The impact of lockdown on economic activity has been lower in autumn and winter 2020 and early 2021 than in spring 2020, as people and businesses continue to adapt to life under coronavirus (COVID-19) restrictions.

UK gross domestic product (GDP) – a measure of total economic activity – fell by 24% between February and April 2020, with the first national lockdown announced in late March. The impact of increased restrictions in subsequent lockdown periods was less severe – activity was 7.4% and 9.0% below its pre-pandemic level in November 2020 and January 2021 respectively.

While guidance has varied across the nations and regions of the UK at different times, we have previously identified three main periods of public health restrictions:

- spring 2020 lockdown (23 March 2020 to 13 May 2020)

- autumn and winter 2020 restrictions (14 October 2020 to 4 January 2021)

- early 2021 lockdown (from 5 January 2021)

The Oxford Government Response Trackers’ Stringency Index assesses the different levels of restrictions across time.

The smaller fall in economic activity under public health restrictions has coincided with increased mobility in autumn and winter 2020 and early 2021 compared with spring 2020. This is according to Google’s indices of time spent and visits to workplaces, retail and recreation, groceries and pharmacies, and transit stations.

Mobility data show reductions in movement in each lockdown period

Google mobility at selected locations compared with baseline period (3 January to 6 February 2020), UK

Source: Google mobility reports

Notes:

- Google Mobility data have been smoothed by taking a weekly average of the given index. Therefore, indices may not start at a base of 0.

- The base period is the median value from the five-week period 3 January to 6 February 2020 for the given day of the week.

- Please note that aggregating to weekly values averages over days of the week, each of which has a different level of baseline mobility. However, this still provides a useful indication of the larger mobility trends.

- Seasonal effects from Christmas are captured during autumn and winter 2020 restrictions.

- More information on this external statistic is available.

Download this chart Mobility data show reductions in movement in each lockdown period

Image .csv .xlsTogether, the trends in mobility and economic activity suggest that the economy is coping better with restrictions in early 2021 compared with when they were first introduced in spring 2020.

We look at five ways in which people and businesses have adapted to lockdowns.

1. Businesses are more likely to remain open in some capacity

Businesses within industries hardest hit by lockdowns – such as arts, hospitality, construction, retail and manufacturing (which account for 22.7% of GDP) – have shown signs of adapting to public health restrictions.

More than 80% of arts, entertainment and recreation and accommodation and food businesses were temporarily closed during the spring 2020 lockdown; this had dropped to around 55% during January 2021.

In construction, around 30% of firms paused trading in spring 2020, down to less than 4% in early 2021.

These changes are likely to be a result of businesses adapting, such as hospitality companies offering takeaway only, arts organisations streaming performances online and construction firms introducing measures to make their workplaces COVID-secure. In some cases, changes to Working safely during coronavirus (COVID-19) guidance would have also affected businesses’ ability to remain open in different periods.

The number of businesses temporarily closed because of coronavirus restrictions has fallen in almost all industries since the spring 2020 lockdown

Proportion of UK businesses that had temporarily closed or paused trading across a two-week period in lockdown, by industry, UK, 23 March 2020 to 21 February 2021

Source: Office for National Statistics – Business Insights and Conditions Survey

Notes:

- Final unweighted results, Wave 1 to Wave 6, and final weighted results, Wave 7 to Wave 24, of the Office for National Statistics' (ONS') Business Insights and Conditions Survey (BICS). Please note, businesses were asked this question regarding the last two weeks, where Wave 1 reference period was 23 March to 5 April 2020.

- Unweighted estimates from Waves 1 to 6 should be treated with caution, as results reflect the characteristics of those that responded and not necessarily the wider business population.

- “Spring 2020 lockdown” refers to Wave 1 (trading period 23 March to 5 April 2021) of BICS when the UK was in national lockdown, this wave is unweighted and should be treated with caution when comparing with Waves 7 onwards. “Autumn and winter 2020 restrictions” refers to Wave 18 (trading period 16 to 29 November) when England was already in lockdown and new restrictions were put in place for Wales, Scotland and Northern Ireland. "Early 2021 lockdown” refers to Wave 24 (trading period 8 to 21 February 2021) when all nations had restrictions in place to varying degrees (England, Wales, Scotland and Northern Ireland). For more information on all waves, please see Business Insights and impact on the UK economy.

- Industries may not sum to 100% because of rounding and percentages less than 1% being removed for disclosure purposes.

- Mining and quarrying has been removed for disclosure purposes, but its total is included in “All industries”.

Download this chart The number of businesses temporarily closed because of coronavirus restrictions has fallen in almost all industries since the spring 2020 lockdown

Image .csv .xls2. There are more people working at their normal place of work in early 2021 than there were in the spring 2020 lockdown

Across all industries, around 45% of the workforce have been operating from their normal place of work during the early 2021 lockdown, down from 51% during autumn and winter 2020 restrictions but up from 36% in the first national lockdown.

This is supported by our previous analysis of behaviours during different lockdown periods, which shows the proportion of people travelling to work is up by around 10 percentage points in the early 2021 lockdown compared with spring 2020. Similarly, road activity observed from traffic camera data in London and the North East of England shows an increase of cars, buses, vans and trucks on the roads in the early 2021 lockdown compared with spring 2020.

Most industries have seen an increase in staff in the workplace despite renewed restrictions in autumn and winter 2020 and early 2021

Proportion of UK businesses working at normal place of work across a two-week period in lockdown, by industry, UK, 23 March 2020 to 21 February 2021

Source: Office for National Statistics – Business Insights and Conditions Survey

Notes:

- Final unweighted results, Wave 1 to Wave 6, and final weighted results, Wave 7 to Wave 25, of the Office for National Statistics' (ONS') Business Insights and Conditions Survey (BICS); businesses not permanently stopped trading. Please note, businesses were asked for their experiences during a 2-week reference period, where Wave 1 reference period was 9 March to 22 March 2020. This will be different from trading status question, where Wave 1 refers to the period of completion which was 23 March to 5 April 2020.

- Unweighted estimates from Waves 1 to 6 should be treated with caution, as results reflect the characteristics of those that responded and not necessarily the wider business population.

- “Spring 2020 lockdown” refers to Wave 1 (trading period 23 March to 5 April 2021) of BICS when the UK was in national lockdown, this wave is unweighted and should be treated with caution when comparing with Waves 7 onwards. “Autumn and winter 2020 restrictions” refers to Wave 19 (trading period 16 to 29 November) when England was already in lockdown and new restrictions were put in place for Wales, Scotland and Northern Ireland. "Early 2021 lockdown” refers to Wave 25 (trading period 8 to 21 February 2021) when all nations had restrictions in place to varying degrees (England, Wales, Scotland and Northern Ireland). For more information on all waves, please see Business Insights and impact on the UK economy.

- Industries may not sum to 100% because of rounding and percentages less than 1% being removed for disclosure purposes.

- Mining and quarrying was removed for disclosure purposes, but its total is included in “All industries”.

- Businesses were asked for their experiences for the reference period. However, for questions regarding the last two weeks, businesses may respond from the point of completion of the questionnaire.

Download this chart Most industries have seen an increase in staff in the workplace despite renewed restrictions in autumn and winter 2020 and early 2021

Image .csv .xlsWhile the proportion of people working from home has remained high since spring 2020 in industries such as information and communication, and professional, scientific and technical activities, other sectors less suited to work remotely have adapted to allow their staff to return to their normal place of work.

For example, during the spring 2020 lockdown, around a third of construction staff were working on-site as the introduction of restrictions and uncertainty on their implications for the sector saw a temporary suspension of projects and closure of sites. As a result, output in the construction sector (which accounts for 6.4% of GDP) fell by 40% in April 2020 alone, the largest monthly fall on record, with an average of 42% of the construction workforce on furlough in this period.

Under the autumn and winter 2020 restrictions and the early 2021 lockdown, building activity has held up much better, helped in part by additional guidance for employers to create a COVID-secure workplace. Official estimates show that the construction industry grew by 0.9% in January 2021 against the backdrop of lockdown restrictions. Around 59% of staff have been working on site and less than 5% have been placed on furlough.

Staff returning to their normal place of work has coincided with a fall in the number of workers on furlough

Proportion of UK businesses on partial or furlough leave, working at normal place of work and working remotely, by selected industries, 23 March 2020 to 21 February 2021

Embed code

Notes:

- Final unweighted results, Wave 1 to Wave 6, and final weighted results, Wave 7 to Wave 25, of the Office for National Statistics' (ONS') Business Insights and Conditions Survey (BICS); businesses not permanently stopped trading.

- Unweighted estimates from Waves 1 to 6 should be treated with caution, as results reflect the characteristics of those that responded and not necessarily the wider business population.

- Industries may not sum to 100% because of rounding and percentages less than 1% being removed for disclosure purposes.

- Mining and quarrying was removed for disclosure purposes, but its total is included in “All industries”.

- Businesses were asked for their experiences for the reference period. However, for questions regarding the last two weeks, businesses may respond from the point of completion of the questionnaire.

3. Consumer spending is increasingly resilient to lockdown restrictions

Daily total expenditure by sector and UK nations

Seven-day rolling average of adjusted indexed values (100 = day of week average February 2020)

Source: Revolut, Office for National Statistics calculations

Notes:

- Introduction of lockdowns and other restriction polices are expected to differ between the four UK nations.

- Geographic locations are defined by Revolut cardholder address rather than merchant location.

- Merchant category codes classify businesses dependent upon primary business categories, which can then be grouped up to higher, mutually exclusive sectoral levels. In this analysis, Entertainment includes pubs, restaurants, and social venues; Retail spending includes clothing and footwear, department stores, mixed retail businesses, household goods, and other retailers; Food and drink includes supermarkets, convenience stores, and other food and drink providers; Fuel and Transport includes petroleum and fuel products, commuter transportation, railways, taxicabs.

- Lockdown dates: UK: Lockdown 1 – 23 March 2020 to 15 June 2020, Lockdown 3 – 5 January 2021 to present (7 March 2021); England: Lockdown 2 – 5 November 2020 to 1 December 2020, Wales: Fire-break – 23 October 2020 to 9 November 2020; Northern Ireland: Lockdown 2 – 16 October 2020 to 11 November 2020.

Download this image Daily total expenditure by sector and UK nations

.PNG (95.3 kB)High-frequency consumer spending data from Revolut provide insight into the relative impact of different UK lockdowns. With Revolut customers generally younger and more metropolitan than average with a fast-growing customer base of several million in the UK, spending may not be representative of the UK macroeconomic picture – we weight to adjust for this, alongside high user-base growth, and sectoral representation.

Data from Revolut suggest that spending across England, Scotland, Wales and Northern Ireland dropped to lower levels during the spring 2020 lockdown compared with subsequent periods of restrictions. Average spending across the UK as a whole fell by 56% in the spring 2020 lockdown compared with pre-pandemic, as opposed to 17% under autumn and winter 2020 restrictions (boosted by seasonal spending) and 28% during the early 2021 lockdown.

This is consistent across various categories of spending. Compared with a pre-pandemic baseline, the drops in spending on retail (including clothing and footwear shops), entertainment (pubs, restaurants and social venues) and fuel and transport (covering personal travel spend) were substantial in autumn and winter 2020 and early 2021, although less severe than compared with spring 2020.

This matches what we have seen in levels of workplace and retail and recreation mobility, which have remained higher in more recent periods of restrictions compared with spring 2020.

Food and drink (including supermarkets and convenience stores) is the only category where spending has consistently remained above or around its pre-pandemic baseline across the four nations, with only Wales seeing slightly lower levels in the early 2021 lockdown.

Notably, all nations saw food and drink spending spike amid uncertainty and panic buying in the days leading up to the spring 2020 lockdown. The spikes ahead of latter restrictions were far less significant, as consumers adjusted.

4. Lockdown has accelerated the shift to online shopping

Retail sales index, in-store value sales, compared with online value sales, seasonally adjusted, Feb 2020 = 100; and Google mobility data locations compared with January to February 2020 baseline

Embed code

Notes:

- Google mobility data have been smoothed by taking a monthly average of given index. Therefore, Indices may not start at 0.

- The base period is the median value from the five-week period 3 January to 6 February 2020 for the given day of the week.

- Please note that aggregating to monthly values averages over days of the week, each of which has a different levels of baseline mobility captured in early 2020. However, this still provides a useful indication of the larger mobility trends.

- More information on this external statistic is available.

- Office for National Statistics (ONS) retail sales index is referenced to February 2020 = 100.

Across the different lockdowns there have been various restrictions on non-essential retail stores, which had an impact on the number of people travelling to access these services. However, much like overall economic activity, the impact of coronavirus restrictions on retail sales has lessened since the spring 2020 lockdown.

Total sales values dropped to 6.5% below their pre-pandemic level in January 2021, a far cry from the 23.3% fall in April 2020.

This reduced impact is partly down to an acceleration in the long-term shift by consumers towards online shopping. The value of online retail sales has increased markedly, largely offsetting the fall in in-store sales.

Feedback from online retailers suggests that non-essential store closures have helped boost sales. As a result, the share of online retail sales rose to a record 35.2% in January 2021, up from 19.5% a year earlier in January 2020 and 34.1% in May 2020.

The rise of online sales as a percentage of all retail has been consistent across sub-sectors, including food stores, that were able to remain open. With the help of click and collect services, the proportion of online food sales increased from 5.3% in February 2020 to 12.2% in January 2021.

And this could be a culture shift: according to our recent Opinions and Lifestyle Survey (OPN), 21% of adults plan to continue doing more of their grocery shopping online once the pandemic is over than did so before, which rises to 33% for people shopping online for other things.

All store types have seen an increase in online as a percentage of total sales

Online retail sales proportions by sector, seasonally adjusted, Great Britain, January 2020 to January 2021

Embed code

5. There is evidence of a rise in domestic travel in autumn and winter 2020 and early 2021 compared with spring 2020

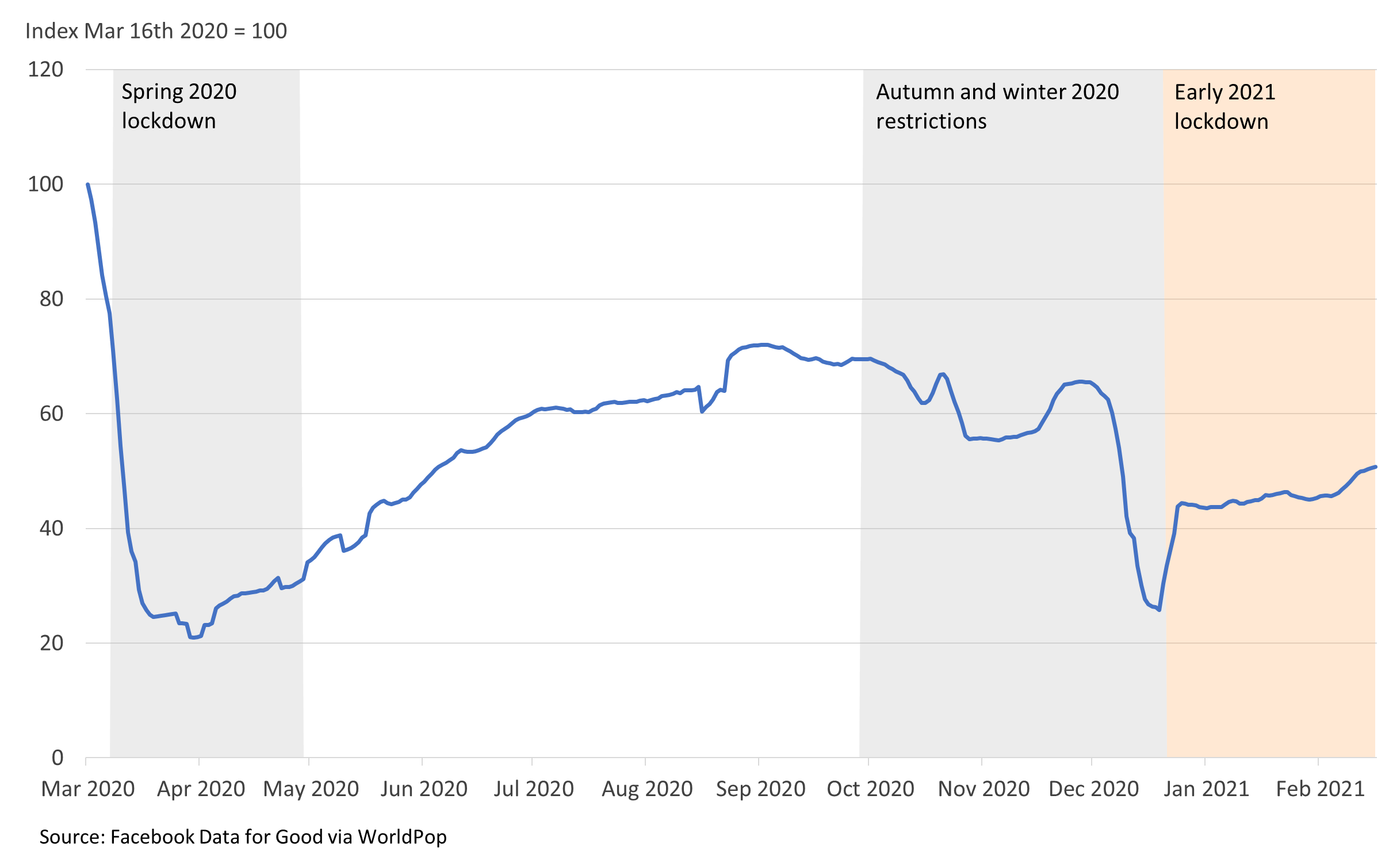

Facebook mobility data showing the relative number of journeys between local authorities, UK

16 March 2020 to 24 February 2021

Notes:

- Seasonal effects from Christmas are captured during autumn and winter 2020 restrictions.

- More information about Facebook Data for Good via WorldPop can be found in a blog post by the Data Science Campus.

Download this image Facebook mobility data showing the relative number of journeys between local authorities, UK

.png (126.5 kB)People have been making more journeys outside their local area in autumn and winter 2020 and early 2021 than they did in spring 2020, according to Facebook data on travel between local authorities. The data may include travel for work, and there was a steep drop in mobility around the Christmas period.

Despite the relative increase since last spring, travel between local authorities remained well below the pre-pandemic baseline throughout more recent periods of restrictions.

Meanwhile, hotel occupancy rates in England show a similar trend up to the end of 2020 – rates were up across most regions in the autumn and winter compared with the spring.

There was a surge in occupancy rates in some areas over the summer, amid increased demand for domestic holidays when restrictions were eased. The South West of England saw the largest rise while London recorded the smallest.