Cynnwys

- Abstract

- Introduction

- Data sources

- Historical estimates of debt securities assets held by the households and NPISH sectors

- Blue Book 2017 revisions to estimates of households and NPISH holding of debt securities

- Historical estimates of debt securities and liabilities issued by the households and NPISH sectors

- Conclusion and next steps

- References

- Relevant Links

- Acknowledgement

1. Abstract

This article is the third in a series of articles presenting our work to reconcile the sources of historical data for the households (HH) and non-profit institutions serving households (NPISH) sectors.

It presents historical time series of the holding of debt securities (AF.3), one of the instruments that appear in the financial account and it describes the resolution of the issues and difficulties faced in developing historical estimates. This work is part of a wider programme within Office for National Statistics (ONS) to reconstruct historical balance sheet data for the different institutional sectors of the UK economy.

We have mainly used the historical balance sheet data sources already referenced in the previous article Historical estimates of financial accounts and balance sheets, but also identified others that contributed to some of the previously published sources. We have explored the way these historical data have been compiled, trying to highlight and to resolve any emerging issues. We hope this will form the basis of an approach that can be used in future publications presenting historic data for the remaining financial assets categories within this institutional sector.

The estimates we have published for the financial assets and liabilities held by the combined HH and NPISH sectors only go back to 1987. The historical time series data in this article provide users with data that go back to 1920. These are provisional estimates and should be evaluated in conjunction with other initiatives, such as the Economic Statistics Centre of Excellence project, which also constructs historical data, although looking at different aspects of the economy.

Nôl i'r tabl cynnwys2. Introduction

As noted in our previous article, Historical estimates of financial accounts and balance sheets, the need to monitor the distribution of assets and liabilities throughout the UK economy has increased since the financial crisis in 2008, highlighting the need for the analysis of financial stocks and flows in the economy and for econometric-based policy work to be put in historical context. The study of infrequent financial events benefits from the availability of long historical time series data that span different government policies and that cover periods of structural change in the financial sector.

Office for National Statistics’ (ONS’s) published annual financial balance sheet data cover only a relatively short period, back to 1987, on a European System of Accounts 2010: ESA 2010 basis. In this article, we focus on debt securities (AF.3), part of the households (HH) and non-profit institutions serving households (NPISH) sectors, and propose a historical time series for use in future analyses (see Reconciling the sources of historic data for the households and non-profit institutions serving households (NPISH) sectors for more information about the AF categories).

ESA 2010 has defined debt securities as negotiable financial instruments serving as evidence of debt and recorded at a market value. It includes both financial assets and liabilities, which may be described according to different classifications: by maturity, holding and issuing sector and subsector, currency and type of interest rate.

The financial transactions in debt securities are divided by original maturity into two categories:

short-term debt securities; for which the original maturity is one year or less

long-term debt securities, for which the original maturity is more than one year

Whilst the household sector does not issue debt securities, it can purchase debt securities issued by other sectors. The NPISH sector can both purchase and issue debt securities.

Currently, ONS publishes balance sheet estimates for debt securities for the HH and NPISH sectors with this short-term and long-term distinction, but also with a further breakdown according to issuing sectors.

The proposed series in this article:

- is for total debt securities level

- contains data relating to periods prior to 1987

- considers differences in the data between different sources for specific time periods

- is consistent with ESA 2010

We invite comments on this time-series and on the general approach. Our intention is to produce further articles presenting similar time-series for the other financial instruments held or issued by the HH and NPISH sectors.

It is worth noting that the content of the personal sector, the category used in our earlier data sources and which is sometimes referred to as being equivalent to the combined HH and NPISH sectors is, in fact, slightly different. For example, the definition of the personal sector in ESA 1995 included partnerships, whereas in ESA 2010, partnerships are included in the definition of the corporate sectors.

A variety of challenges were faced in creating these historical time series, predominantly arising from attempting to reconcile different sources of data. The datasets used were constructed by a variety of authors, over different periods of time, working in different sectors and sometimes using different methodologies. At the granular level, not all sources used the same content (instruments, sub-instruments and headings) when presenting data for a particular financial category. As is often the case with historical data, there were also periods when data were missing for a particular source. Missing data have been dealt with on a case-by-case basis.

The time series produced in this article is an initial step within a wider project, which aims to achieve the reconstruction and restoration of historical data for all economic institutional sectors and for both balance sheets and financial transactions data.

Nôl i'r tabl cynnwys3. Data sources

A variety of data sources have been used and these were described in the article Historical estimates of financial accounts and balance sheets. One main difference between the data on debt securities in that article and the estimates presented in this article is that the former relates to all institutional sectors combined; this article relates specifically to the debt securities of the households (HH) and non-profit institutions serving households (NPISH) sectors. A few of the data sources were enhanced with additional data on debt securities, derived from the Office for National Statistics (ONS) Central Shared Database (CSDB). For more details, please see our previous article on Historic households and non-profit institutions serving households sectors data on currency and deposits. A brief description of the sources for these datasets is given in this section.

Solomou and Weale’s Personal sector wealth in the United Kingdom, 1920 to 1956 (1997), provides estimates for 1920 to 1956, the earliest data we have found for debt securities (AF.3). These personal sector estimates were the only data we found covering this time period. They came from a number of sources, as described in Solomou and Weale’s article. The dataset does not include all the necessary instruments nor is there a detailed instrument breakdown. Nevertheless, it is an impressive dataset that makes the most use of the balance sheet statistics that are available for this time period.

Financial assets and liabilities by institutional sector (Roe, 1971), is taken from Roe’s “Financial Interdependence of the UK Economy” (1971a). This provides a highly detailed breakdown of financial assets and liabilities from 1957 to 1966, organised by both instrument and sector, which is rare for historical balance sheet data. The level of detail will be valuable for estimating the finer level of detail of instruments in other datasets.

Miscellaneous Balance Sheet Data 1957 to 1986: contains miscellaneous official balance sheet data that enable some linking of the pre-ESA 1995 dataset.The data within these spreadsheets were derived from Economic Trends (1980 and 1981) and Financial Statistics Supplementary Tables (1987) publications. The data for the non-bank private sector (NBPS) reported within these balance sheets are less heavily rounded than the data for the other balance sheets. The dataset derived from the Financial Statistics Supplementary Tables will be referred to as FinStats in this article.

Pre-ESA 1995 financial accounts and balance sheets, is the last set of sector financial account and balance sheet estimates produced by ONS under the pre-European System of Accounts 1995: ESA 1995. This was recovered from the annual UK National Accounts (Blue Book) 1997 dataset and contains data as published in mid-1998, prior to the introduction of the ESA 1995 set of accounts. Balance sheet data, by sector, are available only as far back as 1982 for most detailed instruments. However, data for total financial assets and liabilities, by sector, is given back to 1975 for many sectors and in some cases back to 1966. As noted in the article Historical estimates of financial accounts and balance sheets, there are some discrepancies between these totals and the sum of the individual assets and liabilities to which they relate. In this article, we try to find an approach for reconciling these differences.

CSDB-extended pre-ESA 1995 data – this is the main new development presented in our previous article Historic households and non-profit institutions serving households sectors data on currency and deposits and provides a large amount of granular data for earlier years that was not available in the previously-mentioned pre-ESA 1995 source in the earlier article, Historical estimates of financial account and balance sheets. In the CSDB-extended pre-ESA 1995 dataset, sub-instrument data were generally available back to 1966 and, for some sub-instruments, back to 1957. As mentioned in our previous article historic households and non-profit institutions serving households sectors data on currency and deposits, in assessing the validity of this newly-identified data compared with Pre-ESA 1995 financial accounts and balance sheets, the data from the two datasets were found to be highly consistent. Therefore, in this article we have decided that we will use our new, CSDB-extended pre-ESA 1995 data in preference to the pre-ESA 1995 financial accounts and balance sheets.

The final, and important, sources are ONS’s UK Economic Accounts: institutional sector – households and non-profit institutions serving households financial balance sheets 2016 (published 29 September 2017) and 2017 (published 29 June 2018). These data provide a benchmark for the historical series we are aiming to achieve. These datasets were particularly helpful in allocating pre-ESA 1995 balance sheet instruments to ESA 2010 categories.

Nôl i'r tabl cynnwys4. Historical estimates of debt securities assets held by the households and NPISH sectors

The general approach used for the reconstruction and reconciliation of households (HH) and non-profit institutions serving households (NPISH) debt securities historical data is fairly similar to that presented in our previous article Economic Statistics Transformation Programme: enhanced financial accounts (UK flow of funds) – historic households and non-profit institutions serving households (NPISH) sectors data on currency and deposits. The instruments from each dataset were assigned to the appropriate European System of Accounts 2010: ESA 2010 classification, after comparing the instrument definition with the ESA 2010 guidelines. Where possible, the instruments were grouped based on their sub-classification. Once the instruments were classified, they were summed and totals were found for each year, for each classification, in each dataset. These series then translated into a single overlapped series for the total HH and NPISH debt securities data.

One of the main issues faced when attempting to produce a single, historical data series consistent with ESA 2010 for HH and NPISH debt securities was that often we were unable to find sub-instrument estimates overlapping in time to validate the data for earlier years contained in some of the historic sources. As there is no other data source for these earlier years, the broad approach taken in this article was to use the figures as presented in those sources.

A further issue was the lack of debt securities estimates for some sub-instruments for some years. We have tried to find data for any missing sub-instruments using other equivalent detailed sources rather than just using debt securities totals, as this may lead to more accurate totals overall.

In order to reconcile the data from the different historical sources to meet current ESA 2010 requirements we have used data from the last vintage of ESA 2010 Blue Book 2016 (BB16). This is because the BB16 data are much more consistent with other historic data sources estimates and hence would help with the reconciliation process of the historic debt securities data.

Historical estimates of short-term debt securities assets held by households and NPISH

According to the last vintage of ESA 2010 BB16 data, the short-term debt securities total is the sum of five lower-level series:

- debt securities issued by UK central government

- debt securities issued by UK local government

- debt securities issued by UK monetary financial institutions

- money market instruments issued by other UK residents

- money market instruments issued by the rest of the world

Two of these instruments, short-term debt securities issued by UK local government and the money market instruments issued by the rest of the world, were found to have no official published data, or zero in most cases across the time period, see institutional sector – households and non-profit institutions serving households financial balance sheets 2016 and 2017.

This is because it is assumed that holdings and assets for them will be negligible or zero. Instrument Map 1 illustrates the reconciled instruments for short-term debt securities (AF.31). The white cells represent instruments that are either not available, missing or do not meet the full requirements of mapping to the BB16 ESA 2010 classification.

Instrument map 1: reconciled instruments for short-term HH and NPISH debt securities (AF31).

As presented the only historical sources that were found to hold short-term debt securities data were the pre-ESA 1995 pre-ESA 1995 and the Central Shared Database (CSDB)-extended pre-ESA 1995 datasets. Further, checking the data that feeds into each instrument we found no short-term debt security estimates going back further than 1986.

In order to assess the validity of the CSDB-extended pre-ESA 1995 dataset against the current ESA 2010 BB16 dataset, total short-term debt securities data from the two sources were compared, see Figure 1.

Figure 1: Differences in HH and NPISH total short-term debt securities estimates between CSDB-extended pre-ESA 1995 and ESA 2010 BB16 datasets

Source: Office for National Statistics

Notes:

BB is Blue Book.

CSDB is the ONS Central Shared Database.

ESA is European System of Accounts.

HH is households.

NPISH is non-profit institutions serving households.

Download this chart Figure 1: Differences in HH and NPISH total short-term debt securities estimates between CSDB-extended pre-ESA 1995 and ESA 2010 BB16 datasets

Image .csv .xlsFigure 1 shows that the total value of short-term debt securities held by households and NPISH according to the CSDB-extended pre-ESA 1995 data was less in all overlapped years (data available from both sources) when compared with the last vintage of ESA 2010 BB16 data.

As mentioned earlier, this difference is mostly, but not entirely, caused by missing data from some sub-instruments. As shown in the debt securities reconciled instrument map (1), the CSDB-extended data was missing short-term money market instruments (MMI) issued by other UK residents data. To find a replacement the approach adopted was to use the equivalent instrument short-term money market instruments issued by other UK residents data from the last vintage of ESA 2010 BB16 data sector financial account balance sheet, as a proxy for the missing data.

Figure 2 shows that our approach to bridge the difference between the two data sources is plausible and any remaining differences between the two sources could have been caused by periodic revisions.

Figure 2: Differences in HH and NPISH total short-term debt securities estimates between CSDB-extended pre-ESA 1995 and the ESA 2010 BB16 datasets

Source: Office for National Statistics

Notes:

BB is Blue Book.

CSDB is the ONS Central Shared Database.

ESA is European System of Accounts.

HH is households.

MMI is short-term money market instruments.

NPISH is non-profit institutions serving households.

Download this chart Figure 2: Differences in HH and NPISH total short-term debt securities estimates between CSDB-extended pre-ESA 1995 and the ESA 2010 BB16 datasets

Image .csv .xlsHistorical estimates of long-term debt securities assets held by households and NPISH

A challenge faced when attempting to produce a single, historical data series for the long-term debt securities was finding consistency between different historic data sources. One way to improve consistency between sources is to compare similar sub-instrument estimates that overlap in time. Unfortunately, the earlier the historic data the less overlapping data can be found. This is particularly true with the pre-ESA 1995 long-term debt securities sub-instrument data sources, especially at the granular level. As there is no other data source for these earlier years, the broad approach taken was to use the figures as presented in those sources. In addition, historic pre-ESA 1995 aggregated sub-financial instruments data series, such as long-term debt securities, often contain instruments that are missing, mis-classified or incorrectly grouped and which may need to be split. In this article, attempts were made to achieve such splits, but these estimates are very approximate.

As mentioned in our previous article, Historic households and non-profit institutions serving households sector (NPISH) currency and deposits data, an attempt was made to extend the earlier pre-ESA 1995 dataset, which we defined earlier as the final vintage of sector financial account and balance sheet estimates produced by Office for National Statistics (ONS) under the pre-ESA 1995 system of accounts, with further historical data extracted from the ONS CSDB. These CSDB-extended data were extracted back to 1966, the period when official estimates for financial balance sheets data for some sectors based on the pre-ESA 1995 system of accounts had become available.

To assess the validity of the newly identified CSDB households and NPISH long-term debt securities data, total long-term debt securities estimates relating to a 16-year period (1982 to 1997), available from both the pre-ESA 1995 source and the CSDB-extended pre-ESA 1995 data, were examined, (Figure 3).

Figure 3: Combined HH and NPISH sectors total holdings of long-term debt securities, 1982 to 1997

Source: Office for National Statistics

Notes:

HH is households.

NPISH is non-profit institutions serving households.

Download this chart Figure 3: Combined HH and NPISH sectors total holdings of long-term debt securities, 1982 to 1997

Image .csv .xlsAs can be seen in Figure 3, the data from the two datasets are equal. It was, consequently, decided that we would use our new, CSDB-extended pre-ESA 1995 data wherever available in preference to the pre-ESA 1995 sources, with the exception of the ESA 2010 source.

Reconciling long-term debt securities to BB16 ESA 2010 classifications

According to the last vintage of ESA 2010 BB16 data, the long-term debt securities total is the sum of four lower-level series:

- debt securities issued by UK central government

- debt securities issued by UK local government

- debt securities issued by UK monetary financial institutions and other UK residents

- money market instruments issued by other UK residents

Instrument map 2 has been created illustrating the reconciled sources of available data that contribute to the long-term debt securities (AF.32).

Instrument Map 2: reconciled instruments for long-term debt securities (AF32).

The white cells represent instruments that are either missing or do not meet the full requirements of mapping to the BB16 ESA 2010 classification.

Figure 4 shows that there were large differences in long-term debt securities totals between the ESA 2010 BB16 data and data from the historical CSDB-extended pre-ESA 1995. The CSDB-extended pre-ESA 1995 debt securities totals are an average of 45% lower.

Figure 4: Differences in HH and NPISH total long-term debt securities estimates between CSDB-extended pre-ESA 1995 and ESA 2010 BB16 data sets, 1987 to 1997

Source: Office for National Statistics

Notes:

BB is Blue Book.

CSDB is the ONS Central Shared Database.

ESA is European System of Accounts.

HH is households.

NPISH is non-profit institutions serving households.

Download this chart Figure 4: Differences in HH and NPISH total long-term debt securities estimates between CSDB-extended pre-ESA 1995 and ESA 2010 BB16 data sets, 1987 to 1997

Image .csv .xlsAs mentioned earlier, this difference is mostly, but not entirely, caused by missing sub-instruments (see instrument Map 2) from the CSDB-extended pre-ESA 1995 data source. These missing instruments are:

- long-term debt securities issued by UK monetary financial institutions and other UK residents

- bonds issued by the rest of the world

Further investigation to the components and metadata that feed into the measurements of these missing instruments revealed that data are available for one of these instruments, that is, debt securities issued by UK monetary financial institutions and other UK residents, within the historical ONS CSDB but under a different label, UK Corp {corporation} securities debentures and loan stock, and that the data for this instrument do go back to 1966.

To assess the validity of these data, overlapped data periods were compared. Figure 5 suggests that the UK Corp securities debentures and loan stock data are plausible and consistent with the debt securities issued by UK monetary financial institutions and other UK residents taken from the ESA 2010 BB16 dataset (1987 to 1997). This is except for the periods 1987 to 1989 for which ESA 2010 BB16 data were reported as zeros from the official statistics publication. This was because the data for this period were assumed to be negligible or zeros, therefore, it was decided that the data from 1990 to 1997 overall were highly consistent. Consequently, the instrument UK Corp securities debentures and loan stock was added to the CSDB-extended pre-ESA 1995 data source.

Figure 5: Comparing the two instruments: debt securities issued by UK monetary financial institutions and other UK residents, and UK Corp securities debentures and loan stock

Source: Office for National Statistics

Download this chart Figure 5: Comparing the two instruments: debt securities issued by UK monetary financial institutions and other UK residents, and UK Corp securities debentures and loan stock

Image .csv .xlsRegarding the availability of historical data for the other missing instrument, bonds issued by the rest of the world, the situation is more complicated. This is due mainly to the lack of harmonisation of financial statistics instruments prior to ESA 1995. The majority of the historical sources under consideration grouped instruments together in a way that was quite different from the way set out in ESA 2010. This was the case for bonds issued by the rest of the world (see updated instrument Map 3).

Our investigation has revealed that throughout the early datasets under consideration, bonds issued by the rest of the world formed part of an instrument referred to as either overseas securities, overseas assets or foreign assets. Furthermore, this instrument was often allocated to the equity and investment fund shares or units financial category (AF.5) within HH and NPISH sectors and represents mainly a combination of:

- overseas government securities: equivalent to the sum of investment by unnamed entity’s bonds overseas, and investment in rest of the world bonds; together these form the current ESA 2010 BB16 bonds issued by the rest of the world instrument

- overseas company securities, or what is also referred to as investment in rest of the world shares

See instrument map 3.

Instrument Map 3: updated reconciled instruments and components for long-term Debt Securities (AF32).

Using the CSDB-extended pre-ESA 1995 source of data, overseas securities instrument data were extracted back to 1966. However, as mentioned previously, this instrument mainly combines two instruments: overseas government securities (investment by unnamed entity’s bond overseas and investment in rest of the world bonds), and overseas company securities (investment in rest of the world shares) and since we only require one of them, the overseas government securities, a split is required.

Since such a split is not readily available from published sources, data for the overseas securities components, as listed in instrument map (3), needed to be extracted from the ONS CSDB database. The components include:

- investment by unnamed entity’s bonds overseas

- investment in rest of the world bonds

- investment in rest of the world shares

However, the data within these components go back only to 1979.

To assess the validity of this data, a snapshot (11 years period) of the sum of investment by unnamed entity’s bonds overseas, and investment in rest of the world bonds data, (which make up the overseas government securities) extracted from the historic ONS CSDB database and added to the CSDB-extended pre-ESA 1995 dataset. This then was compared with the equivalent bonds issued by rest of the world data from the ESA 2010 BB16 dataset. The result is presented in Figure 6.

Figure 6: Comparison of bonds issued by the rest of the world and overseas government securities

Source: Office for National Statistics

Download this chart Figure 6: Comparison of bonds issued by the rest of the world and overseas government securities

Image .csv .xlsAs can be seen in Figure 6, the data from the two datasets were identical. However, as mentioned earlier the newly-found split of overseas government securities and overseas company securities data goes back only to 1979. In order to achieve this split further back in time, we needed to use a similar split of overseas government securities and overseas company securities data as found in the Roe (1971) historic source of data for the period 1957 to 1966.

In order to estimate the overseas government securities (bonds issued by rest of the world) for the period 1967 to 1978, an average percentage 46%, representing overseas government securities to total overseas securities, was estimated using the average percentage of overseas government securities from the CSDB-extended pre-ESA 1995 dataset (1979 to 1997) and the average percentage of overseas government securities from the Roe dataset (1957 to 1966). The 46% is an average of these two averages. Table 1 presents the data used for calculating the averages.

Table 1: The CSDB-extended PreESA95 and Roe data sets used for calculating the proportions (in£m)

| CSDB-extended Pre-ESA 95 data | Roe data set | ||||||

|---|---|---|---|---|---|---|---|

| Period | Overseas securitities | Overseas government securities | Overseas company securitities | Period | Overseas securities | Overseas government securities | Overseas company securities |

| 1979 | 2,966 | 1,971 | 995 | 1957 | 1,104 | 377 | 727 |

| 1980 | 3,220 | 2,074 | 1,146 | 1958 | 1,388 | 432 | 956 |

| 1981 | 4,490 | 2,793 | 1,697 | 1959 | 1,267 | 433 | 834 |

| 1982 | 6,349 | 3,978 | 2,371 | 1960 | 1,120 | 394 | 726 |

| 1983 | 6,967 | 4,701 | 2,266 | 1961 | 1,643 | 461 | 1,182 |

| 1984 | 8,114 | 6,075 | 2,039 | 1962 | 1,759 | 431 | 1,328 |

| 1985 | 8,141 | 5,800 | 2,341 | 1963 | 1,643 | 397 | 1,246 |

| 1986 | 10,290 | 6,474 | 3,816 | 1964 | 1,661 | 428 | 1,233 |

| 1987 | 9,876 | 6,522 | 3,353 | 1965 | 1,618 | 385 | 1,233 |

| 1988 | 11,384 | 7,620 | 3,764 | 1966 | 1,582 | 364 | 1,218 |

| 1989 | 12,445 | 8,101 | 4,344 | ||||

| 1990 | 11,505 | 7,149 | 4,356 | ||||

| 1991 | 12,654 | 8,189 | 4,465 | ||||

| 1992 | 14,240 | 9,301 | 4,939 | ||||

| 1993 | 16,399 | 10,365 | 6,034 | ||||

| 1994 | 16,818 | 10,695 | 6,123 | ||||

| 1995 | 19,140 | 11,906 | 7,234 | ||||

| 1996 | 13,499 | 6,385 | 7,114 | ||||

| 1997 | 15,226 | 6,748 | 8,478 | ||||

Download this table Table 1: The CSDB-extended PreESA95 and Roe data sets used for calculating the proportions (in£m)

.xls (37.4 kB)This gives two complete, split series for overseas securities (overseas government and overseas company securities) back to 1966 for the CSDB-extended pre-ESA 1995 dataset on debt securities. These averages are then used, in turn, to split overseas securities within the Finstats 1978 to 1985, NPBS 1976 to 1986 and NPBS 1966 to 1980 datasets. It was decided that the estimated average percentage split for the period 1957 to 1966, from Roe (1971), should also be applied to the Solomou and Weale instrument of foreign assets data in order to separately estimate overseas government securities and overseas company securities for this dataset.

The impact of adding in the constructed missing series, long-term debt securities:

- issued by UK monetary financial institutions and other UK residents

- issued by the rest of the world

to the preliminary estimates of HH and NPISH holdings of long-term debt securities that were presented in Figure 4 can be seen in Figure 7.

Figure 7: Differences in HH and NPISH total long-term debt securities estimates between the updated CSDB-extended pre-ESA 1995 and ESA 2010 BB16 data sets, 1987-1997

Source: Office for National Statistics

Notes:

BB is Blue Book.

CSDB is the ONS Central Shared Database.

ESA is European System of Accounts.

HH is households.

NPISH is non-profit institutions serving households

Download this chart Figure 7: Differences in HH and NPISH total long-term debt securities estimates between the updated CSDB-extended pre-ESA 1995 and ESA 2010 BB16 data sets, 1987-1997

Image .csv .xlsAs can be seen, the CSDB-extended pre-ESA 1995 data source estimates of long-term debt securities held by households and NPISH have improved considerably, compared with the starting position in Figure 4. It is judged that these estimates are now in line with the estimates from the ESA 2010 BB16 dataset. The period 1987 to 1989 is an exception as data for debt securities issued by UK monetary financial institutions and other UK residents in BB16 were assumed to be negligible or zeros.

Using the previous reconciled estimates, Figure 8 shows the HH and NPISH total debt securities historical estimates on a consistently-defined BB16 ESA 2010 basis. It shows the reconciled datasets from the different sources are now fairly harmonious overall for this instrument, especially between the ESA 2010 BB16 dataset (1987 to 2016) and the CSDB-extended pre-ESA 1995 dataset (1966 to 1997). The only data highlighting a degree of divergence were the non-bank private sector balance sheets for the period 1966 to 1980 and Solomou and Weale’s Personal sector wealth in the United Kingdom, 1920 to 1956, which we believe overestimate the direct holdings of long-term debt securities by the HH and NPISH sector. See Table 2 for complete granular level datasets.

Figure 8: The reconciled debt securities historical estimates for the HH and NPISH sectors in line with BB16 ESA 2010 definitions, 1920 to 2016

Source: Office for National Statistics

Notes:

BB is Blue Book.

ESA is European System of Accounts.

HH is households.

NPISH is non-profit institutions serving households

Download this chart Figure 8: The reconciled debt securities historical estimates for the HH and NPISH sectors in line with BB16 ESA 2010 definitions, 1920 to 2016

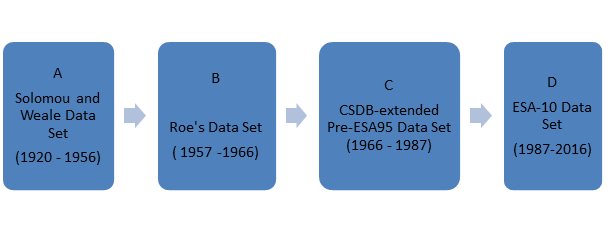

Image .csv .xlsHaving highlighted the issues and methods previously, Figure 9 identifies what we believe to be the best building blocks to use for the construction of historical time series of HH and NPISH holdings of debt securities.

Figure 9: The datasets forming the HH and NPISH debt securities (AF.3) historical series

Notes:

HH is households.

NPISH is non-profit institutions serving households.

Download this image Figure 9: The datasets forming the HH and NPISH debt securities (AF.3) historical series

.png (10.4 kB)Using these building blocks, Figure 10 illustrates the suggested experimental historical time series estimates for the combined HH and NPISH sectors’ holdings of debt securities, consistent with ESA 2010 BB16, 1920 to 2016.

Figure 10: Total debt securities assets estimates for the HH and NPISH sectors consistent with BB16 ESA 2010, 1920 to 2016

Source: Office for National Statistics

Notes:

BB is Blue Book.

ESA is European System of Accounts.

HH is households.

NPISH is non-profit institutions serving households.

Download this chart Figure 10: Total debt securities assets estimates for the HH and NPISH sectors consistent with BB16 ESA 2010, 1920 to 2016

Image .csv .xlsAll of the series in Figure 10 have been left disjointed to highlight breaks in the series. One noticeable break is the Solomou and Weale’s time series data, which we believe overestimate the direct holdings of long-term debt securities by the HH and NPISH sector. This is because they also include indirect holdings of government bonds held in pension funds and insurance companies, which are in the HH and NPISH insurance, pension and standardised guarantee schemes (AF.6). These data will be revisited in future when we consider the HH and NPISH historic time series for the AF.6 category as part of the enhanced financial account continuous development work.

Nôl i'r tabl cynnwys5. Blue Book 2017 revisions to estimates of households and NPISH holding of debt securities

As mentioned earlier, Blue Book 2017 introduced revisions to households (HH) and non-profit institutions serving households (NPISH) debt security estimates.as follows.

Prior to Blue Book 2017, only combined HH and NPISH data were published in the UK's Sector Accounts. Existing data sources were not able to identify individual holdings for these two sectors. Therefore, in Blue Book 2017, new sources for the measurement of a number of HH and NPISH financial and non-financial transactions in the UK’s Sector Accounts were introduced. Included in these were the take-on of new source data for debt securities:

- for HH assets of debt securities issued by UK and overseas residents, the Wealth and Assets Survey (WAS) is now being used to determine financial balance sheet information

- NPISH assets of debt securities are now partly derived from a sample of published charity accounts; these are grossed up using total income recorded in all charity accounts to represent the whole of the NPISH sector

It should be noted that only limited information is available on the specific instruments that the HH and NPISH sectors hold within domestic securities from the new sources. To achieve asset levels for each instrument, administrative and survey data available prior to Blue Book 2017 are used in combination with the new source data to achieve a measure for each instrument. Overseas securities are separately identifiable in the WAS data for the HH sector. NPISH overseas securities are then calculated as a residual once all institutional sectors’ assets are removed.

As data were not available back to 1997, a statistical back-cast has been applied to the data where a new data source has been used. Table 3 provides a summary of the data sources used for balance sheet estimates of separate HH and NPISH holdings of debt securities in comparison with the methods applied to the combined HH and NPISH sector prior to Blue Book 2017.

Table 3: A summary of the data sources used for balance sheet estimates of separate HH and NPISH holdings of Debt Securities

| Instrument | Pre-BB17 Household & NPISH combined Source(s) | BB17 Household Source(s) | BB17 NPISH Source(s) |

|---|---|---|---|

| AF.31N1 | Zero series | Zero series | Zero series |

| AF.31N2 | Zero series | Zero series | Zero series |

| AF.31N5 | Residual | Step 1. Wealth and Assets Survey sets Domestic total | Step 1. Selected Charity accounts sets Domestic total |

| Step 2. Existing administrative and survey source sets individual asset holding allocation | Step 2. Existing administrative and survey source sets individual asset holding | ||

| AF.31N6 | Residual | Step 1. Wealth and Assets Survey sets Domestic total | Step 1. Selected Charity accounts sets Domestic total |

| Step 2. Existing administrative and survey source sets individual asset holding allocation | Step 2. Existing administrative and survey source sets individual asset holding | ||

| AF.31N9 | Zero series | Zero series | Zero series |

| AF.32N1 | Residual | Step 1. Wealth and Assets Survey sets Domestic total | Step 1. Selected Charity accounts sets Domestic total |

| Step 2. Existing administrative and survey source sets individual asset holding allocation | Step 2. Existing administrative and survey source sets individual asset holding | ||

| AF.32N2 | Residual | Step 1. Wealth and Assets Survey sets Domestic total | Step 1. Selected Charity accounts sets Domestic total |

| Step 2. Existing administrative and survey source sets individual asset holding allocation | Step 2. Existing administrative and survey source sets individual asset holding | ||

| AF.32N5-6 | Financial Assets and Liabilities Survey (FALS) | Step 1. Wealth and Assets Survey sets Domestic total | Step 1. Selected Charity accounts sets Domestic total |

| Step 2. Existing administrative and survey source sets individual asset holding allocation | Step 2. Existing administrative and survey source sets individual asset holding | ||

| AF.32N9 | Forecast | Wealth and Assets Survey | Residual |

| Source: Office of National Statistics | |||

Download this table Table 3: A summary of the data sources used for balance sheet estimates of separate HH and NPISH holdings of Debt Securities

.xls (38.4 kB)The impact of the inclusion of new data sources for both sectors up to 1997 and subsequent statistical back-casting to 1987, was to substantially reduce the size of the combined HH and NPISH balance sheet assets of debt securities (AF.3). Figure 11 illustrates the impact of revisions on the combined HH and NPISH balance sheet assets.

Figure 11: The BB17 revisions to the HH and NPISH debt securities assets estimates

Source: Office for National Statistics

Notes:

BB is Blue Book.

HH is households.

NPISH is non-profit institutions serving households.

Download this chart Figure 11: The BB17 revisions to the HH and NPISH debt securities assets estimates

Image .csv .xlsDriving this revision were changes to two particular transactions: long-term debt securities issued by central government (AF .32N1) and long-term debt securities issued by rest of the world (AF .32N9). As seen in Table 3, for long-term debt securities issued by central government, a previous residual method of estimating sector holdings was replaced with estimates based on new source data. For long-term debt securities issued by rest of the world, new source data for households replaced a previous forecast method.

As discussed previously a much lower level of assets was identified for the combined HH and NPISH sector in Blue Book 2017, up to 1997. Therefore, consideration had to be given to removing a “level shift” that would have been evident for certain instruments when comparing previously published data between years 1987 and 1996 and the Blue Book 2017 data derived from 1997 onwards. As also mentioned previously, new source data used to measure the HH and NPISH sectors did not provide information for earlier years, prior to 1997. It was therefore decided to treat each financial instrument on an individual basis based on information that was available to inform this back cast, including consideration of the liabilities of the issuing sector and the asset holdings of other sectors with similar investment behaviours. Table 4 provides a summary of the methods used to estimate historic HH and NPISH balance sheet holdings of debt securities, 1987 to 1997.

Table 4: A summary of the methods used to estimate historic HH and NPISH balance sheet holdings of debt securities, 1997 to 1987.

| Instrument | Household & NPISH sector estimation method used |

|---|---|

| Short-term (AF.31) | |

| AF.31N1 | No change to historic data |

| AF.31N2 | No change to historic data |

| AF.31N5 | No change to historic data |

| AF.31N6 | Statistical backcast; consideration given to the assets of the PNFC sector in this period |

| AF.31N9 | No change to historic data |

| Long-term (AF.32) | |

| AF.32N1 | Statistical backcast; consideration given to the liabilities of Central Government |

| AF.32N2 | No change to historic data |

| AF.32N5-6 | Statistical backcast |

| AF.32N9 | Statistical backcast; consideration given to the assets of the PNFC sector in this period |

| Source: Office of National Statistics | |

Download this table Table 4: A summary of the methods used to estimate historic HH and NPISH balance sheet holdings of debt securities, 1997 to 1987.

.xls (35.3 kB)As a reminder, the time series given in this article is experimental based on the BB16 dataset. Consistency with BB17 estimates will need to be investigated. Our feeling is that it will be better to try to finalise this work in the context of the future work on the other financial assets categories for the HH and NPISH sectors. This will also provide an opportunity to take the future development of work in other areas such as the Economic Statistics Centre of Excellence project on historical time series into account.

Nôl i'r tabl cynnwys6. Historical estimates of debt securities and liabilities issued by the households and NPISH sectors

There are only two instruments that feed into the short- and long-term debt securities liabilities for households (HH) and non-profit institutions serving households (NPISH) sectors according to Blue Book 2016 (BB16) European System of Accounts 2010: ESA 2010 classification. These instruments are:

- short-term money market instruments by other UK residents

- long-term bonds issued by UK monetary financial institutions and other UK residents

Instrument map 4 illustrates the availability and reconciliation of historic data for these instruments from the historic sources under consideration.

Investigation revealed that there are very limited data available on debt securities liabilities for the HH and NPISH sectors historically. The only equivalent reliable historic data were found in the pre-ESA 1995 source and hence the CSDB-extended pre-ESA 1995 and this data only goes back to 1979. Using these sources, Figure 12 illustrates our proposed historic debt securities liability time series for the HH and NPISH sectors. There were no revisions to the debt securities liabilities data as a result of Blue Book 2017 improvements.

Figure 12: Illustrates historic debt securities liability time series for the household and NPISH sectors

Source: Office for National Statistics

Notes:

- NPISH is non-profit institutions serving households.

Download this chart Figure 12: Illustrates historic debt securities liability time series for the household and NPISH sectors

Image .csv .xls7. Conclusion and next steps

This article further develops our previous work reconciling the sources of historic data for the households (HH) and non-profit institutions serving households (NPISH) sectors. It proposes asset and liabilities debt securities time series data extended back to 1920 and 1979 respectively, although recommending that work on other HH and NPISH financial categories, and on other institutional sectors, should be completed before finalising the debt securities asset and liabilities time series. A specific issue will be consistency with BB17 estimates.

The intention is to use the approach presented in this article, for example, the instrument mapping approach to harmonising data from different sources, to produce further articles that will cover assets and liabilities for the other HH and NPISH financial categories. We hope to publish the next article toward the middle of 2019.

As resources permit, we hope to move on to produce instrument mappings and historical time series for all the institutional sectors. This would be a sizeable research programme, however, expected to take a number of years.

Nôl i'r tabl cynnwys8. References

Bjork S, Offer A (2013), ‘Reconstructing UK flow of funds accounts before 1987’, Monograph, The Winton Institute for Monetary History, University of Oxford

Central Statistical Office (1994) ‘Financial Accounts Documentation Manual’, internal unpublished Office for National Statistics report (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

Central Statistical Office (1996), ‘Financial Statistics: Explanatory Handbook 1996 Edition’, Financial Statistics (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

HM Treasury and Central Statistical Office (1981), ‘Financial wealth of the non-bank private sector’, Economic Trends, July 1981, pages 105 to 118 (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

Office for National Statistics (2017) ‘Economic Statistics Transformation Programme: enhanced financial accounts (UK flow of funds) – reconciling sources of historic data for the households and the non-profit institutions serving households (NPISH) sectors’ (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

Marland M (1983), ‘The reconciliation of personal sector transactions and wealth’, Economic Trends, June 1983 (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

Marland M (1983), ‘The reconciliation of personal sector transactions and wealth’, Economic Trends, June 1983 (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

Office for National Statistics (2016), ‘National Accounts articles: Historical estimates of financial accounts and balance sheets – a first step towards reconstructing the data historical financial accounts and balance sheets by institutional sector for the UK’ (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

Office for National Statistics (2016), ‘All data related to Economic Statistics Transformation Programme: Historical estimates of financial accounts and balance sheets’ (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

Office for National Statistics (1997), ‘UK National Accounts (Blue Book)’

Office for National Statistics (2014), ‘UK National Accounts (Blue Book)’

Office for National Statistics (2015), ‘UK National Accounts (Blue Book)’

Office for National Statistics (2017), ‘UK National Accounts (Blue Book)’

Pettigrew C W (1980) ‘National and sector balance sheets for the United Kingdom’, Economic Trends, November 1980 (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

Roe A R (1971a), ‘The Financial Interdependence of the Economy 1957 to 1966’, Department of Applied Economics, Chapman and Hall, London (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

Roe A R (1971b), ‘The Financial Interdependence of the Economy 1957 to 1966’, Department of Applied Economics, Chapman and Hall, London (a copy of the article can be requested from FoFDevelopment@ons.gov.uk)

Sbano T (2008), ‘New historical data for assets and liabilities in the UK’, Economic and Labour Market Review, Volume 2, Number 4

Solomou S, Weale M (1997), ‘Personal sector wealth in the United Kingdom, 1920 to 1956’, Review of Income and Wealth, Series 43, Number 3

Nôl i'r tabl cynnwys9. Relevant Links

Flow of Funds archived background information

Explanatory Notes:

30 April 2018 – Experimental financial statistics for insurance using Solvency II regulatory data – enhanced financial accounts (UK flow of funds)

23 January 2018 – Economic Review: January 2018 – Economic Statistics Transformation Programme: a flow of funds approach to understanding quantitative easing

17 November 2017 – Economic Statistics Transformation Programme: enhanced financial accounts (UK flow of funds) – 2017 matrix update

23 October 2017 – Economic Statistics Transformation Programme: enhanced financial accounts (UK flow of funds) – progress on commercial data use

12 September 2017 – Economic Statistics Transformation Programme: Enhanced financial accounts (UK flow of funds) – A flow of funds approach to understanding financial crises

31 May 2017 – Economic Statistics Transformation Programme: Enhanced financial accounts (UK flow of funds) commercial data use

27 April 2017 – Economic Statistics Transformation Programme: Enhanced financial accounts (UK flow of funds) employee stock options

24 April 2017 – Financial intermediation services indirectly measured (FISIM) in the UK revisited

30 January 2017 – The UK Enhanced Financial Accounts: changes to defined contribution pension fund estimates in the national accounts; part 2 – the data

16 January 2017 – The UK Enhanced Financial Accounts: changes to defined contribution pension fund estimates in the national accounts; part 1 – the methodology

8 August 2016 – Economic Statistics Transformation Programme: UK flow of funds experimental balance sheet statistics, 1997 to 2015

14 July 2016 – Economic Statistics Transformation Programme: Flow of funds - the international context

14 July 2016 – Economic Statistics Transformation Programme: Developing the enhanced financial accounts (UK Flow of Funds)

10 March 2016 – Identifying Sectoral Interconnectedness in the UK Economy

24 February 2016 – Improvements to the Sector & Financial Accounts

12 January 2016 – Historical Estimates of Financial Accounts & Balance Sheets

6 November 2015 – Comprehensive Review of the UK Financial Accounts including explanatory notes for each financial instrument covered in the

13 July 2015 – Introduction Progress & Future Work

Nôl i'r tabl cynnwys10. Acknowledgement

Special thanks go to David Matthewson (ONS) and Ryland Thomas (Bank of England) for their contribution to this article. Also thanks to David Matthew (ONS), Phillip Davies(ONS), Keith Miller (ONS), and Phillip Lee (ONS) for their valuable comments on the contents of this article.

Nôl i'r tabl cynnwys