1. Key points

- The provisional estimate of UK manufacturers’ sales for 2012, at current prices, is £342 billion (£4.2 billion higher than in 2011)

- The value of UK manufacturers’ sales in 2012 was 3.2% (£10.5 billion) above the level seen in 2008, at the start of the recession

- Of the top 10 products by sales value, six related to the motor vehicle and aircraft industries, while three are from the drinks industries (water, beer, and whisky)

- The largest sales in manufactured products in 2012 were from: Food (£62.2 billion); Motor vehicles, trailers and semi-trailers (£39.2 billion); and Machinery and equipment (£26.1 billion)

2. Overview

This release provides estimates of manufacturers’ sales by product and is commonly referred to as PRODCOM. Sales estimates are from businesses based in the UK only, irrespective of the final product destination. All estimates are presented at current prices and have not been adjusted for inflation using a Gross Domestic Product (GDP) deflator. This is important when comparing the value of UK manufacturers’ sales between years.

PRODCOM stands for PRODucts of the European COMmunity. The analyses in this bulletin and the accompanying tables reflect the most recent and comprehensive annual sales by value and volume data, based on the PRODCOM Survey for the years 2008 to 2012.

The PRODCOM Survey is carried out annually by all EU member states, under EU regulation, to enable comparison and, where possible, produce a picture of emerging developments of an industry or product in a European context. The survey has been conducted since 1993 when it replaced the UK’s Annual and Quarterly Sales Inquiries. In 2012, a sample of approximately 21,500 UK businesses was selected for the survey from ONS’s Inter-Departmental Business Register (IDBR).

Latest data for the 27 EU members can be found on the Eurostat website. The survey is conducted across the manufacturing industries; a total of 234 industries and 3,866 products. Every business is classified to a specific manufacturing industry but can span a variety of products depending on its diversity.

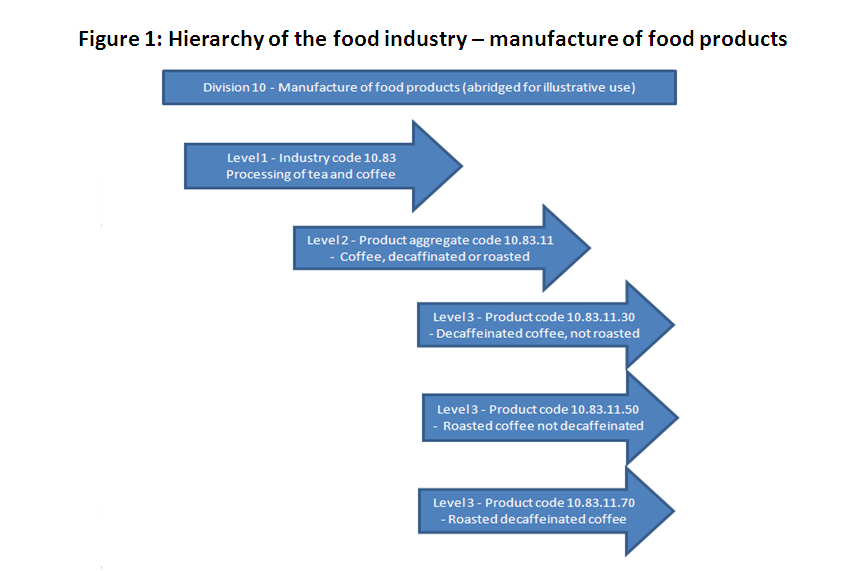

Data in the accompanying reference tables are presented by manufacturing ‘Division’ divided into ‘Industries’, followed by product aggregates and then individual products. The PRODCOM list, which is set by the European Commission, contains a comprehensive breakdown of industries. The structure of the PRODCOM codes are derived from various classification systems (detailed at 2.2). Figure 1 provides an illustration of the hierarchy of the published data.

Figure 1: Hierarchy of the food industry - manufacture of food products

Download this image Figure 1: Hierarchy of the food industry - manufacture of food products

.png (70.1 kB)Businesses selected for the PRODCOM survey are asked to supply the value of manufactured product sales and non-manufacturing income, the latter being used for balancing purposes only. In addition, businesses selected for three quarters of the industries covered, supply volume information.

The estimates in this release are accompanied by Her Majesty’s Revenue and Customs (HMRC) data on imports and exports, both intra (EU) and extra (non-EU). Analysis and data relating to the most recent period is published at uktradeinfo and is used by a wide range of government and international organisations. This information is useful for helping users gauge market share and for businesses to better understand how to establish new markets for their products. The trade data are also used in the ONS’ UK Balance of Payment account to help quantify the health of the UK economy.

Nôl i'r tabl cynnwys3. User engagement

In early 2013, ONS conducted a survey seeking feedback from users of PRODCOM. A number of comments were received with respect to the possibility of expanding and improving the quality of PRODCOM data. We are continuing to seek further feedback from users to help determine priorities in order to define a continuous improvement plan. We would like to take this opportunity to thank all respondents who provided feedback to date.

We are constantly aiming to improve this release and its associated commentary. We would welcome any feedback you might have and would be particularly interested in knowing how you make use of these data to inform your work. Please contact us via email: prodcompublications@ons.gov.uk or telephone Hannah Finselbach on +44 (0)1633 456746.

Nôl i'r tabl cynnwys4. PRODCOM sales 2012

In 2012, the value of UK manufacturers’ sales, at current prices, was estimated to be £342 billion. This is an increase of 1.2% (£4.2 billion) compared with 2011 and, following three consecutive annual increases, is 3.2% (£10.5 billion) above the level seen in 2008, at the start of the recession.

Figure 2: UK manufacturers’ sales

Source: Office for National Statistics

Download this chart Figure 2: UK manufacturers’ sales

Image .csv .xlsTable 1 shows the top 10 PRODCOM products with the highest value of sold production in 2012.

Table 1: The top 10 PRODCOM products with the highest value of sold production in 2012

| Product Description | PRODCOM Code1 | Value (billion) | Percent of Total (%) |

| Motor vehicles with a petrol engine >1500 cm3 (including motor caravans of a capacity >3000 cm3) (excluding vehicles for transporting ≥ 10 persons, snowmobiles, golf cars and similar vehicles). | 29102230 | 13.3 | 3.9 |

| Other medicaments of mixed or unmixed products, packaged for retail sale, not elsewhere classified. | 21201380 | 9.3 | 2.7 |

| Parts for all types of aircraft excluding propellers, rotors, under carriages, for civil use. | 30305090 | 6.4 | 1.9 |

| Motor vehicles with a diesel or semi-diesel engine >1500 cm3 but ≤ 2500 cm3 (excluding vehicles for transporting ≥ 10 persons, motor caravans, snowmobiles, golf cars and similar vehicles). | 29102330 | 6.0 | 1.8 |

| Manufacture, installation and repair of military aircraft and parts there of. | 30309999 | 5.4 | 1.6 |

| Beer made from malt (excluding alcohol duty) excluding: - non-alcoholic beer - beer containing not more than 0.5% by volume of alcohol. | 11051000 | 4.2 | 1.2 |

| Waters, with added sugar, other sweetening matter or flavoured, i.e. soft drinks including: - mineral and aerated). | 11071930 | 3.7 | 1.1 |

| Motor vehicle parts and accessories of bodies (including cabs). | 29322090 | 3.1 | 0.9 |

| Whisky (EXCLUDING alcohol duty) INCLUDING: - malt whisky - grain whisky - blended whisky. | 11011030 | 3.1 | 0.9 |

| Repair and maintenance of civil aircraft and civil aircraft engines. | 33161000 | 3.1 | 0.9 |

| Source: Office for National Statistics | |||

| Notes: | |||

| 1. Product relates to level 3 as specified within the PRODCOM list. | |||

Download this table Table 1: The top 10 PRODCOM products with the highest value of sold production in 2012

.xls (23.6 kB)The products with the highest value of sold production in 2012 were Motor vehicles with a petrol engine (£13.3 billion); Other medicaments (£9.3 billion); Parts for all types of aircrafts (£6.4 billion); and Motor vehicles with a diesel engine (£6.0 billion). These products represented 10% of the total production value for 2012.

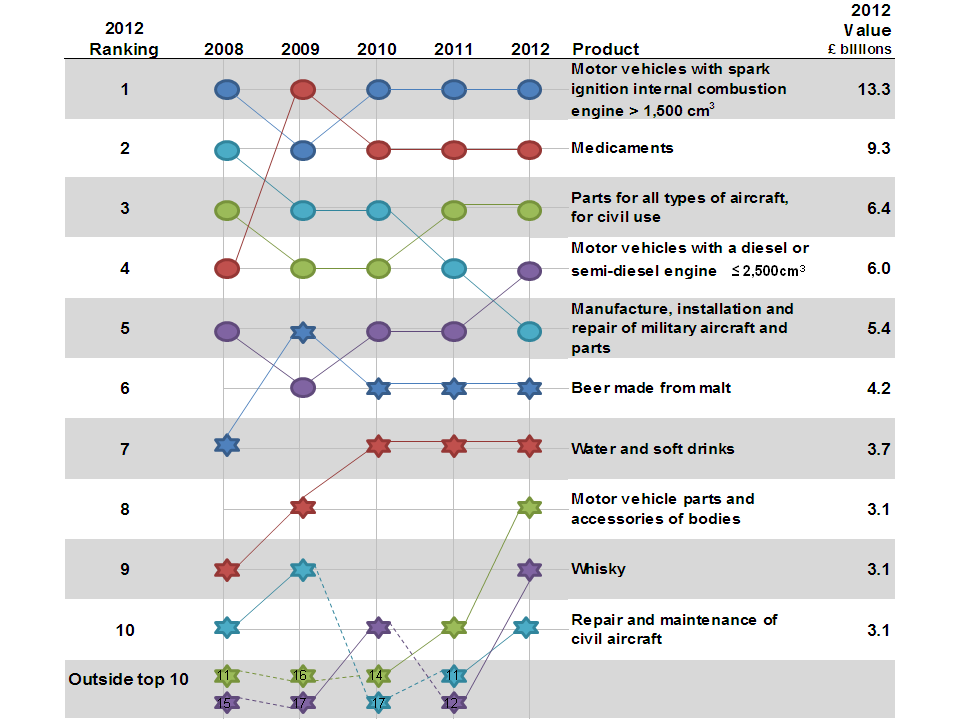

There is little change in the top 10 list of products from the 2011 intermediate estimates; of the current top 10, eight featured in the 2011 list, as shown in Figure 3.

Figure 3: Trend of Top 10 UK manufactured products with the highest production by sales value

Source: Office for National Statistics

Notes:

- Full description of product and product code is given in table 1.

Download this image Figure 3: Trend of Top 10 UK manufactured products with the highest production by sales value

.png (59.7 kB) .xls (35.8 kB)In 2012, ‘Whisky’ (ranked 12 in 2011), and ‘Repair and maintenance of civil aircraft’ (ranked 11 in 2011) moved back into the top 10 list of products. They replaced ‘Iron or steel structures or parts of structures’ (ranked 8 in 2011), and ‘Motor vehicles with a diesel or semi-diesel engine greater than 2500cc’ (ranked 9 in 2011).

The increase in the value of UK manufacturers’ sales of Whisky to £3.1 billion (from £2.8 billion in 2011) may be explained by the increase in global demand for Whisky, as described in this article in the Guardian Newspaper.

The Strategic Vision for UK Aerospace: The Aerospace Growth Partnership report refers to recent investments to improve facilities and capability in UK companies. This may help to explain the increase in the value of ‘Repair and maintenance of civil aircraft’ from £2.9 billion in 2011 to £3.1 billion in 2012.

The latest annual EU comparative data for PRODCOM are available from the Eurostat website. A comparison of the value of sold products between EU Member States will be produced for these 2012 Intermediate Estimates, when the 2012 data for each member state are made available.

Nôl i'r tabl cynnwys5. Results by industrial division

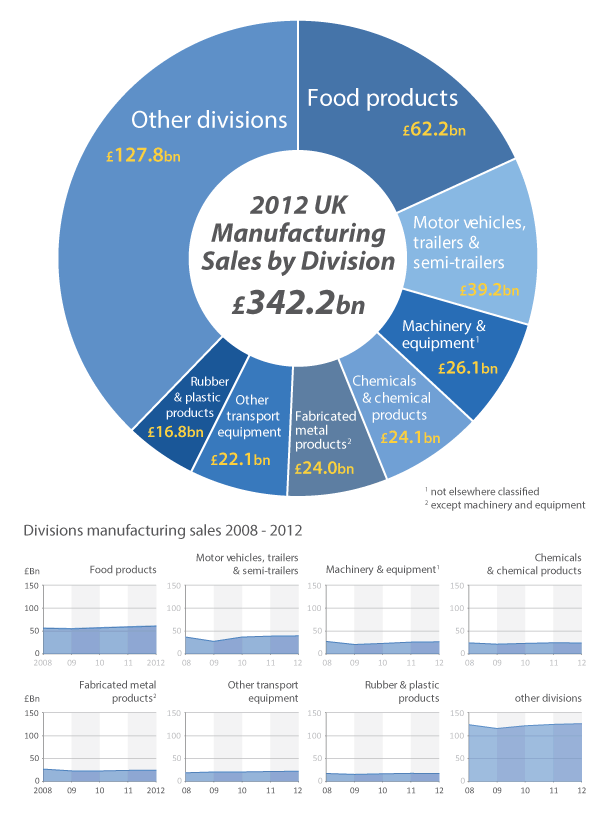

The UK estimate of manufacturers’ sales by product cover 25 ‘divisions’ in the Manufacturing industry (see Table 2 in background notes for more details on coverage). The top five divisions: Food products; Motor vehicles, trailers and semi-trailers; Machinery and equipment; Chemicals and chemical products and Fabricated metal products, except machinery and equipment account for approximately 50% of all UK production sales (see Figure 4 below).

Figure 4: Contribution to total UK manufacturers' sales by division, 2012

Source: Office for National Staqtistics

Download this image Figure 4: Contribution to total UK manufacturers' sales by division, 2012

.png (39.9 kB) .xls (20.0 kB)The largest driver behind the growth in total manufacturing sales in 2012 was from Food products (£1.7 billion increase). Several divisions saw a decline in manufacturing sales, including Chemicals and chemical products (£0.4 billion decrease) compared with 2011.

The industry divisions with the highest production sales have been reasonably consistent over the past five years. For example, Food products and Motor vehicles, trailers and semi-trailers have consistently had the highest manufacturing sales values during this time.

Nôl i'r tabl cynnwys