Cynnwys

- Authors

- Main points

- Introduction

- Summary of ONS data covering post-referendum period

- GDP commentary and analysis of M2

- Foreign direct investment analysis by region

- Recent developments in the UK labour market

- Analysis of 2015 Annual Survey of Hours and Earnings data by gender and working patterns

- Analysis relevant to the Independent Review of UK economic statistics

- Annex A: Dates of our upcoming releases

- UK demand and supply side indicators

2. Main points

Post referendum data

Our estimates for Retail Sales, Consumer Price Index (CPI), Producer Price Index (PPI), vacancies and experimental claimant count statistics covering data for July generally follow existing trends. For example, while CPI remained little changed in July and is low by historic standards, input and output prices for UK manufacturers continued to rise in the year to July 2016. The changes in PPI can be partly attributed to changing oil and petroleum prices which, alongside the sharp depreciation in sterling immediately after the EU referendum result, may also have had an impact on input producer prices.

GDP

The second estimate of gross domestic product (GDP) for Quarter 2 (April to June) 2016 – a period that almost entirely covers the period immediately prior to the EU referendum – indicated that the UK economy grew by 0.6%, unchanged from the preliminary estimate.

Following recent trends, household consumption remains the largest contributor to quarter on same quarter a year earlier GDP growth – adding 1.9 percentage points over this period.

FDI

The share of UK-owned foreign direct investment (FDI) assets held in the EU has been falling since 2011 and the rate of return on direct investments in the EU and all other overseas regions has also been falling over the same time period. In contrast, the value of the stock of overseas investment in the UK has been increasing for all overseas regions, with the EU also seeing an increase in the rate of return on their FDI holdings in the UK.

Labour market

The unemployment-to-vacancy ratio for April to June 2016 dipped to its lowest level since November to January 2005. This potentially reflects a tightening of the labour market, according to this measure.

Gender pay gap

Analysis of hourly earnings distribution and growth in earnings for those in continuous employment, using Annual Survey Hours and Earnings (ASHE) 2015 data shows differences between men and women. Similar differences can be observed between those in part-time and full-time employment. For both genders, there is a greater concentration of hourly earnings around the National Minimum Wage (NMW) at the lower end of the income distribution compared to periods prior to the introduction of the NMW.

Nôl i'r tabl cynnwys3. Introduction

This edition of the Economic Review provides a short summary of our data covering the post-EU referendum period which have been published during August and early September. This will cover:

retail sales for July

prices for July

some labour market indicators for July (claimant count and vacancies)

public sector finances for July

index of production for July

This summary of recently published data will be an ongoing section for the Economic Review over the coming months as more economic data from Quarter 3 (July to September) 2016 and beyond becomes available. An updated table of forthcoming ONS economic statistics releases and the data periods they cover is at Annex A. Information on economic context for these data is also available at Visual.ONS.

This edition of the Economic Review also provides further commentary and analysis of:

the month 2 estimate of gross domestic product (M2 GDP) which includes first estimates of the expenditure components of GDP

trends in foreign direct investment (FDI) by overseas investment region

recent labour market developments with a focus on the relationship between vacancies and unemployment

an analysis of 2015 Annual Survey Hours and Earnings (ASHE) data by gender and full-time or part-time working patterns

In addition, this Economic Review highlights some of our new releases that address some of the recommendations in the Independent review of UK economic statistics: final report. These are the experimental estimates of nowcast real household disposable income which have been updated to 2015 to 2016, and flow of funds whom-to-whom experimental balance sheet estimates which have been updated for 2015.

Nôl i'r tabl cynnwys4. Summary of ONS data covering post-referendum period

Some users have contacted us to ask when any impact from the recent EU referendum could feed through to our economic statistics.

A number of recent releases covered the period immediately after the EU referendum, and a summary of the headlines of each release is set out below.

Retail sales

The reporting period for Retail sales in Great Britain: July 2016 covers a 4 week period from 3 July to 30 July 2016. In July 2016, the quantity bought (volume) of retail sales is estimated to have increased by 5.9% compared with July 2015, and 1.4% compared with June 2016. All sectors showed growth on both a monthly and annual basis, with the main contribution coming from non-food stores. This was mainly driven by department stores but also clothing, which may have been influenced by unusually warm weather in July.

Prices

The reporting period for Consumer price inflation: July 2016 and UK Producer Price Inflation: July 2016 cover the calendar month of July 2016. The consumer price index (CPI) rose by 0.6% in the year to July 2016, relatively unchanged compared with a 0.5% rise in the year to June. Although this is the highest rate seen since November 2014, it is still relatively low in the historic context. The main contributors to the increase in the rate were the rise in prices for motor fuels, alcoholic beverages and accommodation services, and a smaller fall in food prices than a year ago.

While there was little change in the CPI, the input and output prices (PPI) for UK manufacturers rose in the year to July 2016. This follows 2 years of falls, although both input and output prices have been following an upward trend since August 2015. Total input prices rose 4.3% in the year to July 2016, compared with a fall of 0.5% in the year to June 2016. Similarly, output prices for goods produced by UK manufacturers rose 0.3% in the year to July 2016, compared with a fall of 0.2% in the year to June 2016.

This suggests that higher input costs are feeding into output prices of manufactured goods. The changes in input and output producer price inflation can be partly attributed to changing oil and petroleum prices, as the cost of crude oil, energy and refined petroleum products has continued to influence the price of manufactured goods. Alongside this, the sharp depreciation in sterling immediately after the EU referendum result may also have had an impact on input producer prices.

For further information on the effects of post-referendum sterling depreciation on PPI and CPI, please see Additional analysis of the Producer Price Index (PPI) and Consumer Price Index (CPI), which was released alongside the August prices releases.

Index of production

The UK index of production: July 2016 release showed that in July total production remained broadly stable, growing at a monthly rate of 0.1% compared to June. Manufacturing – the largest component of production – contracted at a monthly rate of 0.9% in July, but remains 0.8% higher than in July 2015. Manufacturing output has been broadly stable since early 2014, and this month’s figures give little indication of any change in the trend.

Labour market

While the majority of the UK Labour Market: August 2016 release covered the 3 months to June, it also included July data for the claimant count and vacancies. There were 741,000 job vacancies for May to July 2016. This was slightly fewer (down 7,000) compared with February to April 2016 but little changed compared with a year earlier. For July 2016, there were 763,600 people claiming unemployment-related benefits. This was 8,600 fewer than for June 2016 (the first monthly fall since February 2016) and 27,100 fewer than for a year earlier.

Public sector finances

The data presented in the Public sector finances: July 2016 bulletin presents the latest fiscal position of the public sector as at 31 July 2016 and so includes the first post-EU referendum data. However, estimates for the latest period always contain a substantial forecast element and so any post-referendum impact may not become clear for some time. Public sector net borrowing (excluding public sector banks) was in surplus by £1.0 billion in July 2016: a decrease in surplus of £0.2 billion compared with July 2015. In the current financial year-to-date (April to July 2016), public sector net borrowing (excluding public sector banks) decreased by £3.0 billion to £23.7 billion compared with the same period in 2015.

Nôl i'r tabl cynnwys5. GDP commentary and analysis of M2

The second estimate of gross domestic product (GDP) for April to June 2016 – a period that almost entirely covers the period immediately prior to the EU referendum – indicated that the UK economy grew by 0.6%, unchanged from the preliminary estimate. This was a slight rise from 0.4% growth in Quarter 1 (January to March) 2016 and is the 14th consecutive quarter of expansion since the beginning of 2013. Following a slowdown in GDP growth at the start of 2015, output has grown at a relatively steady pace in recent quarters, and was 2.2% higher in Quarter 2 (April to June) 2016 than in the same period a year earlier.

The first estimate of GDP contains data relating to the output measure. The second estimate of GDP contains the first information on the expenditure components of GDP in Quarter 2 2016 (Figure 1). In light of this, following recent trends, the largest contributor to quarter on same quarter a year earlier GDP growth was household consumption, which added 1.9 percentage points to GDP growth over this period – around two-thirds of GDP growth. Investment continued to make a positive contribution to GDP growth for the 13th consecutive quarter, despite concerns that it may fall off in the run up to the referendum. It should be noted, however, that investment’s contribution to growth over the past year was just 0.2%, below the average of 0.6% seen since Quarter 1 2013.

Figure 1: Contributions to growth in the expenditure measure of GDP, 2012 to 2016

Quarter on same quarter a year ago growth, percent and percentage points, chained volume measure, seasonally adjusted, UK

Source: Office for National Statistics

Notes:

- “Other” includes the statistical discrepancy.

- Total may not sum due to rounding.

Download this chart Figure 1: Contributions to growth in the expenditure measure of GDP, 2012 to 2016

Image .csv .xlsFollowing the UK’s referendum on its membership of the European Union, speculation has grown around the potential impact this could have on consumer spending, investment and economic activity. Some external survey measures of confidence – such as the GfK consumer confidence measure – have fallen in July following a steady weakening since February. However, this weakening has not yet been reflected in our latest data on consumer spending and the performance of retail and “consumer focussed” firms.

Household final consumption expenditure (HHFCE) has been making a solid and rising contribution to GDP growth since 2012 (Figure 2). Services have been the largest contributor to the growth since Quarter 1 2012, particularly in 2012 and 2014 where it contributed 2.8% and 4.5% to HHFCE growth respectively. Since 2014, “durable goods” (those with a long shelf life such as furniture, major household appliances and telephones) have provided solid contributions to growth. “Semi-durable” goods, such as textiles, clothing materials and toys have also provided contributions to growth over the same period, albeit to a lesser extent.

The “non-durable” component which contains goods with short shelf lives such as food and drink, gas and electricity has seen more mixed growth over this period after a strong performance in late 2012 and early 2013, but has still been providing positive contributions every quarter since Quarter 1 2015.

Figure 2: Contributions to the household final consumption expenditure (HHFCE) component of GDP, 2012 to 2016

Quarter on same quarter a year ago growth, percent and percentage points, chained volume measure, seasonally adjusted, UK

Source: Office for National Statistics

Notes:

- Total may not sum due to rounding.

Download this chart Figure 2: Contributions to the household final consumption expenditure (HHFCE) component of GDP, 2012 to 2016

Image .csv .xlsNet tourism has provided a positive contribution to GDP since Quarter 1 2014; part of this could be related to the steady decline seen in the value of the pound in the run up to the referendum. If so, we could see this rise further in Quarter 3 (July to September) 2016, due to the sharp decline in sterling seen after the referendum. Any early evidence of this may come in the retail sales figures which incorporate spending from both UK residents and foreign visitors. These figures were strong on the month to July which also showed some anecdotal evidence of foreign tourists spending on luxury items; sales of watches and jewellery were up 16.6% on the year.

Figure 3 shows the retail sales index (RSI) excluding fuel, broken down by the weighted contributions up to Quarter 2 2016. We can compare these figures with their equivalent components in HHFCE over the same period to try to understand whether HHFCE in July (and the other months of Quarter 3) may follow a similar pattern to July’s retail sales figures. The growth experienced in durable goods since 2012 was consistent. Growth in sales of goods from “household goods stores”, “other non-food stores” and “non-specialised stores” has also been positive, following a similar, slightly more volatile pattern than durable goods. Growth in “textiles, clothing and footwear” stores had contributed to growth in a broadly similar way to semi-durable goods, until 2016 when growth in the stores started falling but stayed consistent in semi-durables. Growth in food does not track well to that of non-durables prior to 2015 but since then both series have showed solid growth.

Figure 3: Contributions to retail sales index growth rate excluding fuel, 2012 to 2016

Quarter on same quarter a year ago growth, percent and percentage points, chained volume measure, seasonally adjusted, UK

Source: Office for National Statistics

Notes:

- Total may not sum due to rounding.

Download this chart Figure 3: Contributions to retail sales index growth rate excluding fuel, 2012 to 2016

Image .csv .xlsRetail is one component to the output measure of GDP. Other consumer-focussed industries might also provide indicators of the relative confidence of consumers. Figure 4 shows GDP growth for the consumer and media focused industries. Overall growth levels have been strong since the beginning of 2015; average quarter on same quarter a year ago growth rate has been 6.4%. Besides the growth in the retail sector there have been strong contributions from “wholesale and retail trade and repair of motor vehicles and motorcycles” and “motion picture, video and TV programme production, sound recording and music publishing activities”. The rise in the latter may offer some explanation as to why semi-durable growth has continued despite sales of textiles, clothing and footwear falling in recent quarters.

Figure 4: Contributions to GDP growth in consumer and media focused industries

Chained volume measure, quarter on same quarter a year ago, seasonally adjusted, 2012 to 2016, UK

Source: Office for National Statistics

Notes:

- Total may not sum due to rounding.

Download this chart Figure 4: Contributions to GDP growth in consumer and media focused industries

Image .csv .xls6. Foreign direct investment analysis by region

One of the most important components of sector-to-sector counterparty data is the UK’s assets and liabilities vis-à-vis the rest of the world – with the difference often referred to as the net international investment position. As mentioned in Economic Review: July 2016, the UK has recently experienced a widening of the current account deficit – a result of the deterioration in the primary income balance that can be attributed to changing trends in UK assets and liabilities. Our recent article, International perspective on UK foreign direct investment (FDI): 2014, was released in August, and this piece provides additional analysis on FDI by region in recent years.

Figure 5 shows the balance of primary income, along with its components. While there has been a decrease in net earnings on portfolio investment since 2010, the primary income account was still recording a surplus, supported by net earnings on FDI. It was not until net earnings on FDI started to fall in 2012 that there has been a primary income account deficit, which has widened in subsequent years.

Net earnings on FDI fell from having a positive contribution of £13.3 billion in 2014 to negative £2.9 billion in 2015. This was the first time that net earnings on FDI have been negative on an annual basis since records began. On a quarterly basis, net earnings on FDI fell sharply in quarter 4 2015 to negative 1.3% of GDP, down from 0.3% of GDP in Quarter 3 (July to Sept). This fall in net earnings on FDI in Quarter 4 (Oct to Dec) 2015 has been the main contributor to the negative annual figure. Measured as a percentage of nominal GDP, the primary income account deficit in 2015 is also the highest on record at 2.0%.

Figure 5: Balance of primary income and its components as a percentage of GDP

Current prices, 2005 to 2015, UK

Source: Office for National Statistics

Notes:

- Total may not sum due to rounding.

Download this chart Figure 5: Balance of primary income and its components as a percentage of GDP

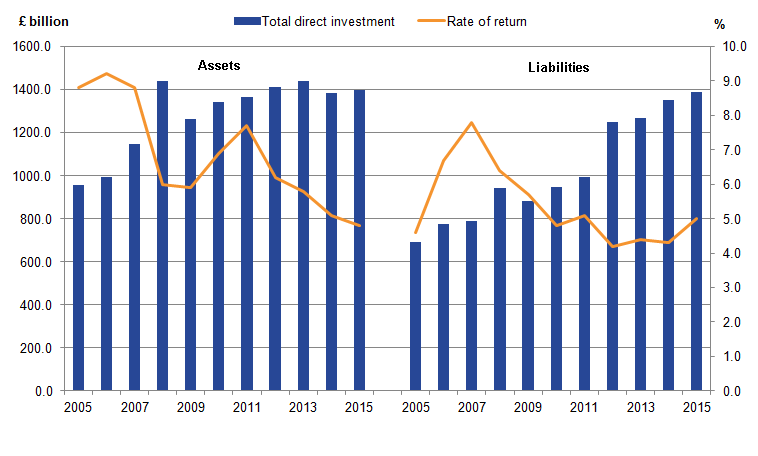

Image .csv .xlsComparing UK investors’ stocks of overseas FDI (FDI assets) and overseas investors’ FDI stocks in the UK (FDI liabilities) with their respective rates of return helps to explain the recent fall in the balance of FDI. Figure 6 shows that the volume of UK FDI assets has remained relatively stable between 2012 and 2015. However, over the same period UK earnings on FDI have fallen, which is shown by the fall in the rate of return. This fall in UK earnings is one of the reasons for the fall in the balance of FDI.

Another factor can be seen in the value of UK FDI liabilities. In 2012 there was a large increase of 25.8% in UK FDI liabilities, which continued to increase in subsequent years. In 2015, the UK’s net position on FDI was down to £6.9 billion from £369.4 billion in 2011. Unlike UK FDI assets, the rate of return on UK FDI liabilities remained relatively stable at around 4.3% between 2012 and 2014, and grew to 5.0% in 2015. The increase in the volume of UK FDI liabilities, combined with an increasing rate of return has led to an increase in FDI earnings generated by overseas investors in the UK, which in turn has narrowed the UK’s primary income balance.

Figure 6: Direct investment positions and rates of return

£ billion and percent, non-seasonally adjusted, 2005 to 2015, UK

Source: Office for National Statistics

Download this image Figure 6: Direct investment positions and rates of return

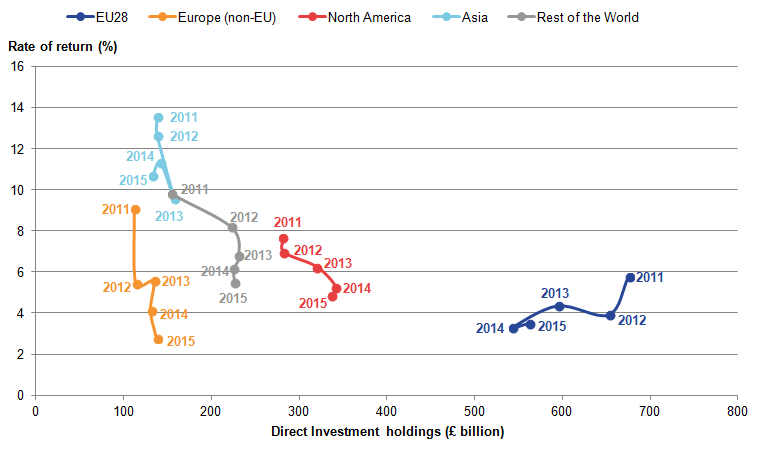

.png (21.7 kB) .xls (33.3 kB)Breaking down UK FDI assets and rates of return by region gives an indication of where earnings on FDI are falling. Figure 7 shows that almost half (49.6%) of the value of UK FDI assets in 2011 was within the EU28 countries. In the subsequent years there was a fall in the value of UK FDI assets held in the EU of 16.8% between 2011 and 2015. This was accompanied by a proportionally larger fall in earnings, which led to a falling rate of return. This fall in the value of UK FDI assets in EU28 countries has been offset by increased value of FDI assets in North America, non-EU Europe and the rest of the world. Despite this, stocks in these regions did not increase, leading to an overall drop in earnings.

Figure 7: UK direct investment assets and rates of return by region

£ billion and percent, 2011 to 2015

Source: Office for National Statistics

Download this image Figure 7: UK direct investment assets and rates of return by region

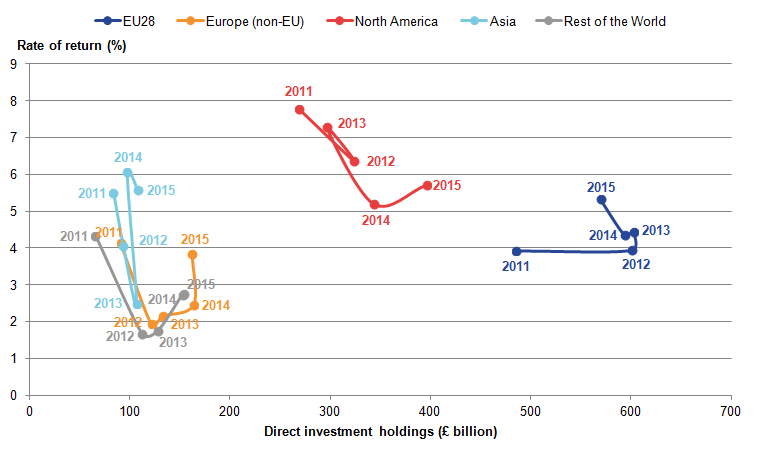

.png (20.5 kB) .xls (28.2 kB)Figure 8 shows the breakdown of overseas investors’ stocks of FDI held in the UK (FDI liabilities) and rates of return, giving an indication of which regions have increased FDI in the UK between 2011 and 2015. In 2012, the value of UK FDI liabilities from EU28 countries grew by 23.8%, making up the majority of the increase in the overall value of FDI liabilities. This was accompanied by a stable rate of return. Since 2012, the value of FDI liabilities from EU28 countries has remained relatively stable, falling slightly in 2015. In 2015, the rate of return stood at 5.3%, which was 1.4 percentage points higher than in 2011. An improvement in the rate of return EU investors generate on their UK FDI assets, along with increased investment, resulted in an increase in FDI debits to this region, contributing to the overall fall in the overall UK primary income balance.

Between 2011 and 2015, all regions have seen an increase in the value of their FDI stocks in the UK, although changes in the rates of return have varied. Non-EU Europe and Asia had similar rates of return in 2011 and 2015, while the rates of return for North America and the rest of the world were lower in 2015 than in 2011. The falls in the rates of return in these regions contributed to a slightly lower overall rate of return. Despite this, debits in these regions have increased, due to the increased stocks of FDI held in the UK.

Figure 8: UK direct investment liabilities and rates of return by region

£ billion and percent, 2011 to 2015

Source: Office for National Statistics

Download this image Figure 8: UK direct investment liabilities and rates of return by region

.png (30.8 kB) .xls (28.7 kB)7. Recent developments in the UK labour market

Recent trends in vacancies

Vacancy estimates were recently published for the three months from May to July 2016, showing a 7000 fall on the previous non-overlapping quarter of February to April 2016. This continues a downward trend in the level of vacancies reported since early 2016.

Figure 9 shows the percentage change in vacancy levels for each quarter, compared to the previous quarter, broken down by 3 major sectors of the economy – production, construction, and services. Manufacturing, which represents around 6% of vacancies, is included in the production series. The series covers April to June 2002 to April to June 2016.

Figure 9: Contribution to change in vacancy level by sector

Quarter on quarter, seasonally adjusted, Quarter 2 2002 to Quarter 2 2016, UK

Source: Office for National Statistics

Notes:

- Total vacancies exclude agriculture, forestry and fishing.

- Services are defined as industry sectors G to S.

- Production sectors include Manufacturing (C) and industries B, D and E (Mining and quarrying (B), electricity, gas and air conditioning supply (D) and water supply, sewerage and waste activities (E)). See Classifications of Industry sectors.

Download this chart Figure 9: Contribution to change in vacancy level by sector

Image .csv .xlsThese data show that the services sector contributes the majority of the percentage change in vacancies each quarter, with a much smaller share accounted for by changes in production and construction vacancies.

The impact of the economic downturn between 2008 and 2009 can be clearly seen, with a 14% fall in vacancies between the third (July to September) and fourth (October to December) quarters of 2008. Vacancy growth has been consistently positive since early 2012, coinciding with a rising UK employment rate.

Since April to June 2015, although vacancy growth has been positive, it has been growing at a slower rate than in the immediately preceding years with some growth in service vacancies partially offset by falls in production or construction vacancies. April to June 2016 saw the first quarterly fall in overall vacancies since April to June 2015, with both production and services sectors seeing a fall in vacancy levels.

Relationship between vacancies and unemployment

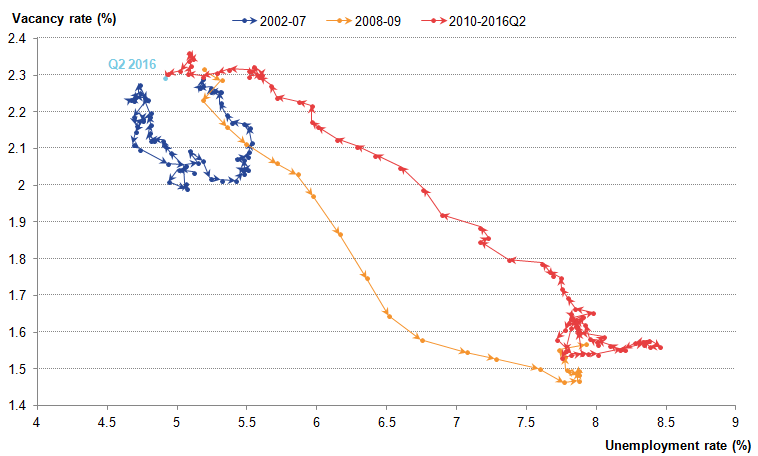

As discussed in a previous edition of the Economic Review, there is evidence to suggest the UK may have experienced a significant tightening of labour market conditions in recent years. One particular measure of labour market tightness shown in Figure 10 looks at the ratio of unemployment to vacancies, giving an indicator of both the demand and supply for labour and job competition.

During the period from 2002 to 2007, the unemployment-to-vacancy ratio averaged 2.5 and deviated from this average by no more than plus or minus 0.4 points throughout this period. Given that the consistency of this ratio pre-downturn was also in line with the relatively stable unemployment rate at a time when there was little slack in the labour market, the average over this period is a potential benchmark for tightness in the labour market. The ratio more than doubled to reach 5.7 at the start of the economic downturn, indicating an opening up of labour market slack and higher competition for vacancies. The ratio remained elevated during 2009 and 2010 then began to steadily fall towards the end of 2011. This coincided with the start of the fall in the unemployment rate, when the labour market began to show signs of improvement for those both in work and looking for work.

Figure 10: Unemployment-to-vacancy ratio and its 2002 to 2007 average

Seasonally adjusted, ratio, Quarter 2 (Apr to June) 2002 to Quarter 2 2016, UK

Source: Vacancy Survey, Labour Force Survey, Office for National Statistics

Download this chart Figure 10: Unemployment-to-vacancy ratio and its 2002 to 2007 average

Image .csv .xlsIn mid-2015, the unemployment-to-vacancy ratio dipped below its 2002 to 2007 average in mid-2015 for the first time since mid-2008, reflecting both falling unemployment numbers and rising vacancies for several years. It has more recently reached 2.2 in the 3 months to June 2016 – its lowest level since November to January 2005.

Figure 11 shows the vacancy rate against the unemployment rate in a certain period, creating a Beveridge curve(s)1. For most of the period before 2010, the Beveridge curve behaved as expected with the economy moving up and down the curve according to economic circumstances. During the economic downturn in 2008 and 2009, firms no longer found it profitable to hold onto staff or open vacancies. As a result, the unemployment rate increased and the vacancy rate decreased, causing a movement down the Beveridge curve.

The apparent outward shift in the Beveridge curve after the downturn may indicate a change in the long run equilibrium unemployment rate, if higher unemployment is now associated with the same level of vacancies or labour demand. But this shift may also be a temporary rather than a structural change, as the most recent data points indicate a leftward shift in the Beveridge curve back to pre-downturn positions with historically low unemployment and relatively high vacancy rates.

Figure 11: UK Beveridge curve; vacancy and unemployment rate

Seasonally adjusted, percent, Quarter 1 (Jan to Mar) 2002 to Quarter 2 (Apr to June) 2016

Source: Office for National Statistics

Download this image Figure 11: UK Beveridge curve; vacancy and unemployment rate

.png (28.0 kB) .xls (41.5 kB)This may be seen as an improvement in matching efficiency compared to the 2008 to 2009 downturn period. If firms are opening fewer vacancies because they are content with recent matches and the skills workers offer, then this will coincide with a downward shift in the Beveridge curve. Demand conditions will then affect future movements along a slightly tighter Beveridge curve if this is established over time.

Notes for Recent developments in the UK labour market:

- The Beveridge curve was developed in the mid-twentieth century in order to depict the inverse relationship between job vacancies and the unemployment rate.

8. Analysis of 2015 Annual Survey of Hours and Earnings data by gender and working patterns

As the movements along the Beveridge curve in Figure 11 show, the rate of recovery in the labour market has been stark compared to both historical and international experience. Some commentators have attributed the rapid improvement in employment immediately following the downturn to a relative weakness in real earnings growth that accompanied this. However, in more recent years UK earnings growth has been consistently higher than the rate of change in prices. It has now been running consistently at around 2.0% since the end of 2014, coinciding with lower inflation to result in rising real incomes.

As with a wide range of our releases, the average figure can mask a vast distribution of earnings experiences in both levels and growth terms. One way to examine this is to use the Annual Survey of Hours and Earnings (ASHE), which will update results for 2016 on 26 October 2016. Analysis to be covered in this update is likely to include the introduction of the living wage, and trends in earnings across regions and occupations. Another key topic is the level of gender earnings inequality – which remains prominent but has exhibited a long downward trend. Between the years 1997 to 2007, the gender pay gap – defined as the difference between median full time gross hourly earnings excluding overtime – fell from 17.4 percentage points to 12.5 percentage points. It fell further during the downturn but has been broadly stable over the past 4 years at just over 9 percentage points.

Change in the UK earnings distribution since 1997

The national minimum wage (NMW) has had a major impact on the earnings distribution. In 1997, before the NMW was introduced, the UK’s earnings distribution was relatively smooth; it was positively skewed and centred on hourly earnings between £4 and £5 per hour. Relatively few jobs paid below £3 per hour, with the number of jobs steadily falling as hourly earnings rise. Mean hourly pay was around 24.2% above the median in 1997. However, by 2015 the earlier smooth profile had been replaced by a striking, sharply-edged distribution, with a mass at around £6.50 per hour – the prevailing adult NMW in April 2015.

Men and women tend to have a different earnings profile; men tend to be in higher pay brackets but the gap in earnings has declined over time – especially in the £10 to £20 pay bracket. Figures 12a and 12b show the distribution of gross hourly earnings for men and women in 1997 and 2015 respectively. It shows the level of pay in pounds, and so it is a snapshot of the earnings gap over a range of different income levels. This can show whether the earnings gap is more or less prevalent at higher or lower earnings.

For both men and women there has been a shift from a relatively smooth earnings profile to a sharply-edged distribution, with a mass at around £6.50 per hour. In 1997, more women were earning between around £3 and £6.70 an hour than men. However, by 2015 more women were earning between around £6.50 and £10.20 an hour than men. There were more men in the tail end of the distribution in both 1997 and 2015. This suggests that more men tend to be in the higher pay brackets than women. While a pay gap still exists between men and women, this pay gap has declined significantly since 1997.

Figure 12a: Distribution of gross hourly earnings for men and women

Pay band (plus or minus 20p), 1997, UK

Source: Office for National Statistics

Download this chart Figure 12a: Distribution of gross hourly earnings for men and women

Image .csv .xls

Figure 12b: Distribution of gross hourly earnings for men and women

Pay band (plus or minus 20p), 2015, UK

Source: Office for National Statistics

Download this chart Figure 12b: Distribution of gross hourly earnings for men and women

Image .csv .xlsThis implies that earnings growth for women has been higher than men – or there has been a compositional shift towards women working higher paid roles.

Growth in earnings

Figures 13a and 13b show the distribution of nominal weekly earnings growth rates for men and women in the year to April 2007 and the year to April 2015 respectively. For each growth rate on the horizontal axis, the figure indicates the frequency of employees who experienced earnings growth within 0.5 percentage points of that rate. The figure shows that weekly earnings growth varies significantly across different growth brackets. A little less than 1% of employees experienced close to 20% weekly earnings growth in 2015, while a similar portion experienced a fall of 10%. A slightly lower proportion of women have experienced pay growth between minus 1% and 1% compared to men, but a higher proportion experienced growth between 5% and 6%. With the inflation in 2015 on average at 0.1, this represents a real increase in earnings.

Secondly, the experience of earnings growth – as measured by the most frequently occurring earnings growth rates – is weak compared to the pre-economic downturn period, but as discussed in a Economic Review: December 2015, has strengthened between 2014 and 2015. In 2007, the most common nominal pay rise was around 2.7% for both men and women – accounting for around 8.7% of men and 8.6% of women – while 7.6% of men and 7.0% of women experienced zero nominal weekly earnings growth. In 2015, the proportion of employees experiencing zero nominal weekly earnings growth was much higher at 10.5% for men and 8% for women. Apart from the employees experiencing no weekly earnings growth, the most frequently occurring rate of growth was closer to 2.2% – accounting for around 9.6% of men and 9.0% of all women. In 2015, in general more men experienced a growth as well as a fall in weekly earnings. These data suggest:

that a higher number of people experienced a nominal pay freeze in the year to April 2015 compared to pre-economic downturn (year to April 2007) but previous analysis in Economic Review: December 2015 suggests that fewer number of people experienced a nominal pay freeze compared to the year to 2014

that, among those experiencing changes in earnings, pay growth strengthened compared to 2014 but is still weak when compared to 2007

Figure 13a: Distribution of growth in gross weekly earnings

Men and women, plus or minus 0.5 percentage point growth, 2007, UK

Source: Office for National Statistics

Notes:

- This chart uses individual level data from ASHE to calculate the growth of nominal weekly earnings for individuals observed in 2006 to 2007 and 2014 to 2015. Note that the ASHE methodology is not specifically designed to model earnings growth for individuals over time.

Download this chart Figure 13a: Distribution of growth in gross weekly earnings

Image .csv .xls

Figure 13b: Distribution of growth in gross weekly earnings

Men and women, plus or minus 0.5 percentage point growth, 2015, UK

Source: Office for National Statistics

Notes:

- This chart uses individual level data from ASHE to calculate the growth of nominal weekly earnings for individuals observed in 2006 to 2007 and 2014 to 2015. Note that the ASHE methodology is not specifically designed to model earnings growth for individuals over time.

Download this chart Figure 13b: Distribution of growth in gross weekly earnings

Image .csv .xlsChanges in earnings by working pattern since 1997

While the distribution and growth of earnings by gender provide useful information on the disparity between men and women, the composition of working patterns can be an important factor to control for. Figures 14a and 14b break down the distribution of gross hourly earnings for full-time and part-time workers in 1997 and 2015 respectively.

The NMW has had a greater effect on part-time workers, but there is still some effect among full-time workers. For full-time workers there has been a shift from a relatively smooth earnings profile to a sharply-edged distribution, with a mass at around £6.70 per hour – 20 pence more than the adult national minimum wage – which gradually declines for higher hourly earnings brackets. For part-time workers the distribution of hourly earnings has shifted from a peak of around £3.80 in 1997 to a peak of £6.70 in 2015. In 2015, around 4.2% of full-time workers receive £6.70 an hour. In contrast, around 17.6% of part-time workers receive £6.70 an hour. Part-time workers are mostly concentrated in the £6.70 to £9.20 per hour pay brackets. For gross hourly earnings of more than £10.20 per hour, full-time workers tend to be in a higher proportion than part-time workers. This suggests that full-time workers on average earn more per hour than part-time workers and this gap has stayed steady since 1997.

Figure 14a: Distribution of gross hourly earnings for full-time and part-time workers

Pay band (plus or minus 20p), 1997, UK

Source: Office for National Statistics

Download this chart Figure 14a: Distribution of gross hourly earnings for full-time and part-time workers

Image .csv .xls

Figure 14b: Distribution of gross hourly earnings for full-time and part-time workers

Pay band (plus or minus 20p), 2015, UK

Source: Office for National Statistics

Download this chart Figure 14b: Distribution of gross hourly earnings for full-time and part-time workers

Image .csv .xlsGrowth in earnings by working pattern

Part-time workers have experienced lower pay growth and they are less likely to earn double digit pay rises. Figures 15a and 15b show the distribution of nominal weekly earnings growth rates for full-time and part-time workers in the year to April 2007 and the year to April 2015 respectively. For each growth rate on the horizontal axis, the figure indicates the frequency of employees who experienced earnings growth within 0.5 percentage points of that rate. The figure shows that weekly earnings growth varies significantly across different growth brackets. Around 0.8% of full-time workers and around 0.6% of part-time workers experienced close to 20% weekly earnings growth in 2015, while around 0.8% of both full-time and part-time workers experienced a fall of 10%.

Secondly, Figure 15 suggests that the experience of earnings growth – as measured by the most frequently occurring earnings growth rates – has weakened since 2007 (but has strengthened between 2014 and 2015). In 2007, the most common nominal pay rise for full-time workers was around 2.7% – accounting for around 9.5% of full-time workers. For part-time workers the most common pay rise was zero – accounting for around 7% for part-time workers. Therefore, in general full-time workers experienced a higher pay growth in 2007 than part-time workers. In 2015, the proportion of workers experiencing zero nominal weekly earnings growth was much higher at 9.8% for full-time and 8.0% for part-time workers. Apart from the employees experiencing no weekly earnings growth, the most frequently occurring rate of growth was closer to 2.3% for full-time workers – accounting for around 10.2% of full-time workers, and 2.6% for part-time workers – accounting for 7.1% of all part-time workers. As in 2007, in 2015 in general more full-time workers experienced a growth as well as a fall in weekly earnings.

Figure 15a: Distribution of growth in gross weekly earnings

Full time and part time, plus or minus 0.5 percentage point growth, 2007, UK

Source: Office for National Statistics

Notes:

- This chart uses individual level data from ASHE to calculate the growth of nominal weekly earnings for individuals observed in 2006 to 2007 and 2014 to 2015. Note that the ASHE methodology is not specifically designed to model earnings growth for individuals over time.

Download this chart Figure 15a: Distribution of growth in gross weekly earnings

Image .csv .xls

Figure 15b: Distribution of growth in gross weekly earnings

Full time and part time, plus or minus 0.5 percentage point growth, 2015, UK

Source: Office for National Statistics

Notes:

- This chart uses individual level data from ASHE to calculate the growth of nominal weekly earnings for individuals observed in 2006 to 2007 and 2014 to 2015. Note that the ASHE methodology is not specifically designed to model earnings growth for individuals over time.

Download this chart Figure 15b: Distribution of growth in gross weekly earnings

Image .csv .xls9. Analysis relevant to the Independent Review of UK economic statistics

The Independent review of UK economic statistics (2016), led by Sir Charles Bean, recommended a series of actions for us and other producers of economic statistics. Work to address these issues is ongoing, but 2 of our recent releases provide some evidence of how we are progressing work around measuring the modern economy and utilising modern statistical methods such as now-casting to provide users with additional information.

The releases highlighted in this section are:

Nowcasting household income in the UK: financial year ending 2016; and

Economic Statistics Transformation Programme: UK flow of funds experimental balance sheet statistics, 1997 to 2015

Household disposable income and working status of households

The strong performance of the UK labour market post-economic downturn is widely known and recognised. An employment rate of 74.5% in the 3 months to June 2016 is the highest since records began. The unemployment rate in the same period of 4.9% is lower than its pre-downturn average. While real average weekly earnings (AWE) fell during the onset of the economic downturn, it has been recovering since September 2014 and this can be partly attributed to periods of very low CPI inflation.

Since employment and incomes are improving for working individuals, one would expect that the employment and income of households that they belong to move in the same direction. Analysis in this section on median household disposable income and share of people in mixed or working households seems to suggest that this is indeed the case.

Household disposable income is the amount of money that households have available for spending and saving after direct taxes (such as Income Tax and Council Tax) have been deducted. Additionally, household income is usually equivalised to take into account that a larger household is likely to need a higher income to achieve the same standard of living as a smaller household. For example, a household made up of 2 adults with a combined income of £21,000 is likely to have higher material living standards than another household earning the same amount but made up of 2 adults and 2 children, everything else being equal. For a more detailed explanation on equivalised household disposable income, refer to Nowcasting household income in the UK: financial year ending 2016.

Figure 16 shows the median equivalised real disposable income for non-retired households1 and the share of people aged 16 and over in mixed or working households2. Since 1996, the median equivalised disposable income of non-retired households has steadily increased and peaked in 2007 before declining during the economic downturn. It began to recover in 2013 to 14 but as of 2015 to 16 it has not recovered to its pre-downturn level.

This trend coincides with movements in the share of people aged 16 and over living in mixed or working households that also declined post-economic downturn but have since recovered. In fact, the share of people aged 16 and over in mixed or working households in 2014 and 2015 were higher than in any other year since 1996. The strong growth in this share is consistent with the all time high employment rate and the relatively low levels of inactivity. The observations above do support the idea that the recovery of real disposable household income could be due in part to increased employment of household members who were previously not working.

Figure 16: Share of people aged 16 and over in mixed or working households and median equivalised real disposable income of non-retired households

1996 to 2015, £ and percent, UK

Source: Office for National Statistics

Notes:

- Income figures have been deflated to 2015 to 2016 prices using the implied deflator for the household sector.

- Income is equivalised using the modified-OECD (Organisation for Economic Co-operation and Development) scale.

- Due to differences in the sampling methodology of the 2 estimates, their time periods are not directly comparable. The reference period for equivalised household disposable income is the financial year ending in March. On the other hand, the share of people in mixed and working households is published twice a year, once for the period between April and June and the other between October and December. Given these restrictions, the equivalised household disposable income for the financial year ending in March is compared with the share of people in mixed and working household in the April to June period at the start of that financial year.

Download this chart Figure 16: Share of people aged 16 and over in mixed or working households and median equivalised real disposable income of non-retired households

Image .csv .xlsPre-economic downturn period

From 1996 to 2008, there was a steady increase in the share of people aged 16 and over in mixed or working households. In that period, the compound annual growth rate (CAGR) of the number of people aged 16 and over in mixed or working households was 0.9%, which was faster than the 0.6% CAGR of the number of people aged 16 and over in all households.

Economic downturn period

During the economic downturn, the number of people aged 16 and over in mixed or working households declined as expected but quickly recovered soon after. The number of people aged 16 and over in all households continued to rise steadily but there was a slowdown in the rise from 2011 onwards. This led the share of people aged 16 and over in mixed or working household to initially fall in 2009 but then to quickly rise from 2012 onwards.

From 2012 onwards

The strong growth in the share of people aged 16 and over in mixed or working households between 2012 and 2015 was driven by a faster increase in the number of people aged 16 and over in mixed or working households compared to the increase of the number of people aged 16 and over in all households.

Between 2012 and 2015, the CAGR of the number of people aged 16 and over in mixed or working households in this period was 0.6% compared to the CAGR of the number of people aged 16 and over in all households which was 0.2%. This drove the increase in the share of people aged 16 and over in mixed or working households.

Further analysis on the age composition of people aged 16 and over in mixed or working households shows that the people in the 50 to 64 and 65 and over age brackets are the ones contributing the most to its increase.

Figure 17 shows the percentage point contributions of different age groups above the age of 16 years to the percentage difference of people aged 16 and over in mixed or working household compared to 1996. The number of people aged 16 and over in mixed or working households has been increasing since 1996, with the exception of 2009 when it dipped a little.

Between 1999 and 2013, there have been negative contributions from people in the 25 to 34 age bracket, slightly offsetting the increase in the number of people in mixed or working households of all ages. In recent years, there has been an increase in the positive contribution of people in the older age brackets, namely the 50 to 64 and 65 and over age groups. An aging labour force where older people are retiring later could be a possible explanation to this trend.

Figure 17: Percentage difference of people aged 16 and over in mixed or working households compared to 1996

Percentage point contributions by age group, 1996 to 2015, UK

Source: Office for National Statistics

Download this chart Figure 17: Percentage difference of people aged 16 and over in mixed or working households compared to 1996

Image .csv .xlsFigure 18 compares the median equivalised real disposable income of non-retired households (where the household reference person (HRP) includes people of all ages) to the median equivalised real disposable income of non-retired household (where the HRP is aged 16 to 50). From 2003 to 2004 to 2009 to 2010, the 2 time series were quite comparable to one another. This shows that the median equivalised real disposable income of non-retired households, where the age of the HRP is restricted to 16 to 50 years, is quite similar to the household income where the HRP includes people of all ages.

From 2009 to 2010 onwards, there was a divergence between the 2 time series. The median equivalised real disposable income of non-retired household, where the HRP include people of all ages, was noticeably higher than the median equivalised real disposable income of non-retired household, where the HRP is aged 16 to 50. This suggests that the incomes of those aged 50 plus were pulling up the median equivalised real disposable income of non-retired households of all ages.

This is further evidence that the recovery of household income is partly due to improvements in the employment rates and income of older people relative to people in the lower age brackets. Furthermore, there is also likely to be some effect from the small number of retired people in non-retired households, as the introduction on the triple lock on the basic state pension would have also improved incomes of pensioners3.

Figure 18: Median equivalised real disposable income of non-retired households

Where household reference person (HRP) includes all ages and HRP is aged 16 to 50, 2003 to 2015, £, UK

Source: Office for National Statistics

Notes:

- Income figures have been deflated to 2015/16 prices using the implied deflator for the household sector.

- Income is equivalised using the modified-OECD scale.

Download this chart Figure 18: Median equivalised real disposable income of non-retired households

Image .csv .xlsThe UK Enhanced Financial Accounts (The UK Flow of Funds Project) – taking the household perspective

This section of the economic review highlights some of the recent enhanced financial accounts data we have published, with a particular focus on assessing changes in the financial assets and liabilities of the household and non-profit institutions serving households (NPISH) sectors.

This perspective can provide some insights into how trends in financial worth and the composition of assets and liabilities for this sector relate to the exposure of households to different economic sectors. The financial accounts and balance sheet information for households can also be considered alongside trends in household consumption over time. This is because economic theory would suggest different forms of income and wealth, including financial wealth, would have a significant influence over household consumption decisions and expenditure over time.

Definitions:

Financial accounts

These measure net financial flows across different sectors of the economy. Financial flows have been published by both the Bank of England (the Bank) and ONS and its forerunners since the 1960s.

At present the financial accounts are published as total assets and total liabilities, by sector and instrument, with little counterparty information.

“Whom-to-whom” information

The concept is to attribute counterparties to the assets or liabilities that a given sector would hold or issue. For example, households typically hold financial assets in the form of deposits, while they hold debt or liabilities in the form of loans (either secured or unsecured). But it is of interest to know who the ultimate recipient and issuer to these relationships are. For example, detailed counterparty information would pick up whether households have moved away from domestic banks and toward foreign banks (classified in the rest of the world sector), or whether households have moved from taking out loans at banks to other more complex facilities (for example, peer-to-peer lending).

Enhanced financial accounts

These introduce full whom-to-whom counterparty information, so that for each instrument both the sector holding the asset and the sector incurring the liability are presented.

This should better assist policymakers to see when and where risk is beginning to build within the financial system.

Flow of funds: net financial assets and liabilities

As an example of the use of flow of funds balance sheet data, which includes counterparty information, the financial assets and liabilities for the household sector can be analysed over time. At present these are combined with the non-profit institutions serving households (NPISH) sector, although there are plans for separating these sectors in Blue Book 2017.

Net financial worth for household and NPISH sectors

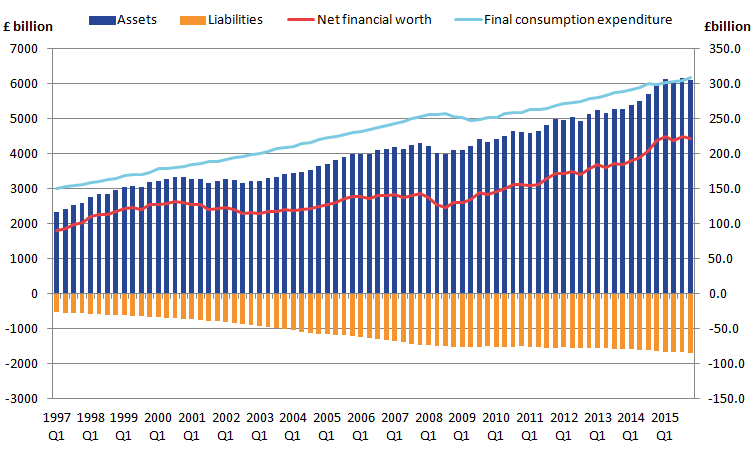

Figure 19 shows that the net financial assets for the household and NPISH sector have roughly trebled since the start of 1997. The overall stock of assets is approximately 3 and a half times that of the stock of liabilities for this sector, indicating a positive net financial worth throughout the period.

There is a fall in financial net worth associated with the 2008 to 2009 economic downturn, but a relatively strong recovery since then. Figure 1 also shows the trend in current price final consumption expenditure for the household and NPISH sectors.

Figure 19: Financial assets, liabilities and net worth for households and NPISH

Quarter 1 1997 to Quarter 4 2015, £billion, UK

Source: Office for National Statistics

Download this image Figure 19: Financial assets, liabilities and net worth for households and NPISH

.png (24.8 kB) .xls (34.8 kB)These data show that the upward trend in consumption expenditure broadly matches growth in the financial net worth of households and NPISH sectors. Both series fall, for example, in Quarter 4 (Oct to Dec) 2008 and Quarter 1 (Jan to Mar) 2009, which is during the economic downturn period.

Counterparty information

Assets

Figure 20 shows the annual average growth rates for each major counterparty for household and NPISH financial assets for the time periods prior to the economic downturn (Quarter 1 1997 to Quarter 1 2008), and then the period from the downturn to 2015 (Quarter 1 2008 to Quarter 1 2015).

Figure 20: Average annual growth rates for household and NPISH financial assets, pre and post economic downturn

1997 Quarter 1 to 2008 Quarter 1 and 2008 Quarter 1 to 2015 Quarter 1, UK

Source: Office for National Statistics

Notes:

- MFIs are monetary financial institutions, OFIs are other financial intermediaries, ICPFs are insurance companies and pension funds, RoW is rest of the World. Other is defined as public corporations, private non-financial corporations, and unknown.

- Annual averages are calculated as geometric means.

Download this chart Figure 20: Average annual growth rates for household and NPISH financial assets, pre and post economic downturn

Image .csv .xlsThese data show that annual average growth of the stock of assets with other financial intermediaries (OFI) and insurance companies and pension funds (ICPF) counterparties has grown fairly similarly for the pre and post economic downturn periods. Growth in the value of assets with rest of the world and other counterparties has fallen significantly since the economic downturn, with a smaller fall in growth in assets held with monetary financial institution (MFI) counterparties.

The only sector (aside from “other”) to significantly increase its growth rate in the value of assets after the economic downturn are those with a central government counterparty. This could be an indication of households holding more government debt as a form of security over more risky equity or other investments. Stocks of government debt held by households may also have increased in value after the economic downturn. However, central government only issued around 3% of overall household and NPISH assets in Quarter 4 2015.

Liabilities

Figure 21 gives equivalent data for the average annual growth rate pre and post economic downturn for household and NPISH liabilities. These data show a large growth in the value of stocks of liabilities (mainly loans) held with OFIs before the economic downturn, which have since fallen back. Growth in liabilities with MFIs and the rest of the world sector has also slowed post-economic downturn.

Other financial intermediaries include companies offering consumer and business credit and finance to purchase consumer goods such as cars, and long-term financial leasing, and companies offering development finance and venture capital. Definitions are available from the European Central Bank.

Figure 21: Average annual growth rates for household and NPISH financial liabilities, pre and post economic downturn

1997 Quarter 1 to 2008 Quarter 1 and 2008 Quarter 1 to 2015 Quarter 1, UK

Source: Office for National Statistics

Notes:

- MFIs are monetary financial institutions, OFIs are other financial intermediaries, ICPFs are insurance companies and pension funds, RoW is rest of the World. Other is defined as public corporations, private non-financial corporations, and unknown.

- Annual averages are calculated as geometric means.

Download this chart Figure 21: Average annual growth rates for household and NPISH financial liabilities, pre and post economic downturn

Image .csv .xlsComposition of household assets

The financial instruments covered in our experimental whom-to-whom data include:

currency

deposits

short-term debt securities

long-term debt securities

loans

equity and investment fund shares or units

insurance, pension and standardised guarantee schemes

financial derivatives

A small number of other instruments, such as monetary gold, are not included, as either counterparty information is not currently available, or there is only one counterparty to the instrument. The stock of the value of each sector’s assets and liabilities is given at the end of each quarter. These estimates form a quarterly time series from 1997 to 2015.

Figure 22 shows the main financial instruments held as assets by the household and NPISH sector between 1997 and 2015. Insurance, pension and standardised guarantee schemes dominate the holding of assets at around 60% of all assets (£3,731 billion in 2015). Within this instrument, the share of pension assets tends to dominate the value of insurance and standardised guarantee scheme business. The share of assets held in “insurance, pension and standardised guarantee schemes” has increased slightly over this period from 55% of total assets in Quarter 1 1997 to 61% by Quarter 4 2015.

The share of deposits as assets increased around the time of the economic downturn in 2008, by around 3 percentage points over a year earlier, with a corresponding fall in holding equity and investment fund assets. The share of equities and investment funds in total assets held by the household and NPISH sector has remained broadly flat at around 12 to 13% since then, which is below its peak of a 24% share of assets in Quarter 4 of 1999.

Figure 22: Share of main financial instruments held as assets by Households and NPISH sectors

Percent, 1997 Quarter 1 to 2015 Quarter 4, UK

Source: Office for National Statistics

Download this chart Figure 22: Share of main financial instruments held as assets by Households and NPISH sectors

Image .csv .xlsExamination of the counterparty estimates within the flow of funds accounts shows as expected that insurance companies and pension funds are the main counterparty for households and NPISH sector financial assets, with around 60% of the counterparty liabilities. There has been a small increase in the share of MFI’s holding the counterparty liability to household and NPISH assets, from the growth in deposits and equity holdings.

Composition of household liabilities

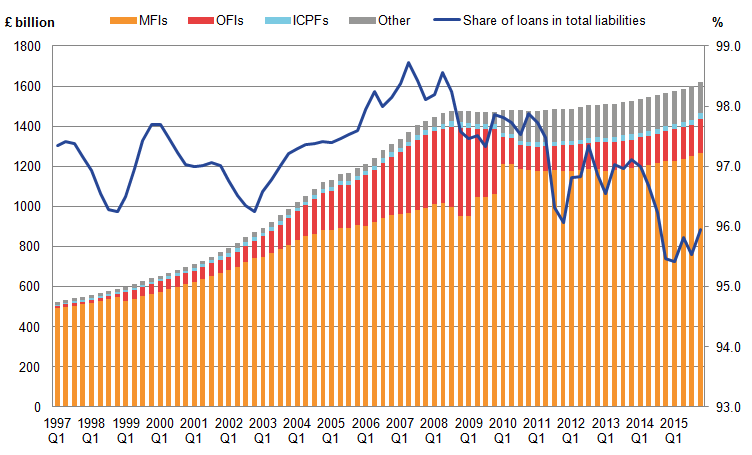

Figure 23 (right hand scale) shows that the share of household and NPISH sector liabilities in the form of loans rose by almost 2 percentage points between 1997 and 2008, from around 97% of all financial liabilities to almost 99% of total financial liabilities in Quarter 2 2008. The share of liabilities in the form of loans has since fallen by 3 percentage points to around 96% by the end of 2015.

Figure 23 also shows that the value of the stock of liabilities in the form of loans (left hand scale) has grown much more slowly in nominal terms since the 2008 downturn than in the period between 1997 and 2008.

Examination of the counterparty estimates within the flow of funds accounts, also shown in Figure 23, shows monetary financial institutions are the main counterparty for households and NPISH sector loans throughout the time period.

Within the total stock of loans however, there is evidence of a rise in the share of other financial intermediaries as the counterparty asset holder, from 2% of household and NPISH loan liabilities in 1997, to 11% of this sector’s loan liabilities in 2015. The share of other financial intermediaries was as high as 25 to 30% between 2007 and 2008. This may reflect increased use of financial credit for cars, pay-day loans and other consumer goods at this time.

Figure 23: Share of loans and value of loan liabilities in household and NPISH sector liabilities

Percent, 1997 Quarter 1 to 2015 Quarter 4, UK

Source: Office for National Statistics

Notes:

- MFIs are monetary financial institutions, OFIs are other financial intermediaries, ICPFs are insurance companies and pension funds, RoW is rest of the world. Other is defined as public corporations, private non-financial corporations, and unknown.

- Share of loans in total liabilities refers to right-hand-side axis, all others refer to left-hand-side axis

Download this image Figure 23: Share of loans and value of loan liabilities in household and NPISH sector liabilities

.png (44.9 kB) .xls (35.3 kB)Next steps for the Enhanced Financial Accounts

ONS and the Bank of England will continue to develop the granularity of the flow of funds and counterparty estimates, as set out in the article Developing the enhanced financial accounts (UK Flow of Funds), published July 2016. For example, one aim is to produce a substantial expansion of the financial corporation sub-sectors, particularly with respect to non-money market investment funds. The additional granularity here is essential in identifying the build-up of risks in the financial sector.

A split of private non-financial corporations into commercial and non-commercial real estate companies is also proposed, including a further breakdown of these corporations by size into small and medium-sized, and large companies.

Notes for Analysis relevant to the Bean Review of UK Economic Statistics:

A retired person is defined as anyone who describes themselves (in the Living Costs and Food Survey) as “retired” or anyone over minimum State Pension age describing themselves as “unoccupied” or “sick or injured but not intending to seek work”. A retired household is defined as one where the combined income of retired members amounts to at least half the total gross income of the household.

A mixed household is a household that contains at least 1 person aged 16 to 64, where at least 1 person aged 16 and over is in employment and at least 1 other is either unemployed or inactive.

Under the triple lock policy, the basic State Pension will increase by either consumer price index (CPI) inflation, average weekly earnings (AWE) growth or 2.5%, whichever of this 3 is the highest.