1. Main points

The value of UK manufacturers’ product sales reached £363.9 billion in 2014, a 2.6% increase on the 2013 estimate of £354.7 billion

UK manufacturers’ product sales have increased consistently since the 2008 to 2009 economic downturn, with average annual growth of 4.0% between 2010 and 2014

The food and motor vehicles, trailers and semi-trailers divisions made the largest contributions to manufacturers’ product sales in 2014, at £67.8 billion and £47.3 billion respectively

The manufacture of food products contributed 0.5 percentage points to manufacturers’ product sales growth in 2014, the largest contribution from a manufacturing division

The UK accounted for approximately 9.1% of total EU manufacturers’ product sales in 2014

2. Your views matter

We continuously aim to improve this release, its associated commentary and other outputs. We would welcome any feedback you might have and, to help ensure our statistics remain relevant, would like to know how you make use of these estimates. Further information, including a list of new or revised outputs can be found in item 1 of the background notes.

Please provide comments via email: prodcompublications@ons.gov.uk or telephone William Barnes on +44 (0)1633 455711

Nôl i'r tabl cynnwys3. Overview

This statistical bulletin provides data on UK manufacturers’ product (PRODCOM) sales. PRODCOM data are published biannually, with this release presenting intermediate estimates for 2014 and final results for 2013.

European Union (EU) member states are required, under regulation, to carry out annual PRODCOM surveys and provide information on mining, quarrying and manufacturing activities defined in the nomenclature of economic activities (see background note 2) to enable comparisons and, where possible, produce a picture of emerging industry and product developments in a European context.

PRODCOM coverage of mining, quarrying and manufacturing activities follow the hierarchy illustrated in Figure 1, with this bulletin structured accordingly. Information is first presented by the industrial divisions (see background note 7) divided into industries, followed by individual products.

Figure 1: Hierarchy of PRODCOM coverage

Source: Prodcom - Office for National Statistics

Download this image Figure 1: Hierarchy of PRODCOM coverage

.png (44.9 kB) .xls (16.9 kB)PRODCOM estimates can be interpreted in 2 ways: in terms of businesses classified to an industry and in terms of products corresponding to an industry. In this release, product information relate to products corresponding to an industry irrespective of which industry the business making the product is classified. On the other hand, all other published variables such as turnover refer to the activity of businesses classified to an industry.

These statistics are presented on a current price basis, which are prices as they were at the time of measurement and are therefore not adjusted for inflation. Due to an update of the Standard Industrial Classification (SIC), estimates prior to 2008 are not directly comparable with those after 2008 (see background note 2 for more information).

Nôl i'r tabl cynnwys4. UK manufacturers’ sales by product 2013

The value of UK manufacturers’ product sales in 2013 was £354.7 billion, a slight upward revision from the £354.5 billion published previously as part of the 2013 intermediate release in December 2014.

Nôl i'r tabl cynnwys5. UK manufacturers’ sales by product 2014

UK manufacturers’ sales were valued at £363.9 billion in 2014, up 2.6% compared with the 2013 estimate of £354.7 billion. The increase in the value of sales in 2014 marks the fifth annual increase since 2009, with the value of sales rising by 21.4% over the period in current prices at an average annual growth rate of 4.0% per year. However, care should be taken when comparing estimates before and after 2008 due to industry reclassifications.

Figure 2: Total value of UK manufacturers’ product sales, 2003 to 2014

Source: Prodcom - Office for National Statistics

Notes:

- Care should be taken when comparing estimates prior to 2008 with those after 2008 due to an industry reclassification.

Download this chart Figure 2: Total value of UK manufacturers’ product sales, 2003 to 2014

Image .csv .xls6. Results by division and industry

The UK manufacturers’ sales by product survey covers 25 industrial divisions (see background note 7).

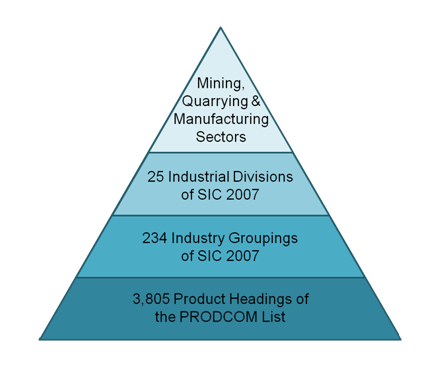

The 5 largest divisions in terms of product sales accounted for over half (52.2%) of the value of UK manufacturers’ product sales in 2014, see Figure 3.

The 2 largest divisions in terms of sales value in the UK manufacturing industries were food and motor vehicles divisions, trailers and semi-trailers, which together accounted for slightly below a third (31.6%) of total UK manufacturer product sales in 2014.

Figure 3: Total UK manufacturers’ product sales by division, 2014

Source: Prodcom - Office for National Statistics

Notes:

- bn = billion.

Download this image Figure 3: Total UK manufacturers’ product sales by division, 2014

.png (63.4 kB) .xls (25.6 kB)The value of UK manufacturers’ product sales reached £363.9 billion, a 2.6% increase on the 2013 estimate of £354.7 billion. Table 1 presents the contribution to growth for a selection of divisions between 2013 and 2014.

Table 1: Contribution to growth and percentage change for selected divisions, 2013 to 2014

| UK | ||||

| Sales value (£ billion) | % Change | Contribution to growth % | ||

| 2013 | 2014 | |||

| Manufacture of wood and of products of wood and cork, except furniture; manufacture of articles of straw and plaiting materials | 6.1 | 6.9 | 12.4 | 0.2 |

| Manufacture of other non-metallic mineral products | 10.4 | 11.2 | 8.0 | 0.2 |

| Manufacture of beverages | 12.4 | 13.3 | 7.3 | 0.3 |

| Manufacture of fabricated metal products, except machinery and equipment | 24.3 | 25.4 | 4.9 | 0.3 |

| Manufacture of furniture | 6.3 | 6.6 | 4.5 | 0.1 |

| Manufacture of food products | 66.0 | 67.8 | 2.7 | 0.5 |

| Manufacture of other transport equipment | 26.5 | 26.6 | 0.7 | 0.1 |

| Repair and installation of machinery and equipment | 14.0 | 13.9 | -0.4 | -0.0 |

| Manufacture of leather and related products | 0.7 | 0.7 | -1.3 | -0.0 |

| Manufacture of computer, electronic and optical products | 12.6 | 12.3 | -2.2 | -0.1 |

| Manufacture of basic metals | 6.7 | 6.4 | -4.3 | -0.1 |

| Manufacture of tobacco products | 1.7 | 1.6 | -6.3 | -0.0 |

| Manufacture of basic pharmaceutical products and pharmaceutical preparations | 12.0 | 10.9 | -9.7 | -0.3 |

| All other divisions | 155.1 | 160.3 | 3.3 | 1.5 |

| Total UK Manufacturers' Sales | 354.7 | 363.9 | 2.6 | 2.6 |

| Office for National Statistics | ||||

| Notes: | ||||

| 1. Further divisional information can be obtained from background notes 7 while estimates can be obtained from excel or open data reference tables. | ||||

Download this table Table 1: Contribution to growth and percentage change for selected divisions, 2013 to 2014

.xls (28.2 kB)Divisions reporting growth

Manufacture of wood and of products of wood and cork, except furniture; manufacture of articles of straw and plaiting materials

Wood and cork products; straw and plaiting materials (excluding furniture) was the fastest growing industrial division in 2014 in terms of manufacturers’ product sales, growing by 12.4% compared with 2013. The division’s total sales are estimated to have reached £6.9 billion in 2014, an increase of £756.0 million compared with 2013.

Although only accounting for a small proportion of its broader industrial division, the sales of products relating to sawmilling and planing of wood industry continues to report strong growth, rising by 9.6% in 2014. UK manufacturers’ sales of products within this industry have followed an upward trend since 2009, rising by 44.4% over the period.

Manufacture of motor vehicles; trailers and semi-trailers1

Manufacturers’ of motor vehicles; trailers and semi-trailers reported sales figures of £47.3 billion, making this the second highest division in terms of sales in 2014. This division is dominated by the manufacture of 2 products: motor vehicles with a petrol engine greater than 1,500cc, at £16.2 billion; and motor vehicles with a diesel engine between 1,500cc and 2,500cc, at £7.7 billion. These 2 products alone make up over half (50.4%) of the total sales for the division, and are discussed in more detail in the results by product section of this bulletin. The importance of the motor industry to the UK economy has recently been explored in an Economic Performance of the UK's Motor Vehicle Manufacturing Industry article published by us and increased investment, new production lines and doubling of export value have been cited by the Society of Motor Manufacturers and Traders, the UK car industry’s trade body, as contributory factors for the growth in 2014.

Manufacture of food

The manufacture of food has traditionally been the largest division in terms of UK product sales. This continued to be the case in 2014, with almost one-fifth (18.6%) of total product sales accounted for by the division (£67.8 billion). While this is the same proportion as reported in 2013, sales once again increased, with annual growth of 2.7%.

There are 25 industries that make up the food division, ranging from relatively small industries such as the manufacture of starches at (£0.3 billion), to the 2 largest; the operation of dairies and cheesemaking (£7.9 billion) and the processing and preserving of meat (£6.6 billion).

Divisions reporting declines

Manufacture of basic pharmaceutical products and pharmaceutical preparations

The manufacture of basic pharmaceutical products and pharmaceutical preparations division experienced the second largest decline in sales in 2014, falling by 9.7% compared with 2013. The drop in sales of over £0.6 billion in 2014 for "medicaments put up in measured doses for retail sale" accounted for half of the total £1.2 billion fall in the division’s total sales. However, the division remains important to the UK economy despite the decline, contributing just under 3.0% to total sales in 2014 (£10.9 billion of £369.3 billion).

Manufacture of basic metals

UK manufacturers’ sales of basic metals fell to £6.5 billion in 2014, down 4.1% compared with 2013. Part of the decline in sales can be attributed to rapidly falling sales from the production of precious metals industry. Manufacturers’ sales of precious metals have fallen 70.2% in the last 3 years, from £874.7 million in 2011 to £260.4 million in 2014. Additionally, the copper industry which had reported strong growth between 2009 and 2011 has seen sales reduce by 35.2%, from £727.0 million in 2011 to £471.4 million in 2014.

Notes for results by division and industry

- This division is excluded from Table 1 as the 2013 data is disclosive.

7. Results by product

The UK manufacturers’ sales by product survey covers 3,805 products. Table 21 illustrates the top 15 products by sales value in the UK in 2014.

Main points:

nine of the top 15 products saw growth in UK manufacturers’ sales in 2014

three products retained the same ranking in the top 15 products as in 2013, with 4 products moving up the rankings and 8 falling

sales from the manufacture of motor vehicles with petrol engines above 1,500cc were the highest in terms of value in 2014 and almost double the second highest product, civil aircraft parts

manufacturers of soft drinks reported annual sales growth of £1.0 billion in 2014

manufacturers’ sales of whisky dropped for the first time in 5 years

Table 2: Trend of published top 15 UK manufactured products with the highest production by sales value, 2013 to 2014

| Product description | Sales value (£ billion) | Sales value % change | Top 15 ranking | ||

| 2013 | 2014 | 2013 | 2014 | ||

| Motor vehicles with petrol engines greater than 1500cc | 13.75 | 16.21 | 17.9 | 1 | 1 |

| Parts for all types of aircraft, for civil use | 7.62 | 8.60 | 12.9 | 3 | 2 |

| Motor vehicles with diesel or semi diesel engines between 1500cc and 2500cc | 10.21 | 7.67 | -24.9 | 2 | 3 |

| Military aircraft and parts manufacture, installation and repair | 7.49 | 6.63 | -11.5 | 4 | 4 |

| Medicaments excl. Antibiotics, hormones, steroids, alkaloids and vitamins | 6.01 | 5.38 | -10.5 | 5 | 5 |

| Soft drinks and flavoured waters | 3.44 | 4.46 | 29.7 | 7 | 6 |

| Civil aircraft and engines repair and maintenance | 3.48 | 3.59 | 3.2 | 6 | 7 |

| Cakes and pastry products, and other bakers' wares with added sweetening matter | 3.04 | 3.26 | 7.2 | 11 | 8 |

| Beer made from malt | 3.24 | 3.24 | 0.0 | 8 | 9 |

| Other structures of iron and steel n.e.c | 2.77 | 3.13 | 13.0 | 15 | 10 |

| Whisky | 3.12 | 3.07 | -1.6 | 9 | 11 |

| Manufacture, installation and repair of military vessels and parts thereof | 3.09 | 3.03 | -1.9 | 10 | 12 |

| Fresh bread containing by weight in the dry matter state not more than 5% of sugars and not more than 5% of fat | 2.98 | 3.01 | 1.0 | 12 | 13 |

| Fresh or chilled cuts of beef and veal | 2.93 | 3.01 | 2.7 | 13 | 14 |

| Parts and accessories of bodies INCLUDING: - assembled motor vehicle chassis-frames with or without wheels but without engines | 2.78 | 2.98 | 7.2 | 14 | 15 |

| Source: Office for National Statistics | |||||

| Notes: | |||||

| 1. Products ranked in the top 15 are excluded if the data are disclosive and therefore may reveal company responses; however, the impact of excluding such data is limited. | |||||

| 2. Estimates can be obtained from excel or open data reference tables. | |||||

Download this table Table 2: Trend of published top 15 UK manufactured products with the highest production by sales value, 2013 to 2014

.xls (20.5 kB)This section examines a selection of product movements within certain industries of the UK’s manufacturing economy.

Motor vehicles

Some of the main motor vehicle products include:

motor vehicles with petrol engines greater than 1,500cc

motor vehicles with a petrol engine less than 1,500cc

motor vehicles with a diesel engine between 1,500cc and 2,500cc

In 2014, motor vehicles with petrol engines above 1,500cc was the leading product in terms of UK manufacturers’ sales worth £16.2 billion, up 17.9% from the 2013 estimate of £13.8 billion, see Table 2. However, while the sales value increased, the volume sold by UK manufacturers reduced by 7.7% since 2013.

One of the success stories within the automotive industry in 2014 has been the increase in UK manufacturers’ sales of petrol vehicles under 1,500cc, which more than doubled from £0.9 billion to £1.8 billion between 2013 and 2014. This growth is also reflected in the volume sold, with just over 200,000 units coming off the production line in 2014, compared with 92,000 in 2013. There was also an increase in the sale of motor vehicles with petrol engines greater than 1,500cc of £2.5 billion, from £13.8 billion in 2013 to £16.2 billion in 2014.

Despite the success of some aspects of the automotive industries, falling sales were reported for other parts. UK manufacturers’ of motor vehicles with diesel engines between 1,500cc and 2,500cc reported sales had fallen to £7.7 billion in 2014, a 25.0% decline compared with 2013.

Aerospace and defence

Some of the main aerospace and defence products include:

parts for all types of aircraft, for civil use

manufacture of aircraft seats

manufacture, installation and repair of military aircraft and parts thereof

civil aircraft and engines repair and maintenance

manufacture, installation and repair of military vessels and parts thereof

Since 2013, UK manufacturers’ sales of parts of civil aircraft increased by almost £1.0 billion to £8.6 billion. This continues the upward trend observed in recent years, with value of sales growing by an average annual rate of 7.8% compared with 2008. Additionally, sales of aircraft seats more than doubled over the same time period, from £417 million to £882 million.

Sales from the repair and maintenance of civil aircraft and engines increased for the fourth year running, reaching £3.6 billion in 2014, up 3.0% compared with 2013.

UK manufacturers’ sales of aerospace and defence products that have seen a decrease relate to the military. The repair, installation and manufacture of military aircraft and parts saw sales in 2014 decline by 11.6% compared with 2013; while the repair, installation and manufacture of military vessels dropped from the top 10 products in 2013 to 12th place in 2014, reflecting a decline in sales over the period.

The changing shape of the UK aerospace industry is detailed in a 'What does the UK aerospace industry look like today?' report published by us. Further information on the manufacture, repair and maintenance of air and spacecraft and related machinery, as well as the manufacture of military fighting vehicles, can be found within the Division 30 and Division 33 sections of our Open Data and Excel reference tables respectively.

Beverages

Some of the main beverage products include:

waters, with added sugar, other sweetening matter or flavoured (soft drinks)

whisky

beer

UK manufacturers’ sales of soft drinks experienced the fastest growth among the top ranked 15 products with the highest sales value between 2013 and 2014, with a growth rate of 29.8%, as shown in Table 2. This represents a sales increase of £1.0 billion, with total soft drink sales of £4.5 billion in 2014. Soft drinks and flavoured waters are 1 of 3 beverages to appear consistently in the top 15 products with the highest sales value, since 2008, alongside beer and whisky.

UK manufacturers’ sales of whisky increased steadily between 2009 and 2013, from £2.2 billion to £3.1 billion. As highlighted in the winter-related products article published by us today, this growth has stalled, with sales falling by 1.6% amid reports of falling demand in the emerging markets.

Books and newspapers

Some of the main book and newspaper products include:

printing of books, brochures and leaflets

printing of newspapers appearing 4 times a week or more

newspapers appearing less than 4 times a week

UK manufacturers’ sales from the printing of books, brochures and leaflets increased in 2014 by 6.7% to £952.6 million. Overall, there has been positive average annual growth of 8.6% since 2008, despite the increased usage of e-books.

However, UK manufacturer sales from the printing of newspapers appearing 4 times a week or more have decreased by 13.7% since 2013 and by 69.1% between 2008 and 2014 to £137.6 million. Similarly, sales from newspapers appearing less than 4 times a week fell by 3.2% between 2013 and 2014 and by 57.3% between 2008 and 2014 to £134.0 million.

Our Internet Access - Household and Individuals 2014 data shows that over half of adults used the internet to read or download newspapers and magazines in 2014.

Other selected products

In 2014, UK manufacturers have also reported notable sales growth with the following products:

beauty, make-up and skin care preparations – sales increased for the second year running, from £713.5 million to £722.0 million; while this is a comparatively small increase, the product has seen growth of 62.3% since 2008

manicure or pedicure preparations – sales have increased every year since 2008, with almost 3 times the value of sales reported in 2008, at £42.7 million in 2014

women's and girls' sweatshirts, pullovers and cardigans – sales almost doubled from £32.4 million to £59.4 million between 2013 and 2014

Declining sales have however been reported by UK manufacturers of the following products:

photosensitive semiconductor cells (solar cells) – sales declined by 72.0%, from £292.7 million to £81.8 million between 2013 and 2014

leather, of bovine animals, without hair, whole – sales of leather in 2014 were more than a third lower than sales in 2013, falling from £102.9 million in 2013 to £32.8 million in 2014

transmission apparatus for radio-broadcasting and television, without reception apparatus – since 2008, sales have declined by 83.7% from £412.4 million to £67.2 million

Notes for results by product

- Products ranked in the top 15 are excluded if the data are disclosive and therefore may reveal company responses; however, the impact of excluding such data is limited.

8. EU PRODCOM data

The PRODCOM survey on production of manufactured goods is carried out annually by EU member states, under EU regulation, to enable comparison and, where possible, produce a picture of emerging developments in an industry or product in a European context.

Provisional data for 2014, the most recent estimates with comparable EU data, shows that manufacturers’ product sales in the EU was worth an estimated EUR 5,1 billion. The UK accounted for approximately 9.1% to total EU manufacturers’ product sales in 2014.

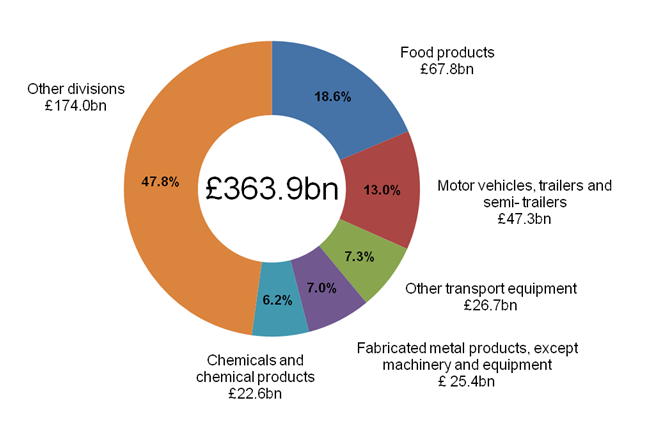

Figure 4 shows the share of top 20 products by value of sold production in the EU, as a percentage of the EU28 total sales. There were 4 products that have a share representing more than 1.0% of the total sales value; 5 of the UK’s top 10 products fall within the EU leading products. These products are: motor vehicles with petrol engines greater than 1,500cc; parts for civil aircraft; motor vehicles with diesel or semi diesel engines between 1,500cc and 2,500cc; medicaments excluding antibiotics, hormones, steroids, alkaloids and vitamins; and beer.

Figure 4: Top 20 products by percentage of total sales, EU28, 2014

Source: Prodcom - Eurostat

Notes:

- Comparisons made using provisional 2014 data from EU28 member states.

- Data are not available for Cyprus, Luxembourg and Malta. According to the terms of the PRODCOM regulation, these countries are exempt from reporting PRODCOM estimates to Eurostat and zero product sales is recorded for them on all products in the Eurostat total.

- The statistical Classification of Products by Activity (CPA) is the classification of products (goods and services) at the European Union. CPA product categories are related to activities as defined by the statistical classification of economic activities in the European Community (NACE).

- UK’s contribution of approximately 9.1% of total EU manufacturers’ product sales of EUR 5,077 billion is based on the exchange rate (1.2768 Euros to £1) of 5th January 2015, the day of dispatch of 2014 PRODCOM questionnaires.