Cynnwys

- Main points

- Introduction

- Things you need to know about this release

- High-level product proportions by industry group

- Detailed product proportions by industry

- Revisions to the Annual Purchases Survey 2015

- Next steps

- Annex A: Classification of Products by Activity (CPA) and Standard Industrial Classification 2007: SIC 2007 mapping

- Annex B: Survey Coverage

1. Main points

This article provides detailed product by industry proportion estimates using Annual Purchases Survey (APS) data for the first time.

Production was the least diverse industry group in terms of its purchasing patterns, with most of the products purchased being from production itself (76.7%).

Of all products, those belonging to construction remained the most widely used across all industry groups (8.4%).

Of all products purchased within the scientific research and development industry, almost one-third (31%) belonged to the manufacture of basic pharmaceutical products and pharmaceutical preparations.

The repair of computers and personal and household goods was the industry that spent the highest proportion on products belonging to telecommunications (20%).

2. Introduction

The primary aim of the Annual Purchases Survey (APS) is to provide a comprehensive picture of the products purchased in the production process and running of UK businesses. This level of detail is required to feed into the supply and use tables (SUTs) and ultimately the compilation of gross domestic product (GDP). The APS will help us to adhere to international best practice outlined in the European System of Accounts 2010: ESA 2010 and Balance of Payments Manual: BPM6.

Specifically, the APS collects information on businesses’ intermediate consumption, which is a national accounts concept defined within the ESA 2010 manual as:

“Intermediate consumption consists of goods and services consumed as inputs by a process of production, excluding fixed assets whose consumption is recorded as consumption of fixed capital. The goods and services are either transformed or used up by the production process.”

The survey is still in development following its re-introduction in the 2015 reference year and this article provides an update on the progress made. This follows on from the Development of the Annual Purchases Survey article released in December 2017 and provides a more detailed level of data for the 2015 reference year together with analysis on these estimates.

The high-level product by industry group estimates (10 product groups by 10 industry groups) of intermediate consumption have been updated and revised since the last article following further validation. A breakdown at the more detailed product and industry level is also now provided. This more detailed level is consistent in structure, but not concept, with the combined use matrix within the SUT publication, although it does not map exactly as the APS does not cover all industries.

In addition, this article includes detail on the next steps, providing detail around plans for the release of the 2016 and 2017 estimates, the use of APS data in supply and use framework and the work being carried out to review and further develop the APS questionnaire.

We are keen to seek views and would welcome your feedback on the contents of this report. If you have any comments, please email purchases.survey@ons.gov.uk.

Nôl i'r tabl cynnwys3. Things you need to know about this release

At present, the estimates produced from the Annual Purchases Survey (APS) are still regarded as experimental. This will be the case until we go through a formal assessment with the UK Statistics Authority to ensure compliance with the Code of Practice for Statistics. We will make further improvements to the survey, for example, to the questionnaire design, which is currently being reviewed. Data from later survey periods will also be processed and validated.

The estimates provided are for the 2015 survey period and its primary purpose is to collect product level information from businesses to estimate the proportion of these used within industries. The estimated proportions will then be used in the production of the supply and use tables (SUTs), which are used in the compilation of the national accounts.

The current proportions used in the production of the SUTs are based on estimates from the 2004 Purchases Inquiry. The main source for the total value of purchases is from the well-established Annual Business Survey (ABS). As the breakdown of products purchased within the industry is required, the APS estimates will be constrained to the ABS industry totals, as set out in the initial requirements. As a result, it is appropriate to present the APS data product proportions within the industries.

There are additional sources included within the full SUTs, such as public sector data and financial corporations, together with balancing adjustments, so estimates will differ.

The APS covers a large element of the economy with some exceptions such as public administration and certain elements of financial industries. The exact inclusions or exclusions of industries are detailed in Annex B. It is also worth noting that the 2004 purchases estimates were based on Standard Industrial Classification 2003: SIC 2003, while the 2015 APS estimates are based on Standard Industrial Classification 2007: SIC 2007.

An overall response rate of 80.4% was achieved for the 2015 APS. When broken down by geography, the response was:

- England – 81.7%

- Scotland – 75.7%

- Northern Ireland – 74.7%

- Wales – 80.4%

4. High-level product proportions by industry group

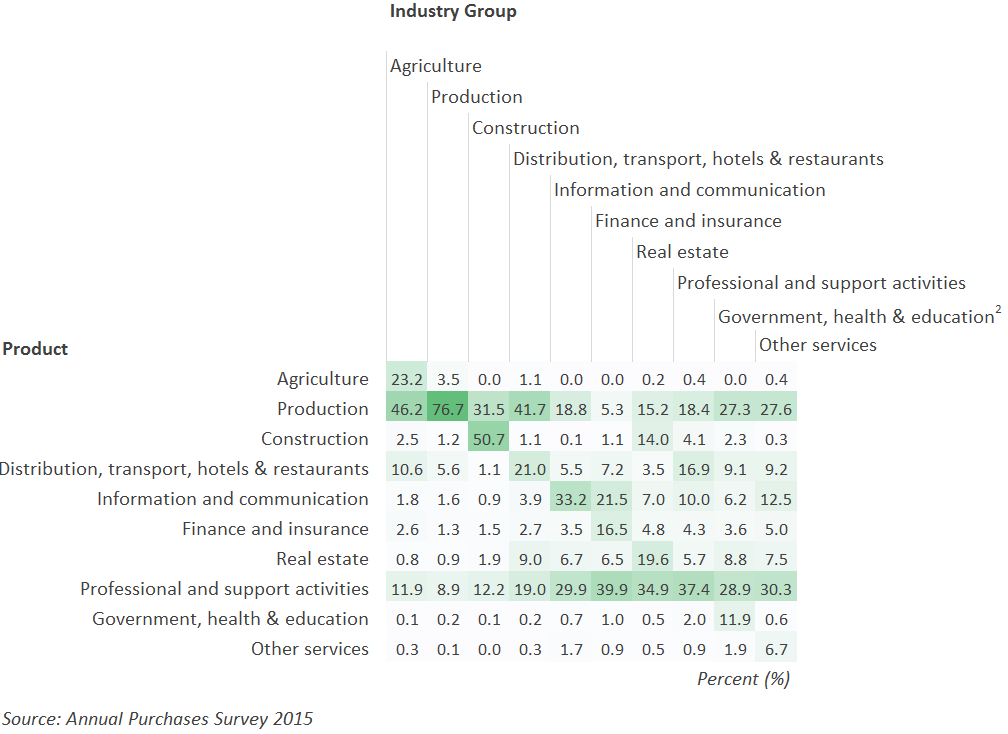

Results from the Annual Purchases Survey (APS) have been aggregated to a broad industry and product breakdown (A10). Using these values, the proportion of each product group within the total value for the industry has been calculated. The sum of the product proportions will sum to 100 within each industrial group. These proportions are detailed within both Figure 1 and Figure 2 and are an update of the proportions included within the previous article in December 2017.

In analysing these data, we will refer to within an industry group or outside an industry group. Within an industry group means businesses are purchasing products mapped to this group based on both the Standard Industrial Classification (SIC) and Classification of Products by Activity (CPA). Outside of the industry group means businesses are purchasing products not directly mapped to their industry group.

An example of within industry groups would be a business in the manufacturing of food products (industry 10) purchasing a product belonging to the manufacture of beverages (CPA 11) for their intermediate consumption; both industry and product would be in production industries.

On the other hand, an example of outside industry groups would be businesses in education (industry 85) purchasing a product belonging to the construction of buildings (CPA 41); the industry would be in services while the products purchased would be within construction.

Figure 1: Percentage of purchases within the same industry group and those from outside, 2015

By sector products

Source: Annual Purchases Survey Office for National Statistics

Download this chart Figure 1: Percentage of purchases within the same industry group and those from outside, 2015

Image .csv .xlsLooking across the 10 industry groups, two have most of their intermediate consumption from a single product group. The proportion of producers’ expenditure on products belonging to production was 76.7% and construction expenditure on products belonging to construction industries was 50.7%, in 2015.

Other industry groups have a more diverse range of expenditure across the product groups. The general spread of the percentages, as shown in Figure 1, is that businesses within production tend to purchase related products, whereas businesses within services tend to have a general spread of products that they purchase.

Figure 2 shows in greater detail the spread of intermediate consumption across industry groups. It shows the percentage of total intermediate consumption on products within each group. The darker the colour, the higher the percentage. For example, Figure 1 shows that 23.3% of products purchased outside the industry group by production businesses, while Figure 2 shows its largest contribution was within products belonging to professional and support activities (at 8.9% of all purchases).

Figure 2: Spread of intermediate consumption, UK, 2015

Source: Annual Purchases Survey Office for National Statistics

Download this image Figure 2: Spread of intermediate consumption, UK, 2015

.png (57.2 kB) .xlsx (11.7 kB)5. Detailed product proportions by industry

The Annual Purchases Survey (APS) collects and can produce estimates at a much more granular level than the A10 groupings. The requirement from the APS is to replicate the “combined use” matrix from within supply and use tables (SUTs) (except for certain industries as detailed in the previous section). Due to the size of the table it is not possible to show it in its entirety within this article but can be found in the supplementary datasets accompanying this release. The format of this table is equivalent to the A10 table by showing detailed product groups proportion of intermediate consumption within industry groups.

This section will focus on the intermediate consumption trends of the UK focusing on some of the main findings from the detailed table. Specifically highlighting the spread of data, the top 15 products across all industries, a focus on specific industries and comparisons with the current SUTs.

5.1 Spread of data

To look more in-depth at the data, the concept of on- and off-diagonal intermediate consumption is used. On-diagonal intermediate consumption means businesses purchasing a product mapped to the industry based on both the Standard Industrial Classification (SIC) and Classification of Products by Activity (CPA). Off-diagonal intermediate consumption refers to businesses purchasing products not directly mapped to their industry.

An example of on-diagonal intermediate consumption would be a business in water transport (industry 50) purchasing a product within water transport (CPA 50); both specifically refer to water transport (SIC and CPA 50).

An example of off-diagonal intermediate consumption, in this context, would be a business within water transport (industry 50) purchasing a product within air transport (CPA 51). Although both industry and product are within transport, they are not in the same industry.

Construction has the highest percentage (33.3%) of on-diagonal intermediate consumption and the distribution, transport, hotels and restaurants industry group has the lowest (5.2%), as can be seen in Figure 3.

Figure 3: Percentage of on-diagonal and off-diagonal intermediate consumption, UK, 2015

By Industry

Source: Annual Purchases Survey Office for National Statistics

Download this chart Figure 3: Percentage of on-diagonal and off-diagonal intermediate consumption, UK, 2015

Image .csv .xls5.2 Top 15 purchases

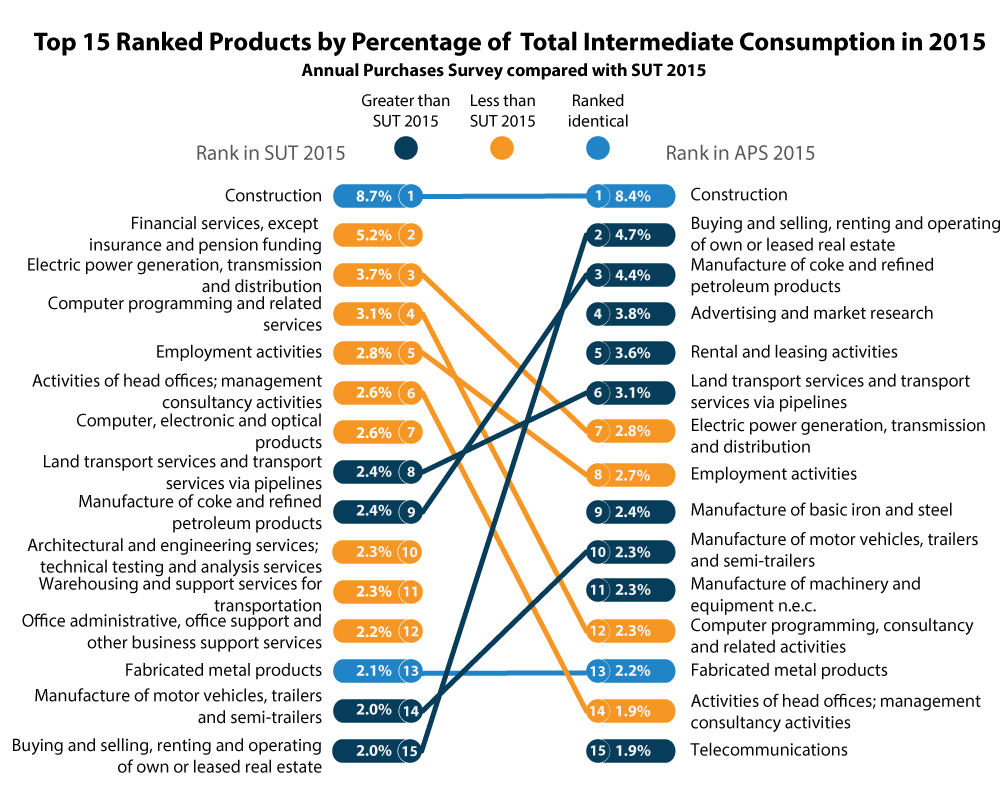

Figure 4 shows the top 15 products making up the highest proportions of total intermediate consumption from the Annual Purchases Survey compared with the current SUTs. It shows the highest proportion of purchased products, based on the APS, was in construction (8.4% of total intermediate consumption).

Figure 4: Top 15 Ranked Products by percentage total of total intermediate consumption in 2015

Annual Purchases Survey compared with SUT

Source: Annual Purchases Survey Office for National Statistics

Download this image Figure 4: Top 15 Ranked Products by percentage total of total intermediate consumption in 2015

.png (160.8 kB) .xlsx (15.8 kB)Comparing the APS and SUTs data, they share 11 out of the top 15 products. The difference is due, in part, to the additional data sources, SIC change and balancing that is undertaken within supply and use. This is evident from the inclusion of financial-based products in SUTs as this primarily comes from financial corporations, which is not fully covered by the APS.

As products belonging to construction industries have the highest proportion of all products purchased, this is analysed in more detail. Figure 5 shows that businesses within construction of buildings (industry 41) contribute the most to the purchases of construction products, with 44.8% of all purchases coming from these businesses. This was followed by other construction-related businesses, with specialised construction activity businesses at 19.0% and civil engineering at 16.9%.

Figure 5: Industries purchasing construction related products, UK, 2015

Source: Annual Purchases Survey Office for National Statistics

Notes:

- Industry 41 - Construction of buildings.

- Industry 43 - Specialised construction activities.

- Industry 42 - Civil engineering.

- Industry 70 - Activities of head offices; Management consultancy activities.

- Industry 71 - Architectural and engineering activities; Technical testing and analysis.

- Other - All other industries.

Download this chart Figure 5: Industries purchasing construction related products, UK, 2015

Image .csv .xls5.3 Focus on specific industries

This section focuses on some of the specific industries to highlight their purchasing patterns. Since the last time an Annual Purchases Survey was conducted in 2004, research and development (R&D) has continued to grow, with pharmaceuticals having the largest R&D expenditure. The purchasing patterns of scientific research and development industries is interesting to focus on.

Similarly, the rapid rise of internet technologies, and developments in hardware and software have created new possibilities for businesses to exchange goods and services, hence the focus on telecommunication industries.

Scientific research and development

Products belonging to the manufacture of basic pharmaceutical and pharmaceutical preparations was the top product purchased by businesses within the scientific research and development industry, with almost one-third (31%) of its total intermediate consumption on this product. The SUTs report this figure as 5.4%.

The scientific research and development industry has increased its total purchases by 63% between 2008 and 2015, therefore it is plausible this industry has evolved since 2004 (when the last Annual Purchases Survey was conducted).

Figure 6: Intermediate Consumption within the Scientific Research and Development Industry, UK, 2015

Top five products in the Annual Purchases Survey

Source: Annual Purchases Survey Office for National Statistics

Notes:

- Industry 21 - Manufacture of Basic Pharmaceutical Products and Pharmaceutical Preparations.

- Industry 72 - Scientific Research and Development.

- Industry 70 - Employment Activities.

- Industry 73 - Advertising and Market Research.

- Industry 20B - Manufacture of Petrochemicals.

Download this chart Figure 6: Intermediate Consumption within the Scientific Research and Development Industry, UK, 2015

Image .csv .xlsTelecommunications

Telecommunication industries have expanded since the last Annual Purchases Survey in 2004 according to the UK National Accounts, The Blue Book time series. The industries that spend a higher proportion of their intermediate consumption on telecommunications are the repair of computers and personal and household goods (industry 95) and information service activities (industry 63).

Figure 7: Industries with the highest proportion of their intermediate consumption in industry 61, UK, 2015

Telecommunication Industry

Source: Annual Purchases Survey Office for National Statistics

Notes:

- Industry 95 - Repair of computers and personal and household goods.

- Industry 63 - Information service activities.

- Industry 61 - Telecommunications.

- Industry 78 - Employment activities.

- Industry 62 - Computer programming, consultancy and related activities.

- Industry 82 - Office administrative, office support and other business support activities.

Download this chart Figure 7: Industries with the highest proportion of their intermediate consumption in industry 61, UK, 2015

Image .csv .xls5.4 Differences between SUTs and APS

Since 2005, supply and use tables (SUTs) have estimated the product proportion within the intermediate consumption figures by using the same split from the Annual Purchases Survey (APS) 2004 estimates, but with the overall total being updated annually from the Annual Business Survey (ABS). These initial estimates are then balanced against expenditure data on products before reaching a position for supply and use of products.

With the APS based on 2015 product proportions and the differences in coverage, it would be expected to see some differences between the 2015 SUTs proportions and the 2015 APS. However, this could be due to methods and/or coverage issues as opposed to any other reason. The products within industry proportions that have the largest difference between sources are shown in Table 1.

Table 1: Proportion of products within the industries that have the largest differences between sources, 2015

| Percentage of an industry's intermediate consumption spent on the specific product (%) | |||

|---|---|---|---|

| Industry | Product | Annual Purchases Survey | Supply and Use Tables |

| Repair and maintenance of aircraft and spacecraft | Manufacture of aircraft and spacecraft and related machinery | 85.1 | 2.4 |

| Manufacture of weapons and ammunition | Manufacture of weapons and ammunition | 75.0 | 3.4 |

| Repair and maintenance of aircraft and spacecraft | Repair and maintenance of aircraft and spacecraft | 5.6 | 57.8 |

| Manufacture of other transport equipment | Manufacture of other transport equipment | 61.9 | 13.5 |

| Buying and selling, renting and operating of own or leased real estate, excluding imputed rent | Construction of buildings, civil engineering and specialised construction activities | 15.4 | 45.0 |

| Source: Annual Purchases Survey, Supply and Use, Office for National Statistics | |||

Download this table Table 1: Proportion of products within the industries that have the largest differences between sources, 2015

.xls (29.2 kB)Repair and maintenance of aircraft and spacecraft (industry 33.16)

The largest difference in intermediate consumption figures between the APS and the SUTs is within the repair and maintenance of aircraft and spacecraft (industry 33.16).

The APS’s intermediate consumption proportion for the manufacture of air and spacecraft and related machinery (product 30.3) is greater than the SUTs. The opposite is true for the intermediate consumption of the product repair and maintenance of aircraft and spacecraft (product 33.16).

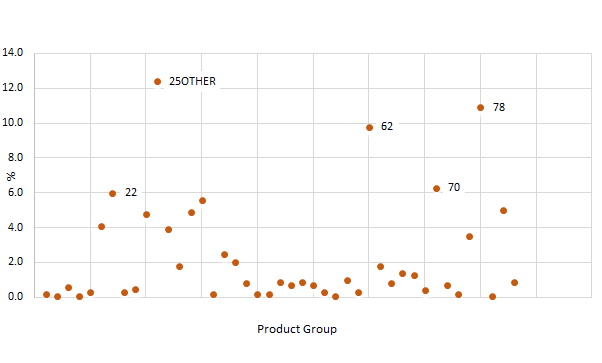

Manufacture of weapons and ammunition (industry 25.4)

The SUTs estimated that the manufacture of weapons and ammunition industry held almost all its intermediate consumption in the manufacture of weapons and ammunition products.

Following the 2015 APS, this may not be the case. These data show that the manufacture of weapons and ammunition industry holds most of its intermediate consumption in the manufacture of fabricated metal products (excluding weapons and ammunition) (industry 25 other), computer programming, consultancy and related activities (industry 62) and in employment activities (industry 78).

Although these are the industry’s top three intermediate consumption products, Figure 8 shows that this industry has a variety of products purchased, with all products relevant to this industry. Hence, it is possible to conclude that the APS has an updated view of the manufacture of weapons and ammunitions industry.

Figure 8: Intermediate consumption within industry 25.4, UK, 2015

Manufacture of weapons and ammunition

Source: Annual Purchases Survey Office for National Statistics

Notes:

- Industry 25 other - Manufacture of fabricated metal products, excluding weapons and ammunition.

- Industry 22 - Manufacture of rubber and plastic products.

- Industry 62 - Computer programming, consultancy and related activities.

- Industry 78 - Employment activities.

- Industry 70 - Activities of head offices; Management consultancy activities.

Download this image Figure 8: Intermediate consumption within industry 25.4, UK, 2015

.png (9.0 kB) .xlsx (20.0 kB)Manufacture of other transport equipment (industry 30 other)

The APS shows that the manufacture of other transport equipment industry has 61.9% of its intermediate consumption in product ‘manufacture of other transport equipment’. For SUTs this figure is only 13.5%. The SUTs have 29.2% of its intermediate consumption in product “rest of repair; installation”, whereas on the APS it is only 5.0%.

Buying and selling, renting and operating of own or leased real estate, excluding imputed rent (industry 68.1-2)

The SUTs combine three products:

- Construction of buildings (product 41)

- Civil engineering (product 42)

- Specialised construction activities (product 43)

Whereas, the APS keeps these products separate. For comparison, these three products have been combined for the following analysis.

The intermediate consumption estimates by the SUTs for products 41, 42 and 43 was 43.1%, whereas for the APS it was only around 15%.

Figure 9: Product proportion of intermediate consumption within industry 68.1-2, 2015

Buying and selling, renting and operating of own or leased real estate, excluding rent

Source: Annual Purchases Survey Office for National Statistics

Notes:

- Industry 68.1-2 - Buying and selling, renting and operating of own or leased real estate, excluding imputed rent.

- Industry 41, 42, 43 - Construction of buildings, civil engineering, specialised construction activities.

- Industry 81 - Services to buildings and landscape activities.

- Industry 35.1 - Electric power generation, transmission and distribution.

- Industry 69.1 - Legal activities.

Download this chart Figure 9: Product proportion of intermediate consumption within industry 68.1-2, 2015

Image .csv .xls6. Revisions to the Annual Purchases Survey 2015

Estimates at the broad industry level were produced and published in December 2017. Since this time, further validation and quality assurance of the Annual Purchases Survey (APS) data has been undertaken, which has resulted in revisions to these estimates. These revisions are made in line with standard Office for National Statistics (ONS) revision policies.

Table 2 provides details on the magnitude of these revisions. The values show the actual percentage point change in the proportion of each product group within each industry group.

Table 2: Revisions to proportion of product group intermediate consumption, by industry group, UK, 2015

| Percentage points | ||||||||||

| Industry Group | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Product | Agriculture | Production | Construction | Distribution, transport, hotels, restaurants | Info, comms | Finance, insurance | Real estate | Professional, support activities | Govt, health, education | Other services |

| Agriculture | 3.1 | 1.0 | 0.0 | -0.2 | 0.0 | 0.0 | 0.1 | -0.1 | 0.0 | 0.1 |

| Production | 0.2 | 5.3 | -0.5 | 1.1 | -2.3 | -1.9 | -0.1 | -3.1 | -4.6 | 0.5 |

| Construction | 1.3 | 0.1 | 7.8 | 0.1 | 0.0 | -2.0 | -2.1 | 0.1 | 0.6 | -0.1 |

| Distribution, transport, hotels and restaurants | -1.4 | 0.1 | -1.0 | 2.6 | -0.8 | -0.8 | 0.1 | 4.5 | 1.5 | 0.9 |

| Information and communication | -1.4 | -1.7 | -2.1 | -1.5 | 2.9 | 3.8 | 0.5 | -0.5 | -0.4 | 2.4 |

| Finance and insurance | -1.4 | -0.6 | -0.5 | -0.6 | -0.4 | -0.3 | 0.5 | -0.1 | -0.1 | 1.4 |

| Real estate | 0.1 | -0.5 | -0.8 | 0.7 | 0.2 | -0.4 | 1.4 | -0.2 | 0.8 | -0.6 |

| Professional and support activities | -0.7 | -3.5 | -2.8 | -2.3 | 0.4 | 1.4 | -0.3 | -1.3 | -1.2 | -4.8 |

| Government, health and education | 0.0 | 0.0 | 0.0 | 0.0 | -0.1 | -0.1 | 0.1 | 0.5 | 3.1 | 0.2 |

| Other services | 0.1 | -0.1 | -0.1 | 0.0 | 0.3 | 0.2 | 0.1 | 0.2 | 0.5 | 0.1 |

| Source: Annual Purchases Survey, Office for National Statistics | ||||||||||

Download this table Table 2: Revisions to proportion of product group intermediate consumption, by industry group, UK, 2015

.xls (38.4 kB)The largest revision was within construction, where the proportion of expenditure on products of these businesses has increased by 7.8 percentage points (from 42.9% to 50.7%),with all other products decreasing as a result.

Within production the proportion of expenditure on professional and support activity-related products has decreased by 3.5 percentage points (from 12.4% to 8.9%).

An intermediate consumption (product by industry) table is also produced as part of the Blue Book Summary supply and use tables for the UK and has been used as a guide to help validate the APS. As would be expected, the proportions of expenditure for some industry groups in this table differ from those in Table 2. The tables are not directly comparable, as the table contained in Blue Book is subject to various adjustments and based on annual purchases patterns from 2004 (based on the previous Standard Industrial Classification).

This contains not only Annual Business Survey (ABS) data, but is also supplemented by several other data sources such as financial intermediation services indirectly measured (FISIM), Civil Aviation Authority, National Health Service, public corporations and non-profit institutions serving households (NPISH) together with balancing adjustments. These additional sources would have an impact on the proportions of all products regardless of the source as they will contribute to industry totals (where applicable).

However, in some areas there would be an expected change due to new technology such as mobile phones and other advancements in computer software.

Nôl i'r tabl cynnwys7. Next steps

Following the inclusion of the detailed estimates of the 2015 Annual Purchases Survey (APS), a number of actions are planned to develop and improve the survey. The main next steps are detailed in this section with indicative timescales.

7.1 Dissemination

Data for the 2016 and 2017 APS are currently being quality-assured, with the current plan to publish the 2016 results in the winter of 2018 and the 2017 results in the spring of 2019.

A technical guide and Quality and Methodology Information (QMI) report will be produced (as is done for other ONS surveys) detailing the methodology and associated metadata. This is planned to be added to the ONS website by the end of the 2018, although details on some of the methods and processes used were included in the previous article. As part of all this work we will be working towards achieving National Statistics status and more information on this will be made available when appropriate.

Current plans are for APS data to be used in the compilation of Blue Book 2019. Work is being undertaken to review the 2015 APS estimates within national accounts and to determine how to bridge the gap to 2004 (when the last Annual Purchases Survey was conducted). Further details of plans for Blue Book 2019 will be disseminated through the usual national accounts updates.

7.2 Questionnaire review

Very few changes were made to the 2016 survey, to ensure consistency with the 2015 survey. More changes were made to the 2017 survey based on feedback received, particularly in terms of extra guidance for respondents. Further changes will also be made to the 2018 survey following the results of work around the questionnaire design, which is currently being undertaken.

The current questionnaire review project is working with a selection of businesses to redesign and redevelop the survey questionnaire. The 2018 questionnaire will likely see several formatting and wording changes and will also include improved guidelines based on feedback on the completion of the previous period questionnaires.

The 2018 survey form will be dispatched to businesses in February 2019 with estimates likely to be available towards the end of the same calendar year.

7.3 Feedback

We are keen to get your views on the methods and work to date to help inform and make improvements to the APS.

If you have any comments, please email us at purchases.survey@ons.gov.uk.

Nôl i'r tabl cynnwys8. Annex A: Classification of Products by Activity (CPA) and Standard Industrial Classification 2007: SIC 2007 mapping

Table 3: Classification of Products by Activity (CPA) and Standard Industrial Classification (SIC)2007

| CPA/SIC Code | Product/Industry Group | Description | |

|---|---|---|---|

| 01 | Agriculture | Crop and animal production, hunting and related service activities | |

| 02 | Agriculture | Forestry and logging | |

| 03 | Agriculture | Fishing and aquaculture | |

| 05 | Production | Mining of coal and lignite | |

| 06 | Production | Extraction of crude petroleum and natural gas | |

| 07 | Production | Mining of metal ores | |

| 08 | Production | Other mining and quarrying | |

| 09 | Production | Mining support service activities | |

| 10.1 | Production | Processing and preserving of meat and production of meat products | |

| 10.2-3 | Production | Processing and preserving of fish, crustaceans, molluscs, fruit and vegetables | |

| 10.4 | Production | Vegetable and animal oils and fats | |

| 10.5 | Production | Dairy products | |

| 10.6 | Production | Grain mill products, starches and starch products | |

| 10.7 | Production | Bakery and farinaceous products | |

| 10.8 | Production | Other food products | |

| 10.9 | Production | Prepared animal feeds | |

| 11.01-6 | Production | Alcoholic beverages | |

| 11.07 | Production | Soft drinks; production of mineral waters and other bottled waters | |

| 12 | Production | Tobacco products | |

| 13 | Production | Textiles | |

| 14 | Production | Wearing apparel | |

| 15 | Production | Leather and related products | |

| 16 | Production | Wood and products of wood and cork, except furniture; articles of straw and plaiting materials | |

| 17 | Production | Paper and paper products | |

| 18 | Production | Printing and reproduction of recorded media | |

| 19 | Production | Coke and refined petroleum products | |

| 20.3 | Production | Paints, varnishes and similar coatings, printing ink and mastics | |

| 20.4 | Production | Soap and detergents, cleaning and polishing preparations, perfumes and toilet preparations | |

| 20.5 | Production | Other chemical products | |

| 20A | Production | Industrial gases, inorganics and fertilisers (all inorganic chemicals) - 20.11/13/15 | |

| 20B | Production | Petrochemicals - 20.14/16/17/60 | |

| 20C | Production | Dyestuffs, agro-chemicals - 20.12/20 | |

| 21 | Production | Basic pharmaceutical products and pharmaceutical preparations | |

| 22 | Production | Rubber and plastic products | |

| 23.5-6 | Production | Cement, lime, plaster and articles of concrete, cement and plaster | |

| 23 OTHER | Production | Glass, refractory, clay, porcelain, ceramic, stone products - 23.1-4/7-9 | |

| 24.1-3 | Production | Basic iron and steel | |

| 24.4-5 | Production | Other basic metals and casting | |

| 25.4 | Production | Weapons and ammunition | |

| 25 OTHER | Production | Fabricated metal products, excluding weapons and ammunition - 25.1-3/5-9 | |

| 26 | Production | Computer, electronic and optical products | |

| 27 | Production | Electrical equipment | |

| 28 | Production | Machinery and equipment n.e.c. | |

| 29 | Production | Motor vehicles, trailers and semi-trailers | |

| 30.1 | Production | Building of ships and boats | |

| 30.3 | Production | Air and spacecraft and related machinery | |

| 30 OTHER | Production | Other transport equipment - 30.2/4/9 | |

| 31 | Production | Furniture | |

| 32 | Production | Other manufacturing | |

| 33.15 | Production | Repair and maintenance of ships and boats | |

| 33.16 | Production | Repair and maintenance of aircraft and spacecraft | |

| 33 OTHER | Production | Rest of repair; installation - 33.11-14/17/19/20 | |

| 35.1 | Production | Electric power generation, transmission and distribution | |

| 35.2-3 | Production | Gas; distribution of gaseous fuels through mains; steam and air conditioning supply | |

| 36 | Production | Water collection, treatment and supply | |

| 37 | Production | Sewerage | |

| 38 | Production | Waste collection, treatment and disposal activities; materials recovery | |

| 39 | Production | Remediation activities and other waste management services | |

| 41 | Construction | Construction of buildings | |

| 42 | Construction | Civil engineering | |

| 43 | Construction | Specialised construction activities | |

| 45 | Distribution, transport, hotels and restaurants | Wholesale and retail trade and repair of motor vehicles and motorcycles | |

| 46 | Distribution, transport, hotels and restaurants | Wholesale trade, except of motor vehicles and motorcycles | |

| 47 | Distribution, transport, hotels and restaurants | Retail trade, except of motor vehicles and motorcycles | |

| 49.1-2 | Distribution, transport, hotels and restaurants | Rail transport | |

| 49.3-5 | Distribution, transport, hotels and restaurants | Land transport services and transport services via pipelines, excluding rail transport | |

| 50 | Distribution, transport, hotels and restaurants | Water transport | |

| 51 | Distribution, transport, hotels and restaurants | Air transport | |

| 52 | Distribution, transport, hotels and restaurants | Warehousing and support activities for transportation | |

| 53 | Distribution, transport, hotels and restaurants | Postal and courier activities | |

| 55 | Distribution, transport, hotels and restaurants | Accommodation | |

| 56 | Distribution, transport, hotels and restaurants | Food and beverage service activities | |

| 58 | Information and communication | Publishing activities | |

| 59 | Information and communication | Motion picture, video and TV programme production, sound recording and music publishing activities | |

| 60 | Information and communication | Programming and broadcasting activities | |

| 61 | Information and communication | Telecommunications | |

| 62 | Information and communication | Computer programming, consultancy and related activities | |

| 63 | Information and communication | Information service activities | |

| 64 | Finance and insurance | Financial service activities, except insurance and pension funding | |

| 65.1-2 | Finance and insurance | Insurance and reinsurance, except compulsory social security | |

| 65.3 | Finance and insurance | Pension funding | |

| 66 | Finance and insurance | Activities auxiliary to financial services and insurance activities | |

| 68.1-2 | Real estate | Buying and selling, renting and operating of own or leased real estate, excluding imputed rental | |

| 68.3 | Real estate | Real estate services on a fee or contract basis | |

| 69.1 | Professional and support activities | Legal activities | |

| 69.2 | Professional and support activities | Accounting, bookkeeping and auditing activities; tax consultancy | |

| 70 | Professional and support activities | Activities of head offices; management consultancy activities | |

| 71 | Professional and support activities | Architectural and engineering activities; technical testing and analysis | |

| 72 | Professional and support activities | Scientific research and development | |

| 73 | Professional and support activities | Advertising and market research | |

| 74 | Professional and support activities | Other professional, scientific and technical activities | |

| 75 | Professional and support activities | Veterinary activities | |

| 77 | Professional and support activities | Rental and leasing activities | |

| 78 | Professional and support activities | Employment activities | |

| 79 | Professional and support activities | Travel agency, tour operator and other reservation service and related activities | |

| 80 | Professional and support activities | Security and investigation activities | |

| 81 | Professional and support activities | Services to buildings and landscape activities | |

| 82 | Professional and support activities | Office administrative, office support and other business support activities | |

| 84 | Government, health and education | Public administration and defence; compulsory social security | |

| 85 | Government, health and education | Education | |

| 86 | Government, health and education | Human health activities | |

| 87 | Government, health and education | Residential care activities | |

| 88 | Government, health and education | Social work activities without accommodation | |

| 90 | Other services | Creative, arts and entertainment activities | |

| 91 | Other services | Libraries, archives, museums and other cultural activities | |

| 92 | Other services | Gambling and betting activities | |

| 93 | Other services | Sports activities and amusement and recreation activities | |

| 94 | Other services | Activities of membership organisations | |

| 95 | Other services | Repair of computers and personal and household goods | |

| 96 | Other services | Other personal service activities | |

| Source: CPA and SIC | |||

Download this table Table 3: Classification of Products by Activity (CPA) and Standard Industrial Classification (SIC)2007

.xls (45.6 kB)9. Annex B: Survey Coverage

The list in this section provides details of the industries included and excluded from the Annual Purchases Survey (APS).

Inclusions:

- Agriculture, forestry and fishing (section A) (Standard Industrial Classification 01.6 to 01.7, 02, 03)

- Mining and quarrying (section B)

- Manufacturing (section C)

- Electricity, gas, steam and air conditioning supply (section D)

- Water supply; sewerage, waste management and remediation activities (section E)

- Construction (section F)

- Wholesale and retail trade; repair of motor vehicles and motor cycles (section G)

- Transport and storage (section H)

- Accommodation and food service activities (section I)

- Information and communication (section J)

- Financial and insurance activities (section K) (64.3, 64.9, 65.1, 65.2, 65.3, 66.1, 66.2, 66.3)

- Real estate activities (section L)

- Professional, scientific and technical activities (section M)

- Administrative and support service activities (section N)

- Education (section P)

- Human health and social work activities (section Q)

- Arts, entertainment and recreation (section R)

- Other service activities (section S)

Exclusions:

- Agriculture, forestry and fishing (section A) (Standard Industrial Classification 01.1 to 01.5)

- Financial and insurance activities (section K) (64.1, 64.2)

- Public administration and defence; compulsory social security (section O)

- Activities of households as employers; undifferentiated goods – and services – producing activities of households for own use (section T)

- Activities of extraterritorial organisations and bodies (section U)