1. Disclaimer

We are producing these Research Outputs to investigate the feasibility of using data from the property website Zoopla, to explore small area statistics on the advertised price of privately-let residential properties in Great Britain. We have sourced Zoopla data from the Urban Big Data Centre (UBDC) collection. This is Office for National Statistics (ONS) analysis of UBDC’s version of Zoopla data. As such, there may be differences from statistics compiled by Zoopla themselves because different assumptions or criteria may have been used.

These Research Outputs are published for the purpose of receiving feedback and are not official statistics at this stage. The underlying data and the statistical datasets that we have produced are not published in this Research Output because our agreement with UDBC (and their agreement with the data owner, Zoopla) doesn’t currently permit this. We are looking to address this for the future development of rent price statistics.

If you require official statistics on private rent prices in England these are available at the local authority level from the Valuation Office Agency and for Wales they are available from Stats Wales. The focus of these Research Outputs is on smaller geographical areas than the local authority level.

Nôl i'r tabl cynnwys2. Why are we producing these statistics?

Housing policy and planning is a very local issue. From the planning process itself, through to the building, buying and renting of homes, the situation varies a great deal not just across the country, but even within individual local authorities. In particular, the affordability of housing, the type of homes being built and the tenure in which people live in their accommodation varies at the local level. Policy-makers trying to react to and plan for these issues need a geographically granular view of housing in their areas.

The private rented sector has more than doubled its share of total dwellings since the turn of the century (dwelling stock by tenure, Ministry of Housing, Communities and Local Government (MHCLG)), but statistics on the cost of private renting are not currently published for areas smaller than local authorities. Housing policy-makers in local authorities need to know how much it costs to rent a private property in different locations within their area. For example, statistics on advertised private rents could help local authorities understand the cost of accessing the rental market for new renters. Exploring how this compares against the cost of renting in the overall private rented sector will help them to understand their local areas’ rental markets and subsequently make appropriate local housing policy.

In addition to the rent price statistics for Wales, there are already official statistics that give us some information about the rental market:

the Office for National Statistics (ONS) Index of Private Housing Rental Prices tells us about inflation of rent prices at the national and regional level; this is a high geographic level because of its model-based methodology and so is of limited use at the local level

the Valuation Office Agency (VOA) private rental market statistics for England provide an indication of average rent prices at the local authority level based on a sample of rental data; the sampling makes this unsuitable for statistics at a lower geographic level; this data excludes Housing Benefit-supported rental data, approximately 20% to 25% of all private rental lettings

Whilst ideally we would have a source that measures rent prices for the entire private rented stock, we don’t currently have data that can provide this directly. However, data from one of the major property websites, Zoopla, does provide a potential measure of “flow” of rented properties, at least for properties that were advertised on the Zoopla website. These data, whilst still not showing the whole picture, could potentially enable the production of small area rent price statistics required by policy-makers.

Nôl i'r tabl cynnwys3. Feedback and next steps

We are keen to receive feedback on these Research Outputs, particularly on how they might be improved and potential uses of the data. Please email your feedback to better.info@ons.gov.uk.

In addition, our longer-term aim is to access and make use of further administrative data to enable us to add more detailed information to these data, for example, property type, number of bedrooms or to provide these data at a lower geographic level.

Nôl i'r tabl cynnwys4. How did we process the Zoopla data?

The data were supplied to us by the Urban Big Data Centre (UBDC). The UBDC is a UK-wide data service for researchers who want to use big data to address a range of urban challenges and are funded by the Economic and Social Research Council.

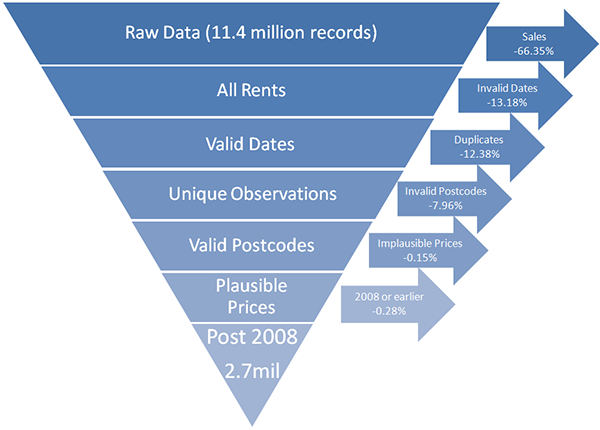

We applied a number of filtering processes on the raw data (Figure 1), to retain only the information we required. The filtering process resulted in a dataset containing around 2.7 million records of private rented property adverts relating to the years 2009 to 2016. We used this dataset to produce statistics on median advertised rent price at the small area level.

Figure 1: Data parsing process overview

Source: Office for National Statistics, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Notes:

- The percentages on this chart relate to the original 11.4 million records.

Download this image Figure 1: Data parsing process overview

.png (70.2 kB)5. What decisions did we make?

Duplicate or unique?

It is possible for the same property to be advertised on Zoopla more than once. In the production of advertised rent price statistics we wanted to avoid including multiple records for one instance of the same advertised property, for example, where multiple letting agents advertise the same property simultaneously or the same letting agent advertises the same property more than once. These are not likely to be common occurrences but help us provide criteria for removing potentially duplicate records.

However, we didn’t want to exclude genuinely re-advertised properties, such as a property formerly advertised becomes available again and is advertised a few months after the previous advert. The data don’t tell us which of these scenarios was really the case and so we have applied some assumptions to ascertain which duplicate property adverts were most likely to relate to properties genuinely advertised for rent on multiple occasions. We classed records with an identical property identifier, month and year of advert as being duplicates and retained a single record from each duplicate set.

Plausible prices

Some property adverts contained rent prices that seemed implausibly low or high. The low prices were sometimes referring to garages for rent rather than residential properties and were sometimes referring to an introductory rent price discount. We think some of the high prices were typographic errors, including extra zeros added to a price by mistake. In order to reduce the biases of the data, caused by these adverts, we set thresholds for the minimum and maximum rent price of property adverts to be included in our rent price statistics. These were a minimum of £200 per month and a maximum of £100,000 per month.

Property types

Statistics on rent prices for different types of property would be helpful to understand the impact on rent prices of the different mix of property types in different areas and to understand the spread of prices in an area. However, around 23% of property adverts in the data (2009 to 2017) did not include information on property type. The percentage of adverts that did contain information about property type improves in more recent years. Whilst just over 30% of properties in 2012 had no type listed, this improved in 2013 (12.7%) and by 2017 (part year) had dropped to 8.6%.

Amongst records that did have a property type listed, there were 26 different property types recorded. Whilst many translate directly to types used in official sources such as the Land Registry, others are less clear, for example, a barn conversion could potentially be detached, semi-detached, terraced or contain flats. Whilst these could be reduced into a few broad categories, we decided to produce the initial statistics without a property type breakdown in order to avoid inconsistency with house price statistics and with other rent price statistics, and also to reduce the risk of statistics for some property types being of lower quality or representativeness. We would like to carry out further work in the future to link different data sources together in order to get a more complete view of a range of variables, including property type.

Level of geography

Our aim is to provide statistics on advertised rent prices at the smallest level of geography possible, however, this has to be balanced against achieving an acceptable level of quality in terms of completeness and usability of the data. We decided that Middle layer Super Output Areas (MSOAs) were the lowest level of geography for which we were able to produce a meaningful statistic for the majority of areas. In England and Wales, an MSOA was designed to hold between 5,000 and 15,000 people and between 2,000 to 6,000 households at the 2011 Census. The equivalent geography in Scotland are Intermediate Zones (IZ), these cover smaller populations than MSOAs and were designed to population thresholds of 2,500 to 6,000 people. We also decided to produce a set of statistics for the local authority level geography. This provides two main benefits:

comparability with other private rented sector statistics, allowing us to validate our data with other sources

some higher level context for our MSOA-level statistics

Which statistics to explore?

In line with our approach to house price statistics for small areas (HPSSA), we chose to report median advertised rent price as the main measure of average rent price. We also included a measure of the number of property adverts to give an idea of the volume of advertised properties and to give context to the prices reported.

When to report statistics and when to suppress?

For any small area dataset it is inevitable that there will be some areas with a very low number of records. This situation requires a decision to be made on how many records are needed to allow a median or other statistic to be deemed reliable. In the case of the MSOA-level rent price statistics we already have a broadly comparable statistic on house prices on which to base this decision, so we decided to follow the same standards as used for our HPSSA data – a minimum of five records is deemed necessary to produce a robust median advertised rent price, indicative of the advertised prices in a particular area. This was agreed by our methodologists for the HPSSA data and had been standard practice in historic statistics produced by the Ministry of Housing, Communities and Local Government. This approach results in some areas lacking 100% coverage.

We applied the threshold of five property adverts to determine whether or not to report the medians, means, quartiles and percentiles and we have reported the number of property adverts for all areas.

Nôl i'r tabl cynnwys6. What do the outputs show?

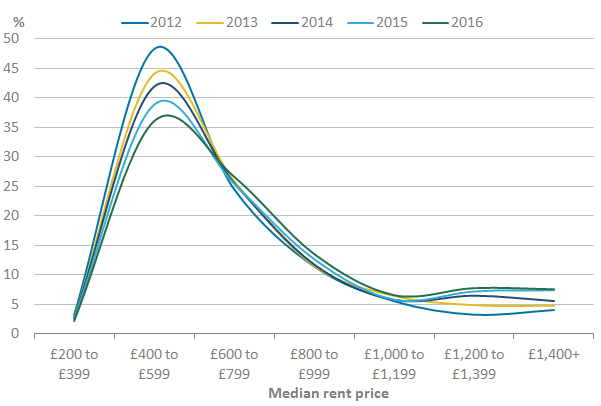

Figure 2 shows the percentage of advertised rented properties by price band between 2012 and 2016. The median advertised rent price band of £400 to £599 per month contained the largest proportion of Middle layer Super Output Areas (MSOA) and Intermediate Zones (IZ) for all years. The proportion of areas in this price band fell by over 12 percentage points between 2012 and 2016, from just over 48% down to 36%. As the percentage of MSOAs and IZs in the lower price bands decrease, the percentage for higher price bands increases year-on-year.

Figure 2: Percentage of Middle layer Super Output Areas or Intermediate Zones by median advertised monthly rent price

Great Britain, 2012 to 2016

Source: Office for National Statistics, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Download this image Figure 2: Percentage of Middle layer Super Output Areas or Intermediate Zones by median advertised monthly rent price

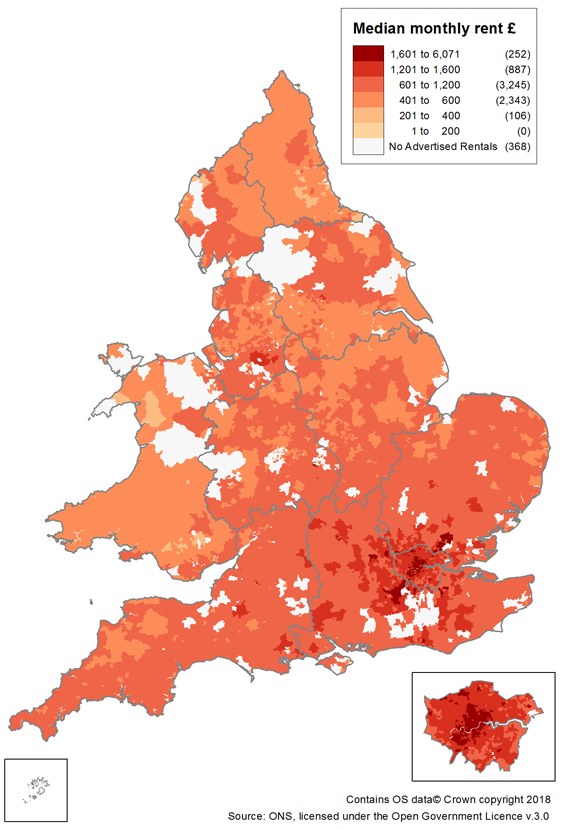

.png (25.6 kB)Figure 3 shows a map of the median monthly advertised rent price by MSOA for England and Wales in 2016. The highest median rent prices advertised are focused on central London, with hotspots in the neighbouring regions. Many of the 368 MSOAs with no rented property adverts are in rural areas, although there are some in London and a large area with no adverts in the South East.

Figure 3: Median monthly advertised rent price

Middle layer Super Output Areas in England and Wales, 2016

Source: Office for National Statistics, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Notes:

- Office for National Statistics licensed under the Open Government Licence v.3.0. Contains OS data © Crown copyright 2018.

- The category for 'No Advertised Rentals' consists of MSOAs with less than five advertised rentals, including those with none.

Download this image Figure 3: Median monthly advertised rent price

.png (272.8 kB)7. Assessing data quality and coverage

There are some types of rented property that are not included in the Zoopla data used to produce these Research Outputs. These are:

advertised rented properties not on the Zoopla website

rented properties that were not advertised, for example, those arranged informally, renewals with existing renters and student housing

properties advertised to rent on the Zoopla website that were filtered out in our processing because of duplication or plausibility (see section 4, How did we process the Zoopla data?)

What geographic coverage gaps are there?

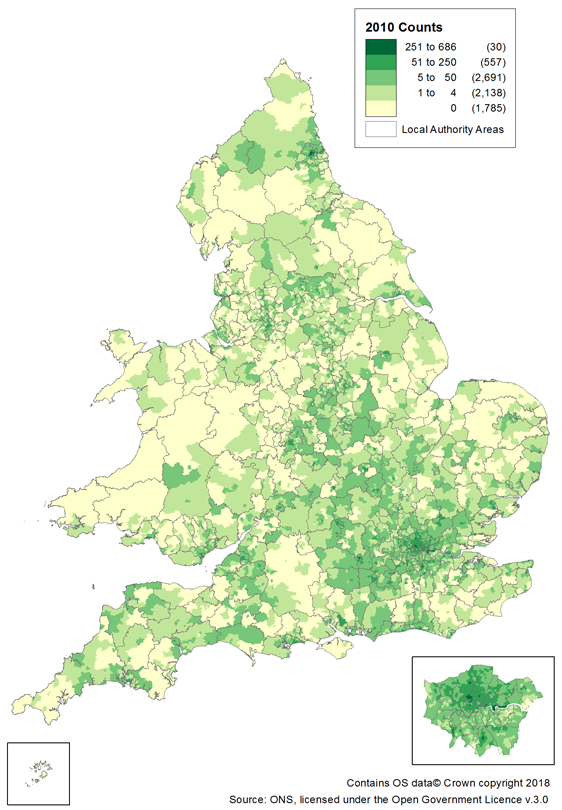

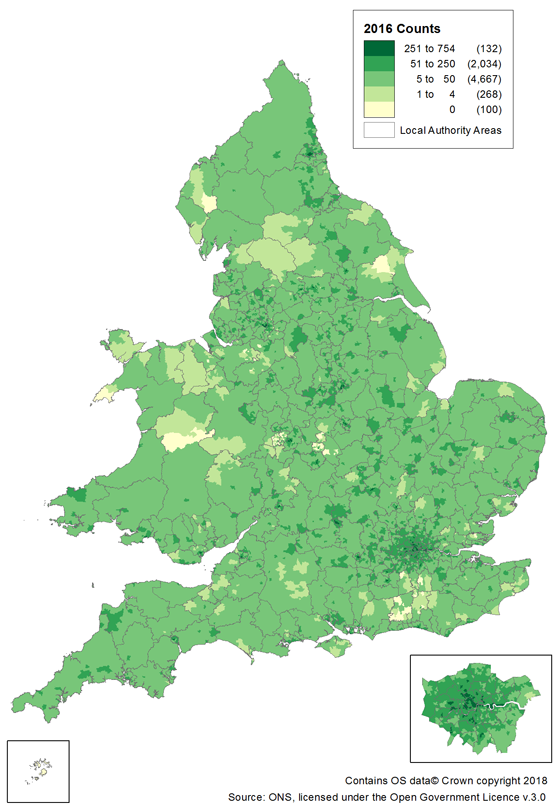

The maps in Figure 4 and Figure 5 show the number of rented property adverts by Middle layer Super Output Areas (MSOA) in England and Wales in 2010 and in 2016. The two maps demonstrate the extent to which geographic coverage has improved since 2010.

In 2010, areas with no rented property adverts were geographically widespread, particularly across the more rural parts of the country. More than 57% of MSOAs had fewer than five recorded property adverts in 2010. In 2016, this figure was just over 5%, although there were some clusters of areas that had a low number of rented property adverts. Where the number of rented property adverts has increased in an area, this could show an increase in coverage of the Zoopla website or an increase in the actual number of rented properties, or be a mix of the two. We think that, overall, an increase in coverage is likely to be the main factor here.

The number of MSOAs in England and Wales that had no recorded rented property adverts reduced from 1,785 (27.8%) in 2010 to 100 (1.4%) in 2016. This is likely to reflect an increase in the market coverage and popularity of the Zoopla website rather than an actual trend in the number of properties being advertised to rent, but it does give an indication of the increased coverage of the data in recent years. The number of areas with low counts (one to four property adverts) has reduced from 29.6% in 2010 to 3.7% in 2016. This represents a notable increase in the usability of these data for the production of small area advertised rent price statistics.

Figure 4: Number of rented property adverts

Middle layer Super Output Areas in England and Wales, 2010

Source: Office for National Statistics, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Notes:

- Office for National Statistics licensed under the Open Government Licence v.3.0. Contains OS data © Crown copyright 2018.

Download this image Figure 4: Number of rented property adverts

.png (368.2 kB)

Figure 5: Number of rented property adverts

Middle layer Super Output Areas in England and Wales, 2016

Source: Office for National Statistics, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Notes:

- Office for National Statistics licensed under the Open Government Licence v.3.0. Contains OS data © Crown copyright 2018.

Download this image Figure 5: Number of rented property adverts

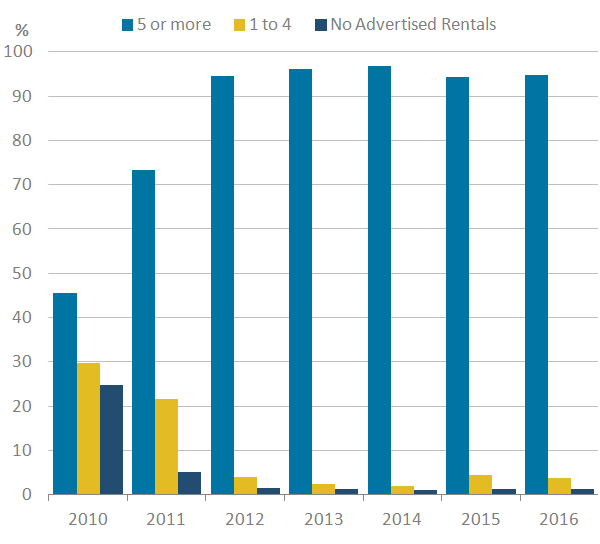

.png (304.1 kB)Figure 6 shows that less than half of MSOAs in England and Wales had five or more rented property adverts in 2010. This increased rapidly over the next two years and in 2016, nearly 95% of MSOAs had five or more rented property adverts. This suggests that there were enough rented property adverts to construct robust advertised rent price statistics in England and Wales between 2012 and 2016.

Figure 6: Percentage of Middle layer Super Output Areas by number of rented properties

England and Wales, 2010 to 2016

Source: Office for National Statistics, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Download this image Figure 6: Percentage of Middle layer Super Output Areas by number of rented properties

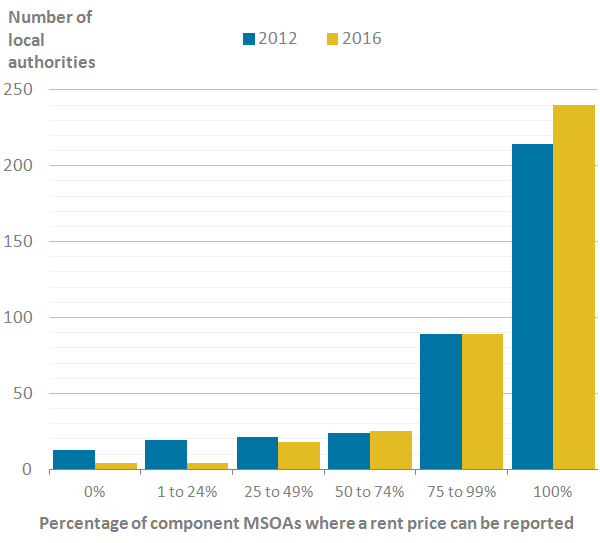

.png (10.6 kB)Figure 7 breaks down the local authorities (LAs) and council areas (CAs) of Great Britain according to the percentage of the underlying neighbourhoods (MSOA or Intermediate Zone) for which a median advertised rent price can be reported for 2012 and for 2016. These are the areas in which there were five or more rented property adverts.

The chart shows that a median advertised rent price can be reported for every component neighbourhood in the majority (63%) of LAs or CAs in 2016, up from 56% in 2012. There were 7% of LAs or CAs for which a median advertised rent price could not be reported in half of their constituent neighbourhoods in 2016. This shows that most areas of Great Britain had good coverage in 2016.

Figure 7: Number of local authorities and council areas by percentage of Middle layer Super Output Areas or Intermediate Zones for which a median advertised rent price can be reported

Great Britain, 2012 and 2016

Source: Office for National Statistics, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Download this image Figure 7: Number of local authorities and council areas by percentage of Middle layer Super Output Areas or Intermediate Zones for which a median advertised rent price can be reported

.png (12.1 kB)How do these Research Outputs compare with other data sources?

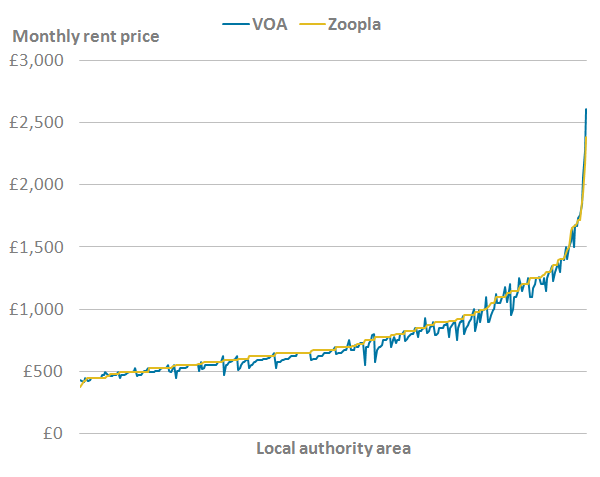

The Valuation Office Agency (VOA) produces statistics on median monthly private rent price by local authority in England. These statistics measure rent prices paid (excluding Housing Benefit tenants) from a sample of administrative data but unlike the Zoopla data used to produce our Research Outputs, they measure rent prices in the overall rented stock rather than only from properties being advertised for rent. Although the data sources are different and measure slightly different things, we would expect to see some degree of correlation between the two sets of statistics.

Figure 8 compares the median rent prices reported in the two different sets of statistics for English local authorities in 2016. The chart shows that the two sets of statistics followed the same broad pattern, but there were some differences. In 85.9% of local authorities the median rent price in the two statistics differed by 10% or less. However, there were areas where the difference was greater. Coventry, for example, was £200 more expensive in the Zoopla dataset (£750 per month) than in the VOA statistics (£550 per month). The areas with the largest percentage differences in the two rent price measures were Coventry (36.6%) and Shepway (34.9%), with the Zoopla figure higher in both cases.

Figure 8: Median monthly private rent price, Valuation Office Agency and Zoopla

Local authorities in England, 2016

Source: Office for National Statistics, Valuation Office Agency, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Notes:

- This chart is ordered by the Zoopla data, hence the Zoopla line is smooth. Ordering by the VOA data would have the opposite effect.

Download this image Figure 8: Median monthly private rent price, Valuation Office Agency and Zoopla

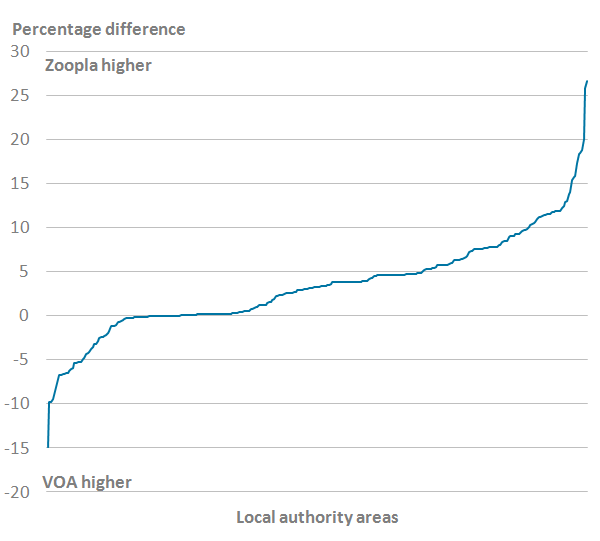

.png (19.5 kB)Figure 9 shows the percentage difference in median rent price between the Zoopla data and the VOA statistics for each of the 326 local authorities in England. The Zoopla median advertised rent price was greater than the VOA median rent price paid in just over 75% of areas in 2016, while the VOA data were higher in 19% of areas. There were 17 areas where the sources gave the same figure in 2016.

Figure 9: Percentage difference between Valuation Office Agency and Zoopla median monthly rent price

Local authorities in England, 2016

Source: Office for National Statistics, Valuation Office Agency, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Download this image Figure 9: Percentage difference between Valuation Office Agency and Zoopla median monthly rent price

.png (13.5 kB)Given that the Zoopla data shows advertised prices and the VOA data shows prices paid, including those let to long-term tenants, this difference is expected because it is common for landlords to increase rent when re-letting. This creates a relatively more expensive rent price in the Zoopla data than in the VOA statistics for the majority of areas. In areas where demand for rented properties is high, the actual rent prices are likely to be more similar to advertised prices than in areas where demand is lower. Therefore, the use of statistics for advertised rent prices versus actual rent prices depends to some extent on what the user needs from the statistic.

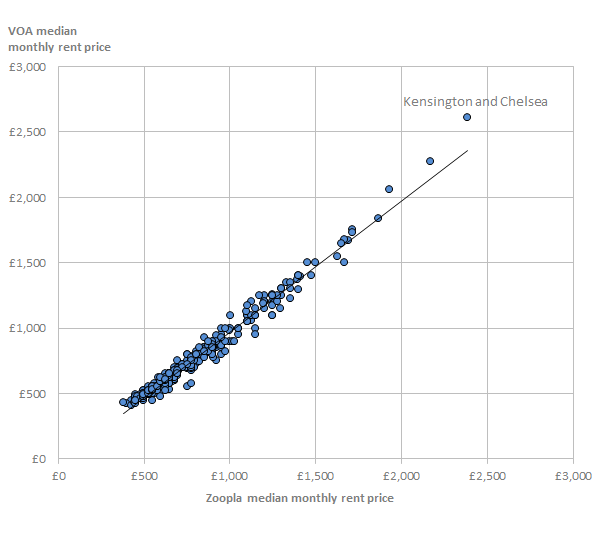

Figure 10 shows the median advertised rent price for English local authorities plotted against the median rent price from the VOA statistics in 2016. The chart shows a strong positive correlation between the two sets of statistics. There are just a few minor outliers.

Figure 10: Valuation Office Agency median monthly private rent price and Zoopla median advertised rent price

Local authorities in England, 2016

Source: Office for National Statistics, Valuation Office Agency, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Download this image Figure 10: Valuation Office Agency median monthly private rent price and Zoopla median advertised rent price

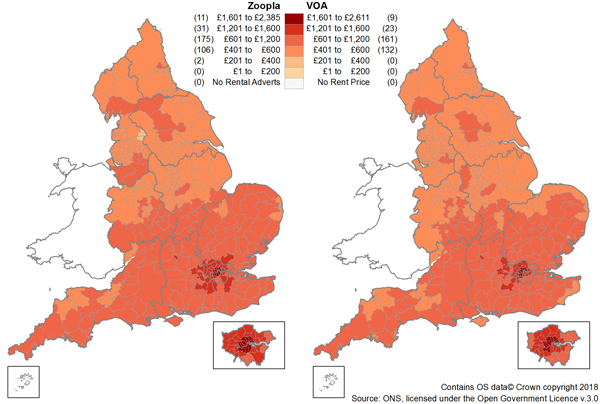

.png (19.4 kB)Figure 11 shows maps of both the Zoopla and the VOA median rent price statistics by local authority for England in 2016. Whilst there are minor differences, the pattern is broadly the same, with the highest rent prices in both statistics focused on the centre of London.

Figure 11: Median monthly rent price from Zoopla and Valuation Office Agency data

Local authorities in England, 2016

Source: Office for National Statistics, Valuation Office Agency, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Notes:

- Office for National Statistics licensed under the Open Government Licence v.3.0. Contains OS data © Crown copyright 2018.

- Zoopla data reports advertised rent prices and VOA data reports actual rent prices paid.

- The equivalent source of private rental statistics for Wales is broken down by number of bedrooms, so has not been included in this analysis.

Download this image Figure 11: Median monthly rent price from Zoopla and Valuation Office Agency data

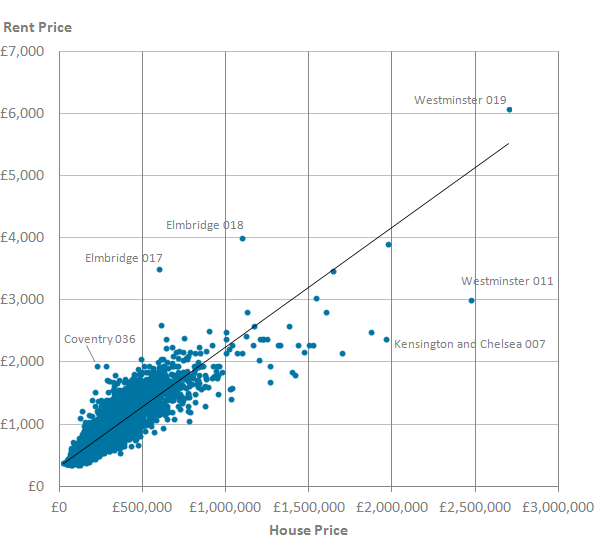

.png (183.4 kB)We publish statistics on median prices paid to purchase property at MSOA level in the House price statistics for small areas (HPSSA). This gives an opportunity to compare our advertised rent price statistics with a related aspect of the housing market at a small geographic level. We would expect to see broadly similar geographic trends in both house price statistics and rent price statistics. Figure 12 shows the median advertised rent price plotted against the median price paid for property in 2016 for MSOAs in England and Wales. The chart shows the two datasets have a broad positive correlation, with a few outliers.

Figure 12: Median monthly advertised rent price (Zoopla) and median price paid for residential property (Land Registry, ONS)

Middle layer Super Output Area in England and Wales, 2016

Source: Office for National Statistics, HM Land Registry, Zoopla Property Group PLC © 2018. (2018). Zoopla Historic Data (UK to 2018) [data collection], Urban Big Data Centre

Download this image Figure 12: Median monthly advertised rent price (Zoopla) and median price paid for residential property (Land Registry, ONS)

.png (31.7 kB)If you would like to provide any feedback on these Research Outputs regarding the use of the data and methods to produce these statistics, email better.info@ons.gov.uk.

Nôl i'r tabl cynnwys