Cynnwys

- Main points

- Things you need to know about this release

- Labour productivity up for the seventh consecutive quarter compared with a year ago

- Output per hour up in both services and manufacturing, compared with a year ago

- Unit labour costs grow for the thirteenth consecutive quarter

- Experimental industry by region productivity statistics

- Links to related statistics

- What’s changed in this release?

- Quality and methodology

1. Main points

Labour productivity for Quarter 2 (Apr to June) 2018, as measured by output per hour, grew by 1.4% compared with the same quarter a year ago; this remains noticeably below the long-term trend observed before 2008 when productivity growth averaged nearly 2% per year.

Labour productivity grew, compared with the previous year, in both services and manufacturing industries, by 1.8% and 1.3% respectively.

UK labour productivity is estimated to have increased by 0.5% in Quarter 2 (Apr to June) 2018 compared with the previous quarter; the increase in productivity can be attributed to a fall in the number of actual hours worked and stronger output growth.

Labour productivity in the services industries grew by 0.9% in Quarter 2 2018 compared with the previous quarter, while productivity in manufacturing industries decreased by 0.1% over the same period.

Productivity hours worked decreased by 0.1% in Quarter 2 (Apr to June) 2018 compared with the previous quarter, while the number of jobs increased by 0.1% over the same period; comparing with the same quarter a year ago, productivity hours worked decreased by 0.2%, while the number of jobs increased by 0.9% respectively.

Earnings and other labour costs growth outpaced productivity growth, resulting in unit labour cost growth of 2.0% in the year to Quarter 2 (Apr to June) 2018, down from the 2.7% growth in the year to Quarter 1 (Jan to Mar) 2018.

2. Things you need to know about this release

This release reports labour productivity estimates for Quarter 2 (Apr to June) 2018 for the whole economy and a range of industries, together with estimates of unit labour costs. Productivity is important as it is considered to be a driver of long-run changes in average living standards.

This edition forms part of our quarterly productivity bulletin, which also includes an overarching commentary, quarterly estimates of public service productivity and articles on productivity-related topics and data.

Labour productivity is calculated by dividing output by labour input. Output refers to gross value added (GVA), which is an estimate of the volume of goods and services produced by an industry, and in aggregate for the UK as a whole. Labour inputs in this release are measured in terms of workers, jobs (“productivity jobs”) and hours worked (“productivity hours”).

This release also reports estimates of unit labour costs (ULCs), which capture the full labour costs – including social security and employers’ pension contributions – incurred in the production of a unit of economic output. Labour costs make up around two-thirds of the overall cost of production of UK economic output. Changes in labour costs are therefore a large factor in overall changes in the cost of production. If increases in labour costs are not reflected in the volume of output, this can put upward pressure on the prices of goods and services, therefore this is a closely watched indicator of inflationary pressure in the economy.

The equations for labour productivity and ULCs can be found in the Quality and methodology section of this release.

The output statistics in this release are consistent with the latest Quarterly national accounts published on 28 September 2018. Note that productivity in this release does not refer to gross domestic product (GDP) per person, which is a measure that includes people who are not in employment.

The labour input measures used in this release are consistent with the latest labour market statistics as described further in the Quality and methodology section of this bulletin.

Unless otherwise stated all figures are seasonally adjusted.

This release introduces a number of methodological improvements in the estimation of labour productivity statistics, which were announced in Improvements to the latest Labour productivity bulletin: October 2018, published in September 2018. Further information can be found in Section 8 “What has changed in this release?” of this statistical bulletin.

Nôl i'r tabl cynnwys3. Labour productivity up for the seventh consecutive quarter compared with a year ago

Compared with the same quarter a year ago, labour productivity, on an output per hour basis, grew by 1.4% and has been growing for the past seven consecutive quarters.

A 1.4% growth, compared with the same quarter in the previous year, is significantly lower than the long period of average productivity growth prior to the economic downturn, and represents a continuation of the UK's “productivity puzzle”. This sustained stagnation contrasts with patterns following previous UK economic downturns, when productivity initially fell, but subsequently recovered to the previous trend rate of growth. There is wide and varied economic debate regarding the causes of this puzzle and further analysis of recent UK productivity trends can be found in the January 2016, May 2016 and June 2016 Economic reviews, as well as in several stand-alone articles including: What is the productivity puzzle?, The productivity conundrum, explanations and preliminary analysis and The productivity conundrum, interpreting the recent behaviour of the economy.

This puzzle is shown in Figure 1, which presents two alternative measures of productivity – output per hour and output per worker – alongside their projected 1994 to 2007 trends. Following years of steady growth, each measure peaked prior to and fell during the economic downturn. However, due to a strong labour market performance accompanying a relatively weak recovery in output growth, productivity has not returned to its pre-downturn trend. Productivity in Quarter 2 (Apr to June) 2018, as measured by output per hour, was 17.6% below its pre-downturn trend – or, equivalently, productivity would have been 21.4% higher had it followed this pre-downturn trend1 .

Labour productivity increased by 0.5% in Quarter 2 2018. This increase left productivity 1.9% above its peak in Quarter 4 (Oct to Dec) 2007, prior to the economic downturn.

Figure 1: Output per hour and output per worker

Seasonally adjusted, Quarter 1 (Jan to Mar) 1994 to Quarter 2 (Apr to June) 2018, UK

Source: Office for National Statistics

Download this chart Figure 1: Output per hour and output per worker

Image .csv .xlsFigure 2 breaks down the growth in productivity between Quarter 1 (Jan to Mar) 2008 and Quarter 2 2018 into contributions from different industry groupings and an “allocation effect” due to changes in the share of output and labour in each grouping. All else being equal, stronger productivity growth in any given industry, or a movement of output and labour towards higher productivity industries, will tend to increase aggregate productivity growth, while the opposite would reduce it.

Non-financial services were the main positive contributor to productivity growth over this period, partly offset by negative contributions from non-manufacturing production and finance. The negative allocation effect – suggesting that output and labour have been moving away from higher to lower productivity industries in recent years – partly captures the falling share of output in mining and quarrying, which has among the highest levels of productivity of UK industry. This is partially a result of the falling reserves of oil and gas in the North Sea. Although negative for the period as a whole, the allocation effect was initially positive following the downturn, but turned negative in recent years.

Figure 2: Contributions to growth of whole economy output per hour

Seasonally adjusted, cumulative quarterly changes, Quarter 1 (Jan to Mar) 2008 to Quarter 2 (Apr to June) 2018, UK

Source: Office for National Statistics

Notes:

- Non-manufacturing production refers to: agriculture, forestry and fishing; mining and quarrying; electricity, gas, steam and air-conditioning supply; and water supply, sewerage, waste management and remediation activities.

Download this chart Figure 2: Contributions to growth of whole economy output per hour

Image .csv .xlsNotes for: Labour productivity up for the seventh consecutive quarter compared with a year ago

- Differences between these two measures are due to differences in the denominator used in the calculation. Using the actual output per hour series as the denominator, rather than the trend series, results in a higher percentage gap. This is due to the actual series being lower than the trend series post-downturn.

4. Output per hour up in both services and manufacturing, compared with a year ago

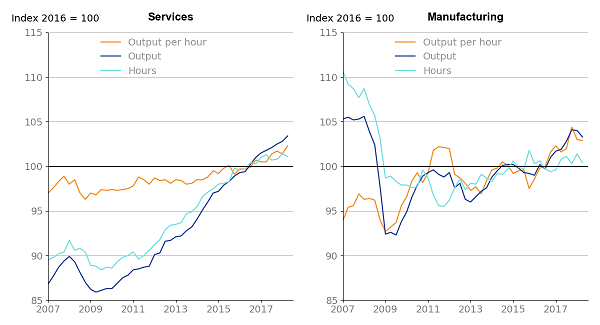

Services output per hour, compared with the same period a year ago, increased by 1.8% in the latest quarter (Quarter 2 (Apr to June) 2018), with output increasing significantly faster than the decrease in hours worked. Similarly, over the year, in manufacturing, labour productivity increased by 1.3%, with output growing faster than the decrease in hours worked. Compared with the previous quarter, output per hour in services increased by 0.9% and in manufacturing decreased by 0.1%.

Figure 3 examines longer-term trends, showing output per hour and its components since Quarter 1 (Jan to Mar) 2008. Services are represented in the left-hand panel, while manufacturing is represented in the right-hand panel. Manufacturing output per hour has been more volatile than services in recent years. This reflects a degree of divergence in manufacturing between gross value added (GVA) and hours, most noticeable in 2009 and between 2011 to 2012, whereas in services, GVA and hours follow fairly similar trends.

Figure 3: Components of services and manufacturing productivity measures

Quarter 1 (Jan to Mar) 2007 to Quarter 2 (Apr to June) 2018

Source: Office for National Statistics

Download this image Figure 3: Components of services and manufacturing productivity measures

.png (35.0 kB) .xls (23.0 kB)5. Unit labour costs grow for the thirteenth consecutive quarter

Unit labour costs (ULCs) reflect the full labour costs, including social security and employers’ pension contributions, incurred in the production of a unit of economic output. Changes in labour costs are a large factor in overall changes in the cost of production. If increased costs are not reflected in increased output, for instance, this can put upward pressure on the prices of goods and services – sometimes referred to as “inflationary pressure”. ULCs grew by 2.0% in the year to Quarter 2 (Apr to June) 2018, reflecting a larger percentage increase in labour costs per hour than output per hour, although this growth level has been fairly consistent over the last three years, as shown in Figure 4.

This shows changes in ULCs since Quarter 1 (Jan to Mar) 2008 compared with the same quarter a year earlier. Holding other factors constant, increasing output per hour reduces ULCs as total labour costs remain constant while output rises. As a result, output per hour has its sign reversed in Figure 4. In this presentation, positive output per hour growth has a negative effect on ULC growth, while negative output per hour growth has a positive effect on ULC growth.

While growth in ULCs has been broadly positive since the onset of the economic downturn, averaging around 1.5% since Quarter 1 2008, there has been substantial variation during this period. During the recent economic downturn, ULCs began to grow at a relatively high rate, reaching a peak of 6.3% by the end of the downturn in Quarter 2 2009 and remaining elevated until Quarter 1 2010. Figure 4 shows that the initial increase in ULC growth during the downturn was driven by falling output per hour, but from Quarter 2 2009 onwards, increasing labour costs per hour were the driving factor. Following the downturn, growth in ULCs began to slow, eventually becoming negative in Quarter 2 2010.

Following a period of low or negative growth, ULC growth has fluctuated around 2% for the past two years. This increase broadly reflects higher hourly labour cost growth, with relatively little offsetting output per hour growth.

Figure 4: Whole economy unit labour costs and their compositions, growth on quarter a year ago

Seasonally adjusted, UK, Quarter 1 (Jan to Mar) 2008 to Quarter 2 (Apr to June) 2018, UK

Source: Office for National Statistics

Notes:

- Labour costs per hour estimates will differ from those in our Index of Labour Costs per Hour bulletin, due to differences in methodology.

Download this chart Figure 4: Whole economy unit labour costs and their compositions, growth on quarter a year ago

Image .csv .xls6. Experimental industry by region productivity statistics

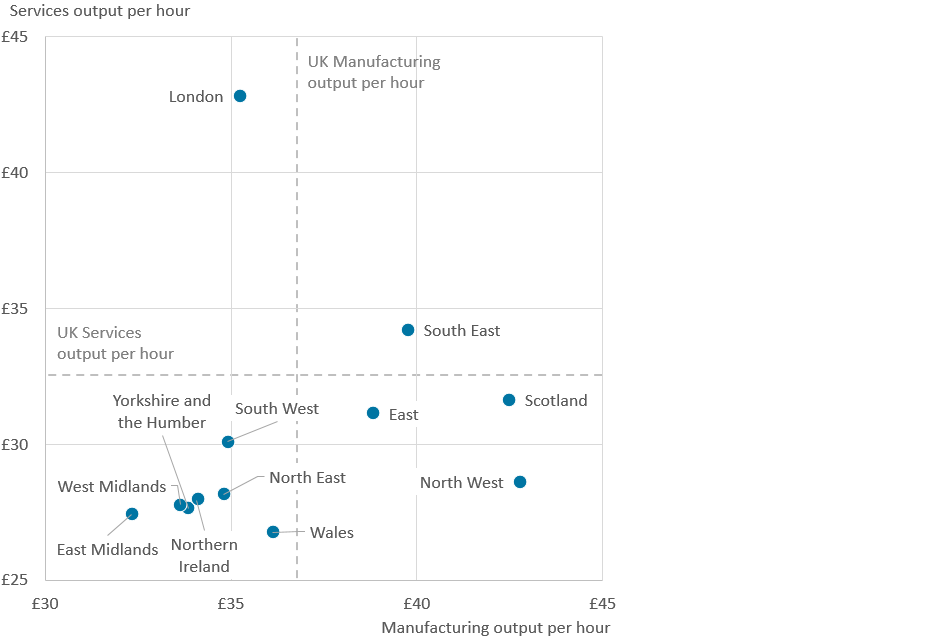

In July 2017, we introduced a dataset of labour productivity for 16 industry sections by Nomenclature of Units for Territorial Statistics (NUTS1) regions of the UK. These experimental statistics provide estimates for output per hour and output per job for each industry section in the NUTS1 region, as well as productivity hours and jobs estimates. Although the methodology employed differs from the National Statistics estimates presented in this release, the datasets have been welcomed by regional users and we plan to incorporate a regular section in the labour productivity statistical bulletin. We are also working in co-operation with the UK Statistics Authority to badge these datasets as National Statistics. For more information about the methodology of these experimental statistics, please see this article.

Figure 5 presents output per hour for the manufacturing and services industries in the UK economy by each of the regions, taking into account the total hours worked in each region. Although London records the highest output per hour in services, the North West and Scotland record the largest output per hour in manufacturing.

Figure 5: Output per hour in services and manufacturing by region

Current prices, 2016

Source: Office for National Statistics

Notes:

- Please note: The unit measurement within the Excel (.xls) dataset for this figure was altered from “£ per million” to “£” on 23 November 2018.

- Output per hour is in current prices.

- Services includes industries G to T.

Download this image Figure 5: Output per hour in services and manufacturing by region

.png (30.0 kB) .xls (36.4 kB)Figure 6 shows the annual growth rates for the manufacturing industry, comparing the periods before and after the economic downturn. Output per hour for manufacturing, grew by 4.4% per year on average before the economic downturn. On a regional basis, Yorkshire and The Humber, the North East, the East, and the North West experienced the largest slowdowns in average growth in labour productivity, with growth in output per hour 5 percentage points lower than growth in the pre-downturn period. London and Wales recorded a post downturn growth rate of around 1 percentage point compared with the pre-downturn period.

Figure 6: Output per hour in manufacturing by region

Chain volume measure, 2016

Source: Office for National Statistics

Download this chart Figure 6: Output per hour in manufacturing by region

Image .csv .xls8. What’s changed in this release?

Revisions

This release reflects methodological improvements to productivity hours, which revised the levels of productivity from Quarter 1 (Jan to Mar) 1994 within particular industries. These improvements have relatively little effect on patterns of growth over time for individual industries and only a small effect on total hours worked across the whole economy (due to the use of unrounded total hours worked). Further information can be found in the article Improvements to the latest Labour productivity bulletin: October 2018, published on 14 September 2018.

Revisions to gross value added and income data from quarterly national accounts are consistent with the UK economic accounts published on 28 September 2018 and they affect the time series from Quarter 1 2017.

Revised estimates in employee jobs have been incorporated for Quarter 1 2018, while latest data from HM Treasury have small effects on employment subsidies and subsequently to unit labour costs, from Quarter 1 2017. Revised estimates from HM Forces have had minor effects on the East of England and the South East for Quarter 3 (July to Sept) 2017 onwards.

Revisions resulting from seasonal adjustment affect all periods, where seasonal adjustment is applied.

Methodological changes

Methodological improvements have been introduced when calculating productivity hours. The improvements (discussed at our February 2018 User Group) include an improved mapping of industry classification prior to 2009; greater consistency across higher and lower levels of industry aggregation; the use of additional data that improve the coverage of labour hours; consistent treatment of Labour Force Survey hours and jobs in mining of metal ores; as well as the application of a seasonal adjustment review.

Both the primary-section level data in LPROD01 as well as the experimental industry-by-region data have been affected by these methodological improvements, within particular industries. There is additionally a very small effect on total productivity hours worked across the whole economy due to the use of unrounded total labour hours.

Further information on the methodological improvements can be found in the article Improvements to the latest Labour productivity bulletin: October 2018 published on 14 September 2018.

Commentary on experimental industry by region productivity statistics

The bulletin introduces commentary on industry by region productivity statistics, with a focus on output per hour in manufacturing industries by region.

International comparisons of UK productivity

In the previous statistical bulletin International comparisons of UK productivity (ICP), final estimates: 2016, we informed users that the Organisation for Economic Co-operation and Development (OECD) had discontinued the publication of their Annual Labour Force Statistics (ALFS) database total employment measure, which has historically been used as the employment measure for ICP. In the absence of these data, Office for National Statistics (ONS) was using an interim method, pending a more detailed review of the international comparisons of productivity labour inputs and further engagement with OECD.

Due to an ongoing review of the methodology, the International comparisons of UK productivity: first estimates 2017 will not be published as part of this release. Further information can be found in the previous statistical bulletin International comparisons of UK productivity (ICP), final estimates: 2016.

Nôl i'r tabl cynnwys9. Quality and methodology

The measure of output used in these statistics is the chained volume (real) measure of gross value added (GVA) at basic prices, with the exception of the regional analysis in Table 9, where the output measure is nominal GVA (NGVA), using the income approach. These measures differ because NGVA is not adjusted to account for price changes; this means that if prices were to rise more quickly in one region than the others, then the measures of productivity for that region could show relative growth in productivity compared with other regions purely as a result of the price changes.

Labour input measures used in this bulletin are known as “productivity jobs” and “productivity hours”. Productivity jobs differ from the workforce jobs (WFJ) estimates, published in Table 6 of our Labour market statistical bulletin, in three ways:

to achieve consistency with the measurement of GVA, the employee component of productivity jobs is derived on a reporting unit basis, whereas the employee component of the WFJ estimates is on a local unit basis

productivity jobs are scaled so industries sum to total Labour Force Survey (LFS) jobs – note that this constraint is applied in non-seasonally adjusted terms; the nature of the seasonal adjustment process means that the sum of seasonally adjusted productivity jobs and hours by industry can differ slightly from the seasonally adjusted LFS totals

productivity jobs are calendar quarter average estimates, whereas WFJ estimates are provided for the last month of each quarter

Productivity hours are derived by multiplying employee and self-employed jobs at an industry level (before seasonal adjustment) by average actual hours worked from the LFS at an industry level. Results are scaled so industries sum to total unadjusted LFS hours and then seasonally adjusted. Labour productivity is then derived using growth rates for GVA and labour inputs in line with the following equation:

Industry estimates of average hours derived in this process differ from published estimates (found in Table HOUR03 in the Labour market statistics release), as the HOUR03 estimates are calculated by allocating all hours worked to the industry of main employment, whereas the productivity hours system takes account of hours worked in first and second jobs by industry.

Whole-economy unit labour costs (ULCs) are calculated as the ratio of total labour costs (that is, the product of labour input and costs per unit of labour) to GVA. Further detail on the methodology can be found in Revised methodology for unit wage costs and unit labour costs: explanation and impact.

The equation for growth of ULCs can be calculated as:

Manufacturing unit wage costs are calculated as the ratio of manufacturing average weekly earnings to manufacturing output per filled job. On 28 November 2012 we published Productivity measures: sectional unit labour costs, describing new measures of ULCs below the whole-economy level and proposing to replace the currently published series for manufacturing unit wage costs with a broader and more consistent measure of ULCs.

A research note, Sources of revisions to labour productivity estimates, is available and further commentary on the nature and sources of the revisions introduced in this quarter is available in the UK productivity bulletin – introduction.

The Labour productivity Quality and Methodology Information report contains important information on:

the strengths and limitations of the data and how it compares with related data

uses and users of the data

how the output was created

the quality of the output including accuracy of the data