Cynnwys

- Main points

- Things you need to know about public sector finances

- What’s changed in this release?

- How much is the public sector borrowing?

- How much does the public sector owe?

- Revisions since previous release

- How do our figures compare with official forecasts?

- International comparisons of borrowing and debt

- Quality and methodology

- Looking ahead

- Links to data and related publications

1. Main points

Borrowing (public sector net borrowing excluding public sector banks) in February 2019 was £0.2 billion, £1.0 billion less than in February 2018; this was the lowest February borrowing since 2017.

Borrowing in the current financial year-to-date (April 2018 to February 2019) (YTD) was £23.1 billion, £18.0 billion less than in the same period last year; the lowest YTD borrowing for 17 years (April 2001 to February 2002).

Borrowing in the financial year ending (FYE) March 2018 was £41.8 billion, £3.1 billion less than in FYE March 2017; the lowest financial year for 11 years (since FYE 2007).

Debt (public sector net debt excluding public sector banks) at the end of February 2019 was £1,785.6 billion (or 82.8% of gross domestic product (GDP)); an increase of £22.7 billion (or a decrease of 1.4 percentage points of GDP) on February 2018.

Debt at the end of February 2019 excluding Bank of England (mainly quantitative easing) was £1,599.6 billion (or 74.1% of GDP); an increase of £29.1 billion (or a decrease of 0.9 percentage points of GDP) on February 2018.

Central government net cash requirement in the current financial YTD (April 2018 to February 2019) was £13.5 billion (£5.4 billion less than financial YTD 2018) or £14.8 billion excluding both UK Asset Resolution Ltd and Network Rail (£6.0 billion less than in financial YTD 2018).

2. Things you need to know about public sector finances

In the UK, the public sector consists of five subsectors: central government, local government, public non-financial corporations, Bank of England and public financial corporations (or public sector banks).

Unless otherwise stated, the figures quoted in this bulletin exclude public sector banks (that is, currently only Royal Bank of Scotland (RBS)), as the reported position of debt (and to a lesser extent borrowing) would be distorted by the inclusion of RBS's balance sheet (and transactions). This is because government does not need to borrow to fund the debt of RBS, nor would surpluses achieved by RBS be passed on to government, other than through any dividends paid as a result of government equity holdings.

Public sector net borrowing excluding public sector banks (PSNB ex) measures the gap between revenue raised (current receipts) and total spending (current expenditure plus net investment (capital spending less capital receipts)). Public sector net borrowing is often referred to by commentators as “the deficit”.

The public sector net cash requirement (PSNCR) represents the cash needed to be raised from the financial markets over a period of time to finance the government’s activities. This can be close to the deficit for the same period but there are some transactions, for example, loans to the private sector, which need to be financed but do not contribute to the deficit. It is also close but not identical to the changes in the level of net debt between two points in time.

Public sector net debt excluding public sector banks (PSND ex) represents the amount of money the public sector owes to private sector organisations including overseas institutions, largely as a result of issuing gilts and Treasury Bills, less the amount of cash and other short-term assets it holds. Public sector net debt is often referred to by commentators as “national debt”.

While borrowing (or the deficit) represents the difference between total spending and receipts over a period of time, debt represents the total amount of money owed at a point in time.

The debt has been built up by successive government administrations over many years. When the government borrows (that is, runs a deficit), this normally adds to the debt total. So reducing the deficit is not the same as reducing the debt.

Accounting for student loans

On 17 December 2018, we announced our decision on how we will treat student tuition fee and maintenance loans in the government’s accounts. We have published a blog explaining our role and why we have taken these decisions. We aim to implement these changes in September 2019.

Nôl i'r tabl cynnwys3. What’s changed in this release?

This section presents information on aspects of data or methodology that have been introduced or improved since the publication of the previous bulletin (21 February 2019), along with supporting information users may find useful.

UK contributions to the European Union budget

In February 2019, the UK’s GNI and VAT contribution to the European Union (EU) was £2.9 billion, £1.0 billion higher than in February 2018; the highest cash payment in any month on record (monthly records began in January 1993). This is due largely to the timing of payments made to the EU by all member states rather than a reflection of any budgetary increase.

EU regulation sets out a “draw-forward” mechanism, which allows the European Commission to call up to five months’ worth of contributions within the first quarter of the calendar year from member states. This process enables the EU to manage its cash flow, as a larger proportion of the expenditure is paid out during the first quarter of the budgetary year.

The request for more funding from member states under the draw-forward does not increase contributions over the year, it reprofiles contributions over the budgetary year.

In 2019, the draw-forward request from the EU to all member states was for 4.7 months’ worth of contributions in the first quarter, compared with 3.7 months’ worth in 2018, which has led to the higher payment this year.

This payment was anticipated by the Office for Budget Responsibility (OBR) in their March 2019 forecast.

Self-assessed tax receipts

In both January and (to a lesser extent) July, receipts are particularly high due to the receipt of self-assessed Income Tax, Capital Gains Tax and self-assessed (Class 4) National Insurance contributions. Although affecting primarily January and July receipts, late payments of these self-assessed taxes tend to lead to high receipts in the following month (February and August respectively), although to a lesser degree.

The proportion of self-assessed taxes recorded in January and February can vary year-on-year and it is therefore advisable to consider data for the two months (January and February) together.

In January and February 2019:

combined self-assessed Income Tax receipts were £18.7 billion, of which £14.7 billion was paid in January and £4.0 billion was paid in February; an increase of £1.7 billion compared with the same period in 2018

combined Capital Gains Tax receipts were £8.8 billion, of which £6.8 billion was paid in January and £2.0 billion was paid in February; an increase of £1.3 billion compared with the same period in 2018

combined receipts for self-assessed Income Tax and Capital Gains Tax were £27.5 billion, of which £21.4 billion was paid in January and £6.0 billion was paid in February; an increase of £3.0 billion compared with the same period in 2018

The sale of railway arches

On 11 September 2018, Network Rail announced they had agreed terms for the sale of their Commercial Estate business in England and Wales. On 4 February 2019, the National Audit Office confirmed that Network Rail had completed a £1.46 billion sale of its commercial property portfolio consisting of approximately 5,200 properties across England and Wales, mainly railway arches.

Public sector net debt and the central government net cash requirement have each reduced by an amount equivalent to the cash received by central government from the sale.

We are currently investigating the nature of the transaction to ensure that the impacts will be fully reflected in the public sector finances and so it has yet to be determined whether public sector net borrowing is affected and therefore it remains unchanged

VAT changes to the supply of digital services

On 1 January 2015, Value Added Tax (VAT) rules relating to the supply of telecommunications, radio and television broadcasting and electronically supplied services changed. Prior to 1 January 2015, supplies made by EU businesses to EU-resident customers were subject to VAT in the country where the suppliers were established; from 1 January 2015, the supplies are subject to VAT in the country where the customer is resident. The tax changes are as a result of European legislation.

After a period of transition, from 1 January 2019, all VAT collected for digital services with the EU are collected by the tax authority in the appropriate country. This month, we have included these cash receipts for the first time, covering the period April 2018 to February 2019.

Nôl i'r tabl cynnwys4. How much is the public sector borrowing?

In February 2019, the public sector spent more money than it received in taxes and other income, meaning it had to borrow £0.2 billion. February is typically a lower borrowing month compared with the rest of the financial year as it benefits from the receipt of late payments of self-assessed Income and Capital Gains Taxes due each January.

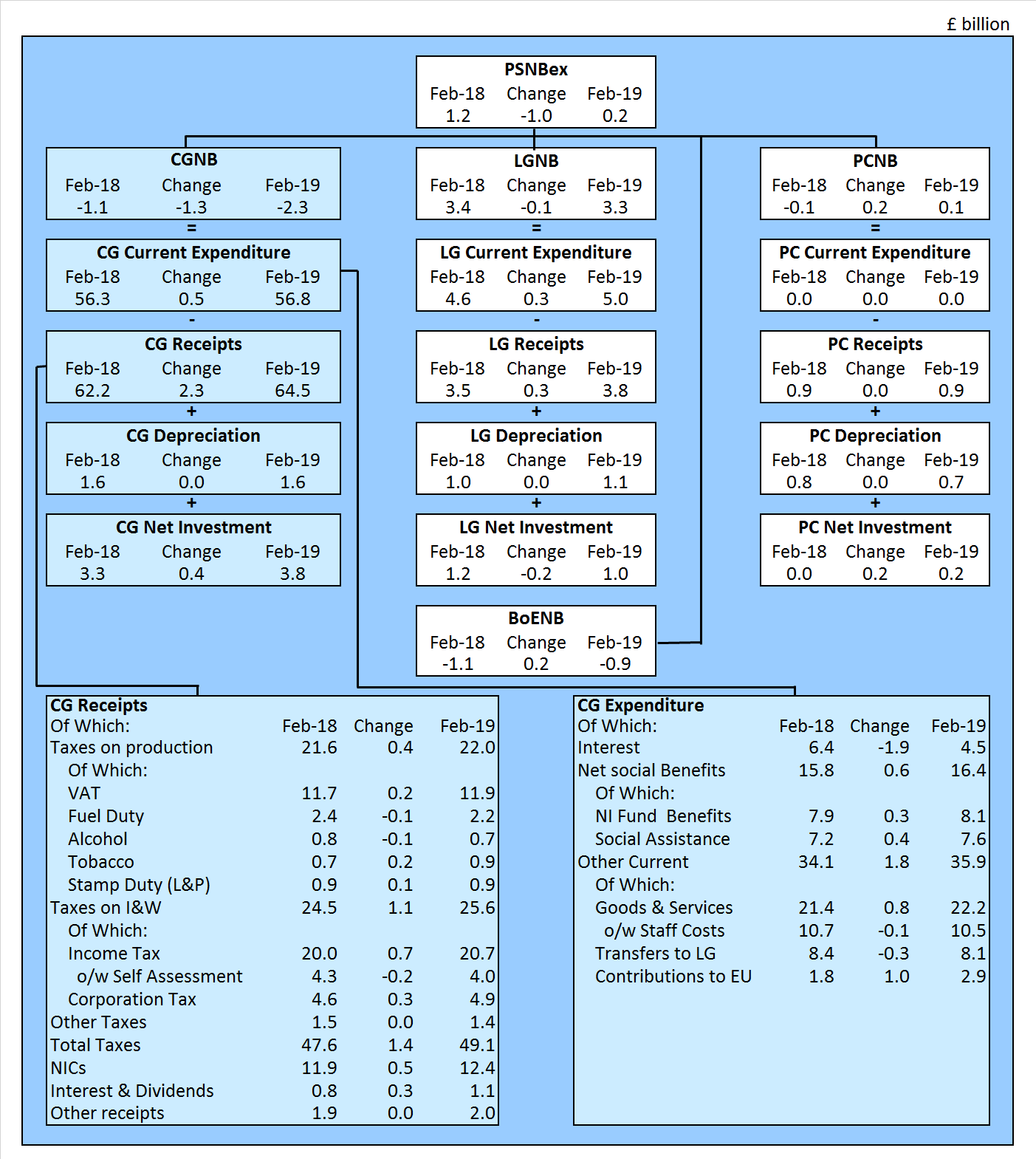

Figure 1 summarises public sector borrowing by subsector in February 2019 and compares this with the equivalent measures in the same month a year earlier (February 2018). This presentation splits public sector net borrowing excluding public sector banks (PSNB ex) into each of its four subsectors: central government, local government, public corporations and Bank of England.

Central government receipts in February 2019 increased by 3.6% (or £2.3 billion) compared with February 2018, to £64.5 billion, while total central government expenditure increased by 1.7% (or £1.0 billion) to £60.6 billion.

Much of this annual growth in central government receipts in February 2019 came from Income Tax-related revenue, with Pay As You Earn (PAYE), National Insurance contributions and Capital Gains Tax increasing by £0.7 billion, £0.5 billion and £0.1 billion respectively. However, self-assessed Income Tax receipts fell by £0.2 billion over the same period.

This month, accrued receipts of both Value Added Tax (VAT) and Corporation Tax (CT) were February records in nominal terms (records for VAT began in 1998 and for CT in April 2000 – due to the change in methodology), though it is important to note that both of these taxes contain forecast cash receipts data and are liable to revision as actual cash receipts data are received.

Over the same period, there were notable increases in the UK contributions to the European Union (EU) budget, expenditure on goods and services, along with net social benefits.

In February 2019, the UK’s net contribution to the EU was £2.9 billion, £1.0 billion higher than in February 2018 and the highest cash payment in any month on record (monthly records began in January 1993). See Section 3 for further details.

Interest payments on the government’s outstanding debt have decreased, due largely to movements in the Retail Prices Index to which index-linked bonds are pegged.

Local government data for February 2019 are based on budget forecasts for England, Wales and Scotland, while public corporations data remain initial estimates, with most components calculated by the Office for National Statistics (ONS) based on the Office for Budget Responsibility (OBR) forecasts. In both cases, additional administrative source data are used to estimate transfers to each of these sectors from central government.

Figure 1: How each sector contributes to the growth in monthly borrowing

February 2019, compared with February 2018, UK

Source: Office for National Statistics – Public Sector Finances

Notes:

- PSNBex – Public sector net borrowing excluding public sector banks.

- CGNB – Central government net borrowing.

- LGNB – Local government net borrowing.

- PCNB – Non-financial public corporations net borrowing.

- BoENB – Bank of England net borrowing.

- L&P – Land and property.

- I & W – Income and wealth.

- Contributions to EU – UK VAT, GNI and abatement contributions to the EU budget.

- NICs – National Insurance contributions.

Download this image Figure 1: How each sector contributes to the growth in monthly borrowing

.png (132.2 kB) .xls (91.1 kB)Due to the volatility of the monthly data, the cumulative financial year-to-date borrowing figures often provide a better indication of the position of the public finances than the individual months.

In the current financial year-to-date (YTD) (April 2018 to February 2019), public sector spending exceeded the money received in taxes and other income. This meant the public sector had to borrow £23.1 billion; that is, £18.0 billion less than the same period in the previous financial YTD. Borrowing so far in this financial year has been the lowest for any April to February period for 17 years.

The public sector spent £35.8 billion for capital spending (or net investment), such as infrastructure, while the “day-to-day” activities of the public sector (current budget) were in surplus by £12.8 billion, therefore the public sector borrowed £23.1 billion.

Figure 2 presents both monthly and cumulative public sector net borrowing (excluding public sector banks) in the current financial YTD (April 2018 to February 2019) and compares these with the previous financial year.

Figure 2: Cumulative borrowing remains lower than the same period last year

Cumulative financial year-to-date (April 2018 to February 2019) compared with the financial year ending March 2018 (April 2017 to March 2018), UK

Source: Office for National Statistics – Public Sector Finances

Notes:

- OBR forecast for public sector net borrowing excluding public sector banks from March 2019 Economic and Fiscal Outlook (EFO).

Download this chart Figure 2: Cumulative borrowing remains lower than the same period last year

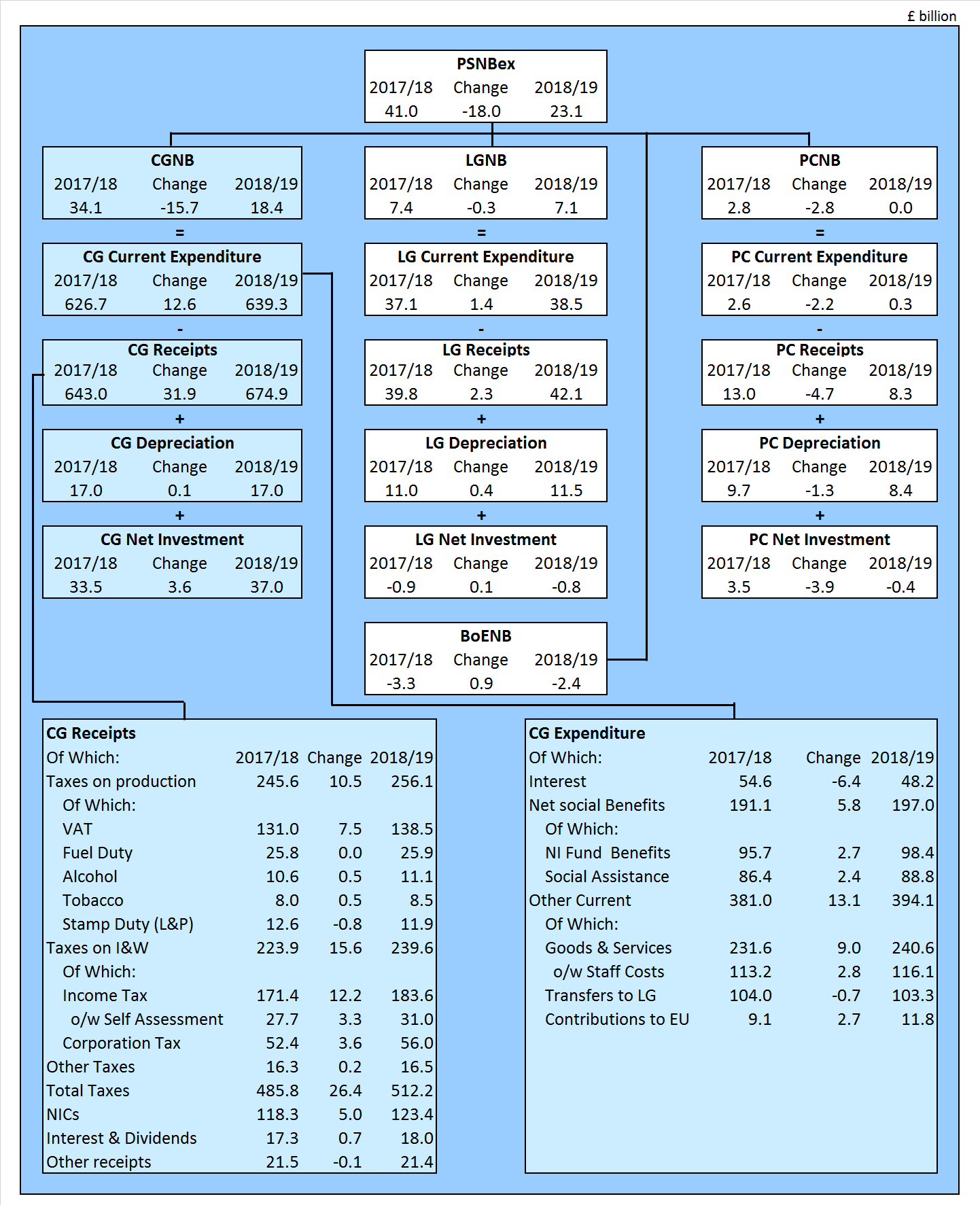

Image .csv .xlsFigure 3 summarises the contributions of each subsector to public sector net borrowing (excluding public sector banks) in the current financial YTD (April 2018 to February 2019) and compares these with the same period in the previous financial year.

The difference between central government's income and spending makes the largest contribution to the amount borrowed by the public sector. In the latest financial YTD (April 2018 to February 2019), of the £23.1 billion borrowed by the public sector, £18.4 billion was borrowed by central government and £7.1 billion was borrowed by local government, while the borrowing of the Bank of England was in surplus by £2.4 billion.

In the current financial YTD (April 2018 to February 2019), central government received £674.9 billion in income, including £512.2 billion in taxes. This was 5% more than in the same period in 2017.

Over the same period, central government spent £676.3 billion, around 2% more than in the same period in 2017. Of this amount, just below two-thirds was spent by central government departments (Education, Defence, Health and Social Care), around one-third was spent on social benefits (such as pensions, unemployment payments, Child Benefit and Maternity Pay), with the remainder being spent on capital investment and interest on government’s outstanding debt.

Figure 3: How each sector contributes to the growth in year-to-date borrowing

Current financial year-to-date (April 2018 to February 2019) compared with the same period last year, UK

Source: Office for National Statistics – Public Sector Finances

Notes:

- PSNBex – Public sector net borrowing excluding public sector banks.

- CGNB – Central government net borrowing.

- LGNB – Local government net borrowing.

- PCNB – Non-financial public corporations net borrowing.

- BoENB – Bank of England net borrowing.

- L&P – Land and property.

- I & W – Income and wealth.

- Contributions to EU – UK VAT, GNI and abatement contributions to the EU budget.

- NICs – National Insurance contributions.

Download this image Figure 3: How each sector contributes to the growth in year-to-date borrowing

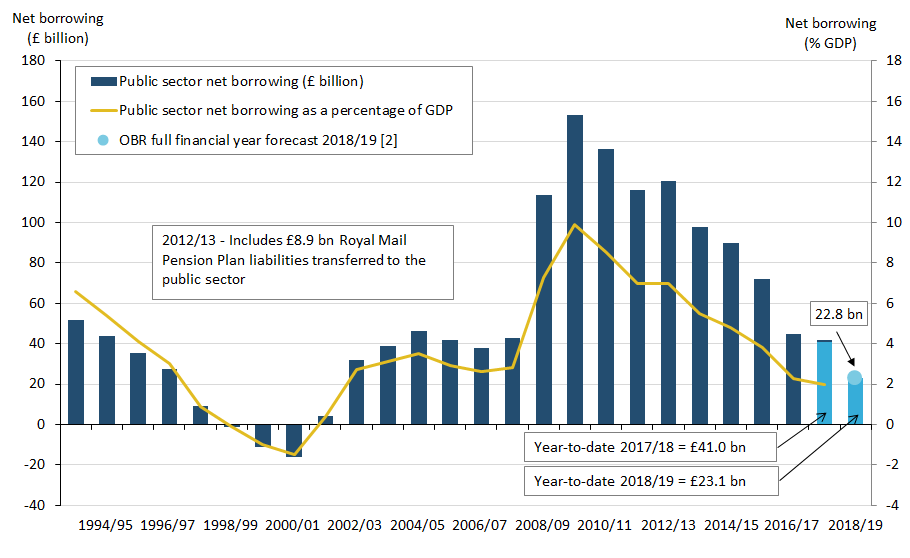

.png (150.7 kB) .xls (81.4 kB)Figure 4 illustrates that annual borrowing has been generally falling since the peak in the financial year ending (FYE) March 2010 (April 2009 to March 2010).

In the latest full financial year (April 2017 to March 2018), the £41.8 billion (or 2.0% of gross domestic product (GDP)) borrowed by the public sector was around one-quarter of the amount seen in the FYE March 2010, when borrowing was £153.1 billion (or 9.9% of GDP).

Figure 4: Borrowing has been generally falling since its peak in financial year ending March 2010

Public sector net borrowing (excluding public sector banks), UK, April 1993 to February 2019

Source: Office for National Statistics – Public Sector Finances

Notes:

- Financial year 2017/18 represents the financial year ending 2018 (April 2017 to March 2018).

- Office for Budget Responsibility (OBR) full financial year forecast of £22.8 billion for public sector net borrowing excluding public sector banks (March 2019 Economic and Fiscal Outlook).

- Ytd equals year-to-date (April 2018 to February 2019).

Download this image Figure 4: Borrowing has been generally falling since its peak in financial year ending March 2010

.png (43.3 kB) .xls (89.6 kB)5. How much does the public sector owe?

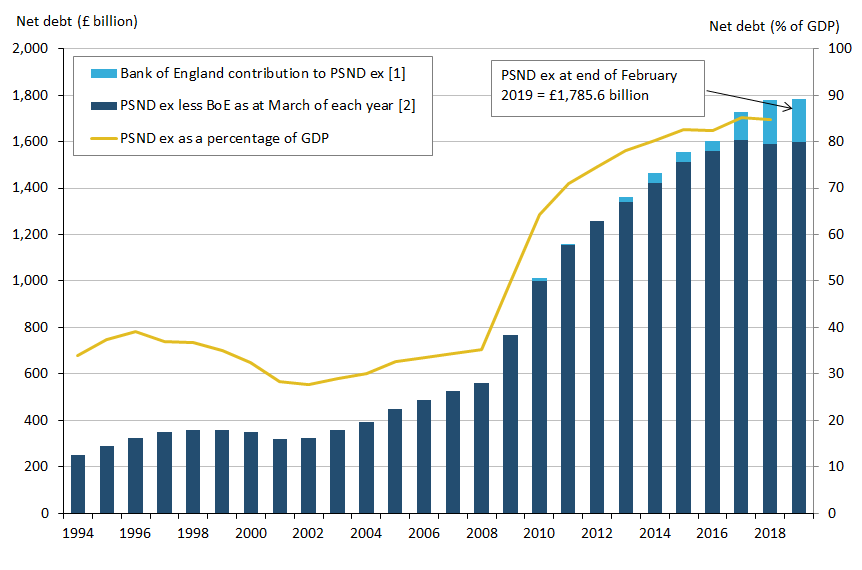

Public sector net debt (PSND ex) represents the amount of money the public sector owes to private sector organisations (including overseas institutions), that has built up by successive government administrations over many years.

When the government borrows, this normally adds to the debt total, but it is important to remember that reducing the deficit is not the same as reducing the debt.

At the end of February 2019, the amount of money owed by the public sector to the private sector stood at around £1.8 trillion (Figure 5), which equates to 82.8% of the value of all the goods and services currently produced by the UK economy in a year (or gross domestic product (GDP)).

Figure 5: Debt as a percentage of gross domestic product (GDP) has been falling over the latest financial year

Public sector net debt (excluding public sector banks), UK, March 1994 to the end of February 2019

Source: Office for National Statistics – Public Sector Finances

Notes:

- Includes Asset Purchase Facility (APF), which includes the Term Funding Scheme (TFS).

- Public sector net debt excluding public sector banks (PSND ex) is the combination of PSND ex Bank of England (BoE) plus BoE contribution to PSND ex.

Download this image Figure 5: Debt as a percentage of gross domestic product (GDP) has been falling over the latest financial year

.png (43.4 kB) .xls (70.7 kB)The Bank of England’s (BoE) contribution to net debt is largely a product of their quantitative easing measures, namely the Bank of England Asset Purchase Facility Fund (APF) and the Term Funding Scheme (TFS). If we were to exclude BoE from our calculation of public sector net debt (excluding public sector banks), it would reduce by £186.0 billion, from £1,785.6 billion to £1,599.6 billion, or from 82.8% of GDP to 74.1%.

Figure 6 breaks down outstanding public sector net debt at the end of February 2019 into the subsectors of the public sector. In addition to public sector net debt excluding public sector banks (PSND ex), this presentation includes the effect of public sector banks on debt.

Figure 6: How each sector contributes to debt, UK

At end of February 2019

Source: Office for National Statistics – Public Sector Finances

Notes:

- PSND – Public sector net debt.

- PSBsND – Public sector Banks net debt.

- PSNDex – Public sector net debt excluding public sector banks.

- BoEND – Bank of England's contribution to net debt.

- PSND ex less BoE – Public sector net debt excluding both public sector banks and Bank of England.

- NFPCND – Non-financial public corporations' net debt.

- GGND – General government net debt.

Download this chart Figure 6: How each sector contributes to debt, UK

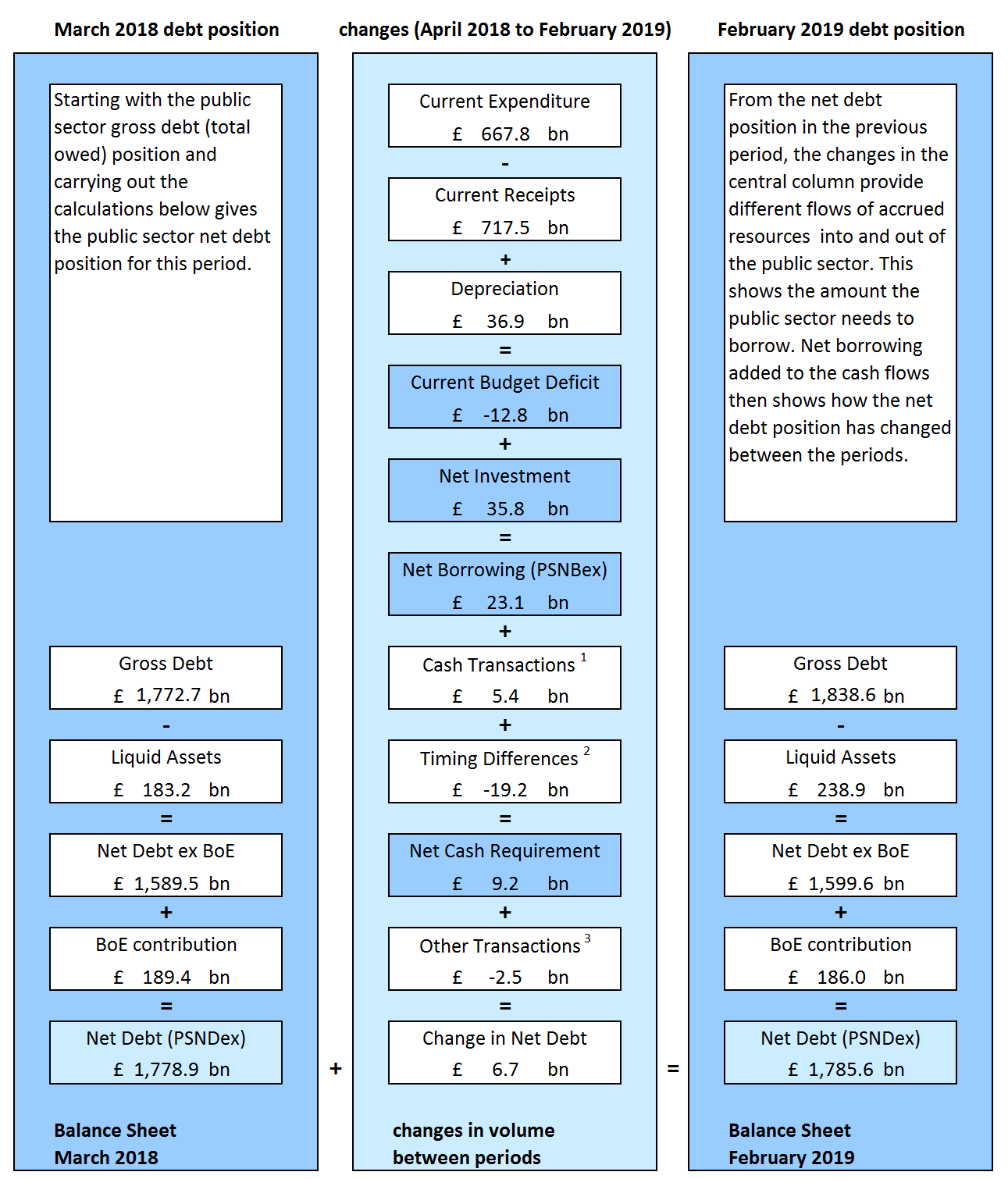

Image .csv .xlsFigure 7 incorporates the borrowing components detailed in Figure 2 to illustrate how the differences between income and spending (both current and capital) have led to the accumulation of debt in the current financial year-to-date (April 2018 to February 2019).

The reconciliation between public sector net borrowing and net cash requirement is presented in more detail in Table REC1 in the Public sector finances Tables 1 to 10: Appendix A dataset.

Figure 7: How the differences in expenditure and receipts affect public sector net debt (excluding public sector banks), UK

Source: Office for National Statistics – Public Sector Finances

Notes:

- Cash transactions in (non-financing) financial assets, which do not impact on net borrowing.

- Timing differences between cash and accrued data.

- Revaluation of foreign currency debt (for example, foreign currency). Debt issuances or redemptions above or below debt valuation (for example, bond premia and discounts and capital uplifts). Changes in volume of debt not due to transactions (for example, sector reclassification).

Download this image Figure 7: How the differences in expenditure and receipts affect public sector net debt (excluding public sector banks), UK

.png (135.1 kB) .xls (60.4 kB)6. Revisions since previous release

Revisions can be the result of both updated data sources and methodology changes. This month, revisions to public sector net borrowing are a result of updated data.

Table 1 presents the revisions to the headline statistics presented in this bulletin compared with those presented in the previous publication (published on 21 February 2019).

Table 1: Revisions to main aggregates

| Revisions since the previous public sector finances bulletin (published 21 February 2019), UK | |||||||||

| £ billion1 (not seasonally adjusted) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Net borrowing | |||||||||

| Period | CG2 | LG3 | NFPCs4 | BoE5 | PSNB ex6 | PSND ex7 | PSND % of GDP | PSNCR ex8 | |

| 2016/17 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| 2017/18 | 0.1 | 0.0 | -0.2 | 0.0 | -0.1 | 0.0 | 0.0 | 0.0 | |

| 2018/19 YTD | 0.1 | 1.7 | -0.2 | 0.0 | 1.7 | 1.5 | 0.3 | 0.0 | |

| 2018 Apr | 0.1 | 0.1 | 0.0 | 0.0 | 0.2 | 0.1 | 0.1 | 0.0 | |

| 2018 May | -0.2 | 0.1 | 0.0 | 0.0 | -0.1 | 0.2 | 0.1 | 0.0 | |

| 2018 Jun | -0.1 | 0.1 | 0.0 | 0.0 | 0.0 | 0.1 | 0.1 | 0.0 | |

| 2018 Jul | 0.2 | 0.1 | 0.0 | 0.0 | 0.3 | 0.2 | 0.2 | 0.0 | |

| 2018 Aug | 0.0 | 0.1 | 0.0 | 0.0 | 0.1 | 0.2 | 0.1 | 0.0 | |

| 2018 Sep | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 | 0.2 | 0.2 | 0.0 | |

| 2018 Oct | 0.3 | 0.2 | 0.0 | 0.0 | 0.5 | 0.6 | 0.2 | 0.0 | |

| 2018 Nov | 0.0 | 0.2 | 0.0 | 0.0 | 0.2 | 0.9 | 0.3 | 0.0 | |

| 2018 Dec | -1.5 | 0.2 | 0.1 | 0.0 | -1.2 | 1.3 | 0.3 | 0.0 | |

| 2019 Jan | 1.3 | 0.6 | -0.3 | 0.0 | 1.6 | 1.5 | 0.3 | 0.0 | |

| Source: Office for National Statistics | |||||||||

| Notes: | |||||||||

| 1. Unless otherwise stated. | |||||||||

| 2. Central government. | |||||||||

| 3. Local government. | |||||||||

| 4. Non-financial public corporations. | |||||||||

| 5. Bank of England. | |||||||||

| 6. Public sector net borrowing excluding public sector banks. | |||||||||

| 7. Public sector net debt excluding public sector banks. | |||||||||

| 8. Public sector net cash requirement excluding public sector banks. | |||||||||

| 9. 2017/18 represents financial year ending 2018 (April 2017 to March 2018). | |||||||||

| 10. 2018/19 YTD refers to the current financial year-to-date (April to January 2019). | |||||||||

Download this table Table 1: Revisions to main aggregates

.xls (56.3 kB)Revisions to public sector net borrowing (excluding public sector banks) in January 2019

This month we report a £1.6 billion increase to public sector net borrowing in January 2019 since the previous bulletin (published on 21 February 2019). This revision is largely a temporary effect of the alignment of our monthly public finances data and our quarterly government finance statistics (GFS) reported to the European Commission.

This month’s GFS submission requires the alignment of these two datasets for the period up to and including December 2018. As is usual, since the finalisation of our GFS dataset, we have received further, more up-to-date central government expenditure data from HM Treasury. To reflect this expenditure in the latest month (February 2019) and to preserve most up-to-date current financial year-to-date (April 2018 to February 2019) expenditure totals, we have applied profile adjustments to January’s expenditure data. On this occasion, in using the most up-to-date data, a larger than normal portion of revision to net investment (more specifically capital grants to the private sector) has been applied to January, rather than across the whole April to January period.

This is a regular quarterly phenomenon and these temporary adjustments applied to January 2019 will be removed for the next release (24 April 2019).

Revisions to public sector net borrowing (excluding public sector banks) in the financial year-to-date (April 2018 to January 2019)

The data for the latest month of every release contain some forecast data. The initial outturn estimates for the early months of the financial year, particularly April, contain more forecast data than other months, as profiles of tax receipts, along with departmental and local government spending are still provisional. This means that the data for these months are typically more prone to revision than other months and can be subject to sizeable revisions in later months.

Public sector net borrowing excluding public sector banks (PSNB ex) in the period April 2018 to January 2019 has been revised up by £1.7 billion compared with figures presented in the previous bulletin (published on 21 February 2019). This increase in borrowing was almost entirely due to the receipt of new local government data, increasing its borrowing by £1.7 billion across the financial year-to-date.

Over the same period central government net borrowing increased by £0.1 billion, while public corporations’ net borrowing reduced by £0.2 billion compared with previous estimates.

Local government net borrowing in the financial year-to-date (April 2018 to January 2019)

This month we have increased our previous estimate of local government borrowing in the financial year-to-date by £1.7 billion. This is due largely to an increase of £1.0 billion to our previous estimate of capital expenditure across this period.

On 10 December 2018, the government published an update on the financial package for Crossrail. It announced that due to increased construction costs, a financial package worth £1.4 billion, largely made up of a loan of £1.3 billion from the Department for Transport (DfT) to the Greater London Authority (GLA), will be made available to Transport for London (TfL) to cover Crossrail construction costs.

In light of this decision, following the receipt of new data, this month we have increased local government gross fixed capital formation (a component of capital expenditure) by £1.0 billion across the current financial year-to-date.

Further, receipts of interest and dividends (from other parts of the public sector) have been reduced by £0.4 billion.

Central government net borrowing in the financial year-to-date (April 2018 to January 2019)

In the central government account, data revisions over the period April 2018 to January 2019 have been largely offsetting. Tax receipts have been revised up by £0.2 billion, while other revenue has decreased by £0.6 billion.

Over the same period, estimates for central government current expenditure increased by £0.3 billion, due largely to an increase in expenditure on goods and services, along with subsidies paid by central government to other sectors. Capital expenditure (net investment) decreased by £0.5 billion, due largely to a decrease in gross capital formation.

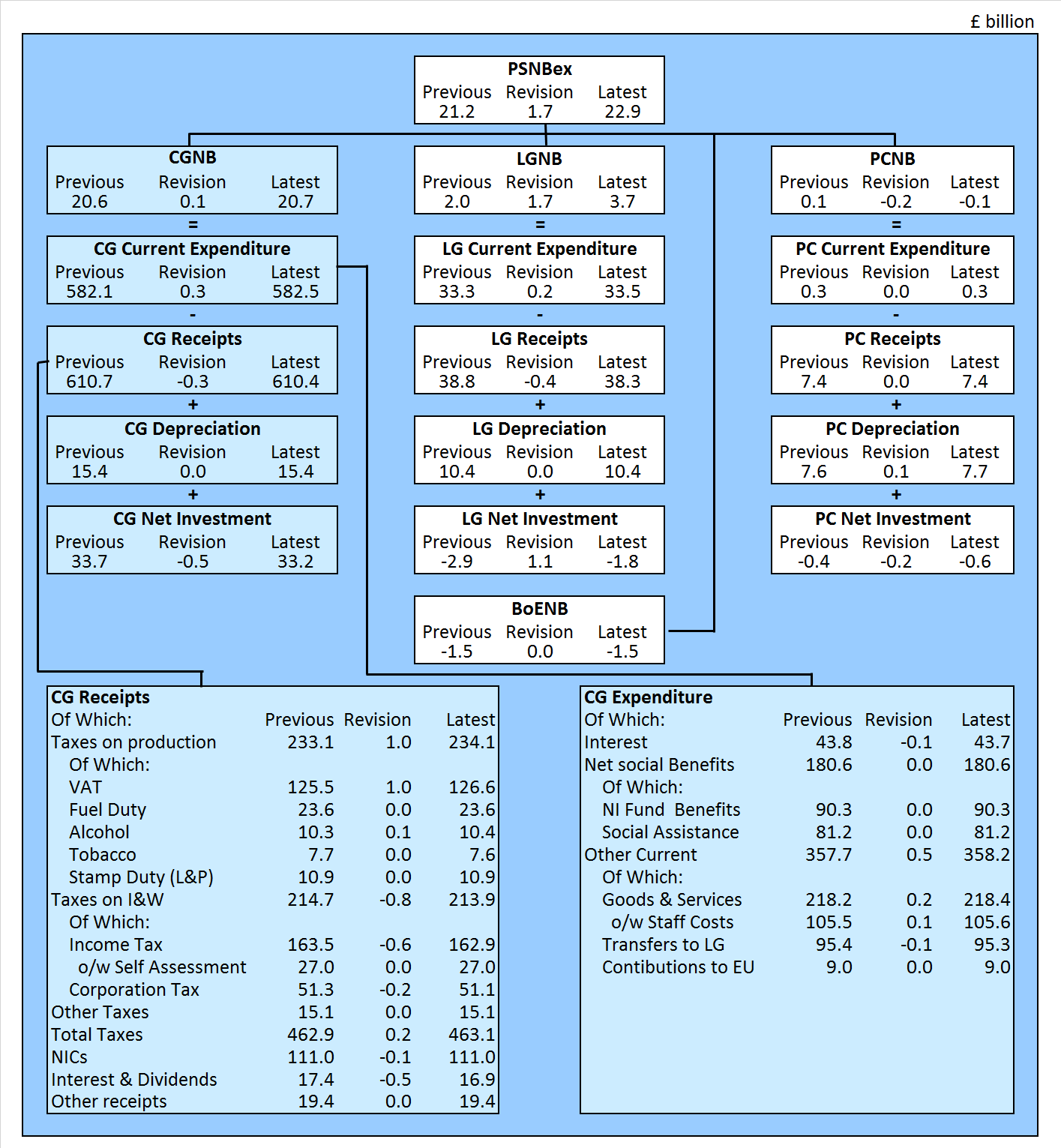

Figure 8 breaks down the revision to PSNB ex by each of its four subsectors: central government, local government, non-financial public corporations and Bank of England (BoE).

Figure 8: How each sector contributes to the revision in year-to-date borrowing

Revisions to net borrowing, latest data for April 2018 to January 2019, compared with that presented in the previous bulletin (published 21 February 2019), UK

Source: Office for National Statistics – Public Sector Finances

Notes:

- PSNBex – Public sector net borrowing excluding public sector banks.

- CGNB – Central government net borrowing.

- LGNB – Local government net borrowing.

- PCNB – Non-financial public corporations net borrowing.

- BoENB – Bank of England net borrowing.

- L&P – Land and property.

- I & W – Income and wealth.

- Contributions to EU – UK VAT, GNI and abatement contributions to the EU budget.

- NICs – National Insurance contributions.

Download this image Figure 8: How each sector contributes to the revision in year-to-date borrowing

.png (134.6 kB) .xls (89.1 kB)Revisions to public sector net debt excluding public sector banks

Our estimate of public sector net debt excluding public sector banks (PSND ex) at the end of January 2019 has been revised up by £1.5 billion compared with figures presented in the previous bulletin (published on 21 February 2019). This revision was due largely to a £1.7 billion increase in our recording of loans to local government; mainly from central government.

Nôl i'r tabl cynnwys7. How do our figures compare with official forecasts?

The independent Office for Budget Responsibility (OBR) is responsible for the production of official forecasts for government. These forecasts are usually produced twice a year, in spring and autumn.

On 13 March 2019, the government published its Spring Statement 2019. On the same day, the independent Office for Budget Responsibility (OBR), responsible for the production of official forecasts for government, published updated forecasts for debt and borrowing, on which the Spring Statement 2019 is based.

The OBR forecasts used in this bulletin are based on those published in its Economic and Fiscal Outlook – March 2019.

Table 2 compares the current outturn estimates for each of our main public sector (excluding public sector banks) aggregates for the latest full financial year with corresponding OBR forecasts for the following financial year. Further, it compares the current financial year-to-date (April 2018 to February 2019) outturn estimates with those of the previous financial year.

Caution should be taken when comparing public sector finances data with OBR figures for the full financial year. Data are not finalised until some time after the financial year ends, with initial estimates made soon after the end of the financial year often subject to sizeable revisions in later months as forecasts are replaced with audited outturn data.

There may also be known methodological differences between OBR forecasts and outturn data.

Table 2: Latest outturn estimates compared with Office for Budget Responsibility forecasts

| Office for Budget Responsibility (OBR) forecasts in the current financial year-to-date (April 2018 to February 2019) compared with the latest full financial year (April 2017 to March 2018), UK | ||||||

|---|---|---|---|---|---|---|

| Excluding public sector banks | £ billion1 (not seasonally adjusted) | |||||

| Financial year-to-date7 | Full financial year8 | |||||

| 2017/18 | 2018/19 | % change | 2017/18 Outturn | 2018/19 OBR Forecast9 | % change | |

| Current budget deficit2 | 4.9 | -12.8 | -360.3 | -0.8 | 20.4 | -2,651.6 |

| Net investment3 | 36.1 | 35.8 | -0.9 | 42.7 | 43.2 | 1.3 |

| Net borrowing 4 | 41.0 | 23.1 | -43.8 | 41.8 | 22.8 | -45.4 |

| Net debt 5 | 1,762.9 | 1,785.6 | 1.3 | 1,778.9 | 1,803.4 | 1.4 |

| Net debt as a percentage of GDP6 | 84.2 | 82.8 | NA | 84.8 | 83.3 | NA |

| Source: Office for National Statistics | ||||||

| Notes: | ||||||

| 1. Unless otherwise stated. | ||||||

| 2. Current budget deficit is the difference between current expenditure (including depreciation) and current receipts. | ||||||

| 3. Net investment is gross investment (net capital formation plus net capital transfers) less depreciation. | ||||||

| 4. Net borrowing is current budget deficit plus net investment. | ||||||

| 5. Net debt is financial liabilities (for loans, deposits, currency and debt securities) less liquid assets. | ||||||

| 6. GDP at current market price. | ||||||

| 7. Financial year-to-date refers to the period from April to February. | ||||||

| 8. 2018/19 refers to financial year ending in March 2019 and 2017/18 refers to financial year ending in March 2018. | ||||||

| 9. All OBR figures are from the OBR Economic and Fiscal Outlook published in March 2019. | ||||||

| 10. NA means "not applicable". | ||||||

Download this table Table 2: Latest outturn estimates compared with Office for Budget Responsibility forecasts

.xls (50.7 kB)8. International comparisons of borrowing and debt

The UK government debt and deficit statistical bulletin is published quarterly (in January, April, July and December each year), to coincide with when the UK and other EU member states are required to report on their deficit (or net borrowing) and debt to the European Commission.

On 17 January 2019, we published UK government debt and deficit: September 2018, consistent with Public sector finances, UK: November 2018 (published on 21 December 2018). In this publication we stated that:

general government gross debt was £1,763.8 billion at the end of March 2018, equivalent to 85.4% of gross domestic product (GDP); 25.4 percentage points above the Maastricht reference value of 60.0%

general government deficit (or net borrowing) was £42.9 billion in the financial year ending (FYE) March 2018, equivalent to 2.1% of GDP; 0.9 percentage points below the Maastricht reference value of 3.0%

This bulletin presents a downward revision of £0.5 billion to general government deficit in the FYE March 2018, to £43.4 billion, compared with that published on 17 January 2019; while the estimate of general government gross debt remains unchanged at £1,763.8 billion.

It is important to note that the GDP measure used as the denominator in the calculation of the debt ratios in the UK government debt and deficit statistical bulletin, differs from that used within the public sector finances statistical bulletin.

Nôl i'r tabl cynnwys9. Quality and methodology

The public sector finances Quality and Methodology Information report contains important information on:

the strengths and limitations of the data and how it compares with related data

uses and users of the data

how the output was created

the quality of the output including the accuracy of the data

The Public sector finances methodological guide provides comprehensive contextual and methodological information concerning the monthly public sector finances statistical bulletin.

The guide sets out the conceptual and fiscal policy context for the bulletin, identifies the main fiscal measures and explains how these are derived and inter-related. Additionally, it details the data sources used to compile the monthly estimates of the fiscal position.

Local government forecasts

In recent years, planned expenditure initially reported in local authority budgets has systematically been higher than the final outturn expenditure reported in the audited accounts. We therefore include adjustments to reduce the amounts reported at the budget stage.

Further information on these and additional adjustments can be found in the public sector finances Quality and Methodology Information report.

Nôl i'r tabl cynnwys10. Looking ahead

This section presents information on aspects of data or methodology that are planned but not yet included in the public sector finances.

Further, in our article Looking ahead: developments in public sector finance statistics, we provide users with early sight of those areas where the fiscal statistics may be significantly impacted upon by methodological or classification changes during the coming 24 months.

EU withdrawal agreement

Although the Office for Budget Responsibility (OBR) discusses the EU settlement in Annex B (PDF, 2.5MB) of their Economic and Fiscal Outlook – March 2018, the details in the report are still subject to negotiation.

There is insufficient certainty at this stage for us to complete a formal assessment of impact on the UK public sector finances.

On 28 January 2019, National Statistician John Pullinger released a statement outlining our legislative preparations for a possible no-deal EU exit.

Accounting for student loans: how we are improving the recording of student loans in government accounts

On 17 December 2018, we announced our decision on how we will treat student tuition fee and maintenance loans in the government’s accounts. We have published a blog explaining our role and why we have taken this decision.

In addition, we have published a technical note, giving further information about how we came to our decision.

It is anticipated that implementation of this decision into our headline statistics will take some time and that any change will be reflected in the public sector finances in September 2019.

East Coast Mainline

On 16 May 2018, the government announced that from 24 June 2018, London North Eastern Railway (LNER) will take over the running of East Coast Mainline services. On 31 August 2018, we announced that LNER would be classified to the public non-financial corporations subsector, effective from 14 February 2018. We are currently investigating the implications of this decision and our conclusions will be announced in due course.

Carillion insolvency

Following Carillion Plc declaring insolvency on 15 January 2018, the UK government announced that it would provide the necessary funding required by the Official Receiver, to ensure continuity of public services through an orderly liquidation. The Official Receiver has been appointed by the court as liquidator, along with partners at PwC that have been appointed Special Managers. The defined benefit pension schemes of former Carillion employees are currently being assessed by the Pension Protection Fund (PPF) prior to any transition into the PPF scheme.

We are currently investigating the various impacts of the liquidation of Carillion on the public sector finances, including in relation to the public-private partnership projects in which Carillion was involved and the additional funding that the government has provided to maintain public services. We will announce our findings in due course.

Prior to liquidation, Carillion held approximately 450 contracts with government, representing 38% of Carillion’s 2016 reported revenue.

Company tax credits

In conjunction with HM Revenue and Customs (HMRC), we are currently reviewing our recording of company tax credits. We will announce the findings of this review and introduce any data revisions at the earliest opportunity.

Nôl i'r tabl cynnwys