1. National Accounts at a Glance

This section of the Blue Book provides an examination of recent trends, key movements and international comparisons for a range of information contained in a number of the subsequent Blue Book Chapters.

All UK data referred to in this section are consistent with the latest Blue Book 2015 publication. All international data have been sourced from Eurostat and OECD on 20 October 2015.

Back to table of contents2. GDP and the headline economy

Chapter 1 of the 2015 Blue Book provides information on the headline economy, including GDP, which is one of the most frequently used indicators of total domestic activity. Trends in GDP can be compared to other major economies, and this shows that the experiences of the world’s major economies varied significantly during the 2008-09 economic downturn and subsequent recovery.

Figure 1 shows that while all countries experienced a significant contraction in output, their performances since 2009 have been markedly different. UK real GDP fell by 4.2% between 2008 and 2009, a contraction similar to that of the European Union as a whole (4.5%). In contrast, France experienced a fall of just 2.9% while Italy’s economy shrank by 5.5%.

Figure 1: Real GDP indexed to 2007=100 (chained volume measures) for major economies, 2007 to 2014

Source: Office for National Statistics, Eurostat

Download this chart Figure 1: Real GDP indexed to 2007=100 (chained volume measures) for major economies, 2007 to 2014

Image .csv .xlsHowever, it is the shape of the recoveries since the troughs of 2009 that are most divergent. In the years from the UK’s trough in 2009 until 2014, UK real GDP grew by 10.2%. This rate of growth was below that of Germany and the US at 10.4% and 11.6% respectively, but remained much higher than the EU as a whole at 5.0%. Since Q4 2012, the UK recovery has gathered pace. It passed its pre-downturn peak in the second quarter of 2013 and has continued growing strongly since.

Back to table of contents3. The industrial and expenditure composition of the recent recovery

While movements in GDP provide a picture of how the whole economy is performing, it is also important to consider: the performance of individual industries, trends in the types of expenditure driving GDP, and how this production accrues to wages and profits. These three different aspects can be observed in the output, expenditure and income measures of GDP respectively. A comprehensive explanation of these three measures can be found on the ONS website.

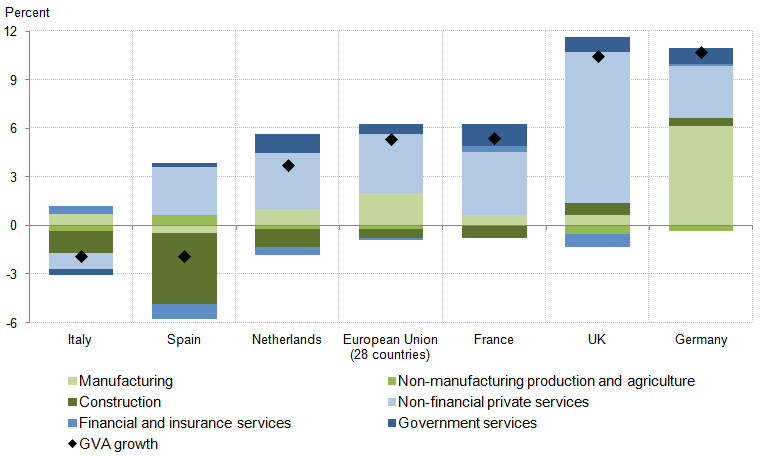

Looking at the industrial composition of the recovery shows that countries who have experienced similar recoveries have not necessarily achieved this through improvements to output in similar industries. For example, while non-financial private services have driven output growth across all major European economies except Italy, this has been the most prominent industry in the UK, making a contribution of 9.3 percentage points to gross value added (GVA) growth from 2009 to 2014.

In Germany, which saw GVA growth of 10.7% between 2009 and 2014, non-financial private services have contributed to a lesser extent (3.2 percentage points). Instead, manufacturing has been the largest driver of Germany’s growth, contributing 6.1 percentage points, in contrast to many of the other economies in which it has made a relatively smaller contribution (0.8 percentage points in the UK).

Construction has acted as a downward drag for most of the major economies, particularly Spain where it pulled down GVA growth by 4.3 percentage points. Even in the two economies where it had a positive impact on GVA, Germany and the UK, the contribution of output in construction has been relatively modest.

Figure 2: Output contributions to total GVA growth for major economies from 2009 to 2014

Source: Eurostat, Office for National Statistics

Notes:

- Contributions may not sum to total GVA growth due to chain linking and rounding

Download this image Figure 2: Output contributions to total GVA growth for major economies from 2009 to 2014

.png (21.1 kB)Examining the underlying goods and services inputs that different UK industries use to produce output (often referred to as intermediate consumption) reveals some further interesting trends. As shown in Figure 3, across the UK economy as a whole, intermediate consumption has remained at approximately 50% of gross output between 1997 and 2013. For most industries this proportion has remained fairly constant across the entire period, despite the economic downturn of 2008/09. For example, intermediate consumption as a proportion of nominal gross output was 26.3% in 1997 and had only increased by 1.4 percentage points by 2013, despite a number of volatile years following the downturn.

While most service industries saw ratios of around 50% or lower in 2013, the construction and production industries’ intermediate consumption are significantly higher. Between 1997 and 2013, the production industry’s proportion increased from 60.9% to 65.0%, with construction’s ratio growing from 58.2% to 60.1%.

Figure 3: Intermediate consumption as a proportion of UK nominal gross output (%), 1997 to 2013

Source: Eurostat, Office for National Statistics

Download this chart Figure 3: Intermediate consumption as a proportion of UK nominal gross output (%), 1997 to 2013

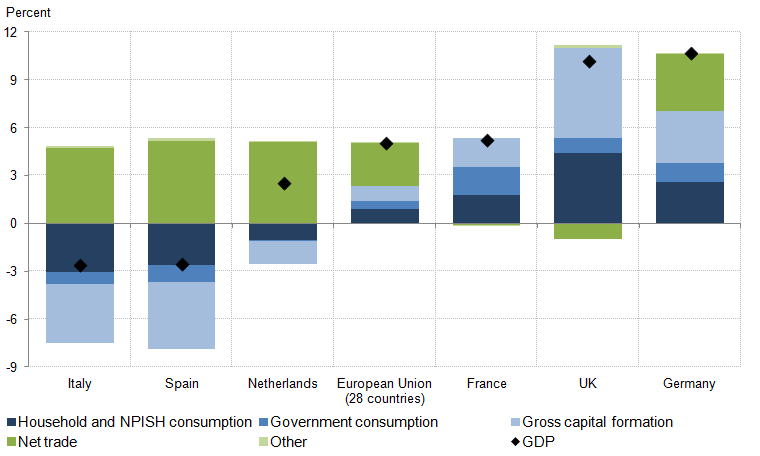

Image .csv .xlsIn terms of the expenditure measure of GDP, Figure 4 shows that, as well as gross capital formation, household and non-profit institutions serving households (NPISH) consumption has been one of the main drivers of growth in the UK, contributing 4.3 percentage points to GDP growth since 2009. However this has not been the case for some other major economies. While household consumption made a positive contribution in Germany, GDP growth has been more broad-based across components, with government consumption and net trade having larger positive contributions than the UK.

While the other four components have contributed positively to UK GDP growth since 2009, the UK is one of the only major European economies in which net trade has made a negative contribution to the recovery, equal to -0.9 percentage points between 2009 and 2014. In Spain and Italy, economies that have experienced a more sustained contraction in GDP, net trade has been the only major expenditure component to make a positive contribution, with household and NPISH consumption, government consumption and, in particular, fixed investment all making negative contributions.

In France, government consumption has been one of the main contributors to GDP growth, accounting for around 34% of its GDP growth since 2009. This is markedly higher than for the other economies in which it has made a positive contribution, Germany and the UK, where its contribution is around 10%.

Figure 4: Expenditure contributions to total GDP growth for major economies from 2009 to 2014, % and percentage points

Source: Office for National Statistics, Eurostat

Notes:

- NPISH stands for non-profit institutions serving households

Download this image Figure 4: Expenditure contributions to total GDP growth for major economies from 2009 to 2014, % and percentage points

.png (20.7 kB)4. Trends in the income measure

Blue Book also includes supplementary information regarding different components that make up GVA for each industry. Under the income approach, GVA is split into compensation of employees (CoE), taxes less subsidies, gross operating surplus (GOS) and mixed income. Estimates of each industry’s intermediate consumption and total output are also published, with the difference between the two equalling GVA.

Such additional information available in Blue Book allows for more detailed analysis of national income. For example, CoE can be used to calculate how much of an industry’s production income accrues to wages & salaries and employers’ social contributions, whereas GOS data can be used to estimate how much profit is generated by companies after considering labour costs, taxes and subsidies.

For most (but not all) countries, CoE comprises the largest part of value added, and provides the basis for a number of important statistics including unit labour costs and the labour share of income. The latter can be interpreted as the proportion of output that is received by workers; one measure of this is the level of CoE as a proportion of nominal GDP, which is shown in Figure 5. As well as being an important indicator of how income is distributed across the sectors of an economy, the labour share of income has implications for consumer demand, UK competitiveness, and economic growth more generally.

Figure 5: Compensation of employees as a proportion of nominal GDP for major economies (%), 2000 to 2014

Source: Eurostat, Office for National Statistics

Download this chart Figure 5: Compensation of employees as a proportion of nominal GDP for major economies (%), 2000 to 2014

Image .csv .xlsFrom 2000 to 2013, UK CoE remained above 50% of nominal GDP, reaching 53.5% in 2009 before falling every year to 49.2% in 2014. In contrast, Italy’s share has averaged just 38.7% over the fifteen year period. In the most recent data, France’s share of 52.8% is the largest in the sample, above the European Union’s average of 47.9% and considerably greater than Italy’s level of 39.9%.

While each country’s share has remained relatively constant over the period as a whole, there were sizeable changes during the economic downturn in 2008 and 2009. As nominal GDP started to fall, the labour share of income rose across all countries with the exception of the US. For example, the European Union labour share reached a peak of 48.7% in 2009, up from 47.3% in the previous year.

Both the short-run trend of temporary increases in the labour share of income during downturns and the long-run downwards trend reflects, to some extent, the changing relationship between wages and productivity. If changes in productivity are not reflected in hourly wages (or vice versa), other things being equal we would see a change in the labour share. Economic theory stipulates that wages should be based on the productivity of workers so that, to a large extent, productivity and hourly wages should display similar trends. However, one interpretation of the downwards trend in the UK’s labour share between 1975 and 1996 is that productivity growth did not fully feed through into hourly wage growth as economic theory might suggest. A short-run breakdown of this relationship between wages and productivity may also explain why LSI increases temporarily during downturns, a topic that has been explored further in ONS’s Examination of Falling Real Wages 2010-2013.

Back to table of contents5. The Sector Financial Accounts

The United Kingdom Economic Accounts (UKEA) published by ONS allow for an examination of the flow-stock relationship in the National Accounts, with changes in flows such as income, spending and saving having an effect on assets and liabilities (stocks).

In the UKEA, the economy is grouped into a number of institutional sectors, split by type of activity, ownership and control. Sectors are defined as follows: non-financial corporations (NFCs), financial corporations (FINCOs), households and non-profit institutions serving households (households and NPISH), general government (GG) and the rest of the world. This provides us with a wealth of information on the UK’s economic performance and financial position relative to others. A comprehensive explanation of the headline sectors, income and capital accounts and the financial balance sheet can be found in ONS published concepts, sources and methods.

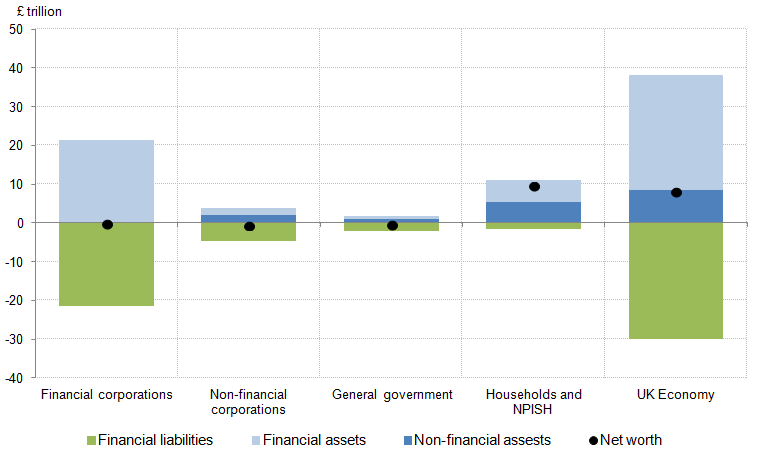

The total value of financial and non-financial assets less financial liabilities across these four headline sectors (NFCs, FINCOs, households and NPISH, and GG) represents the net worth of the UK economy. In 2014, this value rose to £8.1 trillion, a 5.0% rise on the previous year. Figure 6 below shows how financial and non-financial assets and financial liabilities are distributed across the four headline sectors and the UK economy as a whole. This shows that the positive net worth experienced in the UK can be largely attributed to the UK household and NPISH sector, where financial and non-financial assets exceeded the value of financial liabilities. More broadly, it can be observed that the net worth position is small compared to the relative sizes of the constituent assets and liabilities, especially in the financial corporation sector.

Figure 6: UK assets, liabilities and net worth across the headline sectors, £ trillion, 2014

Source: Office for National Statistics

Notes:

- NPISH stands for non-profit institutions serving households

Download this image Figure 6: UK assets, liabilities and net worth across the headline sectors, £ trillion, 2014

.png (20.6 kB)The total value of non-financial assets in the UK was £8.5 trillion in 2014. This is primarily comprised of dwellings and other buildings & structures, which together make up over 81% of the value of non-financial assets in the UK, with other fixed assets such as machinery & equipment, and inventories also held. Over 95% of dwellings are held by households while other buildings & structures are predominantly held by the non-financial corporations and general government sectors.

The total value of financial assets was £29.5 trillion in 2014; this includes a range of different asset types such as monetary gold, currency, securities, loans and insurance. This was matched by £30.0 trillion of financial liabilities, giving a net balance for financial assets of -£0.5 trillion. These assets and liabilities were primarily held by financial corporations.

Figure 7 shows the decomposition of non-financial assets held in 2014 by each sector. Household non-financial assets are shown to be almost entirely held as residential dwellings, while non-financial corporations hold a broader, more evenly distributed range of asset classes, such as machinery and equipment, and inventories. The general government and financial corporation sectors have a very similar asset mix, holding a large proportion of other buildings and structures with some machinery and equipment.

Figure 7: UK non-financial assets breakdown by sector, 2014

Source: Office for National Statistics

Notes:

- NPISH stands for non-profit institutions serving households

Download this chart Figure 7: UK non-financial assets breakdown by sector, 2014

Image .csv .xlsThere are, however, vast differences in the financial asset and liability mix across sectors, as shown in Figure 8. The general government sector is shown to hold most of its liabilities in debt securities, which reflects the fact that government tend to raise liquidity through government bonds. In contrast, households hold most liabilities in loans: of the £1.7 trillion of total financial liabilities in the household and NPISH sector in 2014, 93% came from loans, which can be attributed to mortgage debts necessary to pay for the residential dwellings assets held. Non-financial corporations hold most of their liabilities in shares and other equity.

On the financial assets side, households hold the majority of assets in insurance and pension schemes, (which can be attributed to pensions and insurance products owned by households), but also hold some shares, currency and deposits. Other sectors hold a greater proportion of shares, debt securities and loans.

Figure 8: UK financial assets and liabilities breakdown by sector, 2014

Source: Office for National Statistics

Notes:

- NFC stands for non-financial corporations, FC stands for financial corporations, GG stands for general government, and HH and NPISH stands for households and non-profit institutions serving households

Download this chart Figure 8: UK financial assets and liabilities breakdown by sector, 2014

Image .csv .xls6. Households

The households section of the Blue Book provides a large amount of disaggregated information for the sources of household disposable income and the breakdown of household expenditure. Comparing these data over time allows for analysis of how events, such as the global financial crisis, can affect household spending habits and the income that they receive. Figure 9 shows the growth in total primary income resources received by households. This measure presents the income received by households for their role in the production process, plus any property income received from their existing stock of assets. It consists of wages and salaries, employers’ social contributions, property income, and mixed income and gross operating surplus (which includes income from self-employment). The measure of property income received includes rent, dividends and interest. As these data are taken from the primary income account, it shows households resources before the effects of taxes and benefits.

Figure 9: Breakdown of growth of UK household resources (% and percentage points), 1997 to 2014

Source: Office for National Statistics

Notes:

- GOS stands for gross operating surplus

Download this chart Figure 9: Breakdown of growth of UK household resources (% and percentage points), 1997 to 2014

Image .csv .xlsThe largest positive contribution to resources growth between 1997 and 2008 was typically wages and salaries, but during the economic downturn and the subsequent recovery the growth of this component became more subdued. In 2009, the contribution of wages and salaries increased total household resources by just 0.1 percentage points while property income received acted to reduce resources growth by 4.3 percentage points, which coincided with the large reduction in interest rates on deposits.

Since 2009, Figure 9 shows there was a sustained recovery in wages and salaries that acted to gradually improve total resources growth. The increase in 2014 has also been partly driven by growth in mixed income and GOS and property income, contributing 1.0 and 0.9 percentage points respectively. For the first time since 2008, employers’ social contributions acted to reduce total resources growth in 2014 (by 0.1 percentage points).

Real Household Disposable Income

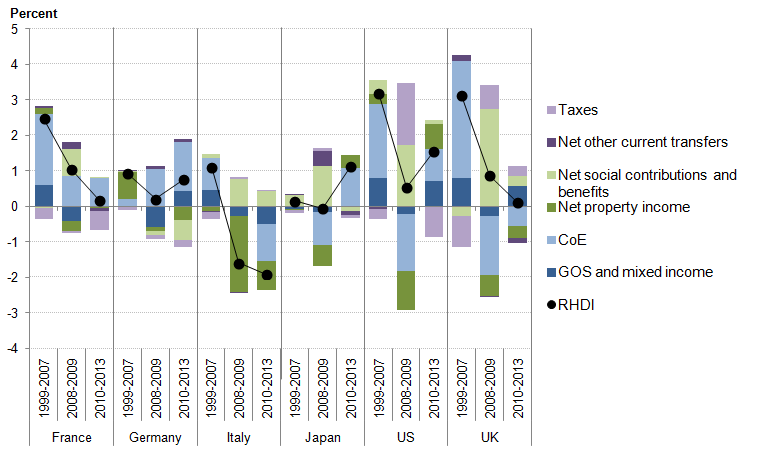

Chapter 6 also provides information on the impact that taxes, redistributive measures (e.g. social benefits) and property income payments on existing liabilities affect household total resources. This culminates in an estimate of the income available to households for final consumption expenditure or saving, known as household disposable income. This measure can then subsequently be deflated by the price of household consumption, to provide a measure of real household disposable income (RHDI). Figure 10 looks at the contributions to average annual RHDI growth from different income sources, comparing major economies across three different periods: prior to the downturn (1999-2007), during the downturn (2008-09), and following the downturn (2010-13).

Figure 10: Contributions to annual real household and NPISH disposable income (RHDI) growth for major economies, % and percentage points, 1999 to 2013

Source: Office for National Statistics, Organisation for Economic Co-operation and Development

Notes:

- NPISH stands for non-profit institutions serving households, CoE stands for compensation of employees, GOS stands for gross operating surplus, and RHDI stands for real household disposable income

Download this image Figure 10: Contributions to annual real household and NPISH disposable income (RHDI) growth for major economies, % and percentage points, 1999 to 2013

.png (28.3 kB)Prior to the downturn, the UK’s average annual RHDI growth at 3.1% came a close second to growth in the US (3.2%). This was due, in part, to a large contribution (3.3 percentage points per annum) from CoE. Japan and Germany saw much lower contributions to growth from CoE (of 0.0 and 0.2 percentage points per annum respectively) and experienced much lower RHDI growth, of 0.2% and 0.9%.

During the downturn, RHDI growth slowed down in all the major economies shown. Although RHDI growth fell to 0.9% per annum in the UK, growth remained comparatively high, with only France achieving higher growth. The biggest negative contribution to the fall in growth in the UK was a fall in the CoE contribution, from 3.3 to -1.7 percentage points per annum. Trends were similar in the US, where CoE was the biggest contributor to the fall of RHDI growth, but net property income (property income paid less property income received) also moved from providing positive contributions to negative contributions (this was true for all countries including the UK).

With most countries experiencing lower growth in CoE, net social contributions acted to partially offset this in all the economies shown with the exception of Germany. This was most prevalent in the UK, with net social contributions and benefits raising the growth of RHDI by 2.8 percentage points per annum between 2008 and 2009.

In the subsequent recovery, the contribution from net social contributions and benefits began to fall back. Over the period of the recovery the UK, along with France and Italy, experienced further decline in the average annual RHDI growth rate, while the remaining economies showed improvement. For example, between 2010 and 2013 the UK average annual RHDI growth fell to 0.1% per annum, while in the US growth recovered to 1.5% per annum.

The Net Lending/Borrowing of Households

In the financial account, statistics for the net lending and borrowing position of households can be broken down to show the extent to which financial assets and liabilities are acquired by the sector. Figure 11 shows net lending/borrowing from the financial accounts and its constituent components over the period 1997 to 2014. Positive bars indicate where households have acquired financial assets (e.g. deposits and pension assets) while negative bars indicate the acquisition of financial liabilities (e.g. loans). If the acquisition of assets exceeds the acquisition of liabilities, this indicates that households are lending to other sectors in the given period.

Figure 11: Breakdown of UK net lending/net borrowing (£ billion), 1997 to 2014

Source: Office for National Statistics

Notes:

- SGS stands for standardised guarantee schemes

Download this chart Figure 11: Breakdown of UK net lending/net borrowing (£ billion), 1997 to 2014

Image .csv .xlsFigure 11 shows that between 2003 and 2008, households started to become net borrowers, acquiring an increasing amount of loans relative to deposits and other assets. Following the downturn, households acquired far fewer loans and only acquired a slightly smaller amount of assets, to become net lenders to other sectors. This trend only continued between 2008 and 2010; following this, households started to move toward becoming net borrowers again as the acquisition of liabilities increased. Households became net borrowers in 2013 and have continued to borrow into 2014: the largest contribution to this change came from a rise in the acquisition of loans, from £39.3 billion to £61.5 billion.

Household Expenditure

Household consumption expenditure provides an insight into the spending behaviour of households. From 2009 onwards, both household disposable income and household consumption expenditure increased, and in 2014 final consumption expenditure by UK households rose 4.3%. But while it is important to observe total growth in consumption, emerging trends can also be observed through the changing composition of household expenditure; this is shown in Figure 12 which attributes the share of total nominal household expenditure to a range of categories.

Figure 12: Consumption expenditure in the UK (by resident and non-resident households) as a percentage of total domestic consumption expenditure for 1997, 2009 and 2014

Source: Office for National Statistics

Download this chart Figure 12: Consumption expenditure in the UK (by resident and non-resident households) as a percentage of total domestic consumption expenditure for 1997, 2009 and 2014

Image .csv .xlsThe largest change in the composition of domestic household consumption expenditure has been that of housing; the share of household consumption attributable to this product rose by 1.0 percentage point between 2009 and 2014. This is a result of housing expenditure growing at a faster rate (29.1%) than domestic consumption expenditure (23.7%), and primarily reflects a 23.9% rise in the price of housing consumption (as measured by the implied deflator). Since 2009 there has also been an increase in the share of transport expenditure of 0.5 percentage points , representing growth in spending on this product of 28.0% between 2009 and 2014.

Of the other components of final household consumption expenditure, there have been large decreases in many of the items which could be classed as ‘discretionary’. This can be observed in shares of spending on alcohol & tobacco, food & drink, and recreation & culture which have all decreased between 1997 and 2014. Expenditure on these items has only increased by 16.4%, 18.5% and 11.1% between 2009 and 2014 respectively, which can again be compared to the 23.7% growth of domestic consumption expenditure over the same period. This broadly follows the economic theory that spending on discretionary items as a proportion of total expenditure may fall during an economic downturn.

Trends in household saving

The household saving ratio measures the proportion of gross household disposable income that is saved. Figure 13 shows that the UK’s saving ratio in 2014 was one of the lowest of the selected European countries, and is less than half that of the 28 economies of the European Union as a whole. Only Denmark reported a lower saving ratio in 2014, with the UK’s ratio of 4.9% notably below the European Union’s average of 10.6%. By contrast, Germany’s saving ratio of 16.8% is the highest of the countries presented in Figure 13, suggesting considerable differences in the preferences of consumers.

Figure 13: Household and NPISH saving ratio for selected European economies, % of total resources, 2014

Source: ce for National Statistics, Eurostat

Notes:

- This chart presents the savings ratio for the European Union (28 countries), the euro area (19 countries) and a number of selected European countries. The gross saving rate of households is defined as gross saving (ESA 2010 code: B.8g) divided by gross disposable income (B.6g), with the latter being adjusted for the change in the net equity of households in pension funds reserves (D8). NPISH stands for non-profit institutions serving households

Download this chart Figure 13: Household and NPISH saving ratio for selected European economies, % of total resources, 2014

Image .csv .xlsSince the economic downturn in 2008, household income and expenditure patterns have developed in different ways, and these developments can be seen through movements in the savings ratio. Figure 14 presents the saving ratio across time for a selection of major European economies. The UK’s saving ratio fell to 5.8% in 2008 before rising to 11.6% in 2010. As the economic outlook worsened and consumer confidence fell following the downturn, households began to save a greater proportion of their income despite record low interest rates. This sharp movement was mirrored in Spain, the Netherlands and the European Union as a whole. However, the increased propensity to save was not observed to the same extent in France and Germany, perhaps due to their savings rates being already at the comparably high levels of 14.7% and 17.0% respectively in 2008.

Figure 14: Household and NPISH saving ratio for selected European economies, % of total resources, 2004 to 2014

Source: Eurostat, Office for National Statistics

Notes:

- NPISH stands for non-profit institutions serving households

Download this chart Figure 14: Household and NPISH saving ratio for selected European economies, % of total resources, 2004 to 2014

Image .csv .xlsSince the economic recovery began to take hold in 2010, the savings ratio in the UK has fallen for four consecutive years, suggesting consumer confidence has improved over the period. This decline is in part because disposable income has risen very slowly while expenditure has risen more quickly, restricting the share of income that households save. This trend has also been seen in the European Union as households chose to save less.

Notes for Households

- Figures may not sum due to rounding

7. Non-financial Corporations

Non-financial corporations produce goods and services for the market and do not, as a primary activity, deal in financial assets and liabilities. This sector includes retailers, manufacturers, utilities, and business service providers among others. The non-financial sector is broken down into two sub-sectors: public non-financial corporations, which are government owned trading businesses; and private non-financial corporations. The following analysis will focus on private non-financial corporations (PNFCs).

Company profits (often referred to as the gross operating surplus of corporations) account for the majority of PNFC primary resources, supported by some additional property income (such as interest received on investments and reinvested earnings on direct foreign investment). However property income paid (primarily dividends that PNFCs pay to other sectors) has exceeded property income received in all years since records began in 1997.

Figure 15 shows the contributions of the components of gross disposable income in the PNFC sector to its overall growth. Higher growth in profits supported positive disposable income growth over the decade prior to the downturn, with the exception of 1998, 2001 and 2006. Disposable income fell quite sharply over the economic downturn due to lower profits, and fell in both 2012 and 2013 before growing by 6.9% in 2014. This growth was driven by the continued recovery in gross operating surplus, which grew by 8.3% in 2014, while falling net property income acted as a drag on gross disposable income growth for the third consecutive year.

Figure 15: Contributions to annual growth in UK private non-financial corporations’ gross disposable income, % and percentage points, 1998 to 2014

Source: Office for National Statistics

Download this chart Figure 15: Contributions to annual growth in UK private non-financial corporations’ gross disposable income, % and percentage points, 1998 to 2014

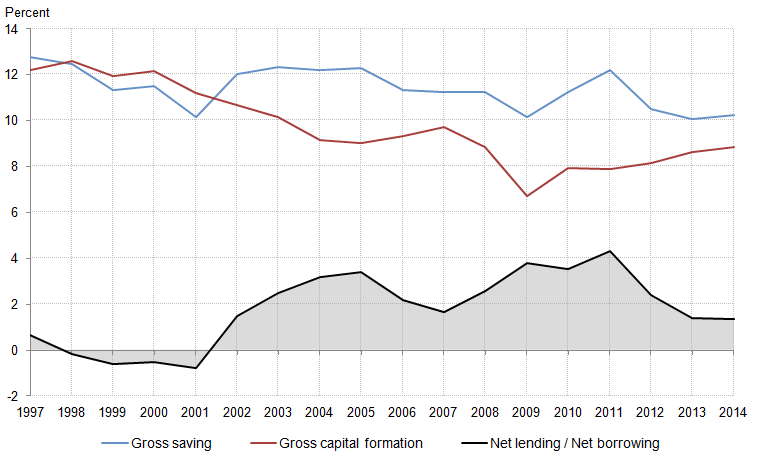

Image .csv .xlsIn the PNFC sector, ONS equates gross saving with gross disposable income (the two terms are interchangeable for this sector). Gross saving equates to retained profits, representing the internally generated funds available for firms to invest. Positive net lending arises when the gross saving of firms exceeds their capital expenditure. If the sector as a whole were a net borrower, it would imply that internally generated funds were insufficient to meet planned capital expenditures (hence necessitating the borrowing of funds from other sectors). Therefore, trends in PNFC net lending can be accounted for by movements in these two components: gross saving and gross capital formation.

As Figure 16 shows, the sector has been a net lender since 2002 due to broadly stable gross saving, and a gradual fall in the ratio of capital expenditure to gross domestic product (GDP). In 2012 and 2013, PNFC net lending as a proportion of GDP fell quite sharply due to a declining corporate saving rate and rising capital expenditure, before levelling off in 2014 to 1.4% of GDP.

Figure 16: Net lending in the UK PNFC sector and its components as a proportion of GDP (%), 1997 to 2014

Source: Office for National Statistics

Notes:

- PNFC stands for public non-financial corporations

Download this image Figure 16: Net lending in the UK PNFC sector and its components as a proportion of GDP (%), 1997 to 2014

.png (34.9 kB)With net lending remaining positive since 2002, internally generated funds for the PNFC sector has been more than sufficient to meet planned capital expenditure, and has consequently been a net lender to other sectors of the economy.

To give a better representation of the relative sustainability of the stock of debt within the entire non-financial corporation sector, Figure 17 presents the ratio of debt to income flows (gross operating surplus).

Figure 17: Debt as a percentage of gross operating surplus for non-financial corporations in major economies (%), 1999 to 2013

Source: Office for National Statistics, Organisation for Economic Co-operation and Development

Notes:

- The UK data presented above uses an OECD-consistent definition of debt: “Debt is defined as a specific subset of liabilities. All debt instruments are liabilities, but some liabilities such as shares, equity and financial derivatives are usually not considered as debt. Debt is thus usually obtained by adding up the following liability categories: securities other than shares except financial derivatives, loans, and other accounts payable. Consolidated data are used for this indicator"

Download this chart Figure 17: Debt as a percentage of gross operating surplus for non-financial corporations in major economies (%), 1999 to 2013

Image .csv .xlsSince 1999, UK non-financial corporations’ relative indebtedness has been broadly comparable with other major economies. From 2006 to 2012, debt as a percentage of gross operating surplus in the UK rose from 642% to 777%, a path mirrored in most other European economies. In 2013, this percentage fell back to its level in 2006 and was below Japan and Portugal.

Back to table of contents8. Financial Corporations

The financial corporations sector consists of institutions whose principal activity is the production of financial services. Financial corporations (FINCOs) can be divided into three main groups: monetary and financial institutions, including bodies such as central banks; insurance corporations and pension funds; and other financial corporations.

Nominal gross value added (GVA) is a measure of the contribution a sector makes to the UK economy and provides the total resources available to a sector. In the decade prior to 2007, GVA generated by FINCOs rose steadily before falling during the global financial market shock. Since 2008, growth has been relatively subdued before picking up slightly in 2013. In Chapter 4 (553 Kb Excel sheet), GVA can be allocated to profits (often referred to as gross operating surplus or GOS), compensation of employees (which is comprised of wages and salaries and employers’ social contributions), and taxes less subsidies on production. Before the downturn, the share of GVA attributable to compensation of employees is shown to be larger than the profit share, averaging 60% and 38% respectively. However, since 2009 this share is now shown to be more evenly split, at 52% and 45% respectively.

GOS measures a sector’s gross profit, and for FINCOs this reached £59.0 billion in 2013, a 22% increase on the year. In 2009, GOS peaked at £61.6 billion before declining to £46.1 billion in 2010, while compensation of employees remained fairly stable between 2009 and 2013. This suggests that FINCOs maintained their levels of employment and wages despite gross profits falling in the recovery period.

Figure 18: Gross value added, its components, and intermediate consumption for the financial corporations sector (£ billion), 1997 to 2013

Source: Office for National Statistics

Notes:

- CoE stands for compensation of employees, GOS stands for gross operating surplus, IC stands for intermediate consumption, and GVA stands for gross value added

Download this chart Figure 18: Gross value added, its components, and intermediate consumption for the financial corporations sector (£ billion), 1997 to 2013

Image .csv .xlsWe can also look at the primary income account of financial corporations. The primary income account is composed of resources (sources of revenue) and uses (sources of expenses). In contrast to other sectors, the main source of primary income for FINCOs is from net interest received from the existing stock of assets and liabilities held by the sector. This is shown in Figure 19.

Figure 19: Composition of resources and uses in financial corporations’ primary income account (£ billion), 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 19: Composition of resources and uses in financial corporations’ primary income account (£ billion), 1997 to 2014

Image .csv .xlsIn all years between 1997 and 2014, interest received by FINCOs exceeded income from other sources, with the amount of interest received peaking in 2008 at £480 billion. However between 2008 and 2009 there was a significant decrease in the level of interest received; a fall of £265 billion (55.2%). This coincided with the sharp falls in the Bank of England base rate that fed through to lower rates on loans and mortgages. Interest paid also fell alongside interest received, which is likely to be partly a result of lower rates payable on consumer deposits. By contrast, other income, which includes earnings from foreign direct investment, rent, and dividends paid and received on shares, has followed a much more stable path since 2004.

The disposable income of the FINCO sector provides a similar concept to disposable income for households – it is a measure that incorporates the income left after expenses (uses) have been paid. In 2014, 79% of FINCOs’ total resources were generated by property income, with interest the largest single component (generating 49% of all resources). After subtracting expenses, FINCOs’ gross disposable income (GDI) reached £88 billion in 2014, a 38% increase on the year before.

Figure 20 illustrates the changes in GDI over time. The positive bars show the level of total resources in £ billions, which act to increase GDI, while the negative bars are expenses (or uses) which act to reduce GDI.

Figure 20: Changes to the components of UK financial corporations’ gross disposable income (£ billion), 1997 to 2014

Source: Office for National Statistics

Download this chart Figure 20: Changes to the components of UK financial corporations’ gross disposable income (£ billion), 1997 to 2014

Image .csv .xlsAfter falling in the aftermath of the economic downturn, GDI was relatively flat until 2013 before increasing sharply in 2014. This sharp increase reflects growth in the total resources available to FINCOs as well as a fall in their expenses. Total resources grew to £223 billion in 2014, a 7.5% increase. The largest source of the fall in expenses came from the decrease in other social insurance benefits, which fell by 11.6% to £71 billion. Taken together, the growth in resources and the fall in expenses in 2014 resulted in the strong growth in GDI.

Another way of calculating GDI is to sum gross saving . An interesting relationship that can be analysed here is the savings ratio, which is calculated as the ratio of gross saving to gross disposable income. Between 2013 and 2014, the savings ratio of the financial corporation sector grew from 8.7% to 14.5%, resulting from a 38% increase in GDI and rise in gross saving of 131% (albeit from a low base; it was £5.6 billion in 2013 and £12.8 billion in 2014).

The net worth of the FINCO sector is composed of net financial assets (the difference between total assets and total liabilities) and non-financial assets, and presents the amount by which assets exceed liabilities, or vice versa. In 2014, the net worth of the FINCO sector was -£197 billion, a fall of £364 billion since 2013 and the first negative value since 2006. This fall in net worth was driven by an increase in total financial liabilities of £913 billion.

Notes for Financial Corporations

- As well as adjusting for the change in pension entitlements

9. Tables

Chapter 1 - National Accounts at a Glance (836.5 Kb Excel sheet)

Back to table of contents