Cynnwys

- Key points

- Overview

- Your views matter

- Interactive wheel for the UK non-financial business economy

- UK non-financial business economy, sections A-S (part)

- Non-financial service industries, sections H-S (part)

- Production industries, sections B-E

- Distribution industries, section G

- Construction industries, section F

- Agriculture (part), forestry and fishing, section A

- European comparison

- Background notes

- Methodoleg

1. Key points

In 2012, the income generated by businesses in the UK, less the cost of goods and services used to create this income was estimated to be £936.3 billion. This amount represents the approximate Gross Value Added at basic prices (aGVA) of the UK Non-Financial Business Economy

Between 2011 and 2012, aGVA increased by 2.3% (£20.6 billion). This increase is a continuation of the recovery seen between 2009 and 2011 and takes aGVA to a level 2.9% (£26.6 billion) above that seen in 2008, at the start of the recession

The Non-Financial Service sector, which accounts for over half of aGVA in the UK Non-Financial Business Economy, contributed most to the increase in aGVA of 5.8% (£27.5 billion) between 2011 and 2012. This is the third consecutive annual increase, taking it to £62.2 billion above the level seen in 2008

The Production sector, which accounts for just under a quarter of aGVA in the UK Non-Financial Business Economy, saw a fall in aGVA between 2011 and 2012, for the first time since 2009

The Distribution sector, which accounts for just over a seventh of aGVA in the UK Non-Financial Business Economy, also saw a fall in aGVA between 2011 and 2012. This is the second consecutive annual decrease, and keeps it below the level seen in 2008

When compared to the provisional results published on 14 November 2013, these revised 2012 results show minimal revision for the UK Non-Financial Business Economy. There were downward revisions of 0.8% (£27.7 billion) in turnover, 0.7% (£16.1 billion) in purchases and 1.2% (£11.4 billion) in aGVA. The direction of movements of aGVA for the broad industry groups remains unchanged, due to a 2.2% (£20.8 billion) downward revision in aGVA for 2011

Data for the Insurance and reinsurance industries continue to be excluded from this release following discussions with key users. This experimental series was previously included in the results for reference years 2008 to 2011 and covered a small part of the Financial & insurance sector. Since November 2013 it has been removed from the Annual Business Survey (ABS) release due to ongoing volatility while a more detailed quality assessment is undertaken. As such results in this release cover the UK Non-Financial Business Economy rather than the UK Business Economy. This does not affect other industries

2. Overview

Estimate of the size and growth of the UK Non-Financial Business Economy for 2012 as measured by the Annual Business Survey (ABS), are presented in this release. It is the key resource for understanding the detailed structure, conduct and performance of businesses across the UK. The release covers:

non-financial services (includes professional, scientific, communication, administrative, transport, accommodation and food, private health and education, entertainment services)

distribution (includes retail, wholesale and motor trades)

production (includes manufacturing, oil and gas extraction, energy generation and supply)

construction

parts of agriculture (includes agricultural support services, forestry and fishing)

Together these industries represent the UK Non-Financial Business Economy and account for around two thirds of the whole economy of the UK in terms of Gross Value Added. Public administration and defence, public sector health and education, finance and farming make up the difference between the UK Non-Financial Business Economy and the whole economy.

The ABS has included estimates for the Insurance & reinsurance industries (SIC 2007 Groups 65.1 and 65.2 respectively) in its UK National releases since 2008. This is the only part of Financial and insurance activities (Section K) covered by the survey. As with any new time-series, estimates for these industries have remained experimental while ongoing quality assurance has taken place. This quality assurance has led the figures to be revised substantially in recent years with a resulting break in the series between 2009 and 2010. The estimates for this series have been removed from releases since November 2013 to allow for a more detailed quality assessment to be undertaken. The removal of these series does not affect other industries published as part of this release and has no impact on any other financial statistics published by ONS.

Estimates published in this release include turnover, purchases, approximate Gross Value Added at basic prices (aGVA) and employment costs. All data are reported at current prices (effect of price changes included).

Where the recession is mentioned it refers to the contraction of Gross Domestic Product (GDP) that started in 2008, the year from which a consistent ABS time series is available. For more information about the survey see the background notes.

The ABS has a wide range of uses: for example, ABS statistics are essential contributors to the UK National Accounts, including the measurement of GDP, they are supplied to Eurostat to meet the requirements of the European Structural Business Statistics (SBS) Regulation, and are used by the devolved administrations and central and local government to monitor and inform policy development. For other uses see background note 3.

Questions often asked of the ABS release are 'What is aGVA?' and ‘How does the measure of aGVA differ from the GVA measure in the National Accounts?’. For an overview of aGVA please see our new infographic 'What is aGVA?'. National Accounts carry out coverage adjustments, conceptual adjustments and coherence adjustments. The National Accounts estimate of GVA uses input from a number of sources, and covers the whole UK economy, whereas ABS does not include farming, financial or public sectors. ABS total aGVA is around two thirds of the National Accounts whole economy GVA because of these differences. For further information on aGVA, see background note 8. There is also a recently published article ‘A Comparison between ABS and National Accounts Measures of Value Added’ (462.3 Kb Pdf) which provides more detail.

ONS makes every effort to provide informative commentary on the data in this release. Where possible, the commentary draws on evidence from businesses or other sources of information to help explain possible reasons behind the observed changes. However, in some places it can prove difficult to elicit detailed reasons for movements, for example, businesses may state a ‘change in the nature of business activity’. Consequently, it is not possible for all data movements to be fully explained.

Nôl i'r tabl cynnwys3. Your views matter

We constantly aim to improve this release and its associated commentary. We would welcome any feedback you might have, and would be particularly interested in knowing how you make use of these data to inform your work. Please contact us via email: abs@ons.gov.uk or telephone Heather Bovill on +44 (0)1633 455107.

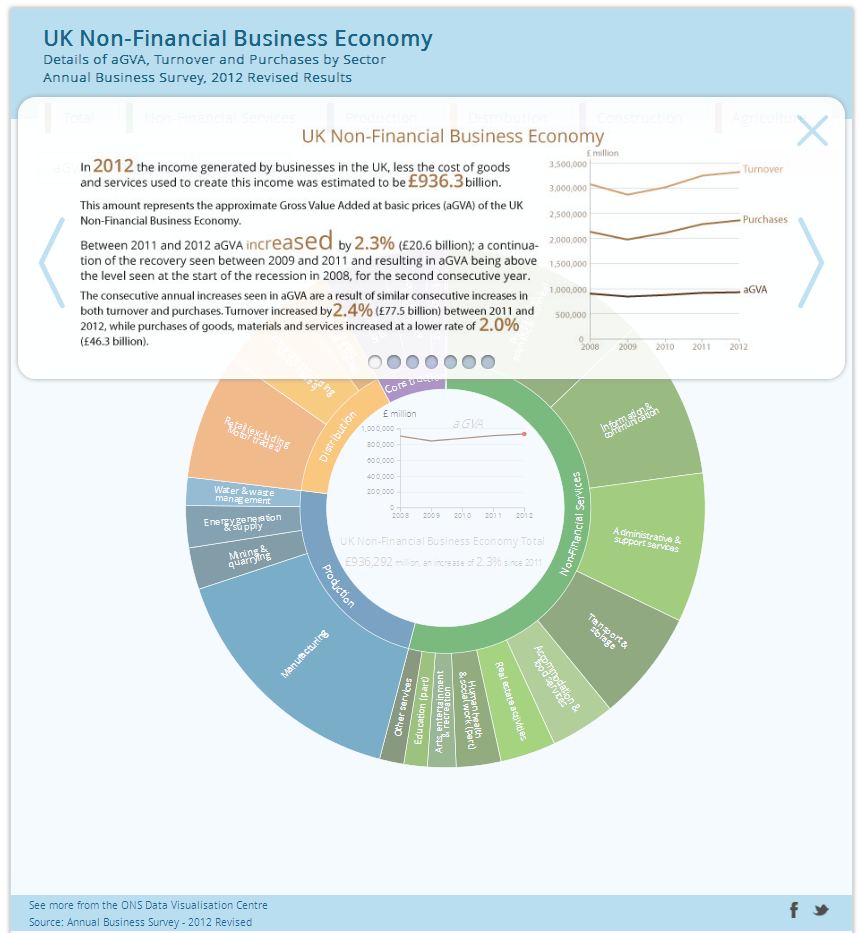

Nôl i'r tabl cynnwys4. Interactive wheel for the UK non-financial business economy

Use the Interactive Wheel to investigate which sectors contribute most to the UK Non-Financial Business Economy. Focus on the Business Economy as a whole or each sector and switch between aGVA, Turnover and Purchases.

5. UK non-financial business economy, sections A-S (part)

In 2012, the income generated by businesses in the UK, less the cost of goods and services used to create this income was estimated to be £936.3 billion. This amount represents the approximate Gross Value Added at basic prices (aGVA) of the UK Non-Financial Business Economy. Between 2011 and 2012 aGVA increased by 2.3% (£20.6 billion); a continuation of the recovery seen between 2009 and 2011 although at a slower rate. This increase resulted in aGVA being above the level seen at the start of the recession, in 2008, for the second consecutive year.

The main drivers of aGVA are:

- turnover (the main component of income)

- purchases (the main component of the consumed goods and services)

The consecutive annual increases seen in aGVA are a result of similar consecutive increases in both turnover and purchases. Turnover increased by 2.4% (£77.5 billion) between 2011 and 2012, while purchases of goods, materials and services increased at a lower rate of 2.0% (£46.3 billion), resulting in an aGVA growth rate that was slightly lower than that for turnover. As with aGVA, turnover and purchases were above levels seen in 2008 at the start of the recession for the second consecutive year (see Figure 1).

The recession and recovery described by the ABS between 2008 and 2012 is broadly in line with Gross Domestic Product (GDP) figures published in the National Accounts. Both the ABS aGVA estimates and the National Accounts GDP estimates show a fall between 2008 and 2009 and then three consecutive annual increases from 2009 to 2012.

Due to the need to balance timeliness of the data with the accuracy, in-line with the ABS Revisions Policy, provisional ABS results are published in November with further quality assurance then leading to planned revisions to the data in subsequent releases.

These revisions usually arise from the receipt of additional data and further validation of existing data by businesses responding to the ABS, which may include restructures that can result in data being reallocated to a different industry.

When compared to the ABS Provisional results published on 14 November 2013, the revised 2012 results show minimal revision for the UK Non-Financial Business Economy. There were downward revisions to the 2012 estimates of 0.8% (£27.7 billion) in turnover, 0.7% (£16.1 billion) in purchases and 1.2% (£11.4 billion) in aGVA. The revisions to aGVA were driven by downward revisions within Distribution and Non-financial services.

However, growth in aGVA between 2011 and 2012 is above the level estimated in the ABS Provisional release due to larger downward revisions to the 2011 estimates. Estimates of aGVA in 2011 have been revised down by 2.2% (£20.8 billion), driven by downward revisions within Distribution and Production industries.

Despite the revisions the direction of movements of aGVA between 2011 and 2012 for the broad industry groups remains unchanged.

A list of industries which are included in the ABS measure of the UK Non-Financial Business Economy, can be found in background note 8.

Figure 1: UK Non-Financial Business Economy details of income and expenditure and resulting aGVA, 2008-2012

Source: Office for National Statistics

Notes:

- A list of industries which are included in the ABS measure of the UK Non-Financial Business Economy, can be found in background note 8

Download this chart Figure 1: UK Non-Financial Business Economy details of income and expenditure and resulting aGVA, 2008-2012

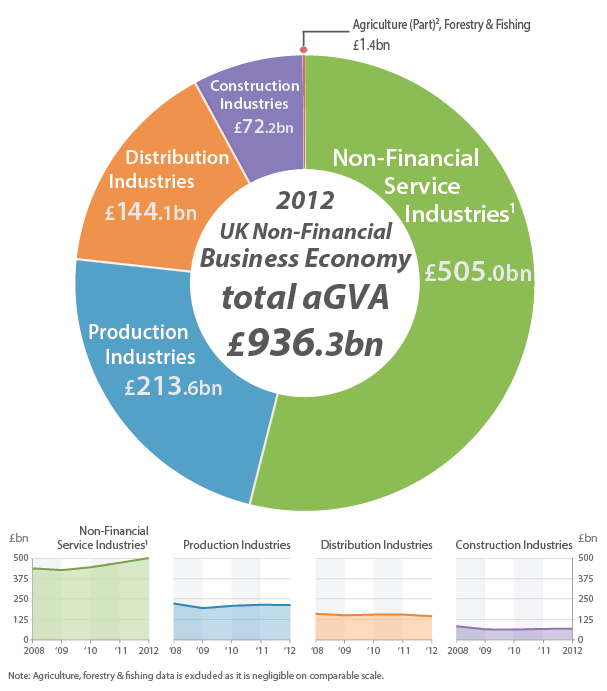

Image .csv .xlsBoth the Non-Financial Services and the Construction sectors saw increases in aGVA between 2011 and 2012, while aGVA in the Production, Distribution and Agriculture (part) sectors experienced decreases.

Non-Financial Services, the largest industry sector of the UK Non-Financial Business Economy contributed most to the increase in aGVA. Non-Financial Service sector aGVA rose by 5.8% (£27.5 billion) between 2011 and 2012, the third consecutive annual increase, taking aGVA to £505.0 billion. The Non-Financial Service sector is the only sector where aGVA is above the level seen in 2008, at the start of the recession.

The Construction sector also experienced growth in aGVA between 2011 and 2012 for the second consecutive year, increasing by 2.9% (£2.1 billion), however, aGVA still remains below that seen in 2008.

The Production sector saw a decrease in aGVA for the first time in three years, falling by just 0.8% (£1.6 billion) between 2011 and 2012. This has seen aGVA for the Production sector fall further below that in 2008, at the start of the recession.

The Distribution sector experienced a second consecutive annual decrease in aGVA, with a fall of 4.7% (£7.1 billion) between 2011 and 2012. This keeps aGVA for the Distribution sector below the level seen in 2008.

The Agriculture (part), forestry and fishing sector experienced a fall in aGVA of 11.4% (£0.2 billion) between 2011 and 2012, and at £1.4 billion, aGVA for the industry also remains lower than the level in 2008.

Figure 2: UK non-financial business economy, details of aGVA by sector, 2008-2012

Source: Office for National Statistics

Notes:

- Excludes Financial and insurance; Public administration and defence; Public provision of Education; Public provision of Health and all medical and dental practice activities

- Agriculture (part: excluding crop and animal production), forestry & fishing data are excluded from the line charts as the values are negligible on a comparable scale

Figure 3: UK non-financial business economy, details of aGVA growth by sector

2008-2012

Source: Office for National Statistics

Notes:

- A list of industries which are included in the ABS measure of the UK Non-Financial Business Economy, can be found in background note 8

Download this chart Figure 3: UK non-financial business economy, details of aGVA growth by sector

Image .csv .xls6. Non-financial service industries, sections H-S (part)

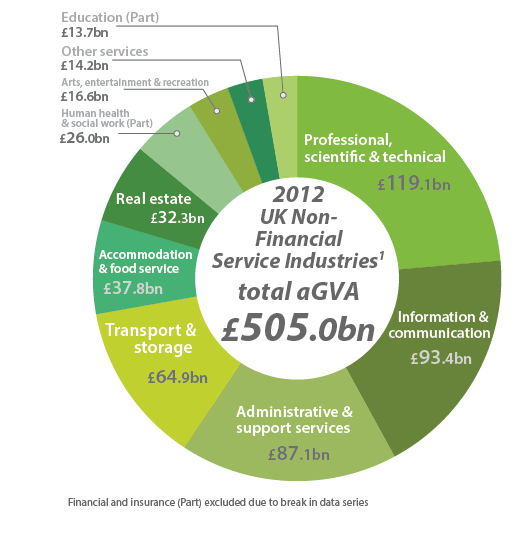

Just over half (53.9%) of the estimated aGVA total of £936.3 billion in 2012 for the UK Non-Financial Business Economy was generated by the Non-Financial Service industries.

Between 2011 and 2012 Non-Financial Service turnover increased at a higher rate than purchases, 4.5% (£46.0 billion) compared to 3.4% (£18.4 billion), resulting in aGVA rising by 5.8% (£27.5 billion).

This is the third consecutive year of growth in aGVA for the sector, following the fall between 2008 and 2009. Turnover, purchases and aGVA are now well above the level seen in 2008 at the start of the recession (see Figure 4).

When compared to the ABS provisional results published on 14 November 2013, the final 2011 and revised 2012 results show downward revisions to aGVA of -£2.6 billion and -£5.6 billion respectively. These revisions were driven by downward revisions to Transport & storage and Professional, scientific & technical activities (Section M) and resulted from a small number of businesses providing additional data, further validation of existing data or reporting restructuring.

Figure 4: Non-Financial Service Industries, details of income and expenditure and resulting aGVA, 2008-2012

Source: Office for National Statistics

Notes:

- A list of industries which are included in the ABS measure of the UK Non-Financial Business Economy, can be found in background note 8

Download this chart Figure 4: Non-Financial Service Industries, details of income and expenditure and resulting aGVA, 2008-2012

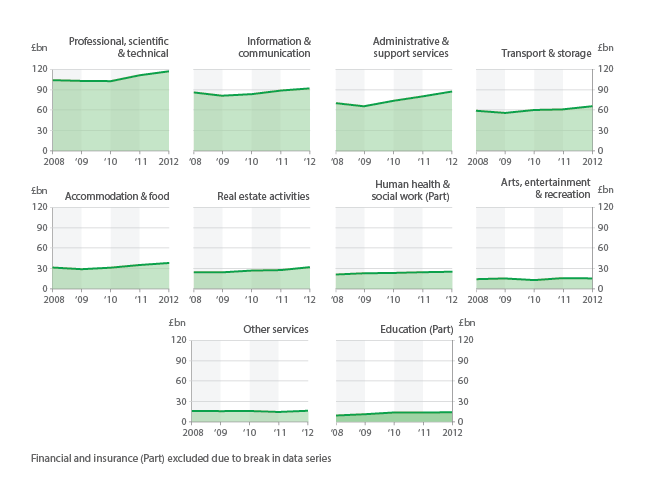

Image .csv .xlsAll of the industry sections within the Non-Financial Service sector saw increases in aGVA between 2011 and 2012 (see Figures 5 and 6).

Those industries which have made the largest contributions to growth are Administrative & support service activities (Section N), Professional, scientific & technical activities (Section M), Transport & storage (Section H), and Real estate activities (Section L). Together these industries accounted for an increase in aGVA of £19.3 billion.

Figure 5a: Non-financial service industries, details of aGVA by section, 2012

Source: Office for National Statistics

Notes:

- Excludes Financial and insurance; Public administration and defence; Public provision of Education; Public provision of Health and all medical and dental practice activities

Figure 5b: Non-Financial Service Industries, details of aGVA by section, 2008-2012

Source: Office for National Statistics

Notes:

- Excludes Financial and insurance; Public administration and defence; Public provision of Education; Public provision of Health and all medical and dental practice activities

Administrative & support services (section N)

Between 2011 and 2012 Administrative & support activities saw turnover rise by 3.3% (£5.6 billion), while purchases decreased by 1.5% (£1.3 billion) leading to an aGVA increase of 8.5% (£6.8 billion).

The main industries driving growth within Administrative & support activities were Employment activities (Division 78) where aGVA increased by 16.4% (£3.6 billion). The growth has been driven by Temporary employment agency activities (Group 78.2) which may be a result of businesses being more likely to recruit temporary rather than permanent staff as a result of continued economic uncertainty. Rental & leasing activities (Division 77) also made a substantial contribution with an 8.7% (£1.3 billion) increase in aGVA.

Professional, Scientific & Technical Activities (Section M)

Turnover in Professional, scientific & technical activities increased by 3.4% (£6.8 billion) between 2011 and 2012, with purchases showing an increase of only 0.7% (£0.6 billion). This resulted in growth of 5.0% (£5.7 billion) in aGVA, resulting in aGVA remaining above that reported for 2008 for the second consecutive year.

This broad section, which covers a range of industries from Legal & accounting activities to Advertising & market research and Veterinary activities, saw increases in aGVA in almost all its divisions between 2011 and 2012. Those making the largest impact on aGVA growth were Architectural & engineering activities & technical testing & analysis (Division 71), Scientific research & development (Division 72) and Legal & accounting activities (Division 69) which between them contributed £4.5 billion to aGVA.

Transport & storage (section H)

Turnover in Transport & storage increased by 5.4% (£7.7 billion) between 2011 and 2012, with purchases rising by 5.9% (£4.9 billion) resulting in a 5.5% (£3.4 billion) increase in aGVA.

The main industries driving growth within Transport & storage were Warehousing & support activities for transportation (Division 52), and Postal & courier activities (Division 53). Increases in this sector may be related to the effect of the Internet economy. Data on the retail sector indicates that turnover from mail order and via the Internet continued to increase at a higher rate than turnover from shops. Increases seen in Warehousing & support activities for transportation and Postal & courier activities are likely to partly result from the delivery and storage of items ordered from the Internet.

Real estate activities (section L)

Real estate experienced an 11.9% (£5.5 billion) rise in turnover, which, coupled with a smaller 8.8% (£1.6 billion) increase in purchases, resulted in growth in aGVA of 11.6% (£3.4 billion) between 2011 and 2012.

The main driver of this aGVA growth came from Renting & operating of own or leased real estate (Class 68.20), which accounts for the majority of the increase in Real estate activities.

Businesses in this industry have noted that a growing rental market has resulted from a trend of falling owner occupation, probably caused by increased mortgage constraints.

Finance & insurance (section K)

The ABS has included estimates for the Insurance & reinsurance industries (SIC 2007 Groups 65.1 and 65.2 respectively) in its UK National releases since 2008. This is the only part of Financial and insurance activities (Section K) covered by the survey. As with any new time-series, estimates for these industries have remained experimental while ongoing quality assurance has taken place. This quality assurance has led the figures to be revised substantially in recent years with a resulting break in the series between 2009 and 2010. Due to ongoing volatility the estimates for this series have been removed since November 2013 to allow for a more detailed quality assessment to be undertaken. The removal of these series does not affect other industries published as part of this release and has no impact on any other financial statistics published by the ONS.

Figure 6: Non-financial service industries, details of aGVA growth by section

2008-2012

Source: Office for National Statistics

Notes:

- N - Administrative & support service activities M - Professional, scientific & technical activities H - Transport & storage L - Real estate activities I - Accommodation & food service activities J - Information & communication S - Other service activities Q (part) - Human health & social work activities P (part) - Education R - Arts, entertainment & recreation

- A list of industries which are included in the ABS measure of the UK Non-Financial Business Economy, can be found in background note 8

Download this chart Figure 6: Non-financial service industries, details of aGVA growth by section

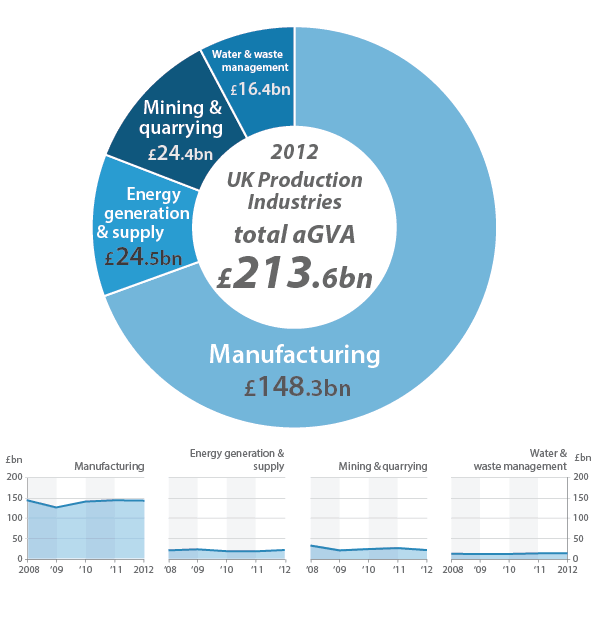

Image .csv .xls7. Production industries, sections B-E

The Production sector in 2012 provided just under a quarter (22.8%) of the estimated aGVA total of £936.3 billion for the UK Non-Financial Business Economy.

Between 2011 and 2012, unlike in the Non-Financial Service sector, both Production sector turnover and purchases decreased (by 0.4% (£2.9 billion) and 1.1% (£5.4 billion) respectively). This led to a decrease in aGVA of 0.8% (£1.6 billion). This fall in aGVA follows two consecutive annual increases and sees aGVA drop further below the level seen in 2008 at the start of the recession (see Figure 7).

When compared to the ABS Provisional results published on 14 November 2013, the final 2011 results show a downward revision to aGVA of -£6.9 billion, while the revised 2012 results show an upward revision of £1.3 billion. These revisions were driven by Manufacturing (Section C) and Energy generation & supply (Section D) as a result of a small number of businesses providing additional data, further validation of existing data or reporting restructuring.

Figure 7: Production Industries, details of income and expenditure and resulting aGVA, 2008-2012

Source: Office for National Statistics

Download this chart Figure 7: Production Industries, details of income and expenditure and resulting aGVA, 2008-2012

Image .csv .xlsIn the Production sector between 2011 and 2012, Section B (Mining & quarrying) and Section C (Manufacturing) saw falls in aGVA of 14.8% (£4.2 billion) and 0.7% (£1.0 billion) respectively.

Over the same period Section D (Energy generation & supply) and Section E (Water & waste management) saw increases in aGVA of 15.4% (£3.3 billion) and 1.9% (£0.3 billion) respectively (see Figures 8 and 10).

Figure 8: Production industries, details of aGVA by section, 2008-2012

Source: Office for National Statistics

Mining & quarrying (section B, which includes oil and gas extraction)

Turnover in Mining & quarrying decreased by 7.5% (£4.0 billion) while purchases increased by 1.7% (£0.4 billion) resulting in a 14.8% (£4.2 billion) decrease in aGVA. This decrease was almost entirely driven by Extraction of crude petroleum and natural gas (Division 06) which saw a 20.0% (£4.9 billion) decrease in aGVA which may be a result of prolonged periods of maintenance to offshore oil rigs.

Manufacturing (section C)

For Manufacturing there were decreases of 0.6% (£3.4 billion) in turnover and 1.8% (£6.4 billion) in purchases between 2011 and 2012. This resulted in a decrease in aGVA of 0.7% (£1.0 billion).

The decrease in manufacturing aGVA was driven primarily by Manufacture of basic metals (Division 24), Manufacture of computer, electronic & optical products (Division 26), Manufacture of motor vehicles, trailers & semi-trailers (Division 29), Manufacture of chemicals & chemical products (Division 20) and Manufacture of basic pharmaceutical products & pharmaceutical preparations (Division 21). Together these five divisions account for a decrease in aGVA of £3.1 billion (see Figure 9).

The £1.0 billion decrease in aGVA for Manufacture of basic metals (Division 24) was impacted by the closure in recent years of the UK’s two largest aluminium smelters.

The £0.5 billion decrease in aGVA for Manufacture of basic pharmaceutical products and pharmaceutical preparations (Division 21) was cited by some businesses as a result of decreased exclusivity of some previously patented products.

Of the divisions showing growth between 2011 and 2012 the largest growth was in Manufacture of fabricated metal products, except machinery & equipment (Division 25) which showed a rise in aGVA of 9.6% (£1.3 billion) and in Repair and installation of machinery equipment (Division 33) which showed a rise of 17.2% (£1.0 billion).

The picture within Manufacturing was mixed with around half of the 24 divisions experiencing decreases in aGVA between 2011 and 2012.

Across the Production sector many divisions have been affected by a trend amongst multinational companies towards restructuring on an international basis. Such restructuring has caused companies to be classified under different sectors to those they have historically occupied, with movements from traditional production industries towards wholesalers and toll processors.

Figure 9: Manufacturing, details of aGVA growth by division

2011-2012

Source: Office for National Statistics

Notes:

- 10 - Food products

11 – Beverages

12 – Tobacco products

13 – Textiles

14 - Wearing apparel

15 - Leather & related products

16 - Wood & of products of wood & cork, except furniture; manufacture of articles of straw & plaiting materials

17 - Paper & paper products

18 - Printing & reproduction of recorded media

19 - Coke & refined petroleum products

20 - Chemicals & chemical products

21 - Basic pharmaceutical products & pharmaceutical preparations

22 - Rubber & plastic products

23 - Other non-metallic mineral products

24 - Basic metals

25 - Fabricated metal products, except machinery & equipment

26 - Computer, electronic & optical products

27 - Electrical equipment

28 - Machinery & equipment n.e.c

29 - Motor vehicles, trailers & semi-trailers

30 - Other transport equipment

31 – Furniture

32 - Other manufacturing

33 - Repair & installation of machinery & equipment - Information for 11 - Beverages and 12 - Tobacco products, suppressed to avoid disclosure

Download this chart Figure 9: Manufacturing, details of aGVA growth by division

Image .csv .xlsEnergy generation & supply (section D)

Electricity generation & supply saw turnover increase at a higher rate than purchases between 2011 and 2012 (4.7% (£4.7 billion) and 1.4% (£1.1 billion) respectively), resulting in aGVA increasing by 15.4% (£3.3 billion). Rises in turnover and purchases are thought to be influenced by increased price of raw materials influenced by international events such as the closing of Japan’s nuclear program and Middle East unrest. The population rise of micro-businesses (with less than 10 people in employment) in this sector is thought to be due to the growth of small producers of renewable energy encouraged by various green grants, subsidies and "feed in tariffs".

Figure 10: Production Industries, details of aGVA growth by section

2008-2012

Source: Office for National Statistics

Download this chart Figure 10: Production Industries, details of aGVA growth by section

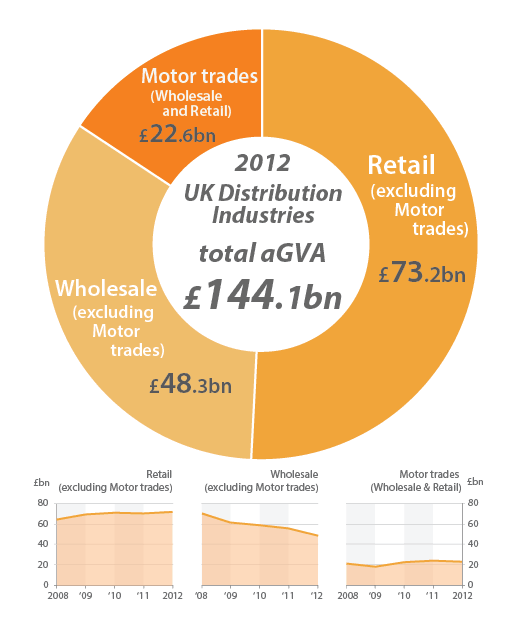

Image .csv .xls8. Distribution industries, section G

The Distribution industries in 2012 provided 15.4% of the estimated aGVA total of £936.3 billion for the UK Non-Financial Business Economy.

This sector saw a 2.6% (£34.6 billion) rise in turnover and a larger 3.1% (£35.8 billion) increase in purchases between 2011 and 2012. This contributed to the decrease in aGVA of 4.7% (£7.1 billion). This second consecutive annual decrease keeps aGVA for the Distribution sector below the level seen in 2008. at the start of the recession (see Figure 11).

When compared to the ABS Provisional results published on 14 November 2013, the final 2011 and revised 2012 results show downward revisions to aGVA of -£10.9 billion and -£6.8 billion respectively. These revisions were driven by downward revisions to Wholesale (excluding Motor trades) (Division 46) and resulted from a small number of businesses providing additional data, further validation of existing data or reporting restructuring.

Figure 11: Distribution Industries, details of income and expenditure and resulting aGVA, 2008-2012

Source: Office for National Statistics

Download this chart Figure 11: Distribution Industries, details of income and expenditure and resulting aGVA, 2008-2012

Image .csv .xlsPerformance within Distribution was mixed (see Figures 12 and 13), with the decrease in aGVA between 2011 and 2012 driven by Wholesale (excluding Motor trades) (Division 46).

Figure 12: Distribution Industries, details of aGVA by division, 2008-2012

Source: Office for National Statistics

Wholesale (excluding motor trades) (division 46)

Wholesale experienced an increase in turnover of 2.7% (£23.0 billion) and purchases of 3.4% (£26.7 billion) between 2011 and 2012. However, aGVA saw a large decrease of 15.1% (£8.6 billion), although the change without industry restructures and reclassification changes would be less pronounced.

The fall between 2011 and 2012 was driven by changes to Other specialised wholesale (Group 46.7). Performance for this industry group is volatile as it is heavily influenced by changes in oil prices. The high oil prices seen in 2011 have continued into 2012 and wholesalers may have been reluctant to pass the higher prices onto their customers.

Motor trades (wholesale and retail) (division 45)

Motor trades also contributed to the fall in aGVA in Distribution between 2011 and 2012, with a decrease of 3.7% (£0.9 billion), as purchases increased at a higher rate than turnover, 4.6% (£5.3 billion) and 3.8% (£5.2 billion) respectively. This fall follows two consecutive annual increases.

Within Motor trades, Maintenance & repair of motor vehicles (Group 45.2) contributed to the fall in aGVA between 2011 and 2012, decreasing by 5.5% (£0.4 billion). This is perhaps a result of consumers putting off car repairs in response to the uncertain economic climate and falling real incomes.

The last few years have seen noticeable changes in the drivers within this division, between sales of new vehicles and maintenance of old vehicles. For example, the Sale of motor vehicles (Group 45.1) saw strong growth between 2009 and 2010, followed by a small fall in aGVA between 2010 and 2011 suggesting that consumers could have brought forward purchases of new cars to take advantage of the Government car scrappage scheme (which ran from May 2009 to April 2010). The group experienced a slight fall of 0.4% (£0.05 billion) in aGVA between 2011 and 2012.

On the other hand, Maintenance & repair of motor vehicles (Group 45.2) saw very little growth between 2009 and 2010, followed by much stronger growth between 2010 and 2011 when the scrappage scheme had ended. Between 2011 and 2012 aGVA in this group has also fallen.

Retail (excluding motor trades) (division 47)

In contrast, aGVA in Retail saw an increase of 3.3% (£2.3 billion) between 2011 and 2012. This growth in aGVA was a result of a 1.9% (£6.4 billion) increase in turnover and a smaller 1.4% (£3.8 billion) increase in purchases.

The increases in aGVA were driven by a 5.6% (£1.2 billion) rise in Retail sale of other goods in specialised stores (Group 47.7) which includes retail sale of clothing and footwear, and a rise of 26.9% (£0.9 billion) in Retail sales not in stores, stalls or markets (Group 47.9) which includes Internet sales. This was countered by a decrease of 36.1% (£0.7 billion) in Retail sale of automotive fuel in specialised stores (Group 47.3) which includes petrol stations.

Perhaps unsurprisingly, reports from businesses indicate that turnover from mail orders and via the Internet increased at a higher rate than turnover from shops.

Although increasing, retail sales from mail order and the Internet remain a small share of total turnover. The rise may be due to customer demand for better value for money, and businesses diversifying to cut expenditure.

Figure 13: Distribution industries, details of aGVA growth by division

2008-2012

Source: Office for National Statistics

Download this chart Figure 13: Distribution industries, details of aGVA growth by division

Image .csv .xlsNotes for Distribution industries, section G

Please note that the ABS figures for the Retail industry should not be compared directly with the annual ‘value non seasonally adjusted’ figures in the monthly 'Retail Sales Inquiry' release because:

- the ABS figures cover the United Kingdom, while the 'Retail Sales Inquiry' covers Great Britain only

- the ABS ‘total’ turnover figures in the main results tables represent sales to both business and the public and are published excluding VAT, while those in the 'Retail Sales Inquiry' represent sales to the public only and are published including VAT

The ABS does publish ‘retail’ turnover figures (for sales to the public only) in its Retail Commodities tables which are inclusive of VAT and will be closer to 'Retail Sales Inquiry' figures, however

- the ABS ‘retail’ turnover figures includes data for National Health Service receipts and commissions whereas the 'Retail Sales Inquiry' do not

- Retail Sales Inquiry does not cover household spending on services bought from the retail sector as it is designed to only cover goods

- although both quote figures for a calendar year, the 'Retail Sales Inquiry' produce monthly output measures which include average weekly value and volume estimates. The value estimates reflect the average total turnover that businesses have collected over a standard reporting period, while the volume estimates are calculated by taking the value estimates and adjusting to remove the impact of price changes. ABS figures are based on annual responses from businesses covering a range of financial years

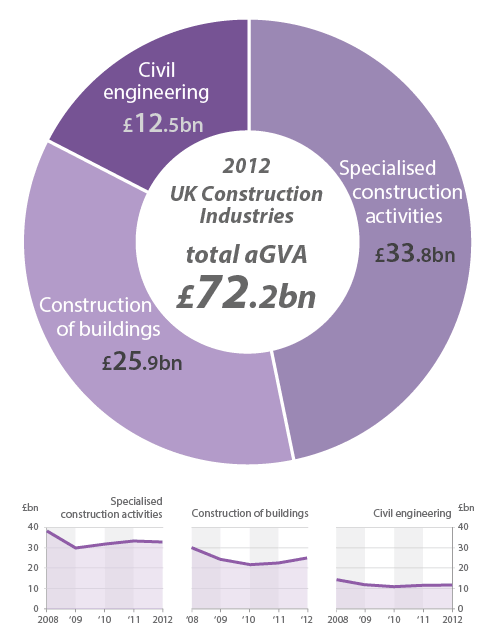

9. Construction industries, section F

Construction turnover decreased slightly by 0.2% (£0.3 billion) between 2011 and 2012 with purchases decreasing by a larger 2.3% (£2.8 billion) to give overall growth in aGVA of 2.9% (£2.1 billion). This is the second consecutive year of growth, but still leaves Construction aGVA £12.6 billion lower than the level in 2008 at the start of the recession (see Figure 14).

When compared to the ABS provisional results published on 14 November 2013, the final 2011 results show an downward revision to aGVA of £0.5 billion, while the revised 2012 results show a downward revision of £0.4 billion. These revisions were a result of a small number of businesses providing additional data, further validation of existing data or reporting restructuring.

Figure 14: Construction Industries, details of income and expenditure and resulting aGVA, 2008-2012

Source: Office for National Statistics

Download this chart Figure 14: Construction Industries, details of income and expenditure and resulting aGVA, 2008-2012

Image .csv .xlsThe growth in Construction was driven by Construction of buildings (Division 41) which saw a 10.4% increase in aGVA between 2011 and 2012, while Civil engineering (Division 42) saw only a minor 0.8% increase. Specialised construction activities (Division 43) experienced a fall in aGVA of 1.4%.

Figure 15: Construction industries, details of aGVA by division, 2008-2012

Source: Office for National Statistics

Construction of buildings (division 41)

Construction of buildings which drove the growth in the Construction sector, experienced an increase in aGVA of 10.4% (£2.4 billion) between 2011 and 2012 as a result of a 3.8% (£2.7 billion) increase in turnover and a 0.2% (£0.1 billion) fall in purchases. The main driver of the change was an increase in Development of building projects (Group 41.1), which saw a rise in aGVA of 25.0% (£1.8 billion).

Figure 16: Construction industries, details of aGVA growth by division

2008-2012

Source: Office for National Statistics

Download this chart Figure 16: Construction industries, details of aGVA growth by division

Image .csv .xlsNotes for Construction industries, section F

Please note that the ABS figures for the Construction industries should not be compared directly with annual figures in the monthly ‘Output in the Construction Industry’ release because:

- the ABS figures cover the United Kingdom, while the 'Output in the Construction Industry' covers Great Britain only

- the two surveys measure different concepts of this industry

- while both quote figures for a calendar year, the ‘Output in the Construction Industry’ are based on the aggregate of the responses to 12 monthly surveys, whereas ABS figures are based on annual responses covering a range of business years

- the ABS figures will always be larger than those in the ‘Output in the Construction Industry’ because the latter excludes: Property developers (SIC 41.1); Payment on purchased services (architects, technical engineering, etc.); Payment to subcontractors, unless the subcontractors are not classified to construction and therefore are not part of the survey; Value of land; Value of materials sold (which are not part of a structure); and Fixtures, equipment and tools that are sold

10. Agriculture (part), forestry and fishing, section A

The ABS covers only hunting, forestry, fishing and the support activities to agriculture. Commentary is therefore limited because its size in terms of economic output, as measured by the ABS, is small in comparison to the other sections of the UK Non-Financial Business Economy. However, data for these parts of Section A can be found in the reference tables linked to this bulletin.

The other parts of agriculture, which include crop and animal production, are covered by the Department for Environment, Food and Rural Affairs (DEFRA).

The part of Section A covered by ABS showed rises in turnover of 0.9% (less than £0.1 billion) between 2011 and 2012 and purchases of 11.3% (£0.2 billion) which led to a decrease of 11.4% (£0.2 billion) in aGVA between 2011 and 2012. This fall means that, at £1.4 billion, aGVA still remains lower than the level in 2008, at the start of the recession.

Validation of data returns for 2011 highlighted a small number of businesses within agriculture (Division 01) which needed to be reclassified resulting in revisions to the 2010 and 2011 figures. In line with the ABS revisions policy previous years (2008 and 2009) have not been revised and users should therefore take caution when comparing figures overtime.

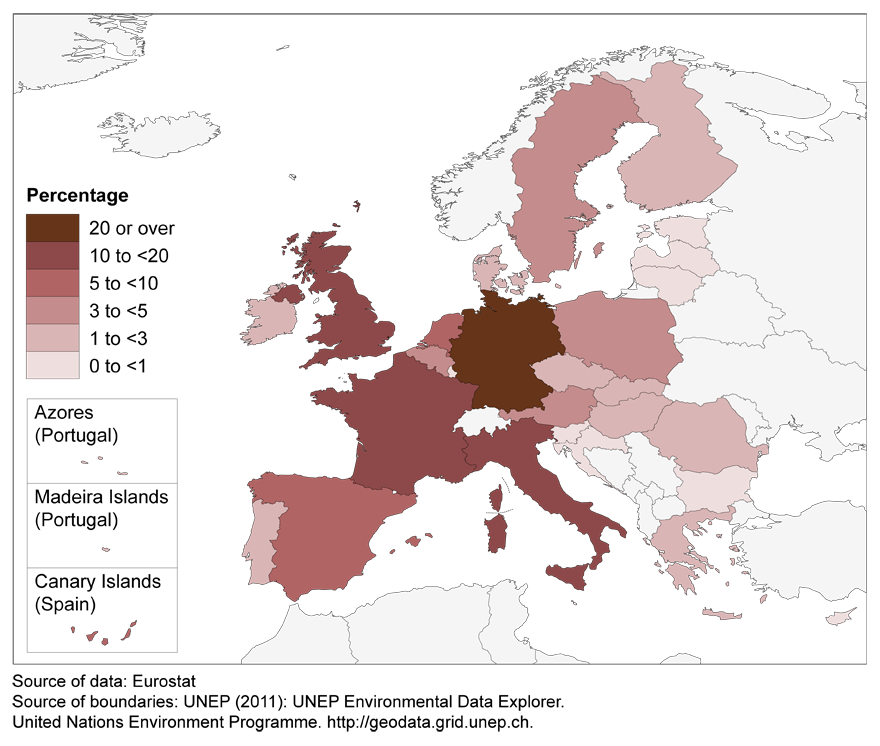

Nôl i'r tabl cynnwys11. European comparison

Map 1 shows the share of the total value of EU-28 aGVA in the business economy of each member state in 2011 (the latest figures available). The UK contributes between 10% and 20% of total EU aGVA. Germany accounts for over 20% of EU aGVA. France and Italy are the only other member states that contribute more than 10% of EU business economy aGVA.

Map 1: Percentage share of the aGVA for the business economy in the EU-28, 2011

Notes:

- aGVA presented here is at factor costs, not at basic prices

- Industry coverage for the European comparisons is SIC Sections B–N, excluding Section K. This is the business economy excluding ‘Agriculture, Education, Human health and social work activities, Arts, entertainment and recreation, Other service activities’

- Because of missing data aGVA for Malta is for 2009, while aGVA for Greece is for 2010. All other data are for 2011, which is the latest available period for European comparisons

- Data are included for all of the EU-28 countries. Croatia joined the European Union on 1 July 2013