Cynnwys

- Main points

- Overview

- Your views matter

- UK non-financial business economy, Sections A to S (part)

- Non-financial services, Sections H to S (part)

- Production, Sections B to E

- Distribution, Section G

- Construction, Section F

- Agriculture (part), Forestry and Fishing, Section A

- Revisions to 2014 and 2013 Annual Business Survey data

- European comparison

- Background notes

- Methodoleg

1. Main points

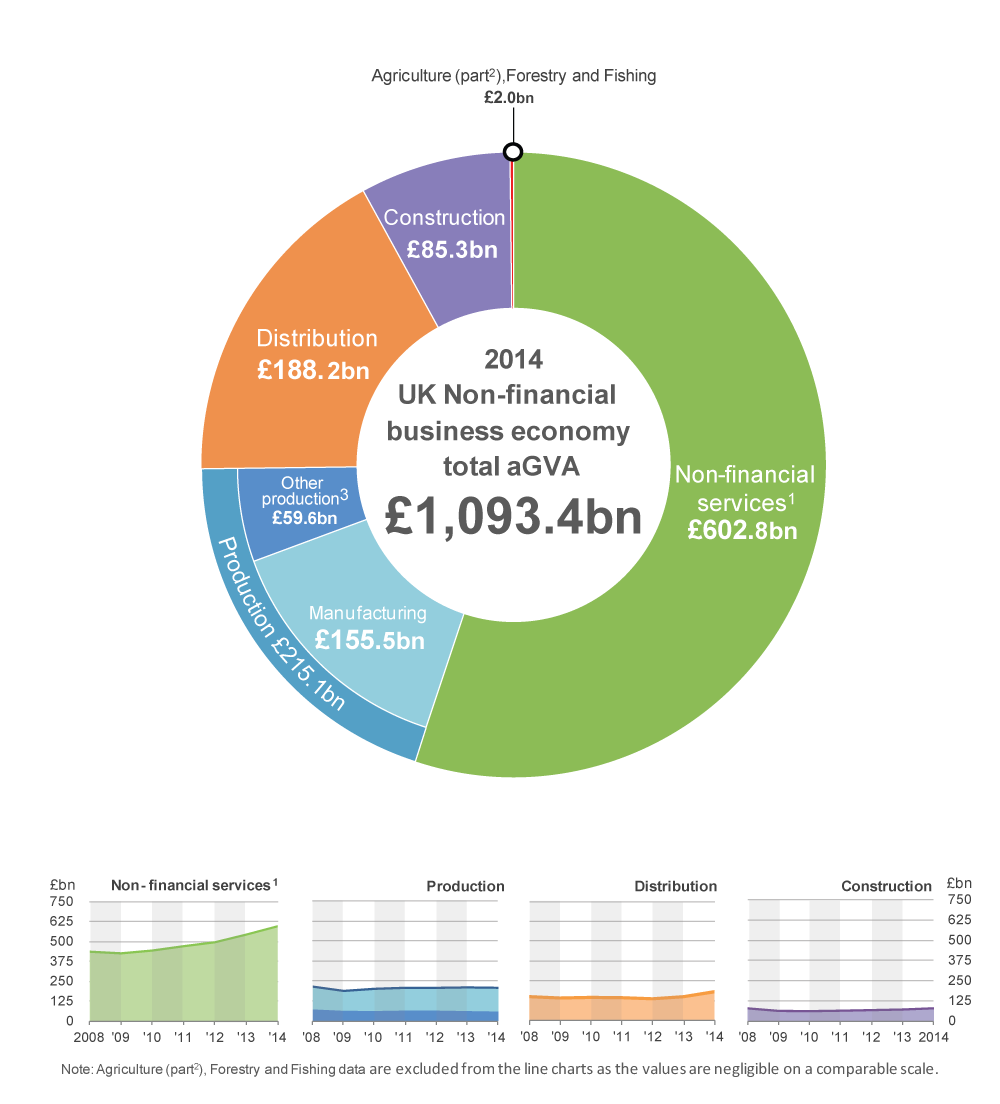

In 2014, the approximate gross value added at basic prices (aGVA) of the UK non-financial business economy was estimated to be £1,093.4 billion. This amount represents the income of UK businesses, less the cost of goods and services consumed in its creation.

Between 2013 and 2014, aGVA increased by 8.8% (£88.4 billion), the largest increase since 1997 and a continuation of the recovery seen between 2009 and 2013. This was due to an increase in turnover combined with a small decrease in purchases. The decrease in purchases was mostly seen within the Wholesale division.

With the exception of the Production sector, all other sectors of the UK non-financial business economy saw growth in aGVA between 2013 and 2014.

The Production sector, which accounts for just under a fifth (19.7%) of aGVA in the UK non-financial business economy, saw a decrease in aGVA of 1.1% (£2.5 billion) between 2013 and 2014, due to the Mining and quarrying section. All the other sections within Production showed growth in aGVA.

Mining and quarrying turnover decreased by a greater amount than its purchases due to the fall in oil prices during 2014. This resulted in a fall of 26.3% (£5.8 billion) in its aGVA between 2013 and 2014 and was the reason for the fall in Production sector aGVA.

The Non-financial services sector, which accounts for over half (55.1%) of aGVA in the UK non-financial business economy, contributed most to the increase in aGVA. The sector’s increase of 9.5% (£52.3 billion) between 2013 and 2014 was the fifth consecutive annual increase. The section making the largest contribution to growth was Professional, scientific and technical activities, with a 10.5% (£13.6 billion) increase.

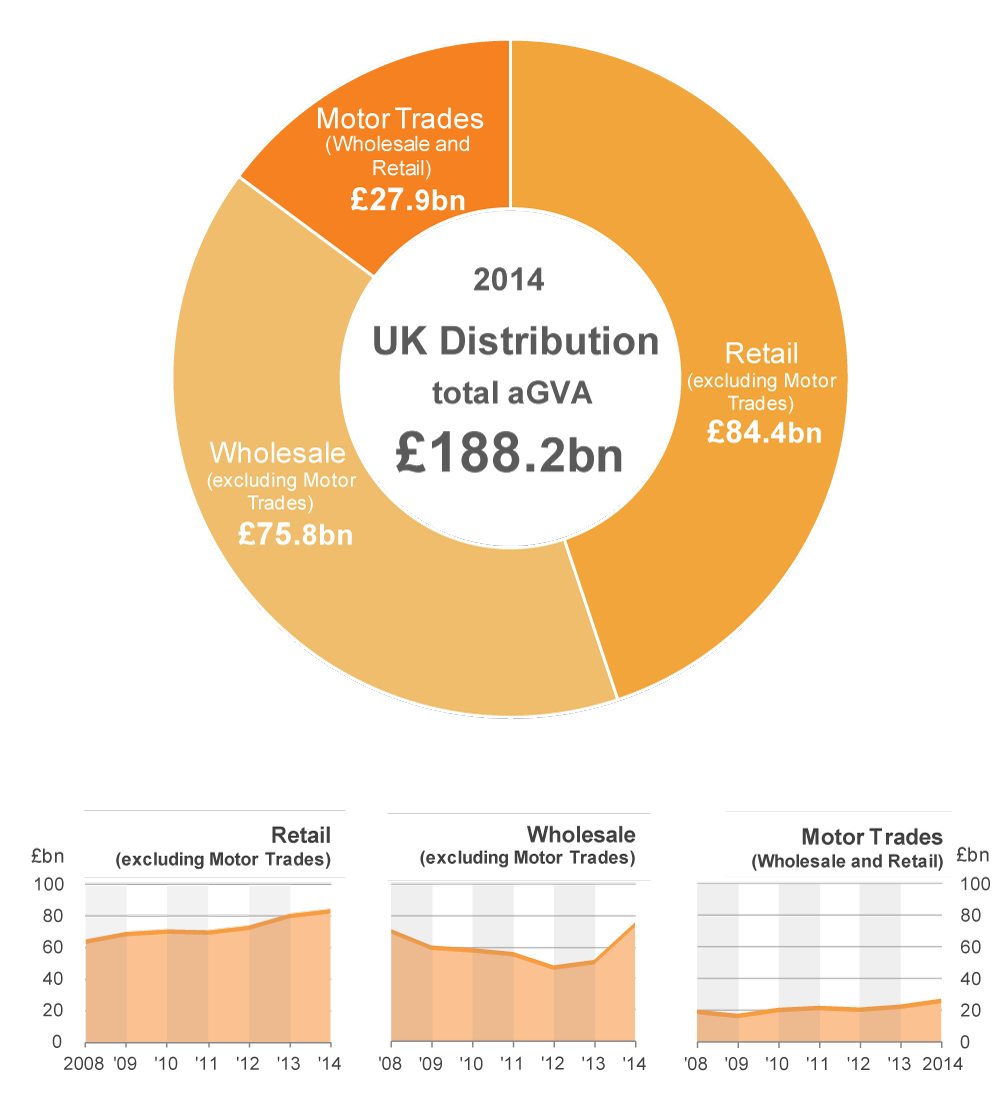

The Distribution sector, which accounts for 17.2% of aGVA in the UK non-financial business economy, saw an increase in aGVA of 19.6% (£30.8 billion) between 2013 and 2014. This took aGVA to 19.2% (£30.4 billion) above the level seen in 2008 for the first time. The division making the largest contribution to growth was Wholesale.

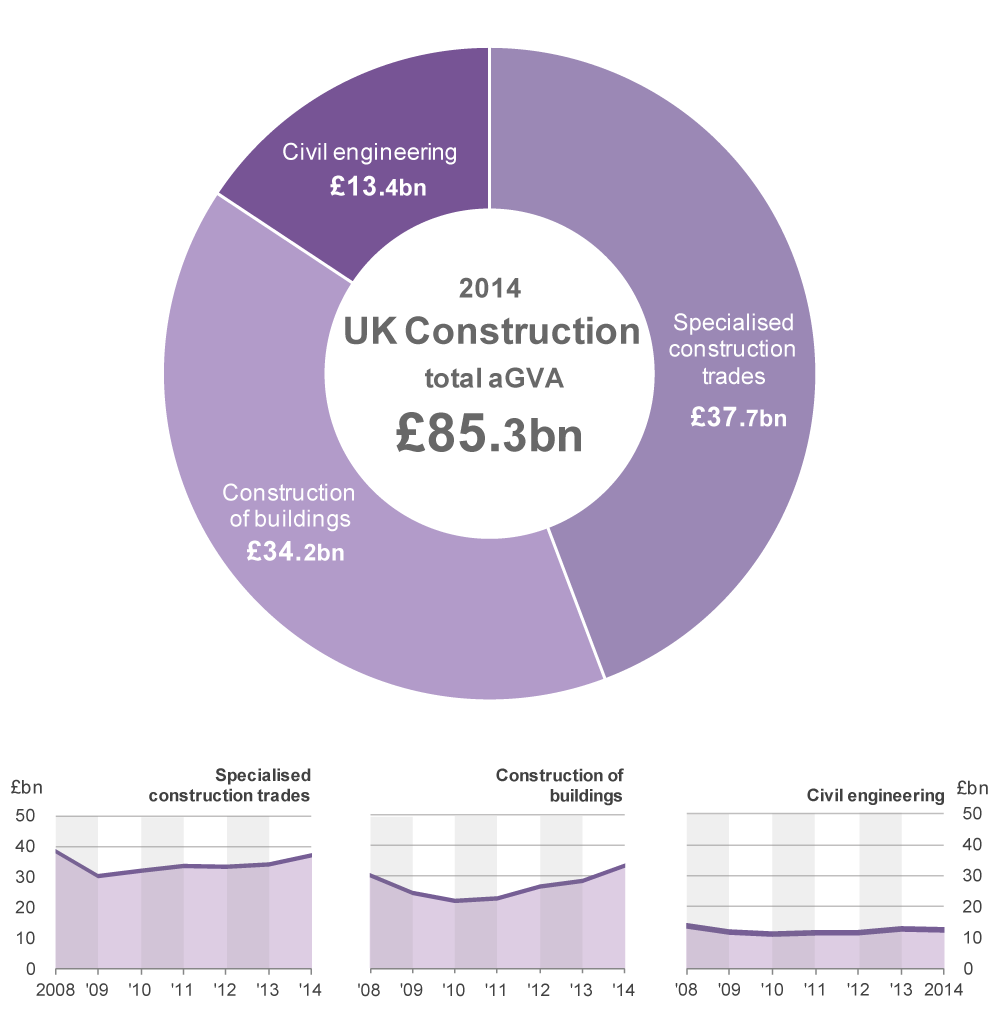

The Construction sector, which accounts for 7.8% of aGVA in the UK non-financial business economy, saw an increase in aGVA of 9.9% (£7.7 billion) between 2013 and 2014. This is the fourth consecutive year of growth, taking the sector above the level seen in 2008 for the first time, by 0.6% (£0.5 billion).

These estimates show small revisions for the UK non-financial business economy compared with the previous estimate published on 12 November 2015. There were downward revisions of 0.8% (£29.1 billion) in turnover, 0.8% (£19.5 billion) in purchases and 1.0% (£11.2 billion) in aGVA. aGVA for 2013 was also revised up by 0.4% (£3.9 billion).

Nôl i'r tabl cynnwys2. Overview

Estimates of the size and growth of the UK Non-financial business economy for 2014 as measured by the Annual Business Survey (ABS) are presented in this release. It is the main resource for understanding the detailed structure, conduct and performance of businesses across the UK. These figures are revised from those published as part of the November 2015 release as more data has become available. Revisions are an inevitable consequence of the trade-off between timeliness and accuracy. The release covers the following sectors:

Non-financial services (includes professional, scientific, communication, administrative, transport, accommodation and food, private health and education, entertainment services)

Distribution (includes retail, wholesale and motor trades)

Production (includes manufacturing, oil and gas extraction, energy generation and supply, water and waste management)

Construction (includes civil engineering, house building, property development and specialised construction trades such as plumbers, electricians and plasterers)

part of Agriculture (includes agricultural support services and hunting), forestry and fishing

Together these industries represent the UK Non-financial business economy and account for around two-thirds of the whole economy of the UK in terms of gross value added. Public administration and defence, public sector health and education, finance, farming and households make up the rest of the whole UK economy and are not covered by this release.

Estimates published in this release include turnover, purchases, approximate gross value added at basic prices (aGVA) and employment costs. All data are reported at current prices (effect of price changes not removed).

Where the economic downturn is mentioned it refers to the contraction of gross domestic product (GDP) that started in 2008, the year from which consistent ABS time series data are available. For more information about the ABS survey see the background notes.

The ABS has a wide range of uses: for example, ABS statistics are essential contributors to the UK National Accounts, including the measurement of GDP, they are supplied to Eurostat to meet the requirements of the European Structural Business Statistics (SBS) Regulation, and are used by the devolved administrations and central and local government to monitor and inform policy development.

ABS data were also recently published in our Exporters and Importers, Great Britain, 2014 release and contributed to the adhoc release Four facts about trade and business links between the UK and the Commonwealth. For other uses see background note 4.

Questions often asked of the ABS release are “‘What is aGVA?” and “How does the measure of aGVA differ from the GVA measure in the National Accounts?”. For an overview of aGVA please see our infographic “What is aGVA?”. National Accounts carry out coverage adjustments, conceptual adjustments and coherence adjustments. The National Accounts estimate of GVA uses input from a number of sources, and covers the whole UK economy, whereas ABS does not include farming, financial or public sectors and households. ABS total aGVA is around two-thirds of the National Accounts whole economy GVA because of these differences. For further information on aGVA, see background note 9. There is also the article “A Comparison between ABS and National Accounts Measures of Value Added” which provides more detail.

We make every effort to provide informative commentary on the data in this release. Where possible, the commentary draws on evidence from businesses or other sources of information to help explain possible reasons behind the observed changes. However, in some places it can prove difficult to elicit detailed reasons for movements, for example, businesses may state a “change in the nature of business activity”. Consequently, it is not possible for all data movements to be fully explained.

It is sometimes necessary to suppress figures for certain items in order to avoid disclosing information about an individual business. The ABS Technical Report describes the methods used to safeguard the information provided in confidence to ONS. In the same way our commentary must also avoid disclosing information about individual businesses.

Nôl i'r tabl cynnwys3. Your views matter

We constantly aim to improve this release and its associated commentary. We would welcome any feedback you might have, and would be particularly interested in knowing how you make use of these data to inform your work. Please contact us via email: abs@ons.gov.uk or telephone Jon Gough on +44 (0)1633 456720.

Nôl i'r tabl cynnwys4. UK non-financial business economy, Sections A to S (part)

In 2014, the income generated by businesses in the UK, less the cost of goods and services used to create this income was estimated to be £1,093.4 billion. This amount represents the approximate gross value added at basic prices (aGVA) of the UK non-financial business economy. Basic prices means the valuation of output includes net taxes (taxes minus subsidies) on production, such as business rates, but not net taxes on individual products that result from the production process, such as Value Added Tax (VAT).

Between 2013 and 2014, aGVA increased by 8.8% (£88.4 billion), the largest growth since 1997. This increase is a continuation of the recovery seen between 2009 and 2013 and takes aGVA to a level 20.2% (£183.7 billion) above that seen in 2008.

The main components of aGVA are:

- turnover (the main component of income)

- purchases (the main component of the consumed goods and services)

The consecutive annual increases seen in aGVA follow a similar pattern of increases in both turnover and purchases between 2009 and 2013. Turnover increased by 1.2% (£43.1 billion) between 2013 and 2014, while purchases of goods, materials and services decreased for the first time since 2009, by 1.3% (£32.6 billion), resulting in an 8.8% growth in aGVA. (see Figure 1).

A list of industries which are included in the Annual Business Survey (ABS) measure of the UK non-financial business economy can be found in background note 9.

Figure 1: UK Non-financial business economy, turnover and purchases and resulting aGVA

2008 to 2014

Source: Office for National Statistics

Notes:

- A list of industries which are included in the ABS measure of the UK Non-Financial Business Economy, can be found in background note 9.

Download this chart Figure 1: UK Non-financial business economy, turnover and purchases and resulting aGVA

Image .csv .xlsWith the exception of Production all other sectors of the UK non-financial business economy, as measured by the ABS, saw growth in aGVA between 2013 and 2014 (see Figures 2 and 3).

Non-financial services, the largest industry sector of the UK non-financial business economy contributed most to the increase in aGVA. The Non-financial services sector aGVA rose by 9.5% (£52.3 billion) between 2013 and 2014, the fifth consecutive annual increase, taking aGVA to £602.8 billion.

The Production sector saw a decrease of 1.1% (£2.5 billion) in aGVA following a slight rise between 2012 and 2013. This decrease in 2014 sees aGVA for the Production sector at £215.1 billion, as a result of the 26.3% (£5.8 billion) fall in aGVA for Mining and quarrying (Section B). All other sections in Production, including Manufacturing, saw an increase in aGVA between 2013 and 2014.

The main contributor to the fall in Mining and quarrying aGVA was Extraction of crude petroleum and natural gas (Division 06), where aGVA fell by 32.0% (£5.5 billion). One potential factor behind this was the sharp fall in commodity prices in the second half of 2014.

The Distribution sector aGVA rose by 19.6% (£30.8 billion) between 2013 and 2014. This increase took aGVA to £188.2 billion, which is above the level of £157.8 billion seen in 2008 for the first time. This rise in aGVA was driven by Other specialised wholesale (Group 46.7), which includes Wholesale of solid, liquid and gaseous fuels and related products, where businesses cited the fall in oil prices during 2014 as the reason for their fall in turnover and purchases (and the resulting rise in aGVA).

The Construction sector experienced growth in aGVA for the fourth consecutive year, increasing by 9.9% (£7.7 billion) to £85.3 billion in 2014, which, like the Distribution sector is now above the level of £84.8 billion seen in 2008 for the first time.

The Agriculture (part), Forestry and Fishing sector experienced a 7.8% (£0.1 billion) rise in aGVA between 2013 and 2014. This second consecutive annual increase takes aGVA to £2.0 billion.

Figure 2: UK Non-financial business economy, aGVA by sector

2008 to 2014, £ billion

Source: Office for National Statistics

Notes:

Excludes Financial and insurance; Public administration and defence; Public provision of Education; Public provision of Health and all medical and dental practice activities.

Excludes crop and animal production.

Includes Mining and quarrying, Energy generation and supply, Water and waste management.

Download this image Figure 2: UK Non-financial business economy, aGVA by sector

.png (83.0 kB) .xls (35.3 kB)

Figure 3: UK Non-financial business economy, aGVA change by sector

2008 to 2014

Source: Office for National Statistics

Notes:

Excludes Financial and insurance; Public administration and defence; Public provision of Education; Public provision of Health and all medical and dental practice activities.

Excludes crop and animal production.

Includes Mining and quarrying, Energy generation and supply, Water and waste management.

Download this chart Figure 3: UK Non-financial business economy, aGVA change by sector

Image .csv .xlsNon-financial services as a whole (Sections H to S) dominates the UK non-financial business economy in terms of aGVA. However, at the Standard Industrial Classification (SIC) section level, Distribution (Section G) and Manufacturing (Section C within the Production sector) are the largest specific contributors followed by Professional, scientific and technical (Section M within the Non-financial services sector). Construction (Section F) also contributes more to aGVA than 7 of the 10 sections within Non-financial services (see Figure 4).

Figure 4: UK Non-financial business economy, aGVA by section

2014

Source: Office for National Statistics

Notes:

Excludes public provision of Education, public provision of Health and all medical and dental practice activities

Excludes crop and animal production

Includes oil and gas extraction.

Download this chart Figure 4: UK Non-financial business economy, aGVA by section

Image .csv .xlsWhen analysing those sections which have made the largest contributions to aGVA growth between 2013 and 2014 (see Figure 5), Distribution (Section G) is the largest, contributing 34.8% of the total aGVA growth. This is followed by 2 sections in the Non-financial services sector with a combined contribution of 28.9%:

Professional, scientific and technical (Section M)

Administrative and support services (Section N)

Only Mining and quarrying (Section B) in the Production sector is showing a fall in aGVA for 2014, decreasing by 26.3% (£5.8 billion) compared with 2013.

Figure 5: UK Non-financial business economy, aGVA change by section

2013 to 2014

Source: Office for National Statistics

Notes:

Excludes public provision of Education, public provision of Health and all medical and dental practice activities

Excludes crop and animal production

Includes oil and gas extraction.

Download this chart Figure 5: UK Non-financial business economy, aGVA change by section

Image .csv .xlsFurther details on these industry sections can be found in the subsequent chapters which describe the Non-financial services sector (Sections H to S), the Production sector (Sections B to E including Manufacturing), the Distribution sector (Section G), the Construction sector (Section F) and the Agriculture (part), Forestry and Fishing sector (Section A).

Nôl i'r tabl cynnwys5. Non-financial services, Sections H to S (part)

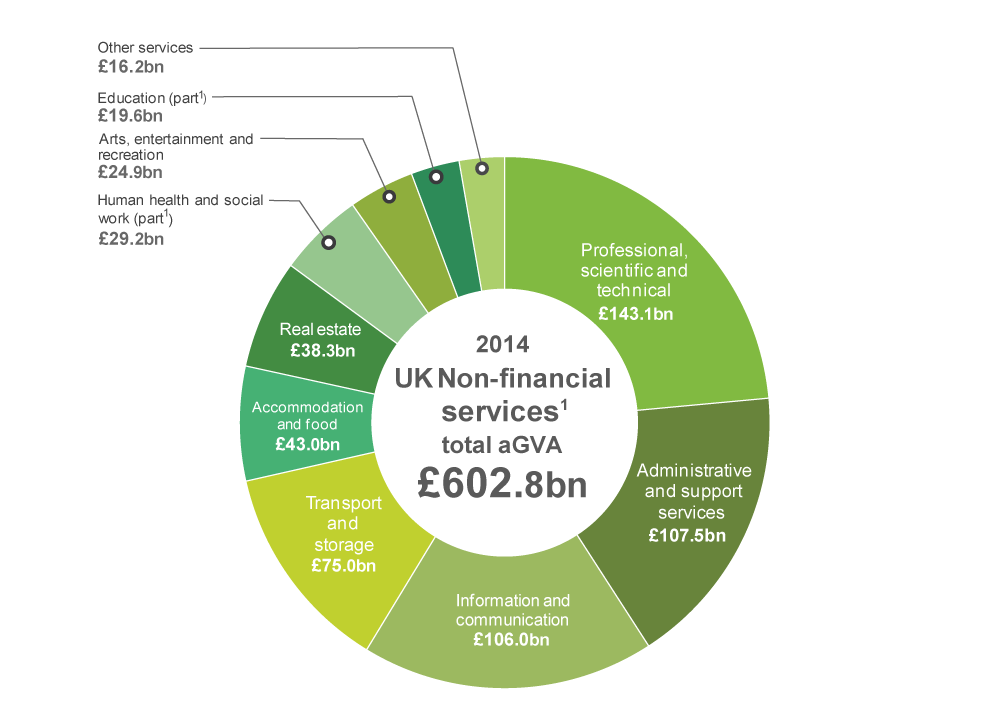

The Non-financial services sector contributed £602.8 billion, over a half (55.1%) of the estimated gross value added at basic prices (aGVA) total of £1,093.4 billion in 2014 for the UK non-financial business economy.

Between 2013 and 2014, Non-financial services’ turnover increased at a higher rate than purchases, 4.4% (£49.9 billion) compared with 0.3% (£1.9 billion). Together with a rise in work of a capital nature this resulted in aGVA rising by 9.5% (£52.3 billion). This is the fifth consecutive year of growth in aGVA for the sector, following the fall between 2008 and 2009, (see Figure 6).

For details of revisions to 2013 and 2014 Non-financial services data see the later chapter on Revisions.

Figure 6: UK Non-financial services, turnover and purchases and resulting aGVA

2008 to 2014

Source: Office for National Statistics

Notes:

- Excludes Financial and insurance; Public administration and defence; Public provision of Education; Public provision of Health and all medical and dental practice activities.

Download this chart Figure 6: UK Non-financial services, turnover and purchases and resulting aGVA

Image .csv .xlsAll of the sections within the Non-financial services sector continued to see increases in aGVA between 2013 and 2014 (see Figures 7 and 8).

Those sections which have made the largest contributions to growth are:

Professional, scientific and technical (Section M)

Administrative and support services (Section N)

Information and communication (Section J)

These sections, which together accounted for 63.9% (£33.4 billion) of the increase in Non-financial services sector aGVA, are described, together with some of the other prominent sections, in more detail after Figure 7b.

Figure 7a: UK Non-financial services, aGVA by section

2014, £ billion

Source: Office for National Statistics

Notes:

- Excludes Financial and insurance; Public administration and defence; Public provision of Education; Public provision of Health and all medical and dental practice activities.

Download this image Figure 7a: UK Non-financial services, aGVA by section

.png (68.3 kB) .xls (32.3 kB)

Figure 7b: UK Non-financial services, aGVA by section

2008 to 2014, £ billion

Source: Office for National Statistics

Notes:

- Excludes Financial and insurance; Public administration and defence; Public provision of Education; Public provision of Health and all medical and dental practice activities.

Download this image Figure 7b: UK Non-financial services, aGVA by section

.png (45.3 kB) .xls (32.3 kB)Professional, scientific and technical, Section M

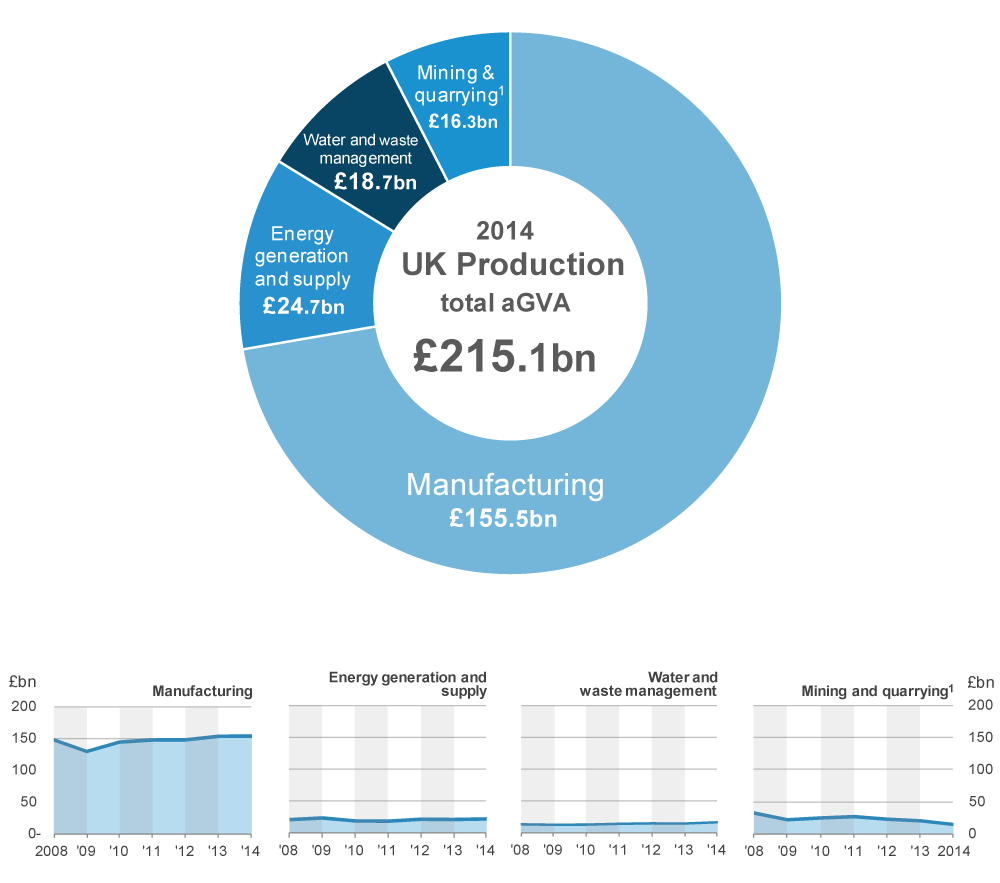

Turnover in Professional, scientific and technical increased by 6.1% (£13.8 billion) between 2013 and 2014, with purchases increasing by 0.5% (£0.5 billion). The resulting growth in aGVA of 10.5% (£13.6 billion), meant aGVA remained above the level reported in 2008 for the fourth consecutive year.

This broad section, which covers a range of industries from Legal and accounting activities to Advertising and market research, and Veterinary activities, saw increases in aGVA in all its divisions between 2013 and 2014. Those divisions within the section, having the largest impact on aGVA growth (with a combined 64.3% (£8.7 billion) contribution) between 2013 and 2014 were:

Activities of head offices; management consultancy (Division 70)

Legal and accounting services (Division 69)

The growth shown by the ABS links to the Management Consultancies Association summary report for 2015 which reported strong growth in 2014 with an 8.4% increase in fee income.

Administrative and support services, Section N

Between 2013 and 2014, Administrative and support services saw turnover rise by 7.4% (£13.7 billion), while purchases increased by 2.8% (£2.6 billion) leading to an aGVA increase of 12.5% (£12.0 billion).

Two divisions contributed to almost three-quarters (73.0%) of the growth within Administrative and support services:

Employment activities (Division 78) with an aGVA increase of 16.6% (£4.7 billion)

Office administrative, office support and other business support activities (Division 82) with an aGVA increase of 17.6% (£4.1 billion)

A growth in this sector was supported by the Recruitment and Employment Confederation report for 2013 to 2014 which indicated a strong increase in employment activities, along with our Workforce Jobs figures which showed a growth of 2.4% in 2014.

Information and communication, Section J

Turnover in Information and communication increased by 2.8% (£5.5 billion) between 2013 and 2014 which, coupled with a 0.4% (£0.4 billion) decrease in purchases, resulted in an increase in aGVA of 8.1% (£7.9 billion) between 2013 and 2014.

Those divisions having the largest impact on aGVA growth, with a combined 82.6% (£6.5 billion) contribution between 2013 and 2014 were:

Telecommunications (Division 61), with an aGVA increase of 15.4% (£4.0 billion)

Computer programming, consultancy and related activities (Division 62), with an aGVA increase of 5.9% (£2.6 billion)

Division 62, which includes the development of mobile phone applications, has shown consistent growth of above 5.0% in each of the last 3 years. The addition of mobile phone applications to the CPI basket in 2011 and increase in internet use on mobile devices indicates this activity has been increasing in importance in recent years. The Bank of England’s agents’ summary of business conditions suggests that some of the increase in demand for IT services may have come “from the finance sector and increased interest in cloud services from most sectors”.

Transport and storage, Section H

Turnover in Transport and storage increased by 3.9% (£6.2 billion) between 2013 and 2014, with purchases rising by 1.2% (£1.1 billion) resulting in a 6.7% (£4.7 billion) increase in aGVA.

Two divisions contributed 79.0% (£3.7 billion) of the growth within Transport and storage:

Land transport and transport via pipelines (Division 49)

Warehouse and support activities for transport (Division 52)

The growth in Division 49 was potentially influenced by the fall in oil prices towards the end of 2014, as reported in Figure 6 of our Economic Review, September 2015 and also supported by the Department of Energy and Climate Change (DECC) in Table 4.1.1 of their monthly release on fuel prices.

Accommodation and food, Section I

Turnover in Accommodation and food increased by 6.7% (£5.2 billion) between 2013 and 2014, with purchases rising by 2.5% (£1.0 billion) resulting in a 12.2% (£4.7 billion) increase in aGVA.

The division having the largest impact on aGVA growth was Accommodation (Division 55) with 23.6% (£2.7 billion) growth between 2013 and 2014.

Education, Section P – private provision only

Turnover in Education increased by 11.5% (£4.1 billion) between 2013 and 2014, with purchases rising by 5.5% (£1.1 billion) resulting in a 20.7% (£3.4 billion) increase in aGVA.

The part of private education having the largest impact on aGVA growth was Tertiary education (Class 85.42) with a 33.5% (£1.8 billion) increase.

Figure 8: UK Non-financial services, aGVA change by section

2008 to 2014

Source: Office for National Statistics

Notes:

Non-financial services excludes: Financial and insurance, Public administration and defence, Public provision of Education, Public provision of Health and all medical and dental practice activities.

Excludes public provision of Education; public provision of Health and all medical and dental practice activities.

Download this chart Figure 8: UK Non-financial services, aGVA change by section

Image .csv .xlsSignificant divisional contributions

Within Sections H to S, at a division level, Computer programming, consultancy and related activities (Division 62) made the largest contribution to Non-financial services aGVA with £45.7 billion in 2014, followed by Legal and accounting services (Division 69) with £42.0 billion (see Figure 9).

Figure 9: UK Non-financial services, aGVA by division

2014

Source: Office for National Statistics

Notes:

Non-financial services excludes: Financial and insurance, Public administration and defence, Public provision of Education, Public provision of Health and all medical and dental practice activities

Excludes public provision of Education, public provision of Health and all medical and dental practice activities

Download this chart Figure 9: UK Non-financial services, aGVA by division

Image .csv .xlsActivities of head offices, management consultancy (Division 70) showed the largest aGVA growth at 21.0% (£6.2 billion) between 2013 and 2014, followed by Employment activities (Division 78) with 16.6% (£4.7 billion) increase in aGVA (see Figure 10).

Computer programming (which made the largest overall contribution to Non-financial services in Figure 9) also showed the eighth largest growth in aGVA of 5.9% (£2.6 billion) in 2014. This division includes the development of mobile phone applications which has been increasing in importance in recent years.

The largest fall in aGVA during 2014 was 5.5% (£0.4 billion) in Human health (Division 86) covering private provision only in Hospital activities (Group 86.1) and Other human health activities (Group 86.9).

Figure 10: UK Non-financial services, aGVA change by division

2013 to 2014

Source: Office for National Statistics

Notes:

Non-financial services excludes: Financial and insurance, Public administration and defence, Public provision of Education, Public provision of Health and all medical and dental practice activities

Excludes public provision of Education, public provision of Health and all medical and dental practice activities

Download this chart Figure 10: UK Non-financial services, aGVA change by division

Image .csv .xls6. Production, Sections B to E

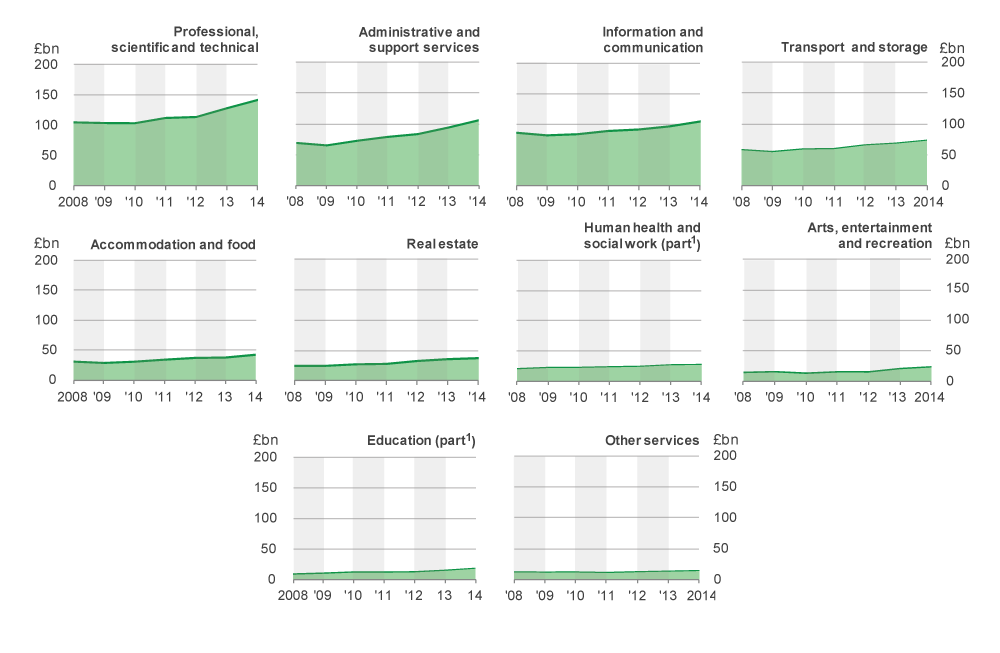

The Production sector in 2014 provided £215.1 billion, just under a fifth (19.7%) of the estimated gross value added at basic prices (aGVA) total of £1,093.4 billion for the UK non-financial business economy.

Both turnover and purchases decreased between 2013 and 2014 within the Production sector, turnover by £5.7 billion (0.8%) and purchases by £2.3 billion (0.5%). Together with changes in the value of stocks and own account capital investment, this led to a decrease in aGVA of 1.1% (£2.5 billion) back to the same level as 2012 after the rise between 2012 and 2013. The decrease in 2014 sees Production sector aGVA £7.4 billion below the level in 2008 (see Figure 11).

Production is the only sector within the UK non-financial business economy showing a fall in aGVA between 2013 and 2014. This is solely due to the impact of Mining and quarrying (Section B) which saw aGVA fall by 26.3% (£5.8 billion), see Figure 13. All other sections within the Production sector (Manufacturing, Energy generation and supply, and Water and waste management), saw a combined rise in aGVA between 2013 and 2014 of 1.7% (£3.3 billion). The levels of aGVA, turnover and purchases for these sections, both combined and individually in 2014, are above the levels seen in 2008.

For details of revisions to 2013 and 2014 Production data see the later chapter on Revisions.

Figure 11: UK Production, turnover and purchases and resulting aGVA

2008 to 2014

Source: Office for National Statistics

Download this chart Figure 11: UK Production, turnover and purchases and resulting aGVA

Image .csv .xlsManufacturing (Section C), which contributes 72.3% of Production sector aGVA, saw a rise in aGVA of 0.3% (£0.4 billion) between 2013 and 2014.

Over the same period Energy generation and supply (Section D), and Water and waste management (Section E) also saw increases in aGVA of 3.5% (£0.8 billion) and 12.7% (£2.1 billion) respectively, while Mining and quarrying (Section B) saw a decrease of 26.3% (£5.8 billion), see Figures 12 and 13.

Figure 12: UK Production, aGVA by section

2008 to 2014, £ billion

Source: Office for National Statistics

Notes:

- Includes oil and gas extraction.

Download this image Figure 12: UK Production, aGVA by section

.png (57.8 kB) .xls (33.3 kB)

Figure 13: UK Production, aGVA change by section

2008 to 2014

Source: Office for National Statistics

Notes:

- Includes oil and gas extraction.

Download this chart Figure 13: UK Production, aGVA change by section

Image .csv .xlsMining and quarrying, Section B, which includes oil and gas extraction

Turnover in Mining and quarrying decreased by a greater amount of 15.9% (£7.9 billion) than purchases, which decreased by 6.5% (£1.9 billion). This resulted in a decrease of 26.3% (£5.8 billion) in aGVA.

The main contributor to the fall in aGVA was Extraction of crude petroleum and natural gas (Division 06), where turnover decreased by 22.2% (£7.7 billion) and purchases by 11.2% (£2.2 billion). This resulted in a fall in aGVA of 32.0% (£5.5 billion) in Division 06.

One potential factor behind this was the sharp fall in commodity prices in the second half of 2014. For example, as reported in Figure 6 of our Economic Review September 2015, crude oil prices fell from an average of £69.72 per barrel between 2011 and 2013 to £31.78 at the start of 2015. This is also supported by the Department of Energy and Climate Change (DECC) in Table 4.1.1 of their monthly release on fuel prices. Another contributing factor may be the slow-down in growth of emerging economies, which fell from 5.0% in 2013 to 4.6% in 2014 as reported by the International Monetary Fund in their July 2015 release of the World Economic Outlook.

Manufacturing (Section C)

The top 4 divisions contributing 43.1% of the overall Manufacturing aGVA in 2014 are (see Figure 14):

Manufacture of food products (Division 10)

Manufacture of motor vehicles, trailers and semi-trailers (Division 29)

Manufacture of fabricated metal products, except machinery and equipment (Division 25)

Manufacture of machinery and equipment not elsewhere classified (Division 28)

Figure 14: UK Manufacturing, aGVA by division

2014

Source: Office for National Statistics

Notes:

- Information for Beverages and Tobacco products, suppressed to avoid disclosure.

Download this chart Figure 14: UK Manufacturing, aGVA by division

Image .csv .xlsBetween 2013 and 2014, Manufacturing saw a negligible decrease in turnover (£0.1 billion) and a small increase in purchases (£0.1 billion) which, together with decreases in stock levels and changes in taxes, contributed to an increase in aGVA of 0.3% (£0.4 billion).

Across Manufacturing, almost 60% (14 out of 24) of the divisions contributing to this sector experienced increases in aGVA between 2013 and 2014.

Those divisions contributing most to the growth in Manufacturing aGVA were:

Manufacture of motor vehicles, trailers and semi-trailers (Division 29) with an aGVA increase of 20.6% (£3.0 billion)

Manufacture of fabricated metal products, except machinery and equipment (Division 25) with an aGVA increase of 9.4% (£1.3 billion)

Together these 2 divisions contributed £4.3 billion to the overall £0.4 billion increase in Manufacturing aGVA, which was offset by a £3.7 billion decrease in Manufacture of other transport equipment (Division 30), see Figure 15.

Manufacture of motor vehicles, trailers and semi-trailers (Division 29)

As was the case in 2013, the increase in Division 29 for this year can again be attributed to the increase in production, sales and exports of cars, in particular high end and luxury vehicles.

Our Economic Performance of the UK’s Motor Vehicle Manufacturing Industry release says growth in this industry has been largely due to the continued growth in exports of motor vehicles to countries outside the EU. The non-EU export market has seen growth for the last 6 years. Exports to non-EU countries are growing at a faster rate than exports to EU countries; this strong demand for exported UK cars is confirmed by reports from the car manufacturing trade body, the Society of Motor Manufacturers and Traders (SMMT). The SMMT report covering 2014 shows that the number of vehicles produced in the UK fell rapidly during the economic downturn, from 1.8 million in 2007 to 1.1 million in 2009. The industry has now partially recovered with 1.6 million vehicles being produced in 2014. Car output, the largest component of Division 29, rose to 1.53 million units, its highest level since 2007.

Manufacture of fabricated metal products, except machinery and equipment (Division 25)

There is a 9.4% (£1.3 billion) increase in aGVA for Manufacture of fabricated metal products (Division 25) driven by a 3.4% (£1.1 billion) rise in turnover and a 143.1% (£0.2 billion) rise in stocks. No particular reasons have been found for these changes.

Manufacture of other transport equipment (Division 30)

Manufacture of other transport equipment (Division 30) showed the greatest decrease in aGVA within Manufacturing during 2014. The 31.6% decrease of £3.7 billion was the result of a small 0.8% (£0.3 billion) decrease in turnover and a large 16.3% (£3.3 billion) increase in purchases. This division had seen steady growth between 2010 and 2013 with the UK government considering the aerospace industry a “phenomenal success story” and a sector that offers “tremendous opportunities for growth” in its House of Commons economic and statistics policy paper (The aerospace industry: statistics and policy). A number of reasons have been given for its regression in 2014; the loss of sites, the loss of contracts and greater spend on sub-contractors.

Manufacture of coke and refined petroleum products (Division 19)

Manufacture of coke and refined petroleum products (Division 19) saw a fall in aGVA of 44.5% (£0.6 billion), the result of a 12.6% (£6.1 billion) decrease in turnover, an 18.2% (£7.0 billion) decrease in purchases and a 907.9% (£1.4 billion) fall in stocks. These decreases can be attributed to the Manufacture of petroleum products (Class 19.20) and are the result of the fall in the price of oil, the loss of sites and reduced volumes due to maintenance. Due to the small size of this division in terms of Manufacturing aGVA, annual changes should be viewed with care.

Figure 15: UK Manufacturing, aGVA change by division

2013 to 2014

Source: Office for National Statistics

Notes:

- Information for Beverages and Tobacco products, suppressed to avoid disclosure.

Download this chart Figure 15: UK Manufacturing, aGVA change by division

Image .csv .xlsThe economic downturn and recovery in the Manufacturing sector described by the ABS, between 2008 and 2014, is broadly in line with movements in comparable industries of our “UK Manufacturers' sales by product (PRODCOM)” figures. Both the ABS turnover estimates and the PRODCOM industry total sales estimates show a fall between 2008 and 2009 and then annual increases from 2009 to 2014, with ABS showing a slight fall in 2012.

Water and waste management, Section E

Water and waste management saw an increase in turnover of 4.4% (£1.5 billion) between 2013 and 2014, with purchases decreasing by 1.3% (£0.2 billion). Together with an increase in work of a capital nature of 66.1% (£0.2 billion), this resulted in an aGVA increase of 12.7% (£2.1 billion).

All 4 divisions within this section have shown increases in aGVA, the largest of which is Waste collection, treatment and disposal activities (Division 38) with a rise of 22.7% (£1.2 billion) in aGVA driven by an increase in turnover of 3.7% (£0.7 billion) and a decrease in purchases of 2.8% (£0.3 billion).

Energy generation and supply, Section D

Energy generation and supply also saw an increase in turnover of 0.7% (£0.8 billion) between 2013 and 2014, with purchases decreasing by 0.4% (£0.3 billion). Together with a decrease in stock levels of 56.4% (£0.3 billion), this resulted in an aGVA increase of 3.5% (£0.8 billion).

The continuing rise in the number of micro-businesses (those with less than 10 employees) in this sector is thought to be due to the growth of small producers of renewable energy encouraged by various green grants, subsidies and "feed-in tariffs". Between 2013 and 2014, the number of micro-businesses in this section increased by 27.2% (to over 2,950 businesses).

Notes for Manufacturing industries, Section C

Please note that the ABS figures for the Manufacturing industries should not be compared directly with PRODCOM's “Total Sales of Businesses Classified to this Industry” figure because:

PRODCOM publish a calendar year figure whereas ABS figures are based on annual responses from businesses covering a range of financial years

PRODCOM focuses on products whilst ABS focuses on activities. The total value of production, in a particular industry, may differ from the turnover reported by ABS as an enterprise might carry out other activities, in addition to production, that contribute to its turnover

PRODCOM and ABS produce estimates using different sampling and statistical methodologies

PRODCOM publish industry totals for turnover excluding HMRC duty, while ABS publishes turnover inclusive of duty

7. Distribution, Section G

The Distribution sector in 2014 contributed £188.2 billion, 17.2% of the estimated gross value added at basic prices (aGVA) total of £1,093.4 billion for the UK non-financial business economy.

The large rise in Distribution aGVA of 19.6% (£30.8 billion) between 2013 and 2014 was a result of a fall in purchases, for the first time since 2009, by a greater proportion of 3.5% (£46.1 billion) than the fall in turnover of 1.3% (£19.5 billion), see Figure 16.

This second consecutive annual increase in aGVA takes it above the level seen in 2008, for the first time by 19.6% (£30.8 billion).

For details of revisions to 2013 and 2014 Distribution data see the later chapter on Revisions.

Figure 16: UK Distribution, turnover and purchases and resulting aGVA

2008 to 2014

Source: Office for National Statistics

Download this chart Figure 16: UK Distribution, turnover and purchases and resulting aGVA

Image .csv .xlsThe division contributing most to the growth in Distribution aGVA was Wholesale with a 78.1% (£24.0 billion) contribution, as a result of purchases falling by a greater amount than turnover (see Figures 17 and 18). This rise in aGVA was driven by Other specialised wholesale (Group 46.7), which includes Wholesale of solid, liquid and gaseous fuels and related products, where businesses cited the fall in oil prices during 2014 as the reason for their fall in turnover and purchases (and the resulting rise in aGVA).

The remaining increases in aGVA which were contributed by Retail and Motor Trades, resulted from increases in both turnover and purchases.

Figure 17: UK Distribution, aGVA by division

2008 to 2014, £ billion

Source: Office for National Statistics

Download this image Figure 17: UK Distribution, aGVA by division

.png (133.1 kB) .xls (30.7 kB)Wholesale (excluding Motor Trades), Division 46

Wholesale experienced greater decreases in purchases of 7.7% (£69.6 billion) than turnover of 4.9% (£48.3 billion) between 2013 and 2014, which resulted in an increase in aGVA of 46.4% (£24.0 billion).

The rise in aGVA between 2013 and 2014 was driven by Other specialised wholesale (Group 46.7), which showed an increase of £20.5 billion. This group includes Wholesale of solid, liquid and gaseous fuels and related products, where the reason cited by businesses for their fall in turnover and purchases (and the resulting rise in aGVA) over this period was the fall in oil prices during 2014. A potential factor behind this was the sharp fall in commodity prices in the second half of 2014, which is described in the earlier chapter on Mining and quarrying (Section B) within the Production sector.

Retail (excluding Motor Trades), Division 47

Retail aGVA saw an increase of 3.7% (£3.0 billion) between 2013 and 2014. This growth in aGVA was a result of a 3.4% (£12.1 billion) increase in turnover and a smaller 3.6% (£10.0 billion) increase in purchases.

The increase in aGVA was mainly caused by a 6.2% (£1.5 billion) rise in Retail sale of other goods (Group 47.7) which includes retail sale of clothing; and a 19.5% (£0.9 billion) rise in Retail sale not in stores, stalls or markets (Group 47.9) which includes retail sale via mail order houses or the internet.

There were variations within Retail sale in non-specialised stores (Group 47.1) with an increase in Other retail sale in non-specialised stores (Class 47.19) of 14.6% (£1.2 billion) which is offset by a decrease in Retail sale in non-specialised stores (Class 47.11) of 5.9% (£1.7 billion), which includes retail sales in supermarkets.

Reports from businesses continued to indicate that turnover from mail orders and via the internet increased at a higher rate than turnover from shops. Although increasing, retail sales from mail order and the internet remains a small share of total turnover.

Retail sale of automotive fuel (Group 47.3) saw decreases in turnover of 3.8% (£0.6 billion) and purchases of 4.9% (£0.7 billion). Reports from businesses indicate that the decrease in turnover and purchases were linked to the drop in crude oil prices.

Motor Trades (Wholesale and Retail), Division 45

Between 2013 and 2014, both turnover and purchases increased, by 10.9% (£16.7 billion) and 10.4% (£13.5 billion) respectively. This resulted in aGVA increasing by 15.3% (£3.7 billion), a second consecutive increase. Within Motor Trades, Sale of motor vehicles (Group 45.1) contributed most to the growth with a 26.2% (£3.3 billion) increase in aGVA between 2013 and 2014. This is the second consecutive annual increase for this group.

Figure 18: UK Distribution, aGVA change by division

2008 to 2014

Source: Office for National Statistics

Download this chart Figure 18: UK Distribution, aGVA change by division

Image .csv .xlsNotes for Distribution industries, Section G

Retail (excluding Motor Trades), Division 47

Please note that the ABS figures for the Retail industry should not be compared directly with the annual “value non-seasonally adjusted” figures in the monthly “'Retail Sales Inquiry” release because:

- the ABS figures cover the UK, while the “Retail Sales Inquiry” covers Great Britain only

- the ABS “total” turnover figures in the main results tables represent sales to both business and the public and are published excluding VAT, while those in the “Retail Sales Inquiry” represent sales to the public only and are published including VAT

The ABS does publish “retail” turnover figures (for sales to the public only) in its Retail Commodities tables in the June release which are inclusive of VAT and will be closer to “Retail Sales Inquiry” figures, however:

- the ABS “retail” turnover figures includes data for National Health Service receipts and commissions whereas the “Retail Sales Inquiry” do not

- Retail Sales Inquiry does not cover household spending on services bought from the retail sector as it is designed to only cover goods

- although both outputs quote figures for a calendar year, the “Retail Sales Inquiry” produce monthly output measures which include average weekly value and volume estimates – the value estimates reflect the average total turnover that businesses have collected over a standard reporting period, while the volume estimates are calculated by taking the value estimates and adjusting to remove the impact of price changes; ABS figures are based on annual responses from businesses covering a range of financial years

8. Construction, Section F

The Construction industries contributed £85.3 billion, 7.8% of the estimated gross value added at basic prices (aGVA) total of £1,093.4 billion for the UK non-financial business economy in 2014.

Construction turnover increased by 9.1% (£18.0 billion) between 2013 and 2014, with purchases increasing by 11.0% (£13.4 billion). Together with a rise in stock levels, this resulted in a growth in aGVA of 9.9% (£7.7 billion). This is the fourth consecutive year of growth, taking it 0.6% (£0.5 billion) above the level seen in 2008 for the first time, see Figure 19.

For details of revisions to 2013 and 2014 Construction data see the later chapter on Revisions.

Figure 19: UK Construction, turnover and purchases and resulting aGVA

2008 to 2014

Source: Office for National Statistics

Download this chart Figure 19: UK Construction, turnover and purchases and resulting aGVA

Image .csv .xlsAs in the previous couple of years, the growth in Construction was mainly in Construction of buildings (Division 41) with a rise of 17.2% (£5.0 billion), see Figures 20 and 21. Specialised construction trades (Division 43) also contributed, with an increase in aGVA of 8.5% (£3.0 billion), but Civil engineering (Division 42) experienced a decrease in aGVA of 2.2% (£0.3 billion).

Figure 20: UK Construction, aGVA by section

2008 to 2014, £ billion

Source: Office for National Statistics

Download this image Figure 20: UK Construction, aGVA by section

.png (63.8 kB) .xls (30.2 kB)Construction of buildings (Division 41)

Construction of buildings, which was the main contributor for the growth in the Construction sector, experienced an increase in aGVA of 17.2% (£5.0 billion) between 2013 and 2014. This was a result of an 11.0% (£8.7 billion) increase in turnover and a 13.6% (£6.8 billion) increase in purchases, coupled with a £2.8 billion rise in stock levels. As was the case in the previous 2 years, the main reason for the growth in aGVA was in the Development of building projects (Group 41.1).

The growth in Construction may be due to several factors such as rising house prices as reported in our Economic Review, July 2015 and improving credit conditions as reported by the Bank of England.

Our House Price Index (HPI) in the Economic Review shows that house prices grew by 3.8% in 2013 and by 10.3% in 2014. The increase in the demand for housing is also reflected by data from the Bank of England which show that mortgage approvals were 5.2% higher in 2014 than in 2013.

Figure 21: UK Construction, aGVA change by division

2008 to 2014

Source: Office for National Statistics

Download this chart Figure 21: UK Construction, aGVA change by division

Image .csv .xlsNotes for Construction industries, Section F

Please note that the ABS figures for the Construction industries should not be compared directly with annual figures in the monthly Output in the Construction Industry release because:

the ABS figures cover the UK, while the “Output in the Construction Industry” covers Great Britain only

the 2 surveys measure different concepts of this industry

while both quote figures for a calendar year, the “Output in the Construction Industry” are based on the aggregate of the responses to 12 monthly surveys, whereas ABS figures are based on annual responses covering a range of business years

the ABS figures will always be larger than those in the “Output in the Construction Industry” because the latter excludes: Property developers (SIC 41.1); Payment on purchased services (architects, technical engineering, etc.); Payment to subcontractors, unless the subcontractors are not classified to construction and therefore are not part of the survey; Value of land; Value of materials sold (which are not part of a structure); and Fixtures, equipment and tools that are sold

the ABS figures include secondary activities related to businesses classified within the construction sector, while the “Output in the Construction Industry” covers only the construction activity of the businesses

9. Agriculture (part), Forestry and Fishing, Section A

The Annual Business Survey (ABS) covers only hunting, forestry, fishing and the support activities to agriculture. Commentary is therefore limited because the sector’s size in terms of economic output, as measured by the ABS, is small in comparison with the other sectors of the UK non-financial business economy. However, data for these parts of Section A can be found in the datasets linked to this bulletin.

Note that the values quoted below for Section A are in £ millions.

The part of Section A covered by ABS showed rises in turnover of 10.7% (£478 million) between 2013 and 2014 and in purchases of 12.6% (£346 million) which led to an increase of 7.8% (£148 million) in gross value added at basic prices (aGVA) between 2013 and 2014. The main contributor to the aGVA increase was Fishing (Group 03.1) which covers Marine fishing and Freshwater fishing. This increase in aGVA was driven by decreases seen in purchases.

This rise means that for the second consecutive year, at £2,044 million, aGVA is higher than the level in 2008.

Comparable GVA figures for the rest of Agriculture (which includes crop and animal production) are available in Chapter 3 (Table 3.2) of the Agriculture in the United Kingdom release published annually by the Department for Environment, Food and Rural Affairs (DEFRA), and shows a value of £9,869 million for 2014.

Nôl i'r tabl cynnwys10. Revisions to 2014 and 2013 Annual Business Survey data

Due to the need to balance timeliness of the data with the accuracy, in line with the Annual Business Survey (ABS) Revisions Policy, ABS Provisional results are published in November with further quality assurance then leading to planned revisions to the data in subsequent releases.

These revisions usually arise from the receipt of additional data and the further validation and revision of existing data by businesses responding to the ABS, which may include restructures that can result in data being reallocated to a different industry.

When compared with the ABS Provisional results published on 12 November 2015, the total revised 2014 results show a small downward revision for the UK Non-financial business economy. There were downward revisions to the 2014 estimates of 0.8% (£29.1 billion) in turnover, 0.8% (£19.5 billion) in purchases and 1.0% (£11.2 billion) approximate gross value added at basic prices (aGVA). The majority of the aGVA downward revisions were in Non-financial services and Production, which together accounted for 84.1% of the overall revision (see Figure 22).

Estimates of aGVA in 2013 have been revised up by 0.4% (£3.9 billion), as a result of upward revisions in Distribution, with a downward revision in Production.

Despite the revisions, the direction of movements of aGVA between 2013 and 2014 for the broad industry groups remains unchanged to that published in November 2015.

Figure 22: UK non-financial business economy, aGVA revisions

2014

Source: Office for National Statistics

Notes:

Excludes Financial and insurance; Public administration and defence; Public provision of Education; Public provision of Health and all medical and dental practice activities.

Agriculture (part), forestry and fishing data are excluded as the values are negligible on a comparable scale.

Download this chart Figure 22: UK non-financial business economy, aGVA revisions

Image .csv .xlsThe Non-financial services sector showed a downward revision of £6.5 billion to the 2014 results. This was driven by downward revisions in Professional, scientific and technical activities (Section M) and in Information and communication (Section J). The final 2013 results show a small upward revision of £0.1 billion to aGVA.

In the Production sector the revised 2014 results show a downward revision of £3.0 billion, driven by Mining and quarrying (Section B), Manufacturing (Section C) and Electricity, gas, steam and air conditioning supply (Section D). The final 2013 results show a downward revision to aGVA of £1.4 billion.

The Construction sector showed a downward revision to aGVA of £1.0 billion in both the revised 2014 and the final 2013 results.

In the Distribution sector the revised 2014 results show a downward revision in aGVA of £0.7 billion. This revision was driven by downward revisions within Retail (excluding Motor Trades) (Division 47) and Wholesale (excluding Motor Trades) (Division 46). The final 2013 results show an upward revision of £6.1 billion in aGVA, driven by upward revisions of £3.2 billion within Wholesale (excluding Motor trades) (Division 46) and £2.9 billion in Retail (excluding Motor Trades) (Division 47).

In the Agriculture (part), Forestry and Fishing sector the revised 2014 results showed a downward revision to aGVA of £0.1 billion.

All of the above revisions were the result of different combinations of the receipt of additional data, the further validation and revision of existing data, and the restructuring of businesses responding to the ABS that can result in data being reallocated to a different industry. The magnitude of the revisions is in line with revisions made in previous years.

Nôl i'r tabl cynnwys11. European comparison

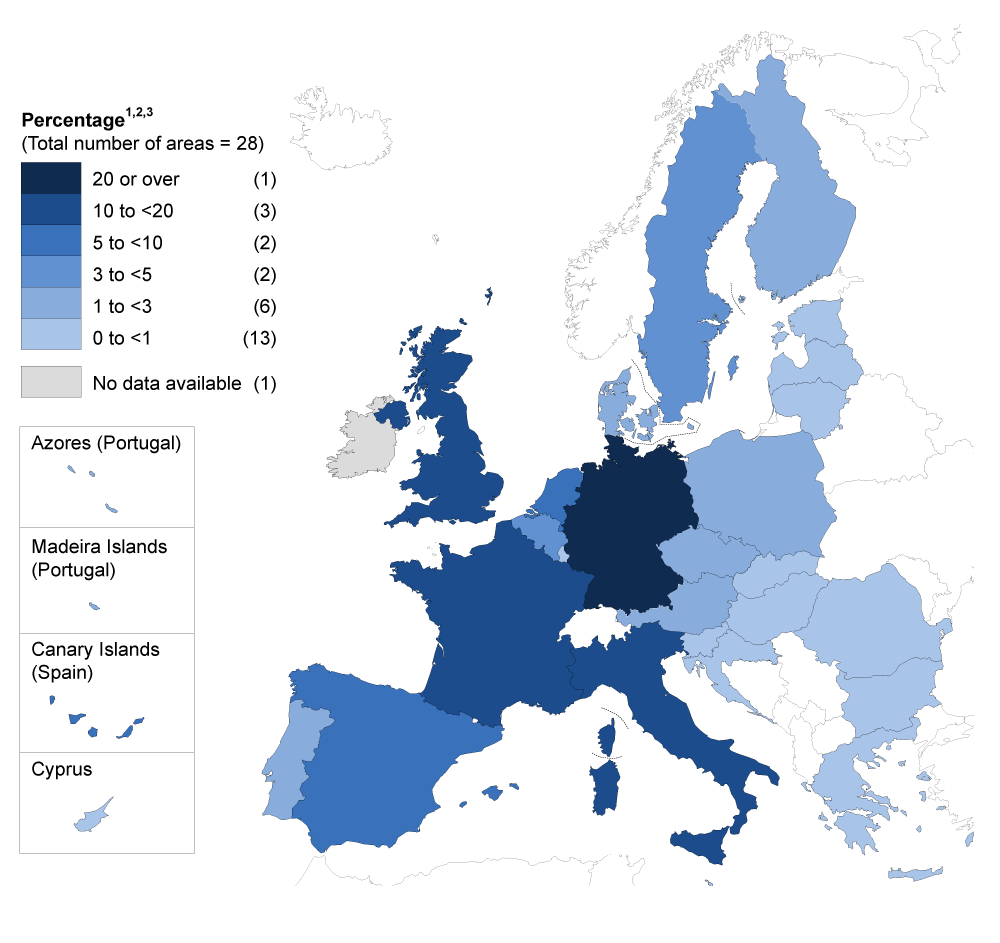

Figure 23 shows the share of the total value of EU-28 gross value added at basic prices (aGVA) in the business economy of each member state in 2012 (the latest figures available). The UK makes the second largest contribution with 17.1% of total EU aGVA. Germany accounts for 23.2% of EU aGVA. France and Italy are the only other member states with more than 10% of EU business economy aGVA.

Figure 23: Percentage share of the aGVA for the business economy in the EU-28

2013

Source: Eurostat

Notes:

aGVA presented here is at factor costs, not at basic prices

Industry coverage for the European comparisons is SIC Sections B–N, excluding Section K. This is the business economy excluding ‘Agriculture, Education, Human health and social work activities, Arts, entertainment and recreation, Other service activities’

Data are included for 27 of the EU-28 countries. Data for Ireland are unavailable. Croatia joined the European Union on 1 July 2013. 2013 data are the latest available period for European comparisons

Source of boundaries UNEP (2015)