1. Executive summary

This is an annual publication, showing the UK national balance sheet (NBS) by type of asset and institutional sector.

It includes a breakdown of produced and non-produced non-financial assets and total financial assets and liabilities to derive the net worth.

The NBS shows the estimated market value of financial and non-financial assets in the UK. This is the value of what these assets would realise if sold on the market. As such they are a measure of the wealth, or total net worth, of the UK.

The NBS is compiled using a cross section of approximately 140 data sources. This includes direct responses and figures supplied by other government departments and agencies, figures taken from annual reports of public corporations and major businesses and data from the Office for National Statistics (ONS) series. Figures for fixed assets are sourced from estimates of UK net capital stocks and modelled in the perpetual inventory method (PIM). This method is explained in the Capital stocks and capital consumption QMI.

Nôl i'r tabl cynnwys2. Output quality

This report provides information describing the quality of the output and details any points that should be noted when using the output.

Office for National Statistics (ONS) has developed Guidelines for Measuring Statistical Quality; these are based upon the six European Statistical System (ESS) quality dimensions. This report addresses the quality dimensions and important quality characteristics, which are:

- relevance

- timeliness and punctuality

- comparability

- coherence

- accuracy

- output quality trade-offs

- assessment of user needs and perceptions

- accessibility and clarity

More information is provided about these quality dimensions in the following sections.

Nôl i'r tabl cynnwys3. About the output

Relevance

The degree to which the statistical outputs meet users’ needs.

The national balance sheet (NBS) is produced annually and used internally by Office for National Statistics (ONS) in the national accounts and sector and financial accounts. The information is used externally by the Bank of England and Her Majesty’s Treasury to monitor economic performance and inform monetary and fiscal policy decision. The information is also used by the statistical office of the European Union (Eurostat), to make comparisons across EU member states.

Timeliness and punctuality

The NBS estimates are usually published 8 to 10 months after the end of the reference year, in the annual Blue Book publication. These estimates are republished in the UK national balance sheet publication.

For more details on related releases, the release calendar is available online and provides 12 months’ advanced notice of release dates. If there are any changes to the pre-announced release schedule, public attention will be drawn to the change and the reasons for the change will be explained fully at the same time, as set out in the Code of Practice for Statistics.

Nôl i'r tabl cynnwys4. How the output is created

The national balance sheet (NBS) shows the market value of financial and non-financial assets in the UK. As such they are a measure of the UK net worth. Assets within the NBS can be broken down by their method, as shown in Table 1.

Table 1: Assets in the national balance sheet

| Asset | Source |

|---|---|

| Fixed assets | Net capital stocks |

| Inventories | Gross capital formation |

| Land | Residual method |

| Financial assets and liabilities | National accounts |

| Source: Office for National Statistics | |

Download this table Table 1: Assets in the national balance sheet

.xls (27.1 kB)Fixed assets

The market value of fixed assets is sourced from Office for National Statistics (ONS) estimates of net capital stock, which are created using a perpetual inventory method (PIM) by asset, industry and institutional sector.

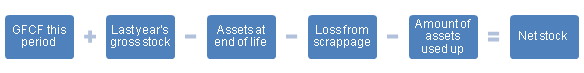

The PIM is a model that enables balance sheets to be calculated from the associated flows, modelling the stock levels of various assets owned by different industries. The PIM takes estimates of gross fixed capital formation as the sum of investment into an asset and adds them to the previous estimates of the stock level of an asset. In this case, the previous stock levels is the value of the assets as if they are new. The value of assets that have reached the end of their useful life and any assets that have been scrapped as a result of bankruptcy are then subtracted from this stock level. A further component is then subtracted from the stock level to account for depreciation of the assets as they lose value over time, generally as a result of wear and tear. The result of this is the net stock estimate for the current period.

Figure 1: Net capital stock calculation

Source: Office for National Statistics

Download this image Figure 1: Net capital stock calculation

.png (3.1 kB)More information on the calculation of net capital stocks and the PIM can be found in the Capital stock and capital consumption QMI.

Inventories

Changes in inventories data are sourced from estimates of gross capital formation, which are added onto previous years’ estimates to produce a current year estimate for the market value of inventories.

Land

Land is calculated through a residual method, where the value of an asset sourced from the net capital stocks data is subtracted from the combined value of the asset and the land underneath it. This provides the value of the land underlying the asset, which is then aggregated across all assets to produce the total land value for a sector.

This is performed for the following fixed assets:

dwellings

other buildings and structures

cultivated biological resources

The method used to calculate the combined value of these assets and their underlying land is outlined in the following paragraphs.

Combined value of dwellings and its underlying land

Dwelling values are modelled using estimates of dwelling stock by Council Tax band at a regional level sourced from the Valuation Office Agency. These are broken down further through assumptions made on tenancy types, with quality of stock adjustments being applied based on housing condition surveys. As these are based on Council Tax bands, these are initially valued using estimates from the valuation year of the Council Tax bands. This valuation is based on data from the Land Registry. This is then adjusted to current year estimates using the UK House Price Index provided by the Land Registry and then aggregated up to a total economy level.

Combined value of other buildings and structures and their underlying land

Other buildings are measured based on rateable value estimates from the Valuation Office Agency. These rateable values are adjusted to market values using capitalisation ratios, which were calculated through comparisons between rateable values and samples of market values. Further adjustments and assumptions are made for smaller aspects of other buildings, such as uncompleted buildings, and these estimates are then aggregated to produce total economy values.

For the value of other structures, data are collected from major sources of infrastructure and aggregated together to produce a total economy value. This includes from HM Treasury for government values, along with company accounts and data from the National Balance Sheet survey for other sectors.

Combined value of cultivated biological resources and its underlying land

Cultivated biological resources considers both agricultural and forestry assets in the balance sheet. While aquaculture should also be considered, lack of data sources means that it is not included in estimates.

Data on agricultural land are available from the Department for Environment, Food and Rural Affairs (Defra) at a total economy level. Institutional sector breakdowns of this land are estimated based on percentage breakdowns of cultivated biological resources from net capital stocks.

Data on forestry land are estimated using a residual method, with estimates of the value of forests and their underlying land provided by UK forestry commissions. The value of the trees, based on estimates provided by the PIM, are deducted from this value to produce a value for forestry land. This value taken from forestry commissions is assumed to be the total forestry land held by central government, which is then scaled up to total economy levels based on the Forestry Commission’s National Inventory of Woodland and Trees publication, which includes the breakdown of forestry land by institutional sector.

More information can be found in Section 3 of the Changes to the national balance sheet for the Blue Book 2017 article, which goes into greater detail on land value and how it is calculated.

Financial assets and liabilities

Data are sourced from various teams across ONS who produce institutional sector level estimates of financial assets and liabilities. These are then collected for the NBS and aggregated to produce total economy estimates.

Estimates of the market value of financial assets and liabilities are also published in the financial balance sheets in the annual Blue Book publication.

Nôl i'r tabl cynnwys5. Validation and quality assurance

Accuracy

The degree of closeness between an estimate and the true value.

The national balance sheet (NBS) estimates are quality assured using a variety of standard practices, such as movement analysis at the sector and asset level. Any atypical movements are investigated to ensure the quality of the data to be published and to understand and explain the movements.

As the NBS estimates are used in the production of the national accounts and Blue Book estimates and are produced according to the national accounts framework, they are subject to the same revisions policy as the Blue Book.

Comparability and coherence

Comparability is the degree to which data can be compared over time and domain, for example, geographic level. Coherence is the degree to which data that are derived from different sources or methods, but refer to the same topic, are similar.

Every effort is made to ensure that the series are comparable over time. Comparable time series are available going back to 1995 for the NBS. Consistency checks and investigations in to any anomalies are carried out at the time of producing the data and confirmed where necessary.

Where possible, changes to the methodology are applied to the whole series to ensure this comparability is maintained. However, the national accounts revisions policy may mean that this is not possible. Another example where this might not be possible is when there are changes to the definitions of the administrative sources, for example, the introduction of the International Financial Reporting Standards (IFRS). In 2005, it was announced that UK companies would be required to produce their accounts in line with the IFRS, to be fully implemented by 2013. The implementation of the IFRS has resulted in the upward revision on the valuation of some tangible assets such as commercial, industrial and other buildings, plant and machinery, and civil engineering work. As there is no obligation for companies to apply IFRS retrospectively, discontinuities in the data series are unavoidable and further information to accurately revise the back series is unavailable. Therefore, it is advisable not to make year-on-year comparisons from 2005 to 2013 for these assets groups, as the changes affect data series across this period.

Since international standards, such as the System of National Accounts (SNA) and the European System of Accounts (ESA), are used in the production of the NBS estimates, the figures should be directly comparable with the accounts of other countries. However, the revisions policies of these countries should be examined before comparing data for back periods.

Nôl i'r tabl cynnwys6. Concepts and definitions

Concepts and definitions describe the legislation governing the output, and a description of the classifications used in the output.

Institutional sectors

Classifications of institutional sectors within the national balance sheet (NBS) are consistent with the System of National Accounts (SNA) and European System of Accounts (ESA). A summary of sectors used in the NBS is shown in Table 2.

Table 2: Institutional sectors used in the UK national balance sheet

| Sector code | Sectors and subsectors | Included sectors |

|---|---|---|

| S.1 | Total economy | S.11 + S.12 + S.13 + S.14 + S.15 |

| S.11 | Non-financial corporations | S.11001 + S.11PR |

| S.11001 | Public non-financial corporations | |

| S.11PR | Private non-financial corporations | |

| S.12 | Financial corporations | |

| S.13 | General government | S.1311 + S.1313 |

| S.1311 | Central government | |

| S.1313 | Local government | |

| S.1HN | Households and NPISH | S.14 + S.15 |

| S.14 | Households | |

| S.15 | NPISH | |

| PS | Public sector | S.11001 + S.13 |

| Source: Office for National Statistics |

Download this table Table 2: Institutional sectors used in the UK national balance sheet

.xls (28.2 kB)Assets

Classifications of assets within the NBS are consistent with SNA and ESA. Definitions of each asset can be found in Annex 7.1 of the ESA 2010 manual (pages 182 to 188).

Non-financial assets include both produced and non-produced assets.

Produced non-financial assets include:

- dwellings

- other buildings and structures

- machinery and equipment

- weapons systems

- cultivated biological resources

- transport equipment

- intellectual property products

- inventories

Non-produced non-financial assets include:

- land

- cherished or personalised vehicle registration plates

Financial assets and liabilities include:

- means of payment, such as currency

- financial claims, such as loans

- economic assets, which are closed to financial claims in nature, such as shares

7. Other information

Output quality trade-offs

Trade-offs are the extent to which different dimensions of quality are balanced against each other.

A trade-off of accuracy over timeliness is made to produce the national balance sheet. An exercise was carried out to assess the viability of producing the national balance sheet (NBS) on a more frequent (than annual) basis, and it was found that the majority of the NBS source data are only available on an annual basis.

Any revisions made to back data from actual sources are also taken on and reflected in the published figures.

The National Statistics revisions policy is available.

Assessment of user needs and perceptions

The NBS will use the guidelines set in the User engagement strategy for the Business Indicators and Balance of Payments division.

Nôl i'r tabl cynnwys8. Sources for further information or advice

Accessibility and clarity

Our recommended format for accessible content is a combination of HTML web pages for narrative, charts and graphs, with data being provided in usable formats such as CSV and Excel. Our website also offers users the option to download the narrative in PDF format. In some instances other software may be used, or may be available on request. For further information please refer to the contact details at the beginning of this report.

For information regarding conditions of access to data, please refer to the following links:

In addition to this Quality and Methodology Information, basic quality information relevant to each release is available in:

Nôl i'r tabl cynnwys