||||||||

| Services: Distribution, hotels and restaurants | 98.7 | 98.7 | 98.6 | 98.4 | 1.3 | 1.3 | 1.4 | 1.6 | ||||||||||

| Services: Transport, storage and communication | 98.7 | 98.8 | 98.7 | 98.8 | 1.3 | 1.2 | 1.3 | 1.2 | ||||||||||

| Services: Business and Real Estate | 99.2 | 99.2 | 99.0 | 99.0 | 0.8 | 0.8 | 1.0 | 1.0 | ||||||||||

| Services: Other | 99.7 | 99.7 | 99.7 | 99.7 | 0.3 | 0.3 | 0.3 | 0.3 | ||||||||||

| Source: Office for National Statistics | ||||||||||||||||||

| Notes: | ||||||||||||||||||

| 1. FDI includes firms with either inward or outward FDI relationship | ||||||||||||||||||

| 2. Includes all firms covered by the Annual Business Survey (ABS) excluding section K (Financial and Insurance Activities), weighted to reflect the population of firms. | ||||||||||||||||||

| 3. Key: | ||||||||||||||||||

| Non-Manufacturing Production equals Section A (Agriculture, Forestry and Fishing), B (Mining and Quarrying), D (Electricity, Gas, Steam and Air Conditioning Supply) and E (Water Supply; Sewerage, Waste Management and Remediation Activities). | ||||||||||||||||||

| Manufacturing equals Section C (Manufacturing). | ||||||||||||||||||

| Construction equals Section F (Construction). | ||||||||||||||||||

| Services: Distribution, hotels and restaurants equals Sections G (Wholesale and Retail Trade; Repair of Motor Vehicles and Motorcycles) and I (Accommodation and Food Service Activities). | ||||||||||||||||||

| Services: Transport, storage, and communication equals Sections H (Transportation and Storage) and J (Information and Communication). | ||||||||||||||||||

| Services: Business and Real Estate equals Sections M (Professional, Scientific and Technical Activities) and N (Administrative and Support Service Activities) and L (Real Estate Activities). | ||||||||||||||||||

| Services: Other equals Sections P (Education), Q (Human Health and Social Work Activities), R (Arts, Entertainment and Recreation) and S (Other Service Activities). | ||||||||||||||||||

Download this table Table 8: Industry distribution of firms by FDI status and year, Great Britain, 2012 to 2015

.xls (29.7 kB)

Table 9: Employment shares among firms by FDI status and year, Great Britain, 2012 to 2015

| Percent | ||||||||||||||||||

| No FDI | FDI | |||||||||||||||||

| Industry | 2012 | 2013 | 2014 | 2015 | 2012 | 2013 | 2014 | 2015 | ||||||||||

| Non-Manufacturing Production | 49.0 | 47.8 | 47.6 | 50.3 | 51.0 | 52.2 | 52.4 | 49.7 | ||||||||||

| Manufacturing | 74.7 | 73.6 | 72.9 | 72.8 | 25.3 | 26.4 | 27.1 | 27.2 | ||||||||||

| Construction | 91.6 | 91.8 | 91.1 | 91.7 | 8.4 | 8.2 | 8.9 | 8.3 | ||||||||||

| Services: Distribution, hotels and restaurants | 68.8 | 68.8 | 68.5 | 67.9 | 31.2 | 31.2 | 31.5 | 32.1 | ||||||||||

| Services: Transport, storage and communication | 72.3 | 69.6 | 69.1 | 70.1 | 27.7 | 30.4 | 30.9 | 29.9 | ||||||||||

| Services: Business and Real Estate | 83.6 | 83.6 | 82.6 | 82.3 | 16.4 | 16.4 | 17.4 | 17.7 | ||||||||||

| Services: Other | 93.7 | 94.5 | 93.8 | 93.4 | 6.3 | 5.5 | 6.2 | 6.6 | ||||||||||

| Source: Office for National Statistics | ||||||||||||||||||

| Notes: | ||||||||||||||||||

| 1. FDI includes firms with either inward or outward FDI relationship | ||||||||||||||||||

| 2. Includes all firms covered by the Annual Business Survey (ABS) excluding section K (Financial and Insurance Activities), weighted to reflect the population of firms. | ||||||||||||||||||

| 3. Key: | ||||||||||||||||||

| Non-Manufacturing Production equals Section A (Agriculture, Forestry and Fishing), B (Mining and Quarrying), D (Electricity, Gas, Steam and Air Conditioning Supply) and E (Water Supply; Sewerage, Waste Management and Remediation Activities). | ||||||||||||||||||

| Manufacturing equals Section C (Manufacturing). | ||||||||||||||||||

| Construction equals Section F (Construction). | ||||||||||||||||||

| Services: Distribution, hotels and restaurants equals Sections G (Wholesale and Retail Trade; Repair of Motor Vehicles and Motorcycles) and I (Accommodation and Food Service Activities). | ||||||||||||||||||

| Services: Transport, storage, and communication equals Sections H (Transportation and Storage) and J (Information and Communication). | ||||||||||||||||||

| Services: Business and Real Estate equals L (Real Estate Activities), Sections M (Professional, Scientific and Technical Activities) and N (Administrative and Support Service Activities). | ||||||||||||||||||

| Services: Other equals Sections P (Education), Q (Human Health and Social Work Activities), R (Arts, Entertainment and Recreation) and S (Other Service Activities). | ||||||||||||||||||

Download this table Table 9: Employment shares among firms by FDI status and year, Great Britain, 2012 to 2015

.xls (21.5 kB)

Table 10: Industry distribution of turnover by FDI status and year, Great Britain, 2012 to 2015

| Percent | |||||||||

| No FDI | No FDI | ||||||||

| Industry | 2012 | 2013 | 2014 | 2015 | 2012 | 2013 | 2014 | 2015 | |

| Non-Manufacturing Production | 26.4 | 23.8 | 26.1 | 27.2 | 73.6 | 76.2 | 73.9 | 72.8 | |

| Manufacturing | 59.9 | 60.2 | 59.4 | 61.1 | 40.1 | 39.8 | 40.6 | 38.9 | |

| Construction | 86.3 | 86.8 | 86.8 | 86.4 | 13.7 | 13.2 | 13.2 | 13.6 | |

| Services: Distribution, hotels and restaurants | 55.1 | 58.5 | 58.4 | 57.4 | 44.9 | 41.5 | 41.6 | 42.6 | |

| Services: Transport, storage and communication | 56.7 | 54.5 | 54.1 | 54.7 | 43.3 | 45.5 | 45.9 | 45.3 | |

| Services: Business and Real Estate | 76.4 | 75.5 | 74.1 | 73.5 | 23.6 | 24.5 | 25.9 | 26.5 | |

| Services: Other | 79.7 | 80.4 | 72.8 | 77.5 | 20.3 | 19.6 | 27.2 | 22.5 | |

| Source: Office for National Statistics | |||||||||

| Notes: | |||||||||

| 1. Turnover is in current prices | |||||||||

| 2. FDI includes firms with either inward or outward FDI relationship | |||||||||

| 3. Includes all firms covered by the Annual Business Survey (ABS) excluding section K (Financial and Insurance Activities), weighted to reflect the population of firms. | |||||||||

| 4. Key: | |||||||||

| Non-Manufacturing Production equals Section A (Agriculture, Forestry and Fishing), B (Mining and Quarrying), D (Electricity, Gas, Steam and Air Conditioning Supply) and E (Water Supply; Sewerage, Waste Management and Remediation Activities). | |||||||||

| Manufacturing equals Section C (Manufacturing). | |||||||||

| Construction equals Section F (Construction). | |||||||||

| Services: Distribution, hotels and restaurants equals Sections G (Wholesale and Retail Trade; Repair of Motor Vehicles and Motorcycles) and I (Accommodation and Food Service Activities). | |||||||||

| Services: Transport, storage, and communication equals Sections H (Transportation and Storage) and J (Information and Communication). | |||||||||

| Services: Business and Real Estate equals Section L (Real Estate Activities), Sections M (Professional, Scientific and Technical Activities) and N (Administrative and Support Service Activities). | |||||||||

| Services: Other equals Sections P (Education), Q (Human Health and Social Work Activities), R (Arts, Entertainment and Recreation) and S (Other Service Activities). | |||||||||

Download this table Table 10: Industry distribution of turnover by FDI status and year, Great Britain, 2012 to 2015

.xls (21.5 kB)

Table 11: Multivariate regression with interactions - full specification, Great Britain, 2015

| Dependent variable: logarithm of labour productivity | |||||||||

| (7) | (8) | ||||||||

| FDI | 0.739*** | FDI | -0.055 | ||||||

| (0.1_ | (0.57) | ||||||||

| No FDI x Small firms | 0.140*** | Interaction | No FDI | FDI | |||||

| (0.01) | Industry B | 0.684*** | 1.945** | ||||||

| No FDI x Medium firms | 0.295*** | (0.11) | (0.6) | ||||||

| (0.01) | Industry C | 0.138** | 0.694 | ||||||

| No FDI x Large firms | 0.293*** | (0.05) | (0.58) | ||||||

| (0.01) | Industry D | 0.219 | 2.171*** | ||||||

| No FDI x Very large firms | 0.111*** | (0.38) | (0.59) | ||||||

| (0.02) | Industry E | 0.287*** | 1.452* | ||||||

| FDI x Small firms | 0.205 | (0.08) | (0.72) | ||||||

| (0.11) | Industry F | 0.340*** | 0.996 | ||||||

| FDI x Medium firms | 0.188 | (0.05) | (0.63) | ||||||

| (0.11) | Industry G | -0.175*** | 0.837 | ||||||

| FDI x Large firms | 0.176 | (0.05) | (0.57) | ||||||

| (0.1) | Industry H | 0.038 | 0.951 | ||||||

| FDI x Very large firms | -0.033 | (0.05) | (0.58) | ||||||

| (0.1) | Industry I | -0.571*** | 0.332 | ||||||

| (0.05) | (0.60) | ||||||||

| Industry J | 0.482*** | 0.814 | |||||||

| (0.05) | (0.62) | ||||||||

| Industry L | 0.117* | 0.965 | |||||||

| (0.06) | (0.62) | ||||||||

| Industry M | 0.414*** | 1.172* | |||||||

| (0.05) | (0.59) | ||||||||

| Industry N | 0.070 | 1.069 | |||||||

| (0.05) | (0.58) | ||||||||

| Industry P | -0.252*** | 0.619 | |||||||

| (0.06) | (0.61) | ||||||||

| Industry Q | -0.342*** | 0.415 | |||||||

| (0.06) | (0.70) | ||||||||

| Industry R | -0.084 | 0.541 | |||||||

| (0.06) | (0.60) | ||||||||

| Industry S | -0.244*** | 0.600 | |||||||

| (0.05) | (0.63) | ||||||||

| Time dummies | Yes | Yes | |||||||

| Region dummies | Yes | Yes | |||||||

| Industry dummies | Yes | No | |||||||

| Size dummies | No | Yes | |||||||

| R-squared | 0.066 | 0.066 | |||||||

| Observations | 172668 | 172668 | |||||||

| Source: Office for National Statistics | |||||||||

| Notes: | |||||||||

| 1. Standard errors in parentheses, * p < 0.1, ** p < 0.05, *** p < 0.01 | |||||||||

| 2. The time period covers 2012 to 2015 | |||||||||

| 3. Where indicated we used 17 Industry dummies, based on the 2007 Standard Industry Classification, covering Sections A to S with the exclusion of Sections K (Financial and Insurance Activities) and Section O (Public Administration and Defence). | |||||||||

| 4. A constant is included in all regressions, and all results are weighted. | |||||||||

| 5. Labour productivity is measured as output per worker (GVA/employment) in 2015 constant prices. | |||||||||

| 6. FDI includes firms with either inward or outward FDI relationship | |||||||||