Cynnwys

- Overview

- Why compare infrastructure internationally?

- Things you need to know about this release

- How does the UK’s stock of infrastructure compare?

- Comparing infrastructure investment across Europe

- Comparisons of government investment in infrastructure

- Conclusions and analysis

- How else can you compare infrastructure across countries?

- Future work

- Authors

1. Overview

In this article, we compare statistics on infrastructure across European countries, following the same principles used in our previous articles, which focused on the UK. Infrastructure is widely thought to have a positive effect on economic growth and productivity, and differences in infrastructure may therefore help to explain differences in productivity across countries. We use available international data sources to compare experimental estimates of stocks of infrastructure, investment in infrastructure, and government investment in infrastructure.

Using this framework, we estimate that the UK’s infrastructure stock as a proportion of gross domestic product (GDP) was 47% in 2016, slightly lower than Italy (52%) and France (54%). Different geographic and demographic factors create different infrastructure needs, making these comparisons difficult. Whilst we have measured supply, we make no estimates of demand, or requirement, and therefore cannot indicate whether a certain level of infrastructure stock is “sufficient”.

We estimate investment by infrastructure-related industries in the UK to be 12% of total investment in 2016, slightly higher than in France and Germany (both 11%). We also estimate this to be 2.5% of GDP in 2016, similar to the other EU G7 economies.

We estimate that government investment in infrastructure in the UK rose as a share of government spending (including transfer payments) from 1.7% to 2.3% between 2006 and 2017. This was higher in the UK than in Italy, France or Germany in 2017. This sustained increase since the economic downturn of 2008 in the UK was not mirrored in other major European countries.

The data we use for these estimates are only indicators for the measurements we are interested in, and there are several potential issues with the methodology, which we explain in the methods and limitations section. Therefore, it is important to highlight that these estimates are experimental, and we present them with an element of caution to inform debate and initiate a conversation with users on how to potentially improve these statistics.

We welcome feedback from you on the usefulness of these statistics, to productivity@ons.gov.uk.

In previous publications, we have set out how we are developing experimental statistics on infrastructure in the UK. The first of these, published in July 2017, tackled definitional issues and presented an initial look at available data sources to measure infrastructure investment. The second, published in August 2018, updated estimates of investment and presented an initial look at infrastructure stocks.

Nôl i'r tabl cynnwys2. Why compare infrastructure internationally?

The UK has a long-standing gap in the level of productivity with other major economies, notably other G7 economies. This gap may be partially explained by differences in the quantity and quality of infrastructure assets across countries.

Infrastructure assets are widely considered to be an important determinant of productivity and the majority of relevant academic studies find a positive effect of infrastructure on productivity and economic growth (for example, Romp and de Haan, 2007). Therefore, comparing the availability of infrastructure assets across countries may help explain differences in productivity.

We compare the UK directly with the other EU G7 countries (Germany, Italy and France), the Scandinavian countries (Sweden, Norway and Denmark), Belgium and the Netherlands. These countries are all developed European economies with varied geographies and levels of economic activity, which provide an interesting comparison with the UK. We also compare government infrastructure investment across Europe as a whole. The datasets published alongside this release contain estimates for a range of countries, including some not discussed in the article.

Nôl i'r tabl cynnwys3. Things you need to know about this release

We estimate infrastructure stocks and investments using national accounting data, which follows our approach in a previous article, Developing new statistics of infrastructure: August 2018. Eurostat and the Organisation for Economic Co-operation and Development (OECD) publish a variety of national accounts data for European countries, which we use in this article.

To estimate stocks of infrastructure, we use data from national balance sheets of the capital stock of the “other structures” asset. This asset encompasses the majority of infrastructure-like capital, and is similar to the approach used in our previous articles for the UK.

To estimate infrastructure investment, we aggregate gross fixed capital formation (GFCF) – the measure of investment in the national accounts – in selected infrastructure-related industries. This excludes much investment by government, but is not a purely private sector measure either.

We also use government income and expenditure data, broken down by the classifications of the functions of government (COFOG), to compare government infrastructure investment across countries. This is the same approach as in our previous articles for the UK, where we aggregate investment by government in infrastructure-related activities (as defined by COFOG).

Eurostat and the OECD compile these data from the national statistical institutes of the relevant countries. For some countries, there are insufficient data available to be able to include them in our analysis. While all countries will follow the international guidance in compiling their national accounts to a large extent, we have limited knowledge on the compilation processes and data quality in other countries, so these data should be treated cautiously.

There is also no universally accepted definition of infrastructure, and it is not separately identified in any national accounts data. While we decided upon a statistical definition in our July 2017 article, this definition may well differ from those used by other studies of infrastructure, which could cause results to differ.

Furthermore, the available data sources do not perfectly align with our statistical definition of infrastructure, and all can only be approximations for the measures we are attempting to attain. More detail on the reasons behind these issues, and the implications for the quality of the estimates, are included in the relevant sections.

Nôl i'r tabl cynnwys4. How does the UK’s stock of infrastructure compare?

In this section we present measures of the stock of infrastructure in the selected countries between 1997 and 2016. The stock of infrastructure is likely to have a relationship with the level of economic activity, so we present these estimates as a proportion of gross domestic product (GDP), to account for differences in economy size across countries. Similarly, the infrastructure stock will also likely be affected by each country’s population and land area, so we also present estimates controlled for these measures. Pre-2012 data for Italy, and data for Germany for the entire time-period, are unavailable.

Figure 1 suggests that the UK has a slightly smaller stock of infrastructure than other EU G7 economies given its economic size, though this observation does exclude Germany, for which data are unavailable. The UK had slightly lower infrastructure stocks as a proportion of GDP than Italy and France in 2016, at 47% compared with 52% and 54% respectively. Norway had the highest in each year, peaking at 90% in 2016, although this may be driven by the inclusion of high-value oil rigs in Norway, which we would not wish to capture in our infrastructure measure.

Figure 1: UK infrastructure stocks lower than other EU G7 economies as a proportion of GDP

Infrastructure stocks as a proportion of GDP, selected countries, 1997, 2007 and 2016

Source: Eurostat, Office for National Statistics

Notes:

- Pre-2012 data for Italy are unavailable. Data for Germany are unavailable over the whole time period.

Download this chart Figure 1: UK infrastructure stocks lower than other EU G7 economies as a proportion of GDP

Image .csv .xlsFigure 2 demonstrates that the infrastructure stock in various countries is not solely dependent on the levels of economic activity, as the varying geography and population of different countries create different infrastructure needs. While the UK has only the fifth highest infrastructure stock in relation to GDP among the eight comparison countries, it has a larger stock than most other comparison countries when comparing on a land-area basis (Figure 2).

Infrastructure stocks per capita (per person) were fairly similar in the UK, France and Italy in 2016. Norway’s infrastructure was more than three times larger than the UK’s in 2016 on a per capita basis, which reflects its relatively small population spread across a relatively large land area.

By contrast, Norway has a much lower value of infrastructure per square kilometre than the UK, again reflecting its large geographic size. By this measure, the UK’s infrastructure stocks are higher than in France and Italy, but still only half as large as in the Netherlands.

Figure 2: UK infrastructure stocks per person similar to France and Italy

Infrastructure stocks per person and per square kilometre of land area relative to the UK, selected countries, 2016

Source: Eurostat, Office for National Statistics

Notes:

- Data for Germany are unavailable.

Download this chart Figure 2: UK infrastructure stocks per person similar to France and Italy

Image .csv .xlsMethods and limitations

These estimates are compiled using the stock of the “other structures” asset from national balance sheets, published by Eurostat. This is a reasonable indicator of the stock of infrastructure, though it also includes some assets irrelevant to infrastructure, while omitting some relevant assets.

The “other structures” asset is defined in the European System of National and Regional Accounts 2010 (ESA10) as:

“Structures other than residential structures, including the costs of the streets, sewers and site clearance and preparation. Also included are public monuments not classified as dwellings or buildings other than dwellings; shafts tunnels and other structures associated with mining and energy reserves; and the construction of sea walls, dykes and flood barriers intended to improve land adjacent but not integral to them.

Examples include highways, streets, roads, railways and airfield runways; bridges, elevated highways, tunnels and subways; waterways, harbours, dams and other waterworks; long-distance pipelines, communication and power lines; local pipelines and cables, ancillary works; constructions for mining and manufacture; and constructions for sport and recreation.”

We use “other structures” as an indicator of infrastructure because it captures the majority of the components of infrastructure within our definition (see our article, Developing new measures of infrastructure investment, for discussion on the definitions of infrastructure). The primary parts of our infrastructure definition are transport, energy, water, waste, communications and flood defences, which are mostly captured in the “other structures” asset. This asset does, however, include some items we may wish to exclude from an infrastructure measure, such as public monuments and structures associated with mining and energy reserves (principally oil rigs). Meanwhile, it will not include software and machinery assets that are separate, but integral to, infrastructure systems.

Recent changes to reporting requirements have led most European countries to exclude the value of land from estimates of the value of the stock of assets on the balance sheet, including “other structures”. Given concerns about large differences in land prices across countries, we compare only countries for which we can be certain land has been excluded. As such, we have excluded Germany from our analysis. Other ONS analysis has examined the role of land values in national balance sheet data across countries.

Nôl i'r tabl cynnwys5. Comparing infrastructure investment across Europe

In addition to the estimates of the stock of infrastructure in Section 4, estimates of investment in infrastructure can also provide an indicator of infrastructure quality. High levels of infrastructure investment may be perceived as either a positive indicator (of a growing and well-maintained infrastructure stock), or a negative indicator (of a poor-quality stock that needs updating and/or repairing). It may also reflect the scale of the wider capital stock and the capital intensity of the industry mix inherent in the economy.

To estimate infrastructure investment in this section, we aggregate gross fixed capital formation (GFCF) in all assets in infrastructure-related industries (covering energy, water, waste, transport and telecommunications). Investments by government are usually recorded in the public administration industry, which we have not included here. As such, this approach will exclude the majority of government infrastructure investments (mostly transport infrastructure, especially roads). However, in countries where governments operate in any infrastructure-related industries, these investments will likely be included in the measures in this section, so it cannot be said to be a “private sector” measure. In the next section, we look specifically at government infrastructure investment.

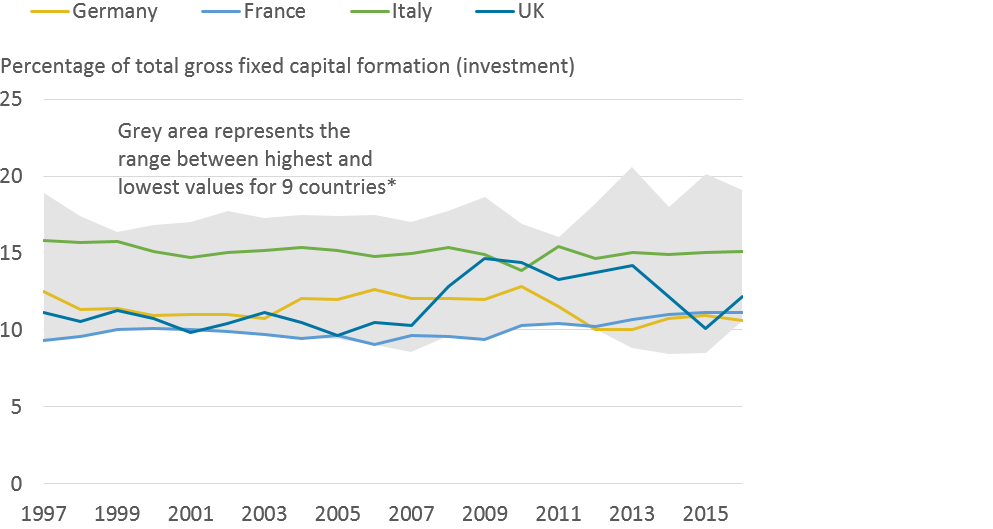

Figure 3 shows infrastructure investment, as described previously, as a share of total investment in the EU G7 countries (the UK, France, Germany and Italy) from 1997 to 2016. These are compared with the range of infrastructure investment ratios in a selection of other major European economies – the Netherlands, Belgium, Norway, Sweden and Denmark. There is a reassuring degree of coherence between the measures of all countries, which are reasonably stable at around 10% to 20% over the past two decades.

Of the EU G7 economies, Italy had the highest infrastructure investment as a share of total investment for the majority of the period shown, only lower than the UK in 2010. The UK saw a decline from 14% in 2013 to 10% in 2015, though this rebounded to 12% in 2016, higher than Germany and France.

Figure 3: Infrastructure investment in the UK fairly similar to other major European countries

Investment in infrastructure-related industries as a proportion of total GFCF, selected countries, 1997 to 2016

Source: Organisation for Economic Co-operation and Development, Office for National Statistics

Notes:

- Grey area shows range of values in nine major European countries: the UK, Germany, France, Italy, the Netherlands, Belgium, Norway, Sweden and Denmark.

Download this image Figure 3: Infrastructure investment in the UK fairly similar to other major European countries

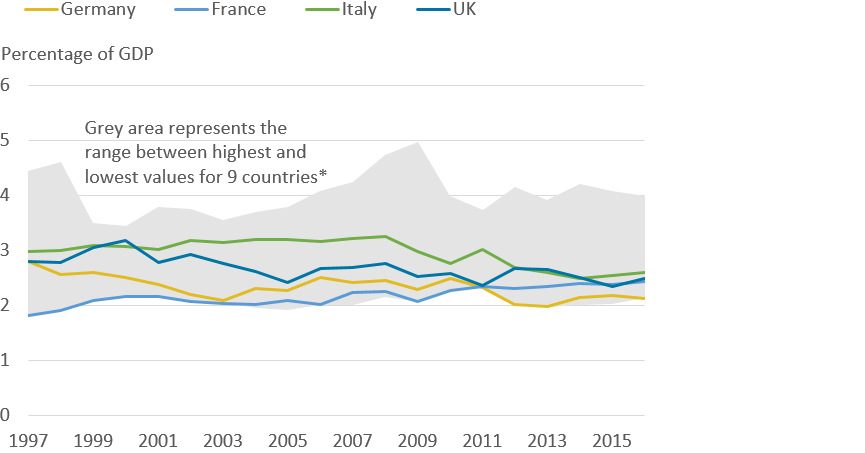

.png (40.9 kB)Figure 4 compares the same measure of investment as a share of gross domestic product (GDP) over time. The trends are similar to Figure 3, indicating that differences in the overall level of investment across countries is not the primary driver of those findings. Once again, Italy saw the most investment in infrastructure as a share of GDP among the EU G7 economies in most periods, closely followed by the UK.

Figure 4: UK infrastructure investment as a share of GDP is similar to other EU G7 economies

GFCF in infrastructure-related industries as a proportion of GDP, selected countries, 1997 to 2016

Source: Organisation for Economic Co-operation and Development, Office for National Statistics

Notes:

- Grey area shows range of values in nine major European countries: the UK, Germany, France, Italy, the Netherlands, Belgium, Norway, Sweden and Denmark.

Download this image Figure 4: UK infrastructure investment as a share of GDP is similar to other EU G7 economies

.png (30.4 kB)Figures 3 and 4 indicate that the UK’s investment in infrastructure between 1997 and 2016 was fairly average compared with its EU G7 counterparts and other major European countries. This investment was mostly in transport, energy and telecommunications industries, which accounted for 45%, 24% and 16% of UK infrastructure investment respectively in 2016.

Methods and limitations

Estimates of infrastructure investment in this section are gross fixed capital formation (GFCF) in all assets in infrastructure-related industries. These industries are defined using a European industrial classification (NACE rev. 2), which is equivalent to the UK Standard Industrial Classification: SIC 2007 to the degree used in this analysis. The selected two-digit industries from SIC 2007 are:

- 35 – electricity, gas, steam and air conditioning supply

- 36 to 39 – water supply, sewerage, waste management and remediation activities

- 49 to 53 – transportation and storage

- 61 – telecommunications

Since these measures include all assets, it will encompass investments by businesses in assets used in the operation of these industries, such as airplanes bought by airline companies. In a broader definition of infrastructure, all assets used in the operation of relevant industries could be considered part of the infrastructure. Consider, for example, what value airports would have without planes, or railways without trains. While this does depart from measures used in our previous articles for the UK, such detailed data are not available internationally, making this the best available comparable measure.

Other ONS analysis in November 2017 and May 2018 has compared investment internationally, looking at trends in particular assets and sectors of the economy. This article is the first to look at infrastructure specifically.

Nôl i'r tabl cynnwys6. Comparisons of government investment in infrastructure

In this section we examine government infrastructure investment. This is not completely separate from the measures in Section 5, which examined investment in infrastructure-related industries (excluding the public administration industry, and thus excluding much investment of government). This section applies a similar approach, but based on a breakdown of the activities of government, rather than industries, and so will overlap to some degree with the former measures. The estimates in this section and Section 5 should therefore not be added together as a measure of total infrastructure investment, due to the risk of double-counting.

We present our measure as a proportion of total government spending, to control for the different size of economies and government in different countries. Figure 5 compares the UK to the other G7 economies, while Figure 6 compares the UK to a distribution of 31 European countries (28 EU member states, as well as Norway, Switzerland and Iceland), to give an indication of these figures in a wider context.

The UK saw a different trend to the other EU G7 economies in government infrastructure investment as a share of total government spending between 2006 and 2017. While this figure decreased in the other three countries during the period, in the UK it increased from 1.7% in 2006 to 2.3% in 2017. This is higher than in France (1.5%), Germany (1.2%) and Italy (0.9%) for 2017.

Figure 5: The UK overtakes other EU G7 economies in government infrastructure investment

Government investment in infrastructure as a proportion of total government spending, EU G7 economies, 2006 to 2017

Source: Eurostat, Office for National Statistics

Download this chart Figure 5: The UK overtakes other EU G7 economies in government infrastructure investment

Image .csv .xlsIn a wider European context, the UK was close to the median in recent years, as shown in Figure 6. This shows the UK’s figures in relation to the 25th percentile, the median and 75th percentile of the range of values in Europe in each year. The UK is still just below the median, though unlike the rest of the distribution the UK has increased over the past decade.

Figure 6: The UK shows different trend to wider European government infrastructure investment trends

Government infrastructure investment as a share of total government spending, UK, 25th percentile, median and 75th percentile, 2006 to 2017

Source: Eurostat, Office for National Statistics

Notes:

- UK included in the calculation of percentiles and median. Distribution based on 28 EU member states and Norway, Switzerland and Iceland.

Download this chart Figure 6: The UK shows different trend to wider European government infrastructure investment trends

Image .csv .xlsFigures 5 and 6 indicate a growing importance of government infrastructure investment in the UK. The findings also hold when looking at government infrastructure investment as a share of gross domestic product (GDP), indicating that this trend is not primarily caused by a decline in overall government spending. Alternative measures are available in the datasets published alongside this release. In Section 7, we examine trends in nominal infrastructure investment more closely.

Methods and limitations

For these estimates, we aggregate government gross fixed capital formation in seven functions within the internationally consistent classifications of the functions of government (COFOG). These selected COFOG codes are:

- 4.3 – fuel and energy

- 4.6 – transport

- 4.7 – communication

- 5.1 – waste management

- 5.2 – waste water management

- 6.3 – water supply

- 6.4 – street lighting

This is consistent with the definition of infrastructure we outlined in our 2017 article.

This method includes investment in all assets within the selected functions. As in the previous section, this may include some assets which we may not wish to capture in a measure of infrastructure investment. For example, if the Department for Transport in the UK invested in an office building, this would be included as it is investment in an asset within the transport COFOG, but it is not an infrastructure asset, according to our definition. Unfortunately, the available data sources do not provide an asset by function breakdown, so we are unable to exclude such assets from the estimates. Other infrastructure definitions may choose to include this investment, arguing that such office buildings are still ultimately used for the purpose of running infrastructure-related services.

The estimates are only for the period from 2006 to 2017, though data are available for earlier years for most countries. We have presented data from 2006 onwards because of a known issue with the UK data, where the road “detrunking” programme in the early 2000s (where some trunk roads were declassified as trunk routes and moved from central to local government control) caused large changes to the data which do not accurately reflect the level of government investment. While we were able to identify this issue in the UK, we do not have access to the metadata for other countries, so there may be similar classification issues for other countries.

Nôl i'r tabl cynnwys7. Conclusions and analysis

Overall, our estimates suggest that the UK government have increased infrastructure investment in recent years by a larger amount than other major European countries. By 2017, UK government investment in infrastructure was a higher proportion of total government spending than in any other EU G7 country. At the same time, the magnitude of total investment in infrastructure-related industries is similar in the UK to the other EU G7 economies, after accounting for economic size. This implies a relatively high overall level of infrastructure investment in the UK in recent years.

This could either be a positive or a negative sign, reflecting either a proactive improvement approach or a reactive approach to infrastructure that has suffered underinvestment in the past. The fact the UK’s infrastructure stock is smaller than that of France and Italy, relative to GDP, suggests that the latter is the case, although the different geographical and demographic factors in these countries may also contribute to this. Uncertainty around all of our estimates (given definitional and statistical issues described in the relevant sections), and the relatively small differences observed between countries, mean we cannot say this with confidence.

Fiscal policies may also help to explain the observed trends in government infrastructure investment. Different countries adopted different policies following the economic downturn of 2008 and the subsequent public debt crisis. In particular, Saha and Von Weizsäcker (2009) (PDF 1,271KB) estimate the size of the stimulus packages in different European countries. The Organisation for Economic Co-operation and Development (OECD) also published a paper, exploring Italy’s fiscal stimulus package and strategy (PDF 45KB), following the economic downturn. Using a combination of both data and literature, we can explore the different policies adopted in different countries and what impact they may have had on infrastructure investment following the economic downturn.

To determine the effects of these policies, Figure 7 shows the growth rates of nominal government investment in infrastructure from 2006 to 2017. Across the entire time period, government investment in infrastructure grew faster in the UK than in Germany, Italy, France and the Netherlands. From 2006 to 2009, in the period covering the economic downturn, government investment in infrastructure grew in Germany, Italy, the Netherlands and the UK, and fell slightly in France. In the post-downturn period (2009 to 2013), government infrastructure investment again grew in the UK, but fell in Italy and was flat in Germany. In more recent years (2013 to 2017), government infrastructure investment rose in the UK and Germany, but fell elsewhere.

Figure 7: Increase in UK government infrastructure investment since economic downturn

Compound annual average growth rates in nominal government infrastructure investment, selected countries, selected periods

Source: Eurostat, Office for National Statistics

Download this chart Figure 7: Increase in UK government infrastructure investment since economic downturn

Image .csv .xlsFigure 7 is in line with the literature, which indicates that countries adopted different approaches to stimulating the economy after the economic downturn in 2008 while simultaneously attempting to reduce government debt. Germany and the Netherlands, for instance, used mostly current spending and tax cuts to stimulate the economy, while cutting back on capital spending. The Dutch government introduced additional tax cuts for small and medium-sized enterprises (SMEs) and allocated extra spending on employment benefits while reducing working hours (Saha and Von Weizsäcker, 2009 (PDF 1,271KB)). In relation to infrastructure, the Dutch government allocated a small percentage of their stimulus package to investments into broadband internet infrastructure and advancement of railroad investments.

Germany and Italy initially increased government infrastructure investment, but this was not long-lasting. In Italy, the government adopted a stimulus package designed to be neutral on the budget balance, with no additional infrastructure spending (OECD, 2011 (PDF 45KB)). Similarly, government investment in infrastructure in Germany did not increase from 2009 to 2013. Following the economic downturn, the main response in Germany was the expansion of the Kurzarbeit programme which aimed to keep workers employed.

In the case of France, the French government announced a €26 billion stimulus plan in February 2009 (later estimated to cost €34 billon) with €4 billion allocated to improve rail and energy infrastructures and the postal service (de Rugy, 2014 (PDF 2.94MB)).

By contrast, government infrastructure investment was used as a stimulus package in the UK in the wake of the economic downturn, and has continued to grow until 2017. As part of the stimulus package, the British government brought forward £3 billion of capital spending to support the economy (Edmonds et al, 2011). In addition, £5 billion was allocated to spending on energy and internet infrastructure with half being spent in 2009 and the other half in 2010 (Saha and Von Weizsäcker, 2009 (PDF 1,271KB)). This has been sustained by a range of projects, including the rollout of superfast broadband, CrossRail, High-Speed 2 railway and investments in transport infrastructure ahead of the 2012 London Olympics.

Nôl i'r tabl cynnwys8. How else can you compare infrastructure across countries?

This article presents the first analysis, to our knowledge, that uses national accounting data to compare infrastructure across countries. However, a small number of alternative statistics exist to achieve the same aim.

The World Economic Forum produces a Global Competitiveness Index, one component of which relates to infrastructure. Other components relate to human capital, technology, institutions and financial markets, amongst other things. The quality of the infrastructure is measured using indicators such as the connectivity of airports, the density of railroads, the electrification rate, and the reliability of the water supply. These are indicators of quality rather than value.

The UK ranks 8th in the overall index and 11th for the infrastructure component alone. Of the countries included in our analysis, the Netherlands was ranked the highest in the infrastructure component of the Global Competitiveness Index, coming in fourth behind Singapore, Hong Kong and Switzerland. Germany, France and Italy were ranked 7th, 8th and 21st respectively. Despite the differences in the approach, the rankings are fairly consistent with our analysis.

Another set of international data on infrastructure are compiled by the OECD. Their indicators cover investment in transport infrastructure, for which an important data source is a survey by the International Transport Forum. Other indicators relate to the usage of infrastructure, such as the volume of passenger and freight transport.

Similarly, Goal 9 of the Sustainable Development Goals (Industry, Innovation and Infrastructure) relates mostly to the quality and usage of infrastructure, rather than its value.

Nôl i'r tabl cynnwys9. Future work

We welcome feedback from you on the usefulness of these statistics to productivity@ons.gov.uk. We hope that this preliminary analysis, presented as it is with a degree of caution, will inform debate and initiate a conversation on how to potentially improve these statistics.

In our future work on infrastructure, we intend to continue to develop measures of investment and stocks of infrastructure for the UK. We intend to publish an article later this year with a specific focus on transport infrastructure, charting developments in the stock of different types of transport infrastructure over time.

We continue to look for ways to explore the relationship of infrastructure with productivity, which this article begins to explore. We intend to explore the contribution of infrastructure in a growth accounting framework, which will require a greater degree of confidence in measures of infrastructure stocks. These, in turn, rely on long-runs of investment data, appropriate price indices, and appropriate depreciation rates. We welcome user input on these topics.

Nôl i'r tabl cynnwys