1. Executive summary

The sharing economy is generally regarded as being activity that is facilitated by digital platforms which enable people or businesses to share property, resources, time and skills, allowing them to ‘unlock’ previously unused or under-used assets. The UK sharing economy was estimated to be worth £0.5 billion in 2014 and is a growing market forecasted to be worth £9 billion by 20251. Measuring and understanding how this phenomenon is captured in official statistics is becoming increasingly important given the rapid growth of such activity. In response to user demand, the Office for National Statistics (ONS) has undertaken a feasibility study to explore potential ways that the sharing economy could be measured and has outlined action points for further work required in this area. This report summarises work undertaken by ONS so far and considers the use of a survey, administrative data and big data to collect information on the sharing economy.

To investigate the feasibility of using a survey, ONS conducted focus groups and interviews with businesses and individuals who had used the sharing economy to provide or receive a good or service. Due to a lack of a widely recognised definition, the scope of study had to be reduced in order to produce meaningful results, and focused on measuring 3 aspects: accommodation sharing, car sharing, and skills and services sharing. Despite this, there was still a lack of clarity around what the sharing economy was and interpretations differed considerably between businesses and individuals. When attempting to measure transactions in financial terms, issues with recall and data confidentiality were also highlighted. However, the research did identify a range of terms relating to the sharing economy which could be explored by future research. This report also discusses the outcome of recent discussions across EU member states to expand the ONS Internet Access Survey to include questions on the sharing economy.

The feasibility of using administrative data sources such as collecting data directly from businesses undertaking sharing economy activities is also considered; however, this raises issues relating to data access and coverage that will require further work to better understand how businesses in the sharing economy record such information. In addition to this, a preliminary analysis of 50 sharing economy businesses was undertaken using data held on the Inter-Departmental Business Register2 (IDBR). The analysis showed that of the 50 businesses identified, the majority were established from 2012 onwards. Growth in the turnover and employment of these 50 businesses was also identified, but in order to take this analysis further, there is a need for ONS to better understand how these businesses are structured. Finally, their industry classifications were analysed, with more than half being classified within the business services and finance industry. The analysis presented serves only to further understanding of this sector and is not an attempt to measure the size of the sharing economy.

The use of big data is also considered in this report; since many sharing economy businesses operate through a website, making use of techniques such as web scraping and Application Programming Interface (API) may allow producers of official statistics to obtain transactional data directly. However, this report acknowledges that there may be legal issues surrounding this approach, but the potential benefits warrant further research.

Notes for Executive summary

- Five key sharing economy sectors could generate £9 billion of UK revenues by 2025, 2014, PricewaterhouseCoopers.

- The IDBR is the comprehensive list of UK businesses used by government for statistical purposes.

2. Introduction

Background

In September 2014, the innovation charity Nesta published a report, ‘Making sense of the UK collaborative economy’, that stated their aim to work with other organisations to provide research and market analysis on the sharing economy – referred to as the collaborative economy in their report. Following this, in November 2014, the Department for Business, Innovation and Skills (BIS) published their findings in ‘Unlocking the sharing economy: independent review’, which explored how the UK could become a global centre for the sharing economy. The government published a response to this in ‘Sharing economy: government response to the independent review’ in March 2015. In this response, the Office for National Statistics (ONS) pledged to assess the feasibility of developing statistics on the sharing economy.

Since then, further reports by Professor Diane Coyle ‘The sharing economy in the UK’ in January 2016 and Chapter 3 of Professor Sir Charles Bean’s ‘Independent review of UK economic statistics’ in March 2016, have also called for the development of robust statistics on the sharing economy - claiming that activity associated with the sharing economy is neglected to some extent by current official statistics.

The objectives of this report are to summarise the work carried out by ONS so far and outline the potential issues with defining and measuring the sharing economy. It will consider 3 methods for collecting information on the sharing economy and assess their feasibility: surveying businesses and/or individuals, using administrative data sources and utilising big data – which includes data from websites, social media and mobile phones. Action points outlining further work to take forward will also be made throughout this report.

Defining the sharing economy

While there is no agreed definition of the sharing economy, it is generally regarded as being activity that is facilitated by digital platforms which enable people or businesses to share property, resources, time, or skills, allowing them to ‘unlock’ previously unused or under-used assets. An important function of the sharing economy is that it brings together or ‘matches’ suppliers to customers through a common platform. The exchange of money is not a pre-requisite for the sharing economy, with many sharing economy businesses allowing users to share or swap goods and services without a financial transaction.

The sharing economy is a growing market within the UK; in 2014 it was estimated to be worth £0.5 billion and is forecasted to grow to over £9 billion by 20251. Examples of popular platforms for the sharing economy include Airbnb, where people offer and book accommodation; BlaBlaCar, where people book and advertise spaces in cars; and Funding Circle, a peer-to-peer lending platform which connects businesses with investors.

It is useful to note that there are a range of terms for what this report refers to as the ‘sharing economy’, these include, amongst others: ‘collaborative consumption’, ‘gig economy’, ‘peer-to-peer economy’ and ‘access economy’. An overview of these and other terms can be found in Chapter 1 of Nesta’s report ‘Making sense of the UK collaborative economy’.

Measuring the sharing economy

The sharing economy is widely regarded to have grown in importance in recent years. Although aspects of the sharing economy are captured in official statistics, such as gross domestic product (GDP), the increase in activity in this area has led to increasing demand for the development of standalone statistics, particularly to inform government policy.

There are a number of challenges faced when attempting to measure the sharing economy, including classifying sharing economy activity, capturing sharing activity between individuals and measuring non-monetary transactions.

One of the main challenges to producing statistics on the sharing economy is the lack of an agreed definition, which makes it difficult to distinguish between sharing economy activities and traditional business activities. While the majority of ONS business surveys use the Standard Industrial Classification (SIC)2 as a basis for collecting and publishing business and economic statistics, the sharing economy does not fit within this classification system, as it is possible for a business in any industry to contribute to the sharing economy.

A further challenge is that it is not only businesses who participate in the sharing economy; large numbers of individuals also participate for a variety of reasons including supplementing existing incomes. In 2014, Nesta3 estimated that 25% of the UK adult population are sharing online in some way and Professor Diane Coyle4 estimated that 3% of the UK workforce is already providing a service through the sharing economy. This shift from the traditional marketplace to an increase in ‘home production’ is difficult to capture using traditional data collection methods. Furthermore, Professor Coyle suggests that it is not possible to calculate the size or value of the sharing economy using current official statistics, as by definition, certain activities involving exchanges between individuals are not included in GDP and the Consumer Price Index (CPI).

With this in mind, it is worth noting exactly what sharing economy activity is accounted for in GDP statistics. Business-to-business and business-to-consumer sharing economy financial transactions are measured within the 3 measures of GDP – production, expenditure and income. For the production approach, ONS conducts a number of established business surveys, such as the Annual Business Survey (ABS), to obtain these data. These sources capture the turnover reported by sharing economy businesses; however this may not capture the full economic activity, as turnover may only report the transaction charge rather than the full cost of the service. If this is the case, it is possible that there is an element of under reporting. Changes in the amount spent on sharing economy activities are included via surveys such as Living Costs and Food Survey (LCF) and are therefore part of the expenditure approach to measuring GDP. The income from sharing economy activities could be captured through a number of different mechanisms: individuals providing sharing economy services may report the income through a business which they have established or alternatively report this activity as personal income – both of which are captured in the income approach. Although there is potential for under reporting in any one of these measures, information from all 3 is utilised before reaching a final balanced position and the headline statistics. During this process weaknesses such as under coverage are considered.

Another challenge faced when attempting to measure the sharing economy arises from the fact that transactions are not always financial – increasingly individuals are swapping goods or services, with no money being transferred. Business statistics are traditionally used to measure financial information and so the nature of the sharing economy itself is posing new challenges for producers of official statistics. For example, the internationally agreed definition of GDP does not account for non-monetary transactions – such as the provision of free goods or services, by donating, lending or swapping. However, these activities are still of interest to ONS in order to better inform the broader debate around economic well-being5. These may be captured by the UK Household Satellite Accounts (HHSA)6 which measure and value household activities that are not included in the conventional National Accounts such as unpaid household labour, household production and household output. ONS published the first Household Satellite Accounts in 2002 and will be publishing an updated set on their website on 7 April 2016.

These and other challenges are explored further throughout this report.

Notes for Introduction

- ‘Five key sharing economy sectors could generate £9 billion of UK revenues by 2025’, 2014, PricewaterhouseCoopers.

- Standard Industrial Classification (SIC) is used for classifying businesses by type of economic activity.

- 'Making sense of the UK collaborative economy’, September 2014, Nesta.

- ‘The sharing economy in the UK’, January 2016, Professor Diane Coyle.

- Information on economic well-being is available on the ONS website.

- Information on Household Satellite Accounts is available on the ONS website.

3. Using a survey

Background and scope

In order to assess the feasibility of using a survey to collect information on the sharing economy, focus groups and structured interviews were held to obtain information from businesses and individuals. Definitions, concepts and variables to explore were predefined collaboratively between the Department for Business, Innovation and Skills (BIS), Nesta and the Office for National Statistics (ONS). The aim of the research was to identify respondents’ general understanding of the sharing economy and assess whether they are able to provide relevant information through a survey.

During the pre-field stage, questions and concepts relating to the sharing economy were subject to expert review. It became clear that the scope of the research needed to be tightened. In consultation with stakeholders, it was therefore agreed that the research would focus on 3 specific areas of the sharing economy: accommodation sharing, car sharing, and skills and services sharing.

Data collection

Focus groups were conducted with individuals who had participated in the sharing economy and semi-structured interviews were held with representatives from businesses that had provided sharing economy services. Individuals were recruited through advertisements on Gumtree1, while businesses were approached by Nesta on behalf of ONS.

A total of 79 people responded to the recruitment campaign. These were sifted to 16 individuals – 8 that had used car sharing and 8 that had used or advertised services online.

Of the 10 businesses that expressed an interest in taking part, 5 were in scope as they provided opportunities for accommodation, car or service sharing to users and providers. Of these, only 2 could be recruited – 1 related to car sharing, while the other related to services sharing. Attempts to recruit an accommodation business were unsuccessful.

Analysis

The information collected during the focus groups and interviews was recorded, transcribed and analysed thematically. The findings, presented below, highlighted several points which should be considered if surveys were used to measure the sharing economy.

Concepts and terminology

Respondents were asked to define what the sharing economy meant to them and what terminology they would use to describe it. The aim was to identify potential terms that could be used in a survey, either in the question wording or as guidance to help explain the concepts to respondents. The most significant finding was respondents’ confusion in defining the sharing economy. There were also conflicting ideas around what economic and social activities formed part of the sharing economy. Many respondents viewed the sharing economy as a way of sharing resources and did not consider activities that involved an exchange of money to be part of the sharing economy.

Definitions of the sharing economy also appeared to differ between individuals and businesses; businesses generally had a clearer understanding of the sharing economy compared with individuals and tended to describe the activities in terms of the economy or marketplace as a whole. They used a range of terms to describe the sharing economy, such as a ‘crowd economy’ and an ’on demand economy’. Some businesses described it as creating ‘a new form of marketplace’, bringing individuals and businesses together through a ‘technology enabled network’. Others said it was ‘disrupting the traditional market’. Business respondents also described the sharing economy as ‘collaborative consumption’ and a ‘way of monetising assets’.

When individuals were asked if there was any terminology they would use to describe the sharing economy, they generally favoured more informal terms such as ‘car pooling’. A theme that emerged was the use of website and brand names to help respondents define the concepts, for example ‘Uber’ and ‘Airbnb’. Some respondents suggested that referring to these in the question wording would help them to understand what was being asked of them.

The use of website names was not the only terminology put forward by respondents. Different terms used to define accommodation sharing were ‘home stay’ and ‘holiday let’. As discussed previously, ‘car pooling’ was a popular way to describe lift and car sharing, or alternatively ‘petrol sharing’ and ‘hitch-hiking’.

Respondents struggled to provide terms for offering or using skills and services online; some preferred ‘peer-to-peer’, while others felt it was misleading. The terms ‘platform’ and ‘exchange’ were also put forward by respondents.

Although this initial research has uncovered a variety of different terms to define the sharing economy and is not necessarily conclusive, it does indicate that respondents can offer more valuable information when asked questions about specific parts of the sharing economy.

Financial information

Respondents were also questioned about the financial aspects of the sharing economy. A reasonable assumption was made that any future data collection would be annual; therefore questions with a 12-month reference period were asked. Discussions focused on how much money respondents had spent through the sharing economy and how much they had earned from it during this time.

Respondents trying to recall how much they had spent on sharing economy activities were generally able to remember this information if they had only engaged in sharing economy activities a few times. Some respondents reported difficulty in keeping track of how many times they had accessed services; with suggestions that it would be easier to give information on average as opposed to total spend. Some respondents explained that they were only able to give estimates due to the differing and confusing hidden costs included in some sharing economy services such as cleaning fees and charges for extra people. There was also some discussion about sharing these services with other people and how that can make it more difficult to calculate expenditure, for example if the payment was split between a group, or if someone else had booked the service on their behalf. Some respondents suggested that they would find it easier to estimate if the question provided ranges for monetary values.

When asked about earnings generated from the sharing economy, some respondents discussed swapping goods or exchanging services with others for free, and therefore would report no earnings if surveyed. Others, who had received money from providing sharing economy services, had mixed reactions to this question. Some respondents were willing to provide responses and explained how they would calculate their estimates, but some respondents refused and warned others who were willing to answer to be careful. Respondents were unwilling to give information if they were, for example, sub-letting accommodation or offering skills and accommodation that was not part of a declared business. Other respondents stated there was no incentive for them to answer these questions. Non-response is a wider issue which affects all social and business surveys to some extent. If a survey was used to collect this information, careful consideration about how response could be maximised should be undertaken. In addition, reassurances about confidentiality should be heavily emphasised when collecting financial information on the sharing economy.

The focus groups and interviews also revealed that individuals’ use of the sharing economy was not solely about using websites that undercut the traditional economy to save money, but also other non-monetary reasons such as meeting, helping and connecting with others. When discussing their participation in the sharing economy, individuals described 2 distinct types of activity:

formal activities – involve sharing economy websites that gather information about users and providers to ensure safety. In these instances, there is always an exchange of money and the fees the provider can charge can be set by the website involved;

informal activities – involve social media or websites that gather minimal data about users and providers. Often these activities do not involve monetary payment.

Collecting financial information about the sharing economy would be likely to capture only the formal activities discussed by respondents, not the informal ones. Whether this is acceptable or not would ultimately depend on the proposed aims and uses of the statistics on the sharing economy which would be defined in consultation with users.

European recommendations for collecting data using a survey

Additional questions on the sharing economy will form part of the ONS Internet Access Survey in 2017; the survey is harmonised across all EU member states and updated annually to capture new developments in technology and the use of the internet. Eurostat, the statistical office of the European Union, leads an annual process in which EU member states discuss and agree new questions to be introduced into the survey each year.

It has been agreed that a small number of questions relating to individuals’ use of the internet for the provision of accommodation and transport services will be added to the survey for reference year 2017. The new questions will avoid using any technical or conceptual terms and will just focus on the specific activities being measured. They will also avoid attempting to measure financial value, instead simply measuring incidence of use. The proposed questions from Eurostat are:

C7. Have you used any website or app to arrange an accommodation (room, apartment, house, holiday cottage, etc.) from another individual in the last 12 months? (tick all that apply or c)

a) Yes, dedicated websites or apps (such as AIRBNB, other national examples)

b) Yes, other websites or apps (including social networks)

c) No, I have not.

C8. Have you used any website or app to arrange a transport service (e.g. by car) from another individual in the last 12 months? (tick all that apply or c)

a) Yes, dedicated websites or apps (such as UBER, other national examples)

b) Yes, other websites or apps (including social networks)

c) No, I have not.

This approach is coherent with the finding of the ONS feasibility study, focusing on specific areas of the sharing economy and using named examples of the businesses undertaking sharing economy activity. ONS will publish the results of these questions as part of the Internet Access Households and Individuals 2017 results in August 2017. Eurostat are expected to publish results for the UK and other European countries in late 2017.

Action points

Measuring the sharing economy using a survey gives the opportunity to capture both the formal and informal activities within the sector. Potential limitations were identified in respondents’ confusion over concepts and an unwillingness to share personal financial information. These issues could affect the quality of the data collected. To mitigate this, the concepts being measured should be clearly defined using terminology that can be understood by individuals and the confidentiality of the data collected should be heavily emphasised.

However, before further progress can be made towards assessing the feasibility of using a survey to measure the sharing economy, the following action points should be explored:

Action point 1: ONS should undertake further work to establish an agreed definition of the sharing economy and define the coverage of the statistics. This will involve defining the types of activities that should be captured (for example, monetary or non-monetary) and who the target population will be (for example, businesses or households and individuals). This should be achieved through working in conjunction with representatives from across government, academia and private sector bodies.

Action point 2: ONS should identify existing surveys where additional questions on the sharing economy could potentially be asked.

Action point 3: ONS should continue to engage at a European level and ensure that ONS keeps pace with international best practice.

Notes for Using a survey

- Gumtree is a free classified advertisement website.

4. Using administrative data

Administrative data

The Office for National Statistics (ONS) uses 2 main sources to produce official statistics, statistical surveys and data from organisations’ administrative or management systems. The report so far has focused on using surveys to collect information on the sharing economy, but using administrative data may have other benefits that a survey cannot offer – for example, it reduces the burden on data providers and the costs of data collection.

Administrative data provided by sharing economy businesses

During the focus groups and interviews conducted as part of the research outlined in Section 3, respondents revealed that high profile sharing economy businesses, such as Airbnb and Blablacar, hold vast amounts of data on individuals who use their sites. These businesses’ websites explain that these details are required to ensure users’ safety when using their services. The data held could be considered a quantifiable way of measuring the sharing economy. It could provide information on the numbers of individuals using these sites, as well as the monetary value of transactions. However, accessing these data could be difficult, as some businesses may refuse to share data with ONS or wider government. ONS welcomes commitment from businesses within the sharing economy, including members of SEUK1, a UK trade body for sharing economy businesses, to work together to develop statistics in this area.

The quality of any administrative data would also have to be considered, as the information collected was not originally intended for statistical use. For example, the timeliness of the data supplied, in addition to its relevance or accuracy, could be subject to similar limitations that other administrative sources present. The number of people registered on a sharing economy website, for example, may not necessarily be a reliable indicator of the active size of the sharing economy.

The effectiveness of using administrative sources to measure the sharing economy is hard to ascertain without further research into the types of information held by these businesses, as well as the issue of data access – both of which are likely to vary considerably amongst businesses. However, any administrative data relating to the sharing economy would be useful to some extent in helping ONS better understand and define this evolving sector. The data could also have practical uses in validating other sources of information, such as survey responses for example.

Administrative data held on the IDBR

The Inter-Departmental Business Register2 (IDBR), which includes information on approximately 2.4 million businesses, is the main sampling frame used for business surveys by ONS and across government. The IDBR is an administrative data source that could be used to improve the understanding of the sharing economy, however, it should also be noted that some very small businesses – those without employees and those below the VAT threshold, are not covered. It is therefore likely that individuals generating income from the sharing economy are also not captured.

ONS conducted a preliminary analysis which identified a sample of 50 sharing economy businesses on the IDBR. It should be noted that the list of 50 businesses considered by this analysis is not exhaustive and can be expanded or refined depending on the definition used for the sharing economy. These businesses were selected through consultation with colleagues from across government and other National Statistical Institutes (NSIs) and were identified via online sources and previous published reports on the sharing economy, as well as members of SEUK. ONS plans to use these 50 businesses to identify characteristics of sharing economy businesses, such as their industry, employment and establishment date, to help locate further businesses on the IDBR that form part of this sector. Therefore, the preliminary findings presented in this report should be treated with caution as they are designed only to further the understanding of the sharing economy and are not an attempt to measure the size.

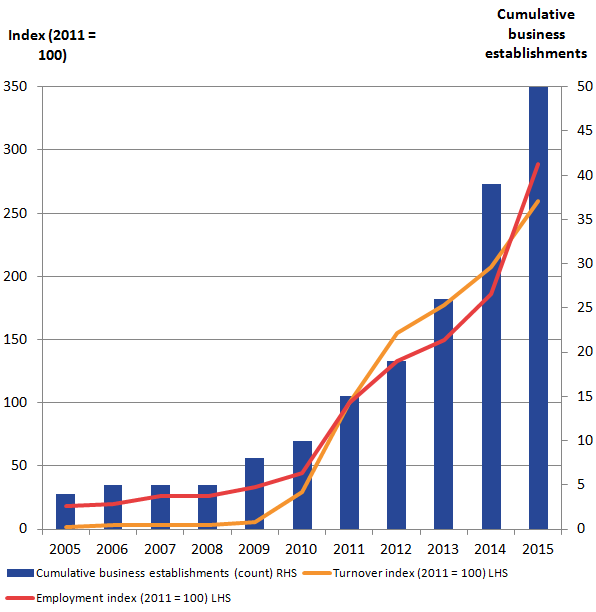

Figure 1 shows that of the 50 businesses identified, the majority were established from 2012 onwards. Interestingly, the sharing economy appears not to be an entirely new phenomenon, as 5 businesses out of the 50 identified were established in 2007 or before.

Figure 1: Establishment dates of 50 selected UK sharing economy businesses

UK, 2007 to 2015

Source: Office for National Statistics

Download this chart Figure 1: Establishment dates of 50 selected UK sharing economy businesses

Image .csv .xlsAs discussed in the introduction to this report, there is no specific Standard Industrial Classification (SIC) for the sharing economy. Figure 2 presents the classifications of the 50 sharing economy businesses identified by ONS, across a range of industry groups. More than half of those identified had their main business activity recorded as ‘Business services and finance’, followed by ‘Transport, storage and communication’ where 15 of the businesses were classified. This information can be used to help track these businesses within the current National Accounts and other official business statistics.

Figure 2: Classifications of 50 selected UK sharing economy businesses by industry group

UK, 2015

Source: Office for National Statistics

Download this chart Figure 2: Classifications of 50 selected UK sharing economy businesses by industry group

Image .csv .xlsFigure 3 illustrates a general upward trend that as the number of sharing economy businesses increases, so does the employment and turnover of the businesses. This reinforces the fact that sharing economy businesses are being captured in the National Accounts and other official statistics to some extent. However, it is important to note that while turnover and employment may be useful indicators of growth within the sharing economy, there are limitations to the coverage of these variables. For example, the turnover of these businesses may only reflect the fee charged for facilitating the activity and not the full economic benefit. Equally it may include other aspects of the business that are not directly related to the sharing economy. The former would understate the size of the sharing economy, while the latter would overstate it. In addition, the employment figures held on the IDBR will only include those employees registered for PAYE (Pay As You Earn) and therefore many individuals who are earning money through the sharing economy, will not be captured as they are not treated as employees of these businesses. These examples highlight the importance of fully understanding how each business is structured before attempting to estimate the size of the sharing economy. The next stage of this analysis is to understand how these businesses are structured through profiling – which involves direct contact with such businesses. ONS welcomes the support of SEUK and other sharing economy businesses to further understanding in this area.

Figure 3: Sharing economy businesses' employment and turnover with cumulative business establishments (2011 = 100)

UK, 2005 to 2015

Source: Office for National Statistics

Download this image Figure 3: Sharing economy businesses' employment and turnover with cumulative business establishments (2011 = 100)

.png (27.7 kB) .xlsx (9.8 kB)Action points

Further work is required to assess the feasibility of using administrative data to measure the sharing economy and in order to do this the following action points should be explored:

Action point 4: ONS should work with sharing economy businesses to gain access to administrative data and also understand how these businesses are structured.

Action point 5: ONS should utilise information such as turnover, employment, establishment dates, and industry classifications to identify further sharing economy businesses.

Notes for Using administrative data

- Information on SEUK is available on the sharing economy website.

- The IDBR is the comprehensive list of UK businesses used by government for statistical purposes.

5. Using big data

Big data

The Office for National Statistics (ONS) recognises the opportunity of using big data1, which includes data from websites, social media, and mobile phones. ONS is already exploring these alternative data sources to assess their potential use in producing official statistics. Utilising big data sources could enable the ONS to produce new outputs whilst reducing costs and improving quality of statistics. However, as with any data source, big data does have limitations – for example, the datasets tend to be large and unstructured. Despite these limitations, big data should be considered as a potential source when investigating how to measure the sharing economy.

Big data may be a particularly relevant source of information for the sharing economy as its growth is inextricably linked to the evolution of the internet, online services and the associated technologies that support peer-to-peer businesses transactions. Many examples of sharing economy businesses – Airbnb, Uber and BlaBlaCar – are online businesses. Therefore, one approach to measuring the sharing economy could be to collect transactional information directly from websites. Web scraping and Application Programming Interface (API) are two main approaches for obtaining this kind of data.

Web scraping

Web scraping (the use of ‘robots’ or ’crawlers’, for example) is a technique that involves extracting semi-structured data from the XML code used to produce web pages. These data can be transformed into more structured data to develop new data products and services – for example, comparison websites and search engines. ONS is already investigating ways of web scraping price and product data from retail websites to support the production of price statistics. However, there are a number of technical challenges with this approach; for example, web scraping applications often ‘break’ if the structure of a website changes. There are also legal issues to consider, as some websites, many of which are sharing economy websites, prohibit web scraping.

Application Programming Interface

API is a set of routines, protocols and tools for building software applications. Some websites provide APIs to enable third parties to easily develop web applications to support the business of their website. For example, a jobs portal might offer an API to enable employment agencies to easily load new job vacancies on to the website. Some APIs may also enable third parties to access databases that sit behind their website. For example, ONS has an API that provides direct access to Census data.

SEUK and their members have indicated a willingness to work with ONS to develop approaches for measuring the contribution of the sharing economy to the UK. Therefore, the best way of obtaining data to support this would be to secure direct access to their data. Even if websites do not have a public API, it might be possible to negotiate access via a private API or some other data transfer arrangement. Clearly, the data requested should only be the minimum information required to produce relevant statistics.

Action points

In order to explore the potential of using big data to measure the sharing economy further, the following action point should be pursued:

Action point 6: ONS should carry out further research to investigate the potential of obtaining data from sharing economy websites including web scraping, APIs and/or negotiated access to data relevant for statistical purposes.

Notes for Using big data

- Information on the ONS big data project is available on the ONS website.

6. Conclusion

This report has discussed the initial work undertaken by ONS to assess the feasibility of measuring the sharing economy. It has considered the potential of using surveys, administrative data and big data to produce official statistics on the sharing economy. While this feasibility study may be a useful addition to the growing field of research on the sharing economy, there are a number of further actions to undertake, in consultation with stakeholders, to better understand this sector. These action points have been outlined throughout the report, and are summarised below:

Action point 1: ONS should undertake further work to establish an agreed definition of the sharing economy and define the coverage of the statistics. This will involve defining the types of activities that should be captured (for example, monetary or non-monetary) and who the target population will be (for example, businesses or households and individuals). This should be achieved through working in conjunction with representatives from across government, academia and private sector bodies.

Action point 2: ONS should identify existing surveys where additional questions on the sharing economy could potentially be asked.

Action point 3: ONS should continue to engage at a European level and ensure that ONS keeps pace with international best practice.

Action point 4: ONS should work with sharing economy businesses to gain access to administrative data and also understand how these businesses are structured.

Action point 5: ONS should utilise information such as turnover, employment, establishment dates, and industry classifications to identify further sharing economy businesses.

Action point 6: ONS should carry out further research to investigate the potential of obtaining data from sharing economy websites including web scraping, APIs and/or negotiated access to data relevant for statistical purposes.

Further discovery work will be undertaken over the coming months to estimate the time and resource required to fulfil the various actions points outlined in this report; following this, ONS will release a detailed work programme this summer.

Nôl i'r tabl cynnwys