Cynnwys

- Main points

- Latest indicators at a glance

- UK flight data

- Road traffic in Great Britain

- Spending on credit and debit cards

- Online job adverts

- OpenTable seated diners

- Retail footfall

- Business impacts and insights

- Social impact of coronavirus (COVID-19)

- Data

- Glossary

- Measuring the data

- Strengths and limitations

- Related links

1. Main points

- In the week ending 11 July 2021, the seven-day average number of daily flights increased by 9% compared with the previous week to 2,307 flights; this is around one-third of the level seen in the equivalent week of 2019 (EUROCONTROL). See Section 3.

- The volume of all motor vehicle traffic on Monday 12 July was at 93% of the level seen on the Monday of the first week in February 2020, a 4 percentage point decrease from a week ago and the largest week-on-week decrease seen since the Spring Bank Holiday on Monday 31 May 2021 (Department for Transport ). See Section 4.

- In June 2021, the monthly CHAPS-based indicator of aggregate credit and debit card spending decreased by 4 percentage points compared with May 2021 to 95% of its February 2020 average level; the first time that the monthly CHAPS-based index has decreased month-on-month since January 2021 (Bank of England CHAPS data). See Section 5.

- On 9 July 2021, the total volume of UK online job adverts had decreased by 4% when compared with the previous week (2 July 2021), but remained much higher than pre-pandemic levels at 129% of its February 2020 average level (Adzuna). See Section 6.

- In the week to 12 July 2021, the seven-day average estimate of UK seated diners fell by 2 percentage points compared with the previous week to 117% of its level in the equivalent week of 2019 (OpenTable). See Section 7.

- In the week to 10 July 2021, overall retail footfall in the UK was at 74% of the level seen in the equivalent week of 2019; footfall at retail parks continued to be much higher than at shopping centres and high streets relative to their 2019 levels (Springboard). See Section 8.

- Currently trading UK businesses reported that 11% of their workforce have moved from furlough or fully homeworking to a hybrid model of working, i.e. spending at least some of their time at their usual place of work, in the last two weeks (at the point at which they responded) (Business Insights and Conditions Survey (BICS) 14 to 27 June 2021). See Section 9.

- The proportion of working adults in Great Britain who in the past seven days worked exclusively from home slightly decreased by 3 percentage points from the previous week to 23% (Opinions and Lifestyle Survey 7 to 11 July 2021). See Section 10.

- There were 14,164 company incorporations in the week to 9 July 2021, a 7% increase from the previous week (13,221); this is also 3% higher than the equivalent week in 2019 (13,806) but 24% lower than the equivalent week of 2020 (18,661) (Companies House). See the accompanying dataset.

- There were 6,608 voluntary dissolution applications in the week to 9 July 2021, a 4% increase from the previous week (6,359); this is also 42% and 27% higher than levels seen in the equivalent weeks of 2020 (4,642) and 2019 (5,203), respectively (Companies House). See the accompanying dataset.

- In the week ending 11 July 2021, average counts of traffic camera activity for nearly all vehicle types and pedestrians in London and the North East were above their pre-lockdown levels (average for week ending 22 March 2020); pedestrians and cyclists in London were highest at 125% of their pre-lockdown level (Transport for London, North East Traffic Cameras). See the accompanying dataset.

Results presented in this bulletin are experimental and may be subject to revision.

2. Latest indicators at a glance

Embed code

Notes:

- For the indicator ‘Proportion of workforce working at their normal pre-pandemic place of work’, the response to this question was changed from “Working at their normal place of work" to "Mainly working at the same place they were working before the pandemic" from Wave 33 of the Business Insights and Conditions Survey (BICS).

More about economy, business and jobs

- All ONS analysis, summarised in our economy, business and jobs roundup.

- Explore the latest trends in employment, prices and trade in our economic dashboard.

- View all economic data.

3. UK flight data

These data are daily flight figures from the European Organisation for the Safety of Air Navigation (EUROCONTROL). Daily flight numbers for the UK alongside other countries are available in EUROCONTROL’s dashboard. EUROCONTROL is a pan-European, civil-military organisation dedicated to supporting European aviation. Its Aviation Intelligence and Performance Review Unit provides independent collection and validation of air navigation services performance-related data and intelligence gathering.

These flights data include international arrivals and departures to and from the UK (including Crown Dependencies) and domestic UK flights, but exclude overflights (flights that pass over UK territory). They capture all flight movements that operate under Instrumental Flight Rules (IFR), where the pilot uses instruments in the flight deck to control, guide and adjust the plane. This includes commercial flights carrying passengers and cargo as well as non-commercial flights such as private and military flights.

Data from EUROCONTROL does not include information on the volume of passengers or cargo carried on UK flights. Especially in the context of the coronavirus (COVID-19) pandemic, flights might not be operating at full capacity and therefore trends in passengers and cargo will differ from trends in flights presented here.

Figure 1: In the week to 11 July 2021, the seven-day average number of daily flights increased by 9% from the previous week to 2,307 flights, around a third of the level in the equivalent week of 2019

Number of daily flights, non-seasonally adjusted, and seven-day moving average, 2 January 2019 to 11 July 2021, UK

Source: European Organisation for the Safety of Air Navigation (EUROCONTROL)

Notes:

- The fall in February 2020 coincides with storm Ciara.

- The falls in December and January coincide with Christmas Eve, Christmas Day, New Year’s Eve and New Year’s Day.

Download this chart Figure 1: In the week to 11 July 2021, the seven-day average number of daily flights increased by 9% from the previous week to 2,307 flights, around a third of the level in the equivalent week of 2019

Image .csv .xlsIn 2019, the total number of flights from, to and within the UK ranged from approximately 5,000 per day in quieter months to over 6,500 per day in peak holiday season. After the Foreign and Commonwealth Office advised against all non-essential international travel (17 March 2020) and the UK first went into lockdown (23 March 2020), the number of flights fell to a low of around 500 per day at the start of April 2020, approximately 10% of what they were in the equivalent period of 2019.

During July and August 2020, as travel corridors were introduced in the UK, flights steadily increased to nearly 3,000 per day (around 40% of the 2019 level), before falling again in line with the normal seasonal pattern. There was a notable increase in flights in the week before Christmas 2020 ahead of the usual Christmas Day decrease.

In early 2021, flights remained steady at around 1,000 per day (around 20% of their equivalent 2019 levels). From mid-May 2021 and as the green list of countries was introduced (17 May 2021), flights have gradually increased.

In the week ending 11 July 2021, the seven-day average number of daily flights was 2,307. This is an increase of 9% on the previous week, when the equivalent figure was 2,126. The average number of flights in the latest week is 69% higher than the corresponding figure for the equivalent week in 2020, but still only around a third of the level seen in the equivalent week of 2019.

The full data time series available for UK flights can be found in the accompanying dataset, which contains daily flight numbers and the rolling seven-day averages.

Nôl i'r tabl cynnwys4. Road traffic in Great Britain

According to Department for Transport (DfT) non-seasonally adjusted road traffic data, the volume of all motor vehicle traffic on Monday 12 July 2021 was at 93% of the level seen on the Monday of the first week of February 2020. This is a decrease of 4 percentage points from the previous week (Monday 5 July 2021) and is the largest week-on-week decrease observed since the Spring Bank Holiday on Monday 31 May 2021. The fall in road traffic volumes on Monday 12 July follows heavy rainfall, resulting in flooding for some areas of London on that day.

Compared with the previous week, the volume of road traffic on Monday 5 July 2021 for light commercial vehicles and heavy goods vehicles decreased by 9 and 6 percentage points respectively, to 101% of their levels in the first week of February 2020. This is the lowest figure recorded for both since the Spring Bank Holiday on Monday 31 May 2021. The corresponding figure for cars was 91%, having decreased slightly by 2 percentage points from the previous Monday.

Figure 2: The volume of motor vehicle traffic on Monday 12 July 2021 was at 93% of the level seen in the first week of February 2020, a decrease of 4 percentage points from a week ago

Daily road traffic index: 100 = same traffic as the equivalent day of the week in the first week of February 2020, 1 March 2020 to 12 July 2021, non-seasonally adjusted

Embed code

Notes:

- The blue shaded areas refer to periods when restrictions across the UK were in effect. In order, these were: first national lockdown in the UK (23 March 2020) to easing of restrictions with non-essential shops reopening in England (15 June 2020); second lockdown in England (5 November 2020) to lockdown being replaced with three-tier system in England (2 December 2020); third lockdown announced in Scotland and England (4 January 2021) to “stay at home” restrictions ending in England (29 March 2021).

The daily DfT estimates are indexed to the first week of February 2020 and the comparison is with the same day of the week. The data provided are useful as an indication of traffic change rather than actual traffic volumes. More information on the methods, quality and economic analysis for these indicators can be found in the DfT methodology article.

Nôl i'r tabl cynnwys5. Spending on credit and debit cards

Daily CHAPS-based indicator

These data series are experimental faster indicators for estimating UK spending on credit and debit cards. They track the daily CHAPS payments made by credit and debit card payment processors to around 100 major UK retail corporates. These payments are the proceeds of recent credit and debit card transactions made by customers at their stores, both via physical and via online platforms. More information on the indicator is provided in the accompanying methodology article.

Companies are allocated to one of four categories based on their primary business:

- "staples" refers to companies that sell essential goods that households need to purchase, such as food and utilities

- "work-related" refers to companies providing public transport or selling petrol

- "delayable" refers to companies selling goods whose purchase could be delayed, such as clothing or furnishings

- "social" refers to spending on travel and eating out

Figure 3: In the week to 8 July 2021, the aggregate CHAPS-based indicator of credit and debit card purchases remained broadly similar to the previous week at 97% of its February 2020 average level

Index February 2020 = 100, a backward looking seven-day rolling average, 13 January 2020 to 8 July 2021, non-seasonally adjusted, nominal prices

Source: Office for National Statistics and Bank of England calculations

Notes:

- Users should note the daily payment data are the sum of card transactions processed up to the previous working day, so there is a slight time lag when compared with real-life events on the chart.

- The vertical lines indicate notable events. In order, the events are: first national lockdown begins; some non-essential shops allowed to reopen; regional restrictions begin in England; Christmas period; lockdowns announced in England and Scotland; reopening of non-essential shops, and outdoor pubs and restaurants in England; further easing of lockdown restrictions, including reopening of indoor pubs and restaurants in England.

- Percentage point difference is derived from current week and previous week index before rounding.

Download this chart Figure 3: In the week to 8 July 2021, the aggregate CHAPS-based indicator of credit and debit card purchases remained broadly similar to the previous week at 97% of its February 2020 average level

Image .csv .xlsFigure 3 shows changes in the value of CHAPS payments received by large UK corporates from their credit and debit card processors, "merchant acquirers".

In the week to 8 July 2021, the CHAPS-based indicator of credit and debit card purchases in aggregate remained broadly similar to the previous week at 97% of its February 2020 average level (up 1 percentage point from the week ending 1 July 2020). The “social” and “delayable” spending categories rose by 4 and 1 percentage points, respectively. The ‘’work related’’ category decreased by 2 percentage points, while the ‘‘staple’’ category remained broadly unchanged from the previous week.

In the latest week, “work related” and “staple” spending were above their February 2020 average levels, at 111% and 110% respectively. Conversely, “delayable” and “social” spending were at 91% and 88% of their February 2020 average levels respectively.

The full data time series available for data on UK spending on debit and credit cards can be found in the accompanying dataset.

Monthly CHAPS-based indicator

In June 2021 the monthly CHAPS-based indicator of aggregate credit and debit card spending decreased by 4 percentage points when compared with May 2021 to 95% of its February 2020 average level. This is the first time since January 2021 that the monthly CHAPS-based index of credit and debit card spending has decreased month-on-month.

The monthly time series is available in the accompanying dataset and includes methodological notes that users should bear in mind. The monthly CHAPS index is calculated by the Office for National Statistics, rather than being an additional series that is produced and validated by the Bank of England.

Nôl i'r tabl cynnwys6. Online job adverts

Job adverts by category

These figures are experimental estimates of online job adverts provided by Adzuna, an online job search engine, by category, by UK country and English region. The number of job adverts over time is an indicator of the demand for labour. The Adzuna categories used do not correspond to Standard Industrial Classification (SIC) categories, so these values are not directly comparable with the Office for National Statistics (ONS) Vacancy Survey.

Figure 4: On 9 July 2021, the total volume of online job adverts remained higher than pre-pandemic levels at 129% of its February 2020 average level

Volume of online job adverts by category, index: 100 = February 2020 average, 4 January 2019 to 9 July 2021, non-seasonally adjusted

Embed code

Notes:

- Further category breakdowns are included in the online job advert estimates dataset and more details on the methodology can be found in Using Adzuna data to derive an indicator of weekly vacancies.

- Users should note that week-on-week changes in online job advert volumes are outlined as percentages, rather than as percentage point changes. Percentage change figures quoted in the commentary will therefore not necessarily match the percentage point changes observed in the charts and accompanying dataset.

According to Adzuna, on 9 July 2021, the total volume of online job adverts in the UK had decreased by 4% when compared with the previous week (2 July 2021). In the three weeks prior to 9 July 2021, the number of online job adverts had generally increased steadily across most categories alongside the easing of lockdown restrictions in the UK.

Of the 28 categories, 25 saw week-on-week falls in the latest week. The largest of these was in "other/general" (which includes adverts that contain generic titles or do not fit into other categories), which fell by 11% following a 3% decrease in the previous week (2 July 2021). Two categories were broadly unchanged, with the only week-on-week increase being in "facilities/maintenance" which rose slightly by 1%.

On 9 July 2021, the volume of total online job adverts remained substantially higher than pre-pandemic levels at 129% of its February 2020 average level. Of the 28 categories, the only three that were below their pre-pandemic levels were "energy, oil and gas", "legal" and "graduate", at 85%, 94% and 97% of their February 2020 average levels respectively.

The "transport/logistics/warehouse" category remains the highest performing category relative to its pre-pandemic levels at 291% of the average volume seen in February 2020; a 143% increase since the beginning of the year (8 January 2021).

Job adverts by region

Figure 5: On 9 July 2021, the volume of online job adverts had decreased across all UK countries and English regions when compared with the previous week (2 July 2021)

Volume of online job adverts by UK countries and English regions, index: 100 = February 2020 average, 7 February 2020 to 9 July 2021, non-seasonally adjusted

Embed code

On 9 July 2021, the volume of online job adverts had decreased across all UK countries and regions when compared with the previous week (2 July 2021). The largest weekly falls were seen in the South West and Wales where the number of online job adverts both decreased by 6%, followed by the West Midlands where they fell by 5%.

Despite the week-on-week falls in the latest week, the volume of online job adverts remained above their February 2020 average levels in all UK countries and English regions. When compared with pre-pandemic levels, they were strongest in the North East, Northern Ireland and the East Midlands, at 174%, 170% and 158% of their February 2020 average levels respectively.

Meanwhile, relative to its February 2020 average level, the volume of online job adverts remained weakest in London, where the corresponding figure was 111% on 9 July 2021. London has been the region with the lowest volume of online job adverts relative to its February 2020 average for the highest number of (non-consecutive) weeks since the beginning of the coronavirus (COVID-19) pandemic (49 weeks since 31 July 2020).

Nôl i'r tabl cynnwys7. OpenTable seated diners

OpenTable is a provider of data for online restaurant reservations, with daily data for the UK, London and Manchester being publicly available in its The state of the industry dashboard. These data show the impact of recent events and restrictions on the hospitality industry using a sample of restaurants on the OpenTable network across all channels, that is, online reservations, phone reservations, and walk-ins.

Figure 6: In the week to 12 July 2021, the seven-day average estimate of UK seated diners fell by 2 percentage points compared with the week before, to 117% of its level in the same week of 2019

Seated diners, seven-day average, percentage compared with the equivalent week of 2019, week ending 24 February 2020 to week ending 12 July 2021, UK, London and Manchester

Source: OpenTable

Notes:

- Data show the percentage of seated diners when compared with the same week in 2019. For example, Week 27 2021 is compared with Week 27 2019.

- Please note that data for Manchester are only available from week ending 16 November 2020.

Download this chart Figure 6: In the week to 12 July 2021, the seven-day average estimate of UK seated diners fell by 2 percentage points compared with the week before, to 117% of its level in the same week of 2019

Image .csv .xlsAccording to OpenTable, in the week to 12 July 2021, the seven-day average estimate of UK seated diners fell by 2 percentage points compared with the previous week; but remained higher than pre-pandemic levels at 117% of its level in the equivalent week of 2019. In London, during the same week, the seven-day average estimate of seated diners also fell by 2 percentage points when compared with the previous week to 69% of its level in the equivalent week of 2019. The equivalent figure for Manchester was 104%, having fallen by 11 percentage points since the previous week for a second consecutive week.

This is the third consecutive week that average estimates of seated diners for the UK, London, and Manchester have all fallen, having peaked in the week to 31 May 2021, shortly after customers were permitted to dine indoors in England. For the UK as a whole, the average estimate of seated diners has fallen by 56 percentage points between 31 May and 12 July 2021 and has decreased by 36 and 128 percentage points in London and Manchester respectively, over the same period.

Nôl i'r tabl cynnwys8. Retail footfall

National retail footfall

National footfall figures are supplied by Springboard, a provider of data on customer activity. It measures the following for overall UK retail footfall, as well as by high street, retail park, and shopping centre categories:

- daily retail footfall as a percentage of its level on the same day of the equivalent week of 2019; for example, Saturday 10 July 2021 is compared with Saturday 6 July 2019

- total weekly retail footfall as a percentage of its level in the equivalent week of 2019

- the percentage change in weekly footfall compared with the previous week; for example, Week 27 of 2021 is compared with Week 26 of 2021

- Springboard's weekly data are defined over a seven-day period running from Sunday to Saturday; Week 27 of 2021 therefore refers to the period Sunday 4 July 2021 to Saturday 10 July 2021

Figure 7: In the week to 10 July 2021, UK retail footfall was at 74% of its level in the equivalent week of 2019

Volume of overall daily retail footfall, percentage compared with the equivalent day of the equivalent week of 2019, 1 March 2020 to 10 July 2021

Source: Springboard and the Department for Business, Energy and Industrial Strategy

Notes:

The vertical lines indicate notable events. In order, the events are: first national lockdowns begin; restrictions begin to ease across the UK; circuit-breaker lockdown in England; circuit breaker replaced with regional restrictions; Christmas; lockdown begins in England; "stay at home" rule ends in England; Easter; reopening of non-essential retail in England and Wales; reopening of non-essential retail in Scotland; reopening of non-essential retail in Northern Ireland.

Users should note that week-on-week changes in retail footfall volumes are outlined as percentages, rather than as percentage point changes. Percentage change figures quoted in the commentary will therefore not necessarily match the percentage point changes observed in the chart.

Download this image Figure 7: In the week to 10 July 2021, UK retail footfall was at 74% of its level in the equivalent week of 2019

.png (120.1 kB)According to Springboard, in the week to 10 July 2021, the volume of overall retail footfall in the UK remained broadly unchanged from the previous week (week to 3 July 2021). Both retail parks and shopping centres saw small week-on-week increases in footfall of 1% while high street footfall was broadly unchanged from the previous week.

In the latest week to 10 July 2021, overall retail footfall was at 74% of the level seen in the equivalent week of 2019. Comparing retail locations, in the same week, footfall at retail parks was at 96% of its level equivalent week in 2019, whereas the corresponding figures for shopping centres and high streets were 69% and 67%, respectively.

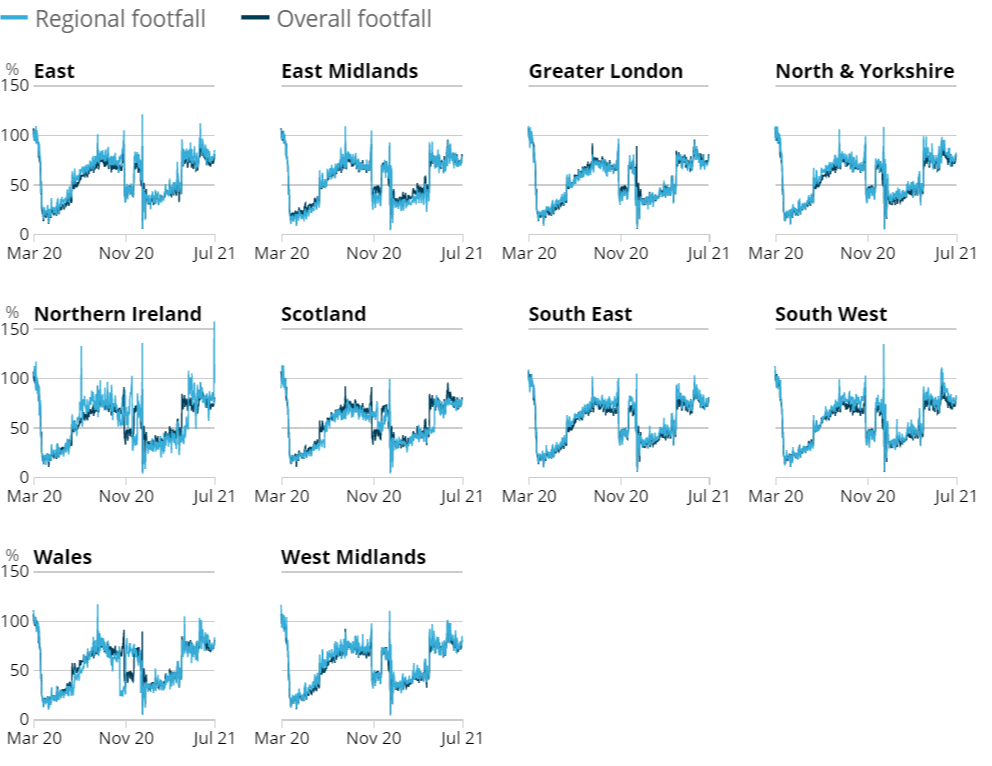

Regional retail footfall

Figure 8: In the week to 10 July 2021, the regions with the lowest retail footfall relative to pre-pandemic levels were the East Midlands and Greater London at 73% of the level in the same week of 2019

Volume of daily retail footfall, percentage of the level recorded on the same day of the equivalent week of 2019, UK countries and English regions, 1 March 2020 to 10 July 2021

Source: Springboard and the Department for Business, Energy and Industrial Strategy

Notes:

- The substantial rise in the index for Northern Ireland on 9 July 2021 is due to retail footfall volumes on that day being compared with those on 12 July 2019, which was a bank holiday. Users should interpret this figure with caution.

Download this image Figure 8: In the week to 10 July 2021, the regions with the lowest retail footfall relative to pre-pandemic levels were the East Midlands and Greater London at 73% of the level in the same week of 2019

.png (131.7 kB)According to Springboard, in the week to 10 July 2021, retail footfall saw week-on-week percentage increases in three of the ten UK countries and English regions. The largest weekly percentage increase in retail footfall was in Greater London, where it rose by 3%, while the West Midlands and South West both saw weekly increases of 2%. Scotland recorded a weekly fall in retail footfall of 3%; this was largely driven by a week-on-week fall of 6% in high street footfall in that country.

In the same week, retail footfall when compared with levels seen in the equivalent week of 2019 was strongest in Northern Ireland, the East of England and the West Midlands, at 90%, 79%, and 78%, respectively. In contrast, retail footfall was weakest in Greater London and the East Midlands; their retail footfall levels in the week to 10 July 2021 were both at 73% of the levels seen in the equivalent week of 2019.

Nôl i'r tabl cynnwys9. Business impacts and insights

Currently trading UK businesses reported that 11% of their workforce have moved from furlough or fully homeworking to a hybrid model of working, i.e. spending at least some of their time at their usual place of work, in the last two weeks (at the point at which they responded). Further, an extra 8% of the workforce that were on partial or full furlough are fully back to where they were working before the pandemic.

Final data for Wave 34 (reference period 14 to 27 June 2021) of the Business Impact of COVID-19 Survey can be found in Business insights and impacts on the UK economy: 15 July 2021.

Further information can also be found in the Business insights and impact on the UK economy dataset.

Nôl i'r tabl cynnwys11. Data

UK spending on credit and debit cards

Dataset | Released 15 July 2021

Experimental indicator for monitoring UK retail purchases derived from the Bank of England's Clearing House Automated Payment System (CHAPS) data.

Shipping indicators

Dataset | Released 17 June 2021

Experimental weekly and daily ship visits dataset covering UK ports.

Traffic camera activity

Dataset | Released 15 July 2021

Experimental daily traffic camera counts data for busyness indices covering the UK.

Online job advert estimates

Dataset | Released 15 July 2021

Experimental job advert indices covering the UK online job market.

Company Incorporations and Voluntary Dissolutions

Dataset | Released 15 July 2021

The number of weekly Companies House Incorporations and Voluntary Dissolution applications accepted.

Business insights and impact on the UK economy

Dataset | Released 15 July 2021

Responses from the Business Insights and Conditions Survey (BICS).

Daily UK flights

Dataset – Released 15 July 2021

Experimental daily UK flight numbers and rolling seven-day average, including flights to, from, and within the UK

Online weekly price changes

Dataset | Released 1 July 2021

Experimental estimates of online price changes for a selection of food and drink products from several large UK retailers.

12. Glossary

Faster indicator

A faster indicator provides insights into economic activity using close-to-real-time big data, administrative data sources, rapid response surveys or experimental statistics, which represent useful economic and social concepts.

Company incorporations

Incorporations are when a company is added to the Companies House register of limited companies. This can also include where an existing business applies to become a limited company, where it was not one before.

Voluntary dissolution applications

A voluntary dissolution application is when a company applies to begin dissolution proceedings. As such, they effectively chose to be removed from the Companies House register. For a company to be eligible to voluntarily dissolve, it should not have completed any trading activity for a period of three months.

Nôl i'r tabl cynnwys13. Measuring the data

UK Coronavirus Restrictions

A full overview of coronavirus (COVID-19) restrictions for each of the four UK constituent countries can be found here:

These restrictions should be considered when interpreting the data featured throughout this bulletin.

Nôl i'r tabl cynnwys14. Strengths and limitations

Information on the strengths and limitations of the indicators in this bulletin is available in the Coronavirus and the latest indicators of the UK economy and society methodology.

Nôl i'r tabl cynnwys

10. Social impact of coronavirus (COVID-19)

This section includes some provisional results from the Opinions and Lifestyle Survey (OPN) covering the period 7 to 11 July 2021. The survey went out to 5,856 adults in Great Britain and had a response rate of 65%. Further information to help understand the impact of the coronavirus (COVID-19) pandemic on people, households, and communities in Great Britain will be available in Coronavirus and the social impacts on Great Britain, due to be published on 16 July 2021.

Travelling to work

In the period 7 to 11 July 2021, the proportion of working adults in Great Britain who in the past seven days:

Shopping

Of the 95% of adults who reported leaving home in the past seven days, the proportion that did so to shop for food and medicine was unchanged from the previous week at 83%.

The proportion of these adults who shopped for things other than food and medicine in the last seven days decreased slightly by 2 percentage points from last week to 40%.

Nôl i'r tabl cynnwys